This version of the form is not currently in use and is provided for reference only. Download this version of

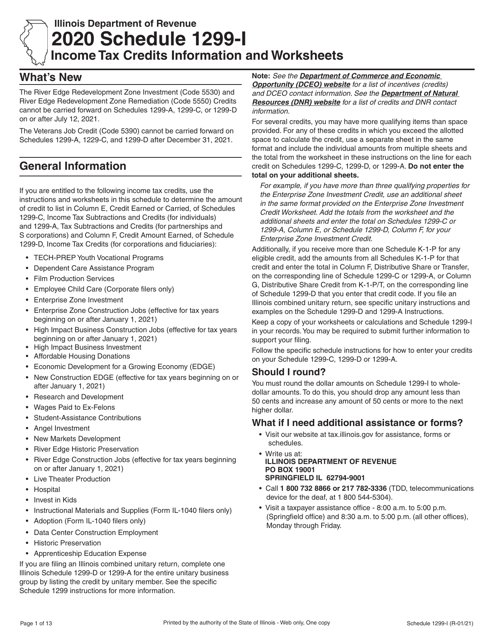

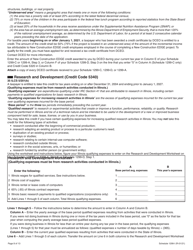

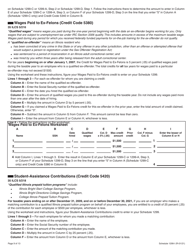

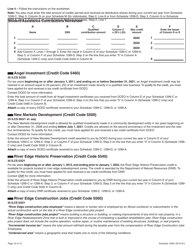

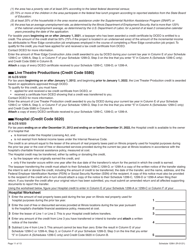

