This version of the form is not currently in use and is provided for reference only. Download this version of

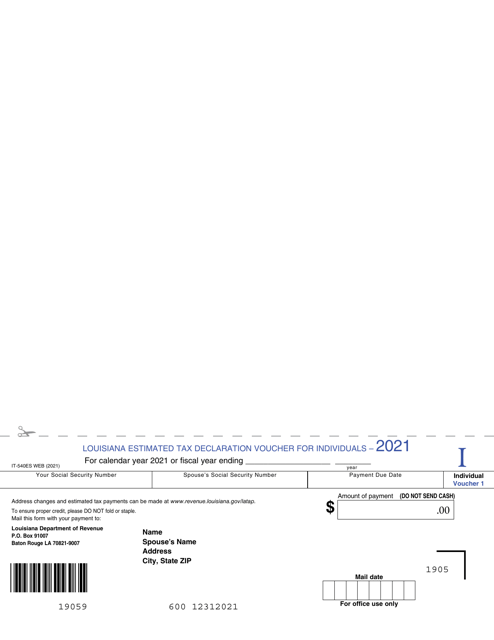

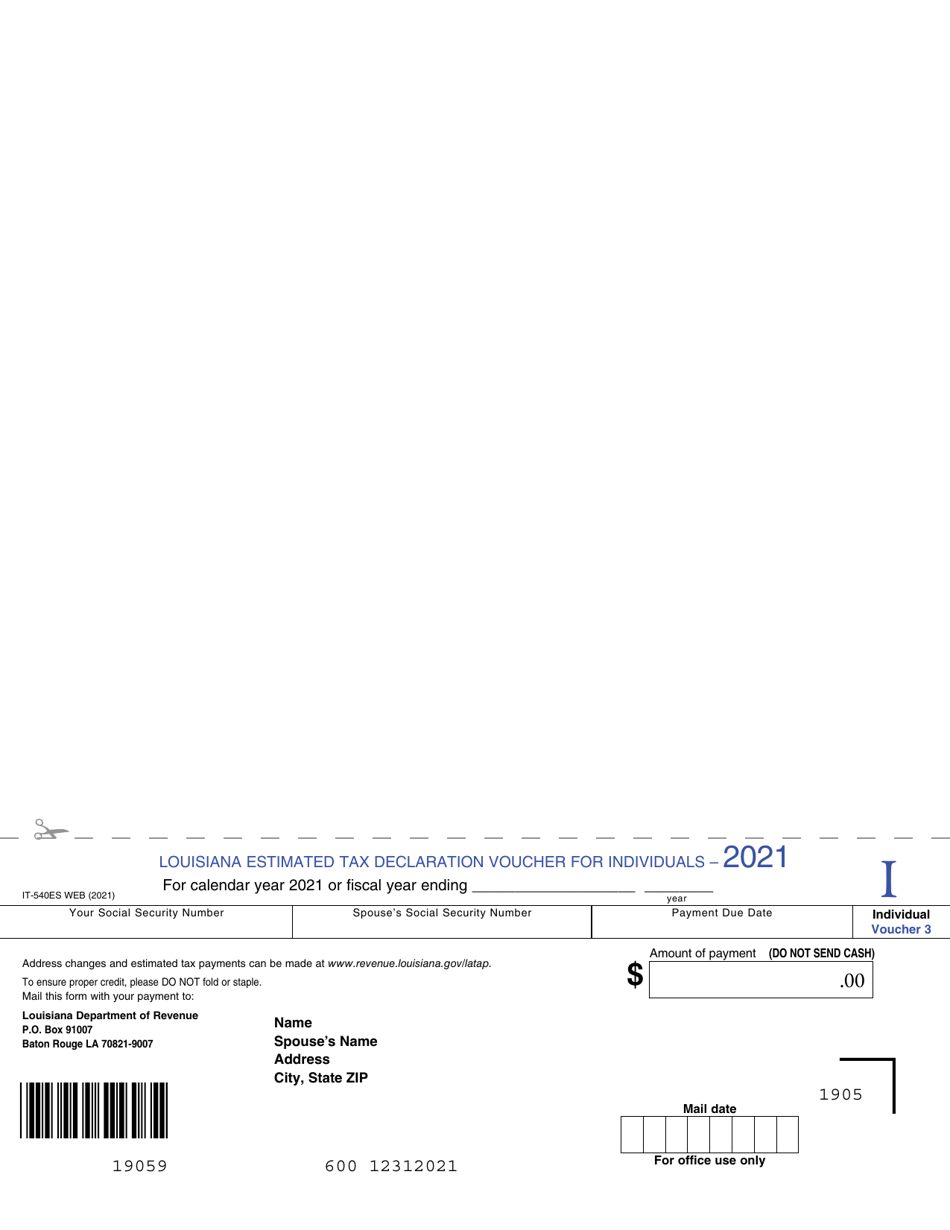

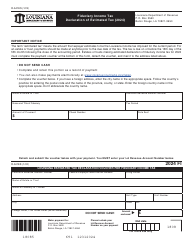

Form IT-540ES

for the current year.

