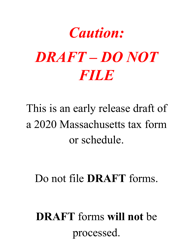

This version of the form is not currently in use and is provided for reference only. Download this version of

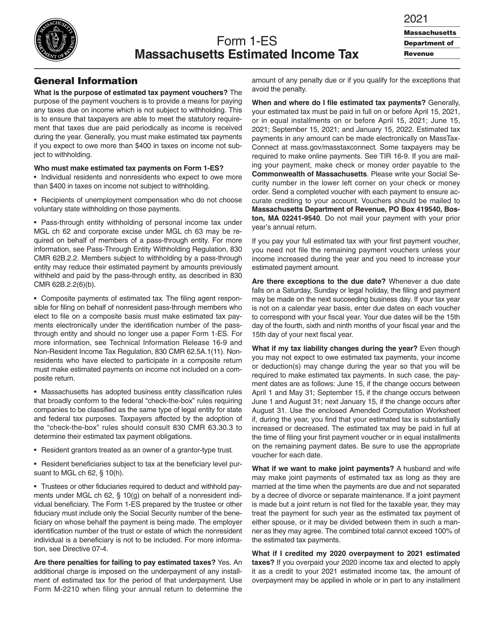

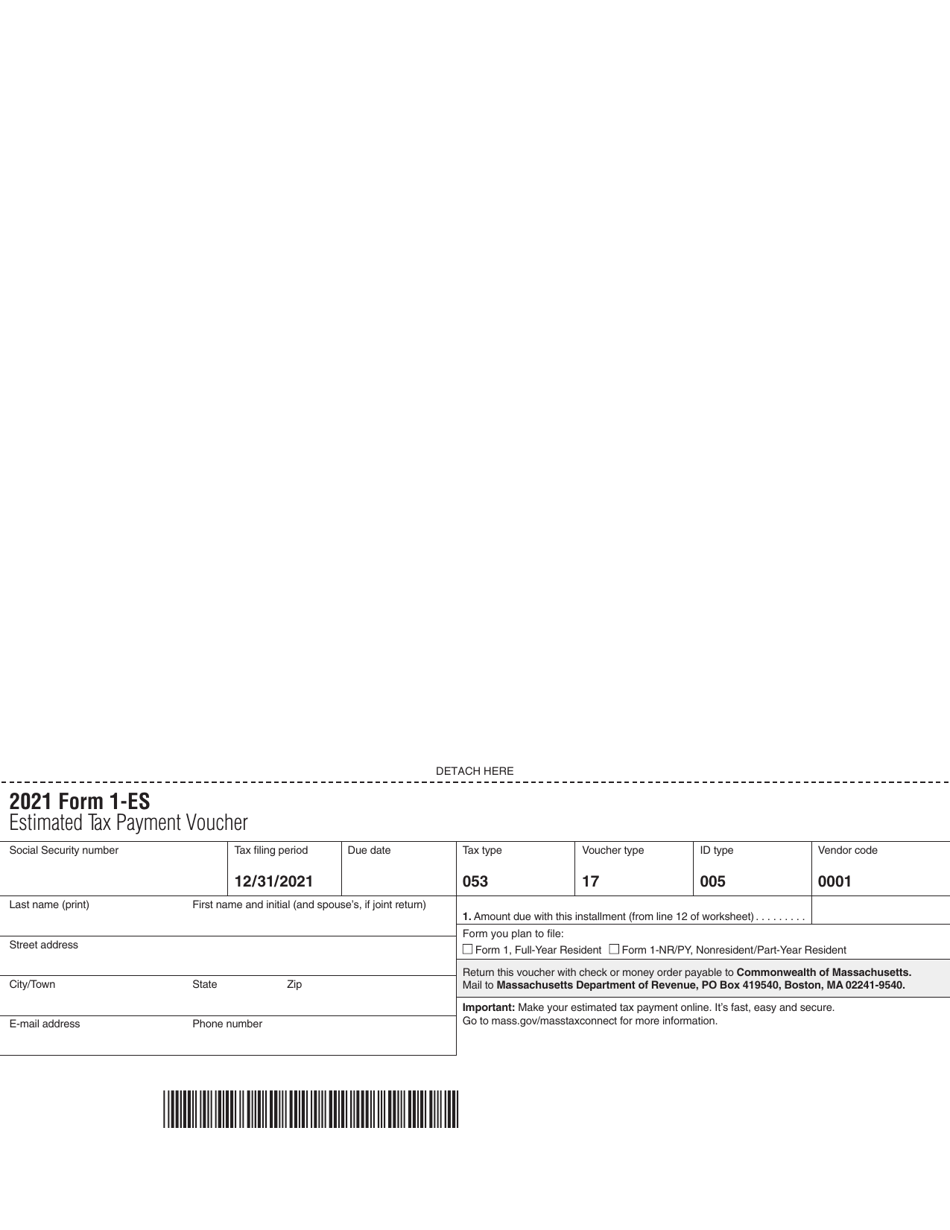

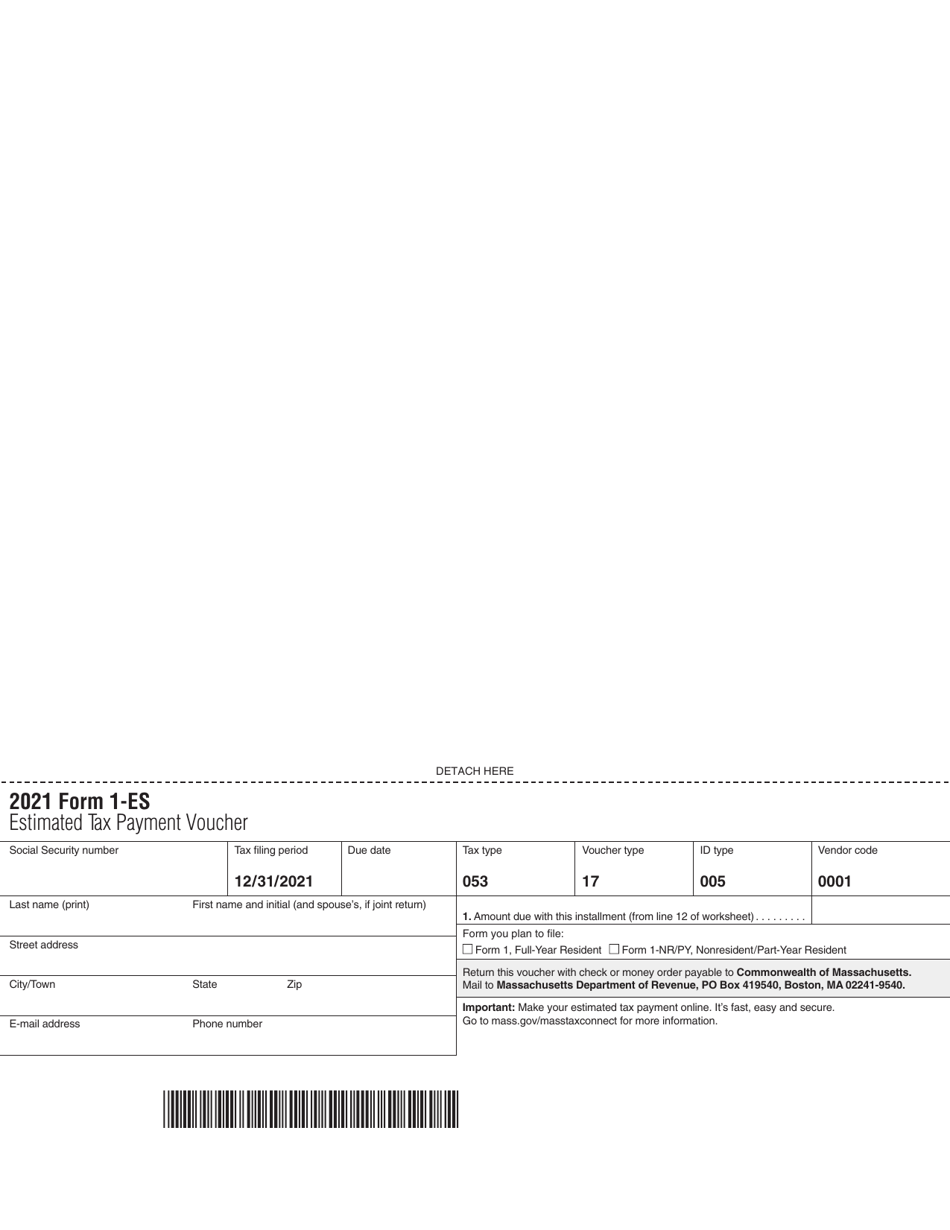

