This version of the form is not currently in use and is provided for reference only. Download this version of

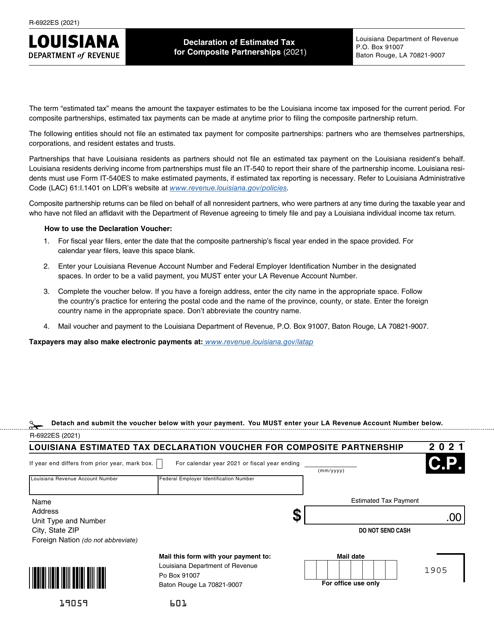

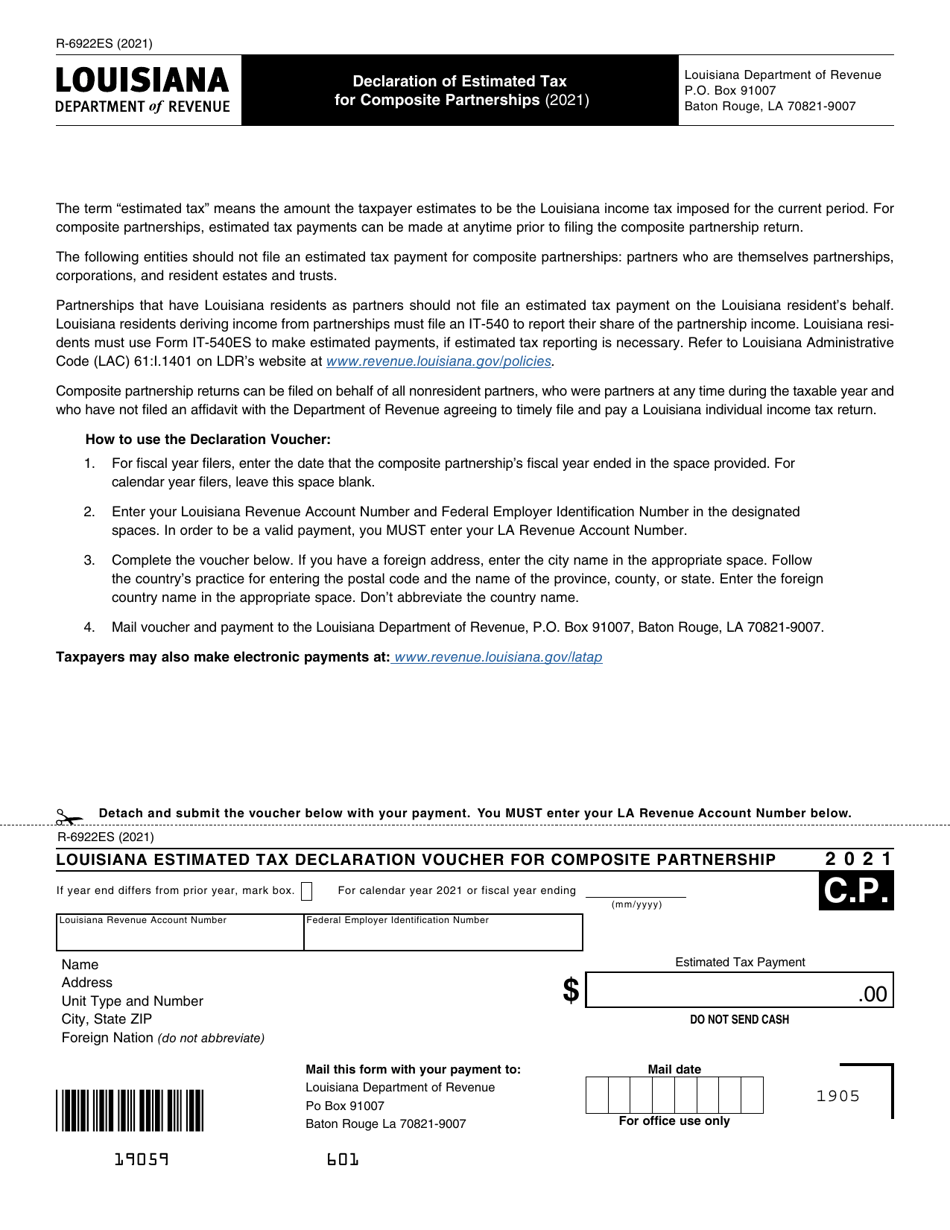

Form R-6922ES

for the current year.

Form R-6922ES Declaration of Estimated Tax for Composite Partnerships - Louisiana

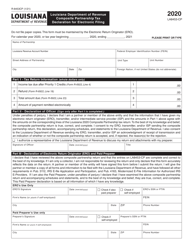

What Is Form R-6922ES?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6922ES?

A: Form R-6922ES is the Declaration of Estimated Tax for Composite Partnerships in Louisiana.

Q: Who should use Form R-6922ES?

A: Composite partnerships in Louisiana should use Form R-6922ES to declare their estimated tax.

Q: What is a composite partnership?

A: A composite partnership is a partnership that elects to file a single Louisiana income tax return on behalf of its nonresident partners.

Q: When should Form R-6922ES be filed?

A: Form R-6922ES should be filed by the 15th day of the fifth month after the close of the partnership's taxable year.

Q: Are there any penalties for not filing Form R-6922ES?

A: Yes, there may be penalties for not filing Form R-6922ES or for underestimating the partnership's tax liability.

Form Details:

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6922ES by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.