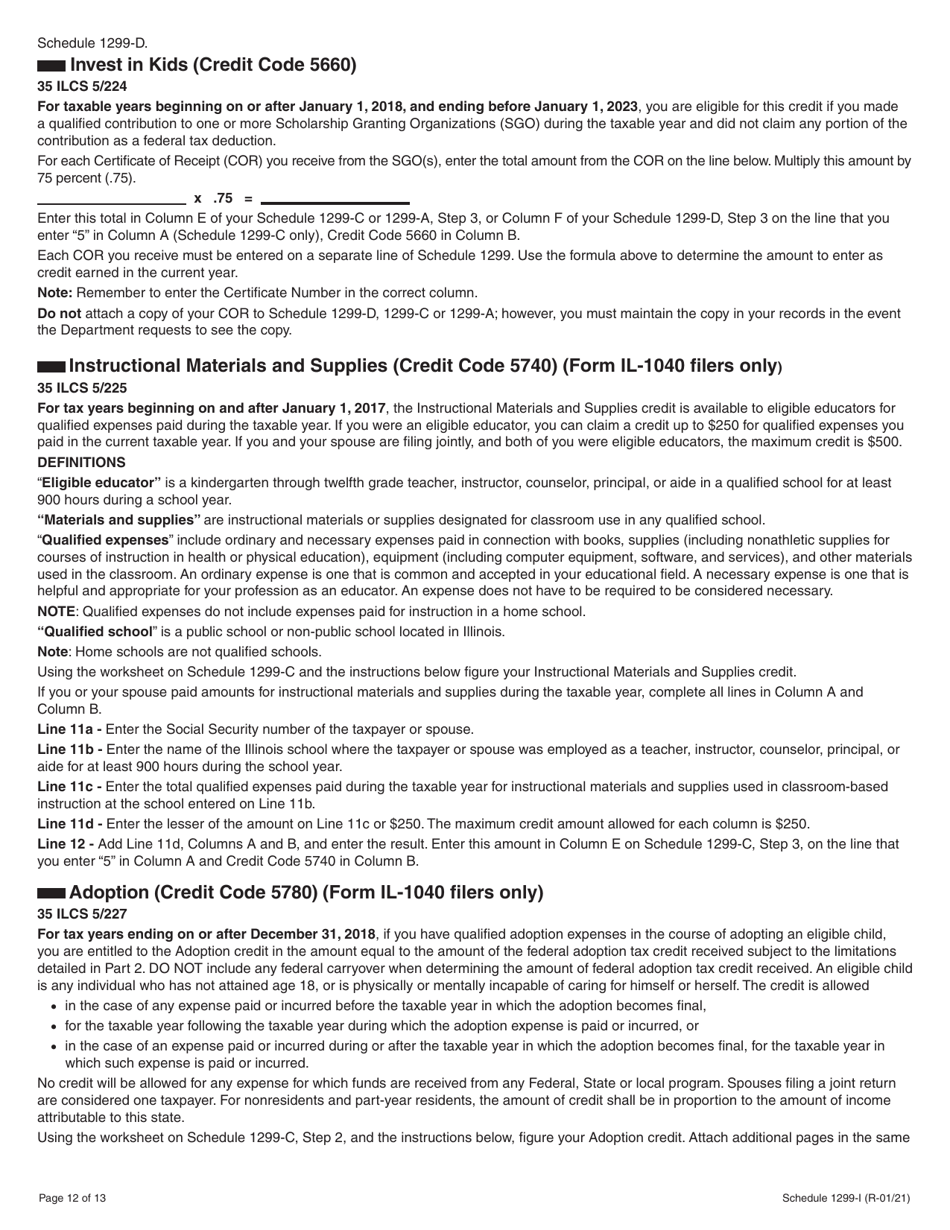

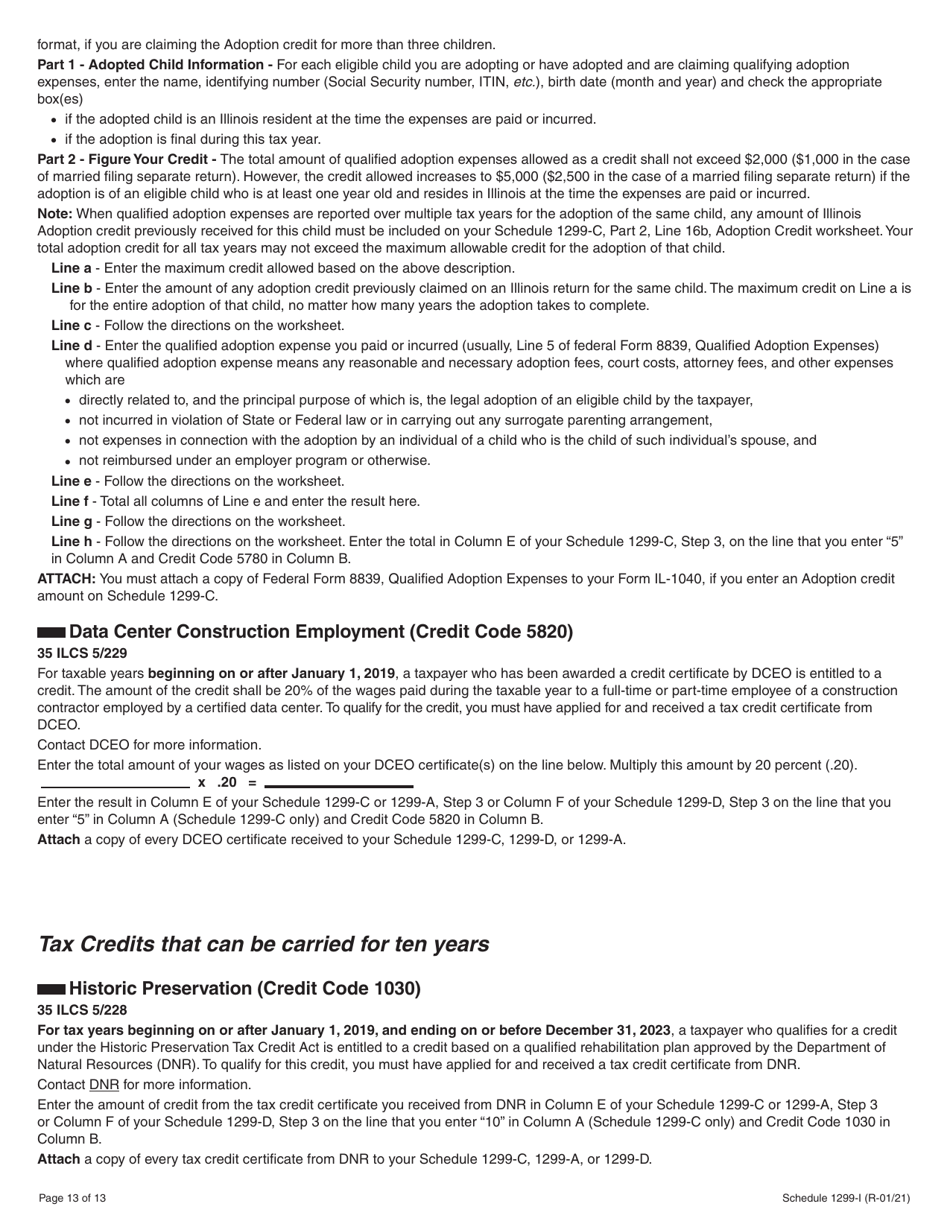

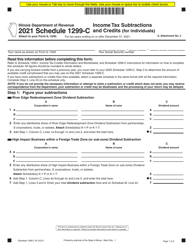

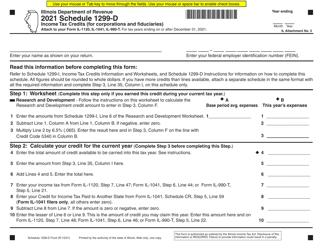

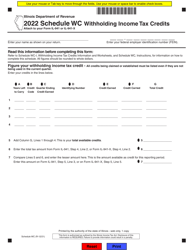

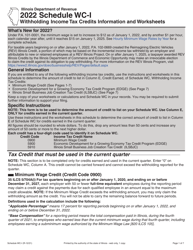

Schedule 1299-I

for the current year.