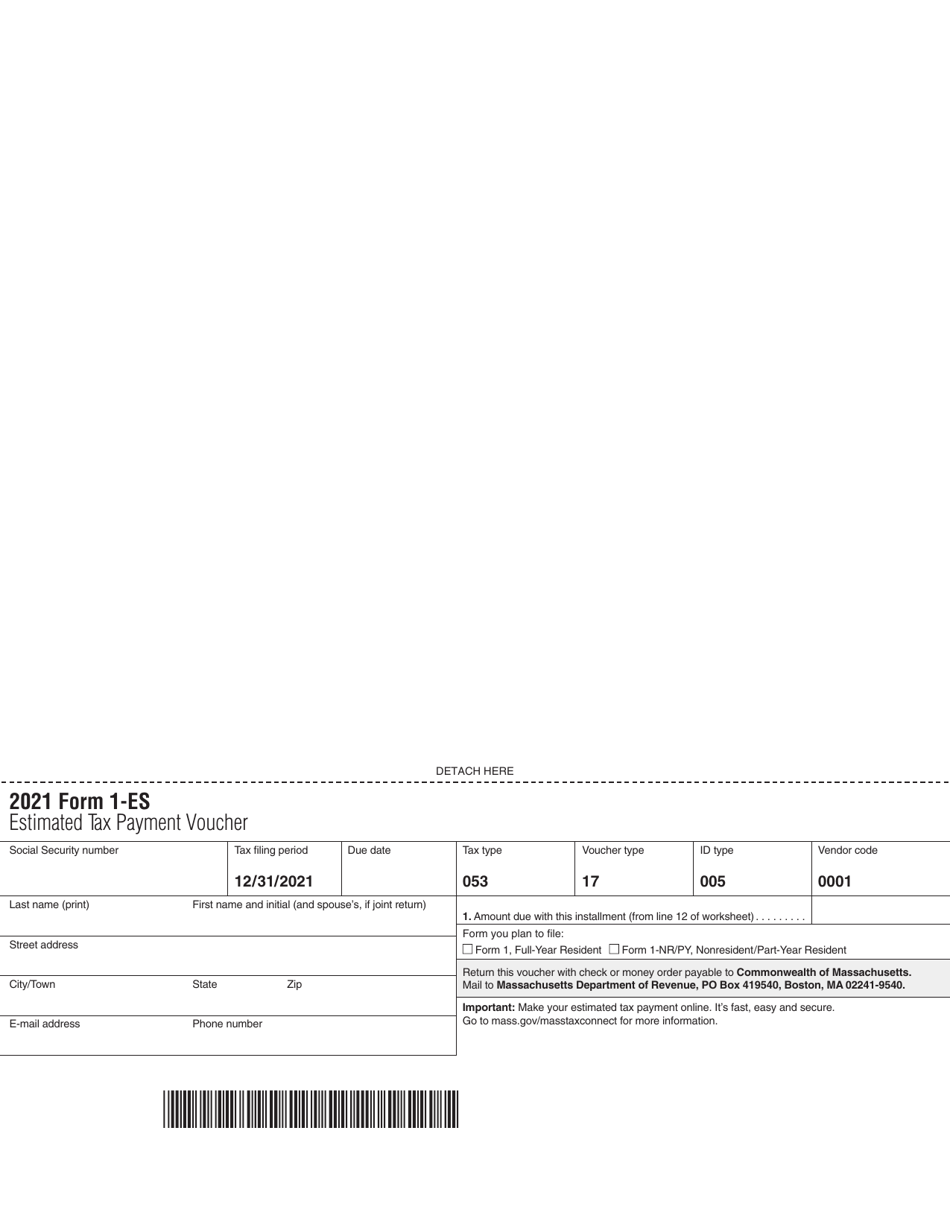

Form 1-ES

for the current year.

Form 1-ES Estimated Tax Payment Voucher - Massachusetts

What Is Form 1-ES?

