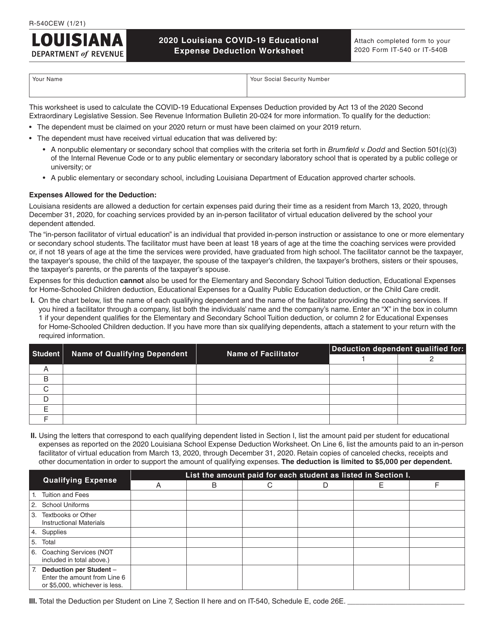

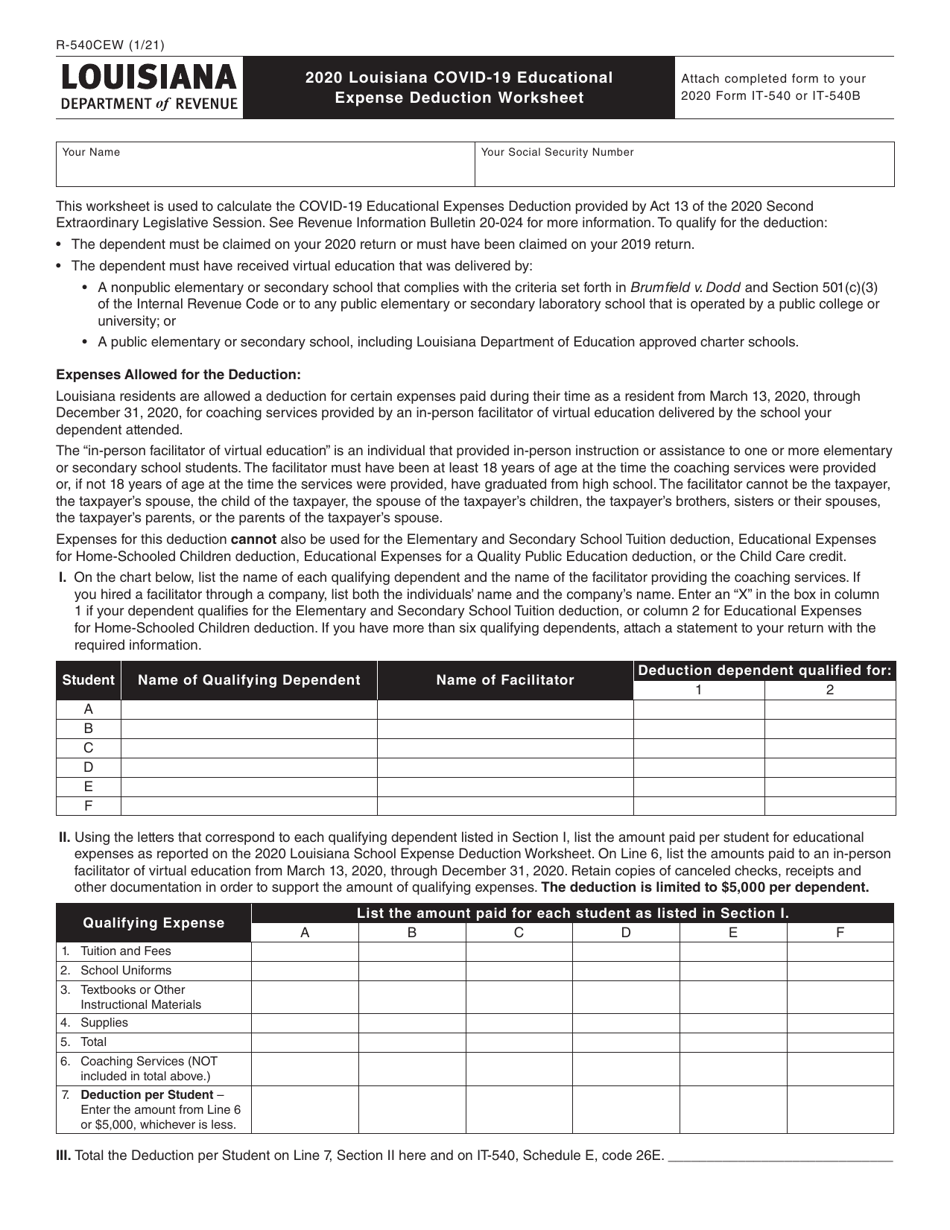

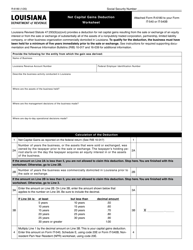

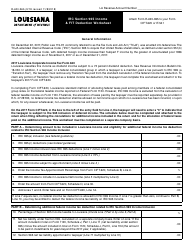

Form R-540CEW Louisiana Covid-19 Educational Expense Deduction Worksheet - Louisiana

What Is Form R-540CEW?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-540CEW?

A: Form R-540CEW is the Louisiana Covid-19 Educational Expense Deduction Worksheet.

Q: What is the purpose of Form R-540CEW?

A: The purpose of Form R-540CEW is to calculate the amount of the Covid-19 Educational Expense Deduction that you may qualify for in Louisiana.

Q: Who is eligible to claim the Covid-19 Educational Expense Deduction in Louisiana?

A: Individuals who have incurred eligible educational expenses due to the Covid-19 pandemic may be eligible to claim this deduction.

Q: What are considered eligible educational expenses for the Covid-19 Educational Expense Deduction?

A: Eligible expenses may include the costs of computers, internet access, software, and other items necessary for distance learning.

Q: How do I fill out Form R-540CEW?

A: The form provides a worksheet where you can enter your eligible educational expenses and calculate your potential deduction amount. Follow the instructions on the form carefully.

Q: When is the deadline to file Form R-540CEW?

A: The deadline to file Form R-540CEW is typically the same as your Louisiana state income tax return deadline, which is usually on or around April 15th.

Q: Can I claim the Covid-19 Educational Expense Deduction if I am not a Louisiana resident?

A: No, this deduction is specific to Louisiana residents who have incurred eligible educational expenses in the state.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-540CEW by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.