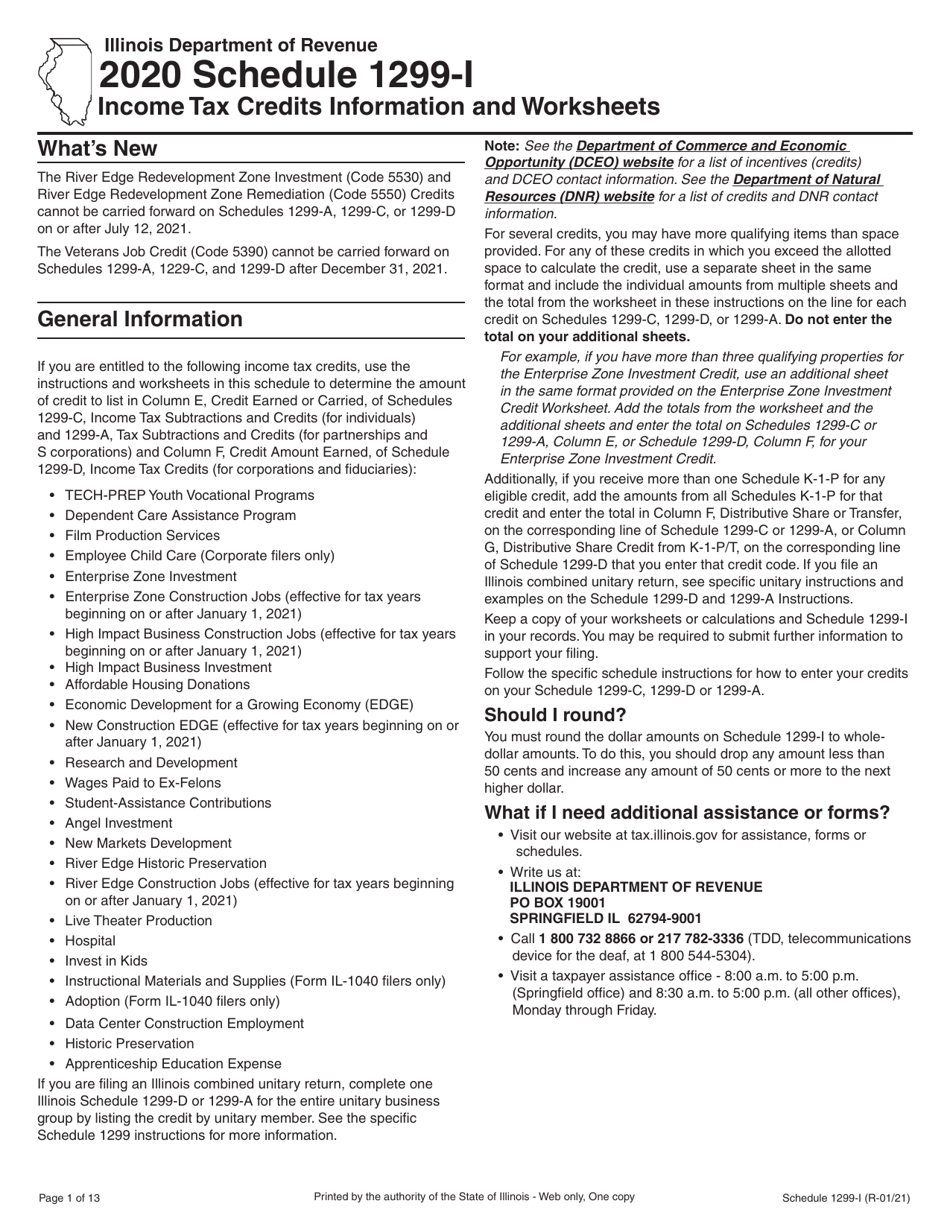

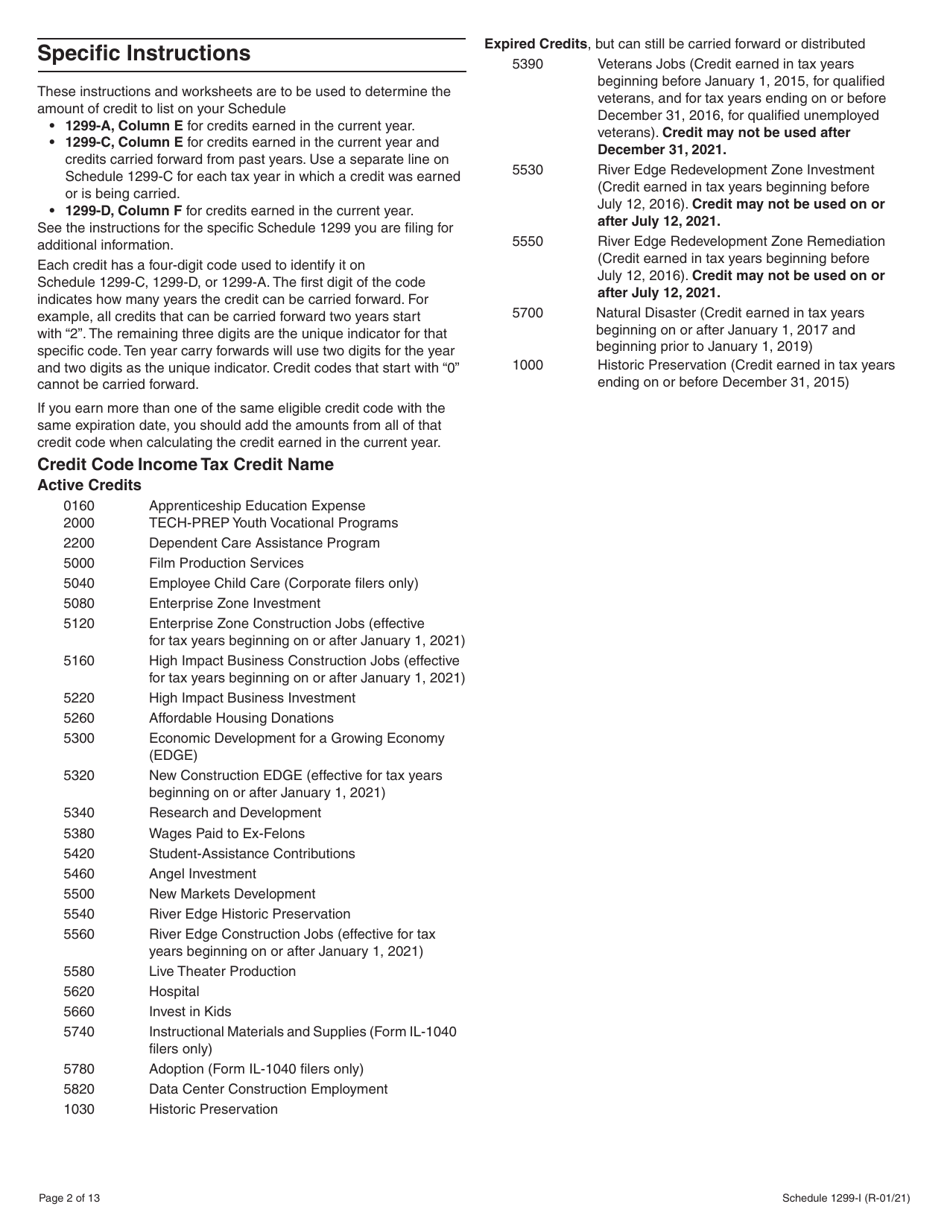

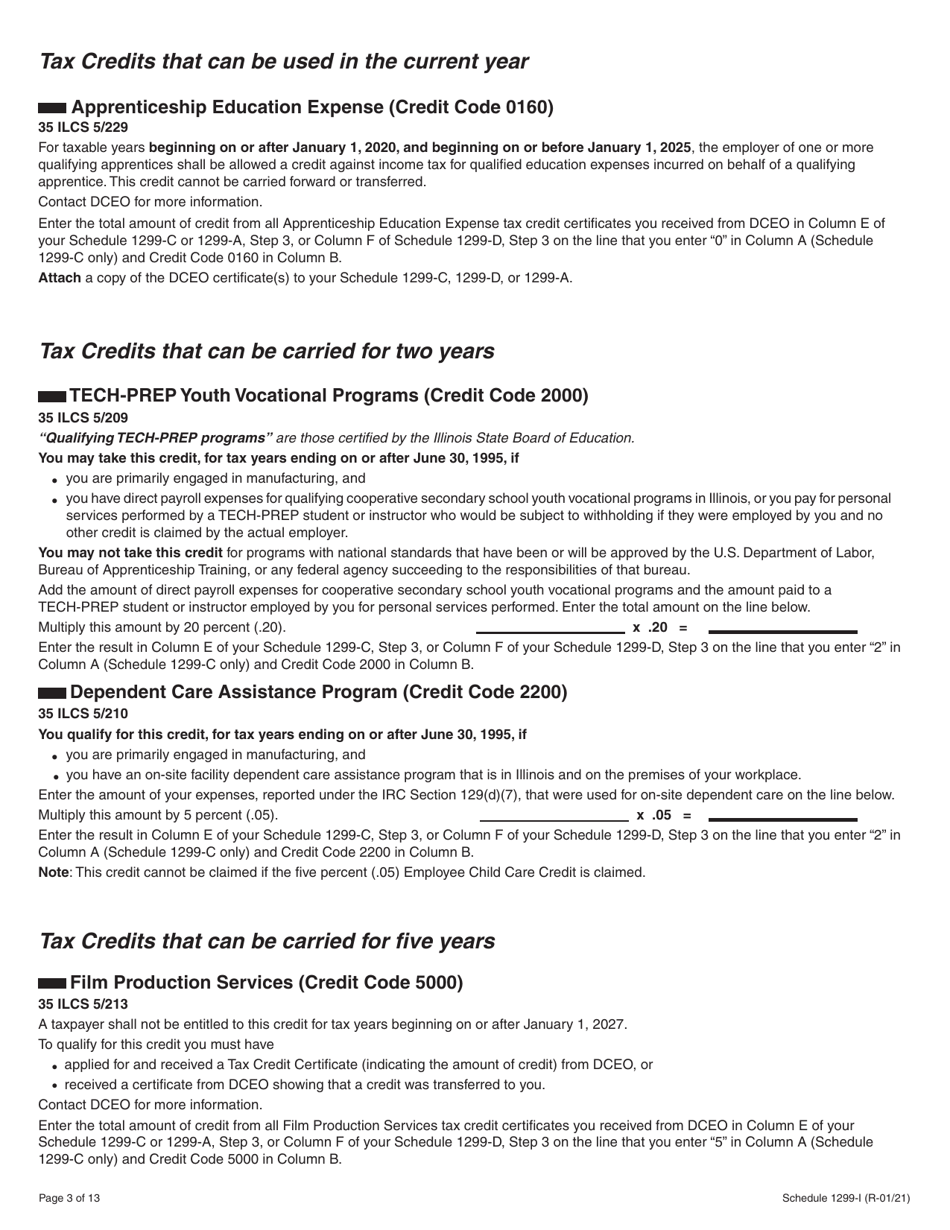

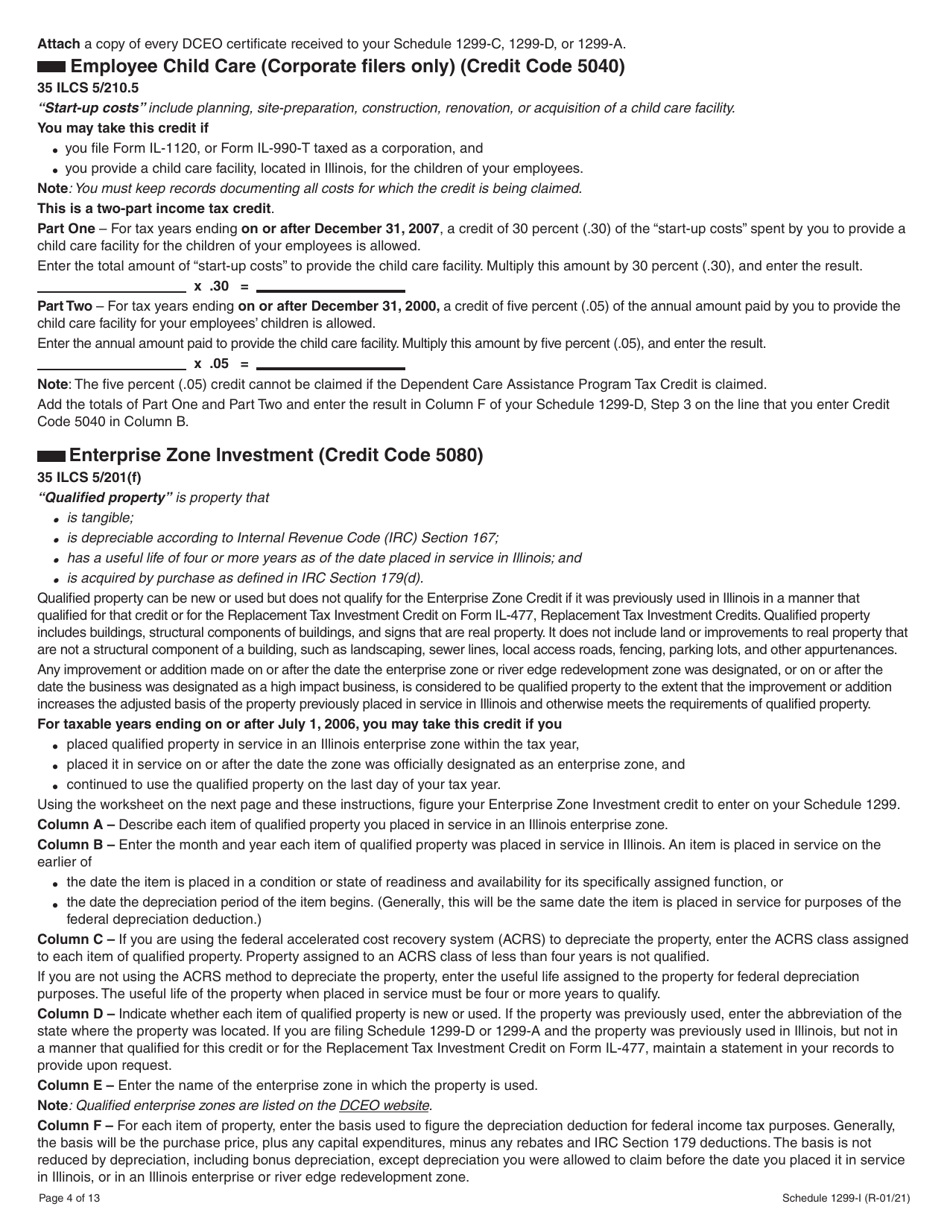

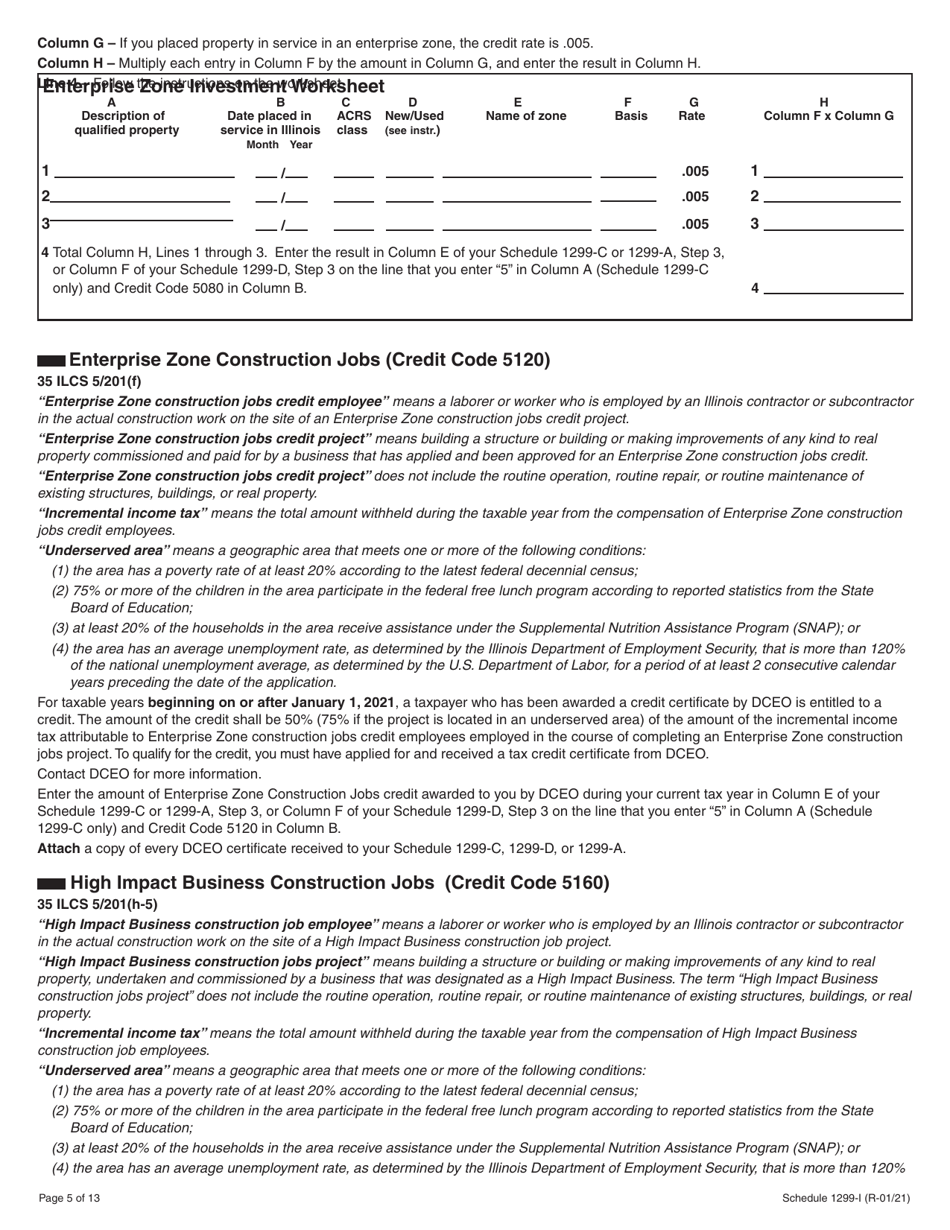

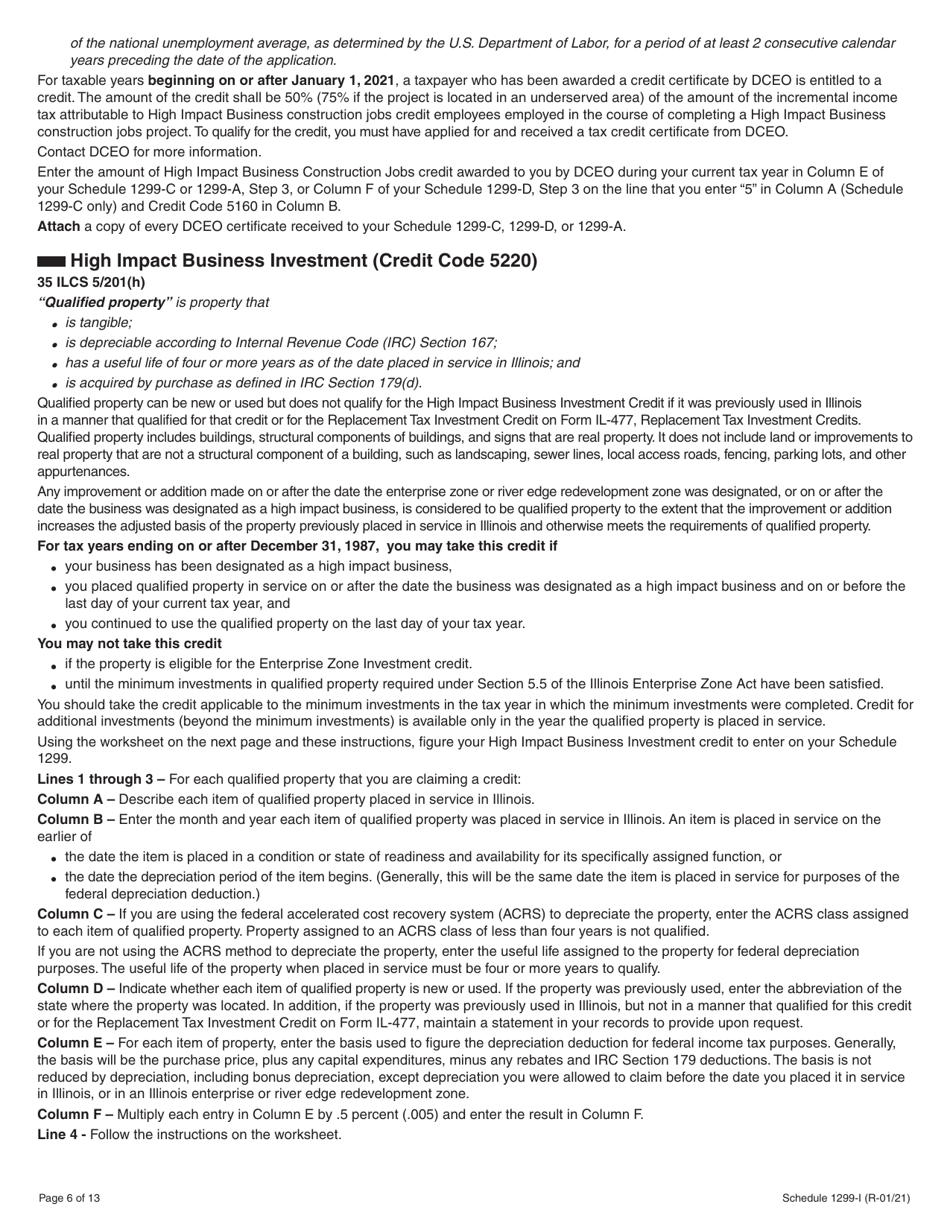

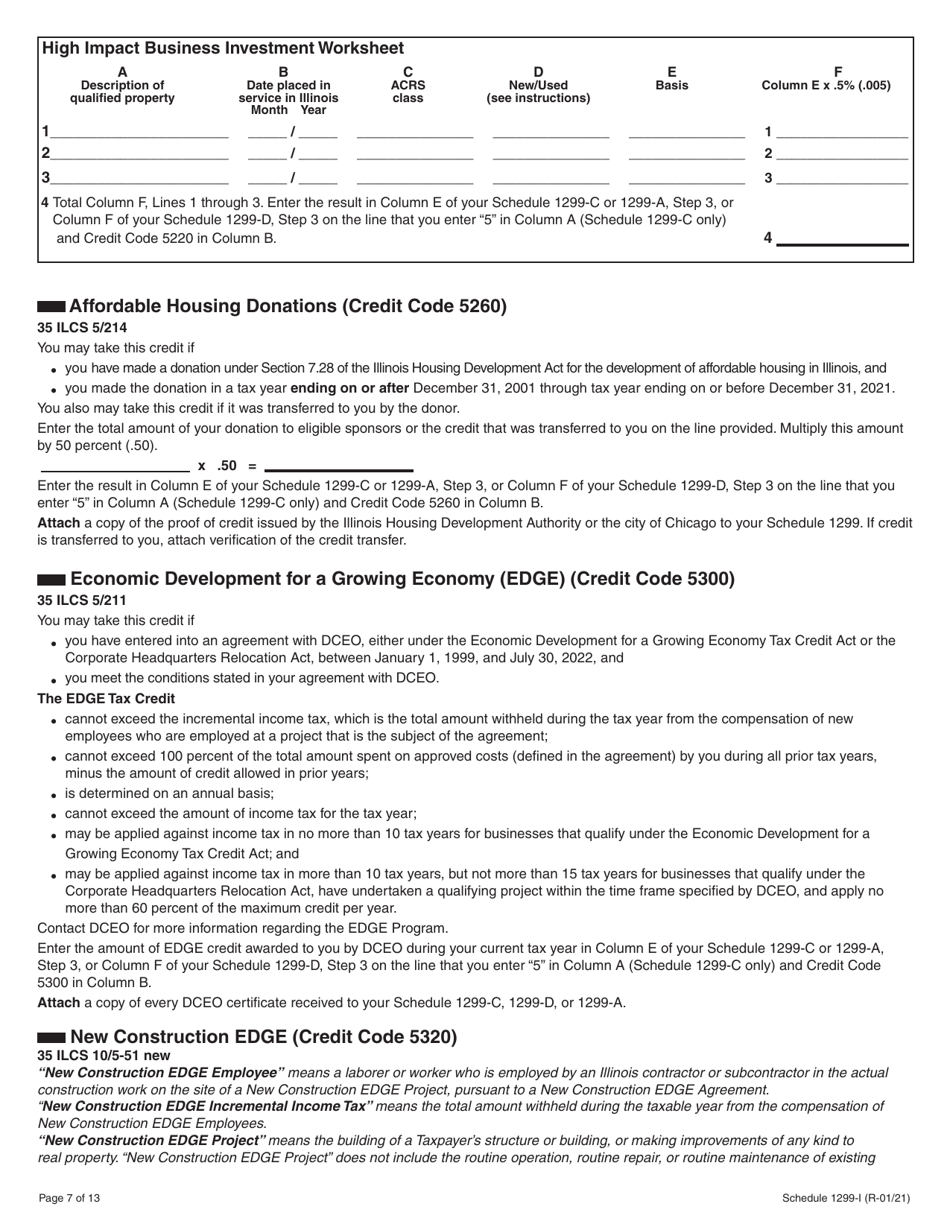

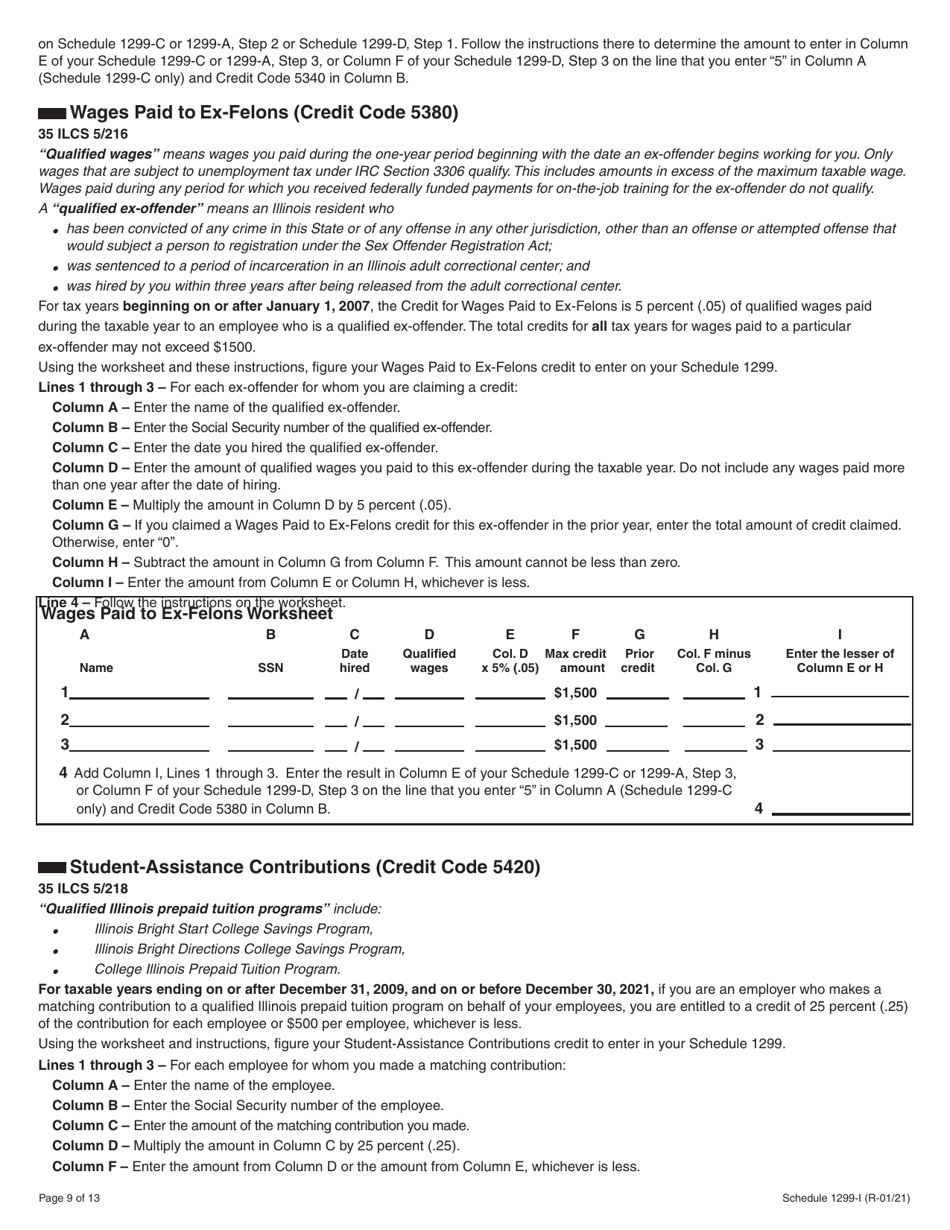