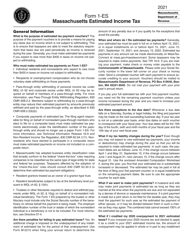

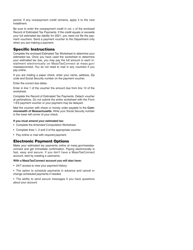

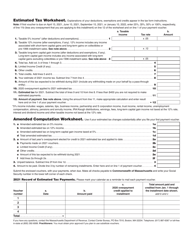

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

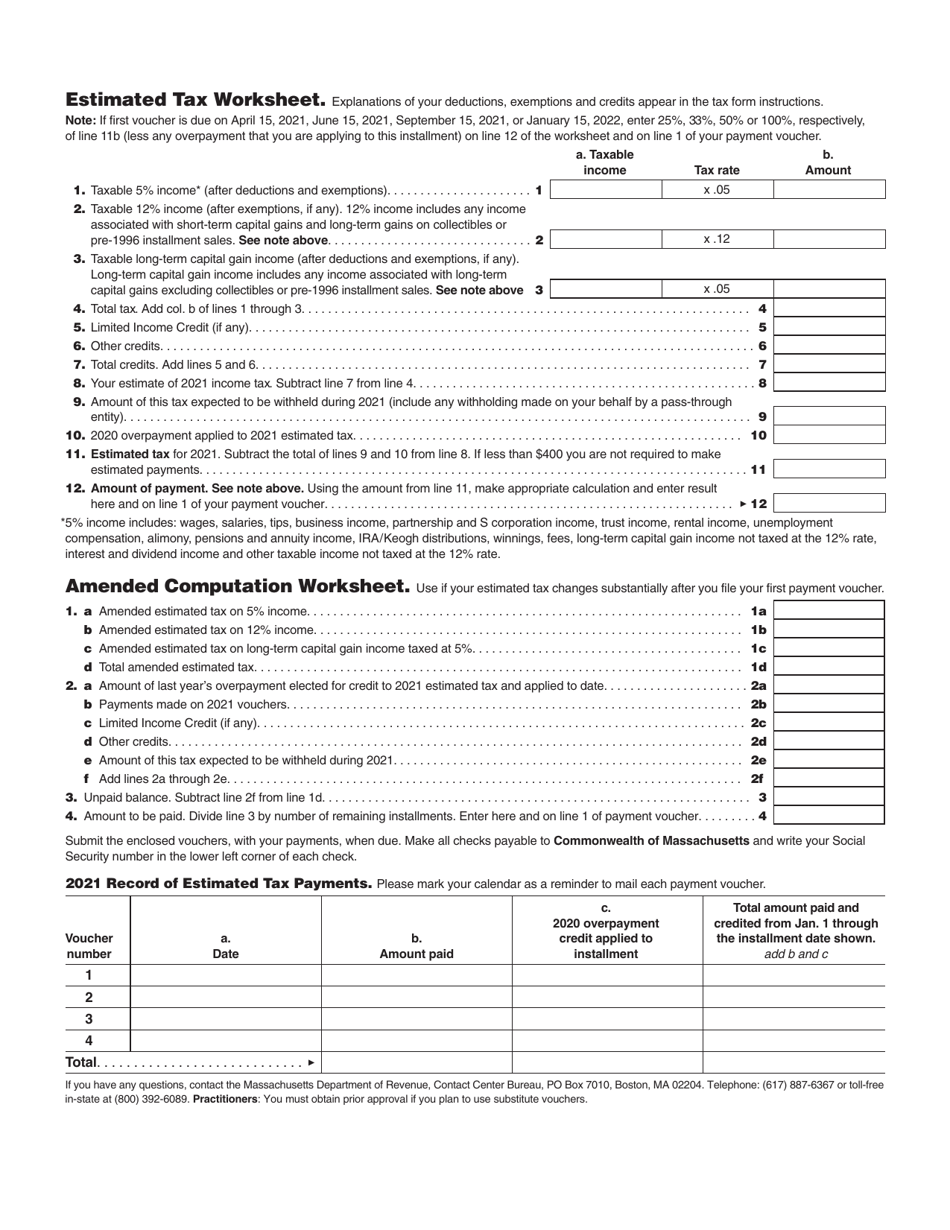

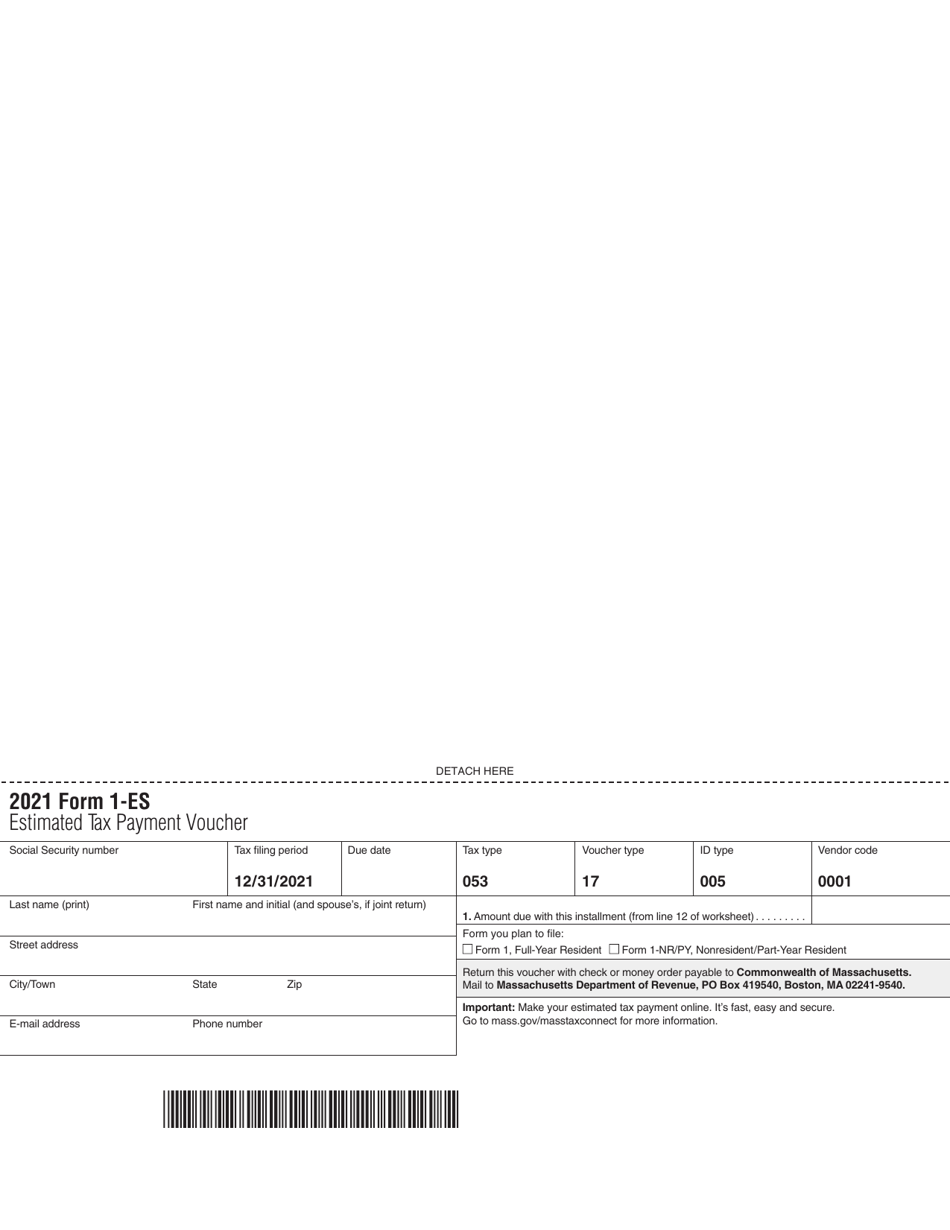

Q: What is Form 1-ES?

A: Form 1-ES is an estimated tax payment voucher for Massachusetts.

Q: When is Form 1-ES used?

A: Form 1-ES is used to make estimated tax payments for Massachusetts income tax.

Q: Who needs to use Form 1-ES?

A: Individuals who expect to owe at least $400 in Massachusetts income tax for the year are required to make estimated tax payments using Form 1-ES.

Q: How often do I need to file Form 1-ES?

A: Form 1-ES needs to be filed quarterly, with payments due in April, June, September, and January of the following year.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1-ES by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.