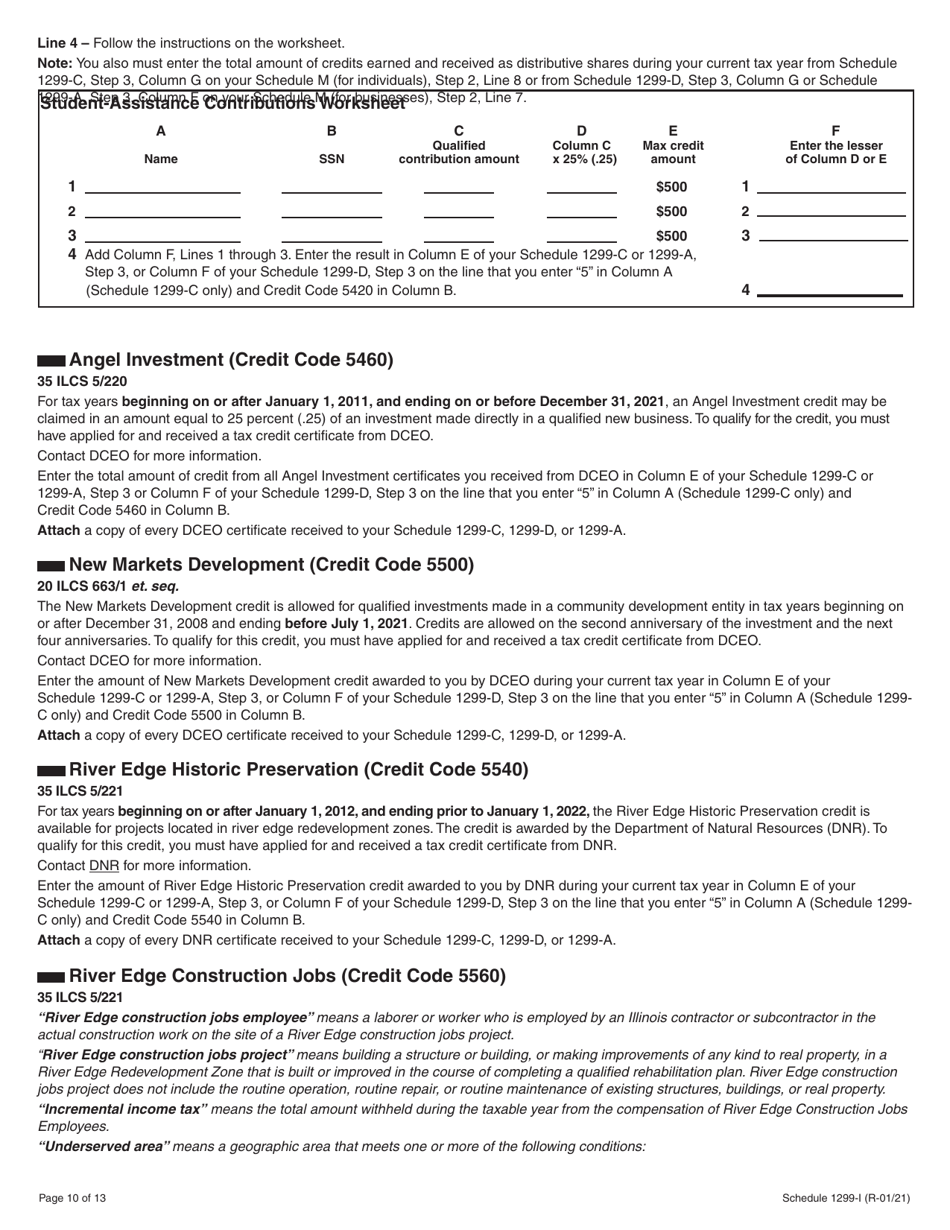

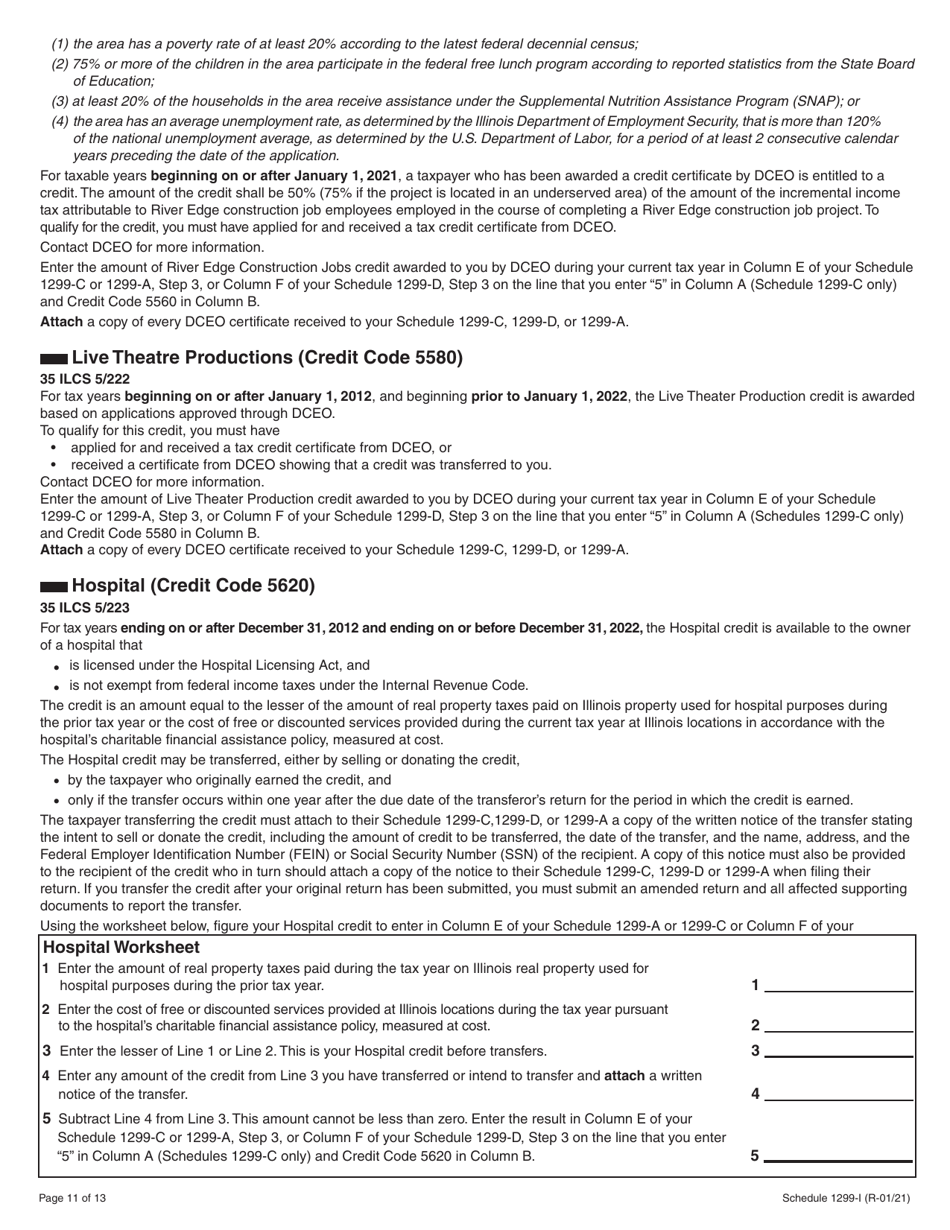

Schedule 1299-I Income Tax Credits Information and Worksheets - Illinois

What Is Schedule 1299-I?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule 1299-I?

A: Schedule 1299-I is a form used to claim income tax credits in the state of Illinois.

Q: Why would I need to file Schedule 1299-I?

A: You would need to file Schedule 1299-I if you qualify for any income tax credits in Illinois.

Q: What are income tax credits?

A: Income tax credits are deductions from your tax liability that can help reduce the amount of taxes you owe.

Q: How do I determine if I qualify for income tax credits?

A: Check the instructions on Schedule 1299-I or consult a tax professional to determine if you qualify for any income tax credits.

Q: Are there any deadlines for filing Schedule 1299-I?

A: The deadline for filing Schedule 1299-I is usually the same as the deadline for filing your Illinois income tax return.

Q: Can I claim multiple income tax credits on Schedule 1299-I?

A: Yes, you can claim multiple income tax credits on Schedule 1299-I if you qualify for them.

Q: Do I need to include any supporting documentation with Schedule 1299-I?

A: You may be required to include supporting documentation for certain income tax credits. Refer to the instructions on Schedule 1299-I for more information.

Q: What should I do if I have questions about filling out Schedule 1299-I?

A: If you have questions about filling out Schedule 1299-I, you should contact the Illinois Department of Revenue or seek assistance from a tax professional.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule 1299-I by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.