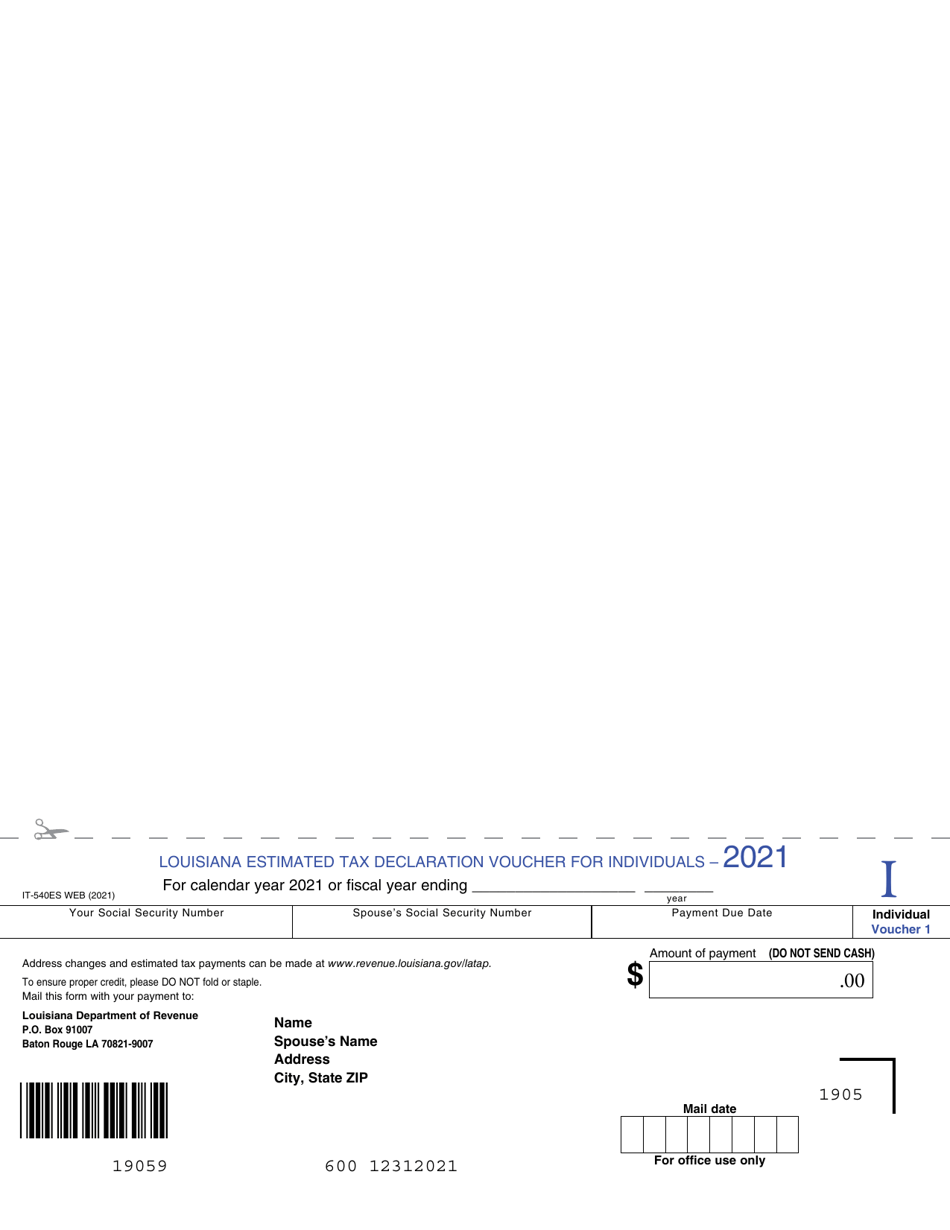

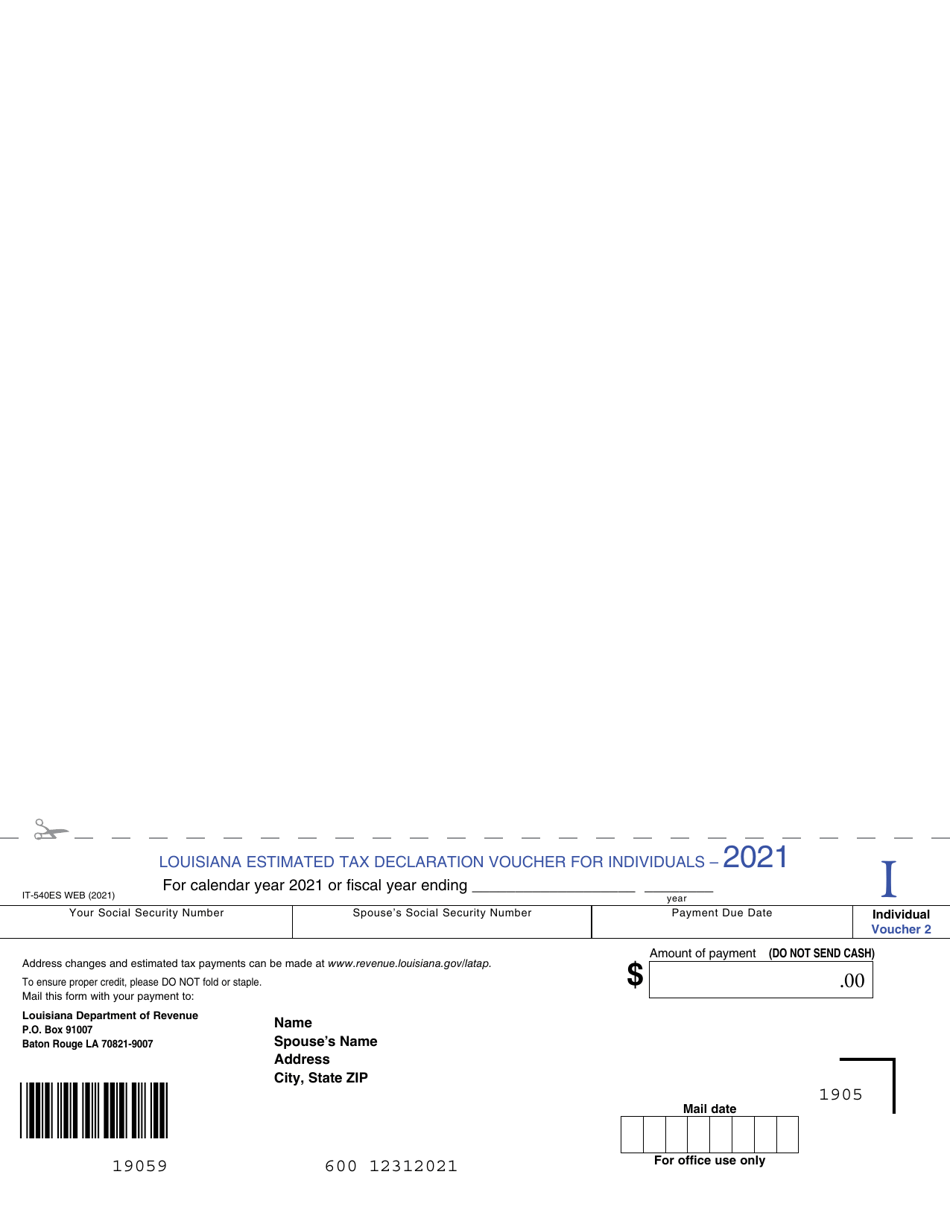

Form IT-540ES Louisiana Estimated Tax Declaration Voucher for Individuals - Louisiana

What Is Form IT-540ES?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-540ES?

A: Form IT-540ES is the Louisiana Estimated Tax Declaration Voucher for Individuals.

Q: Who should use Form IT-540ES?

A: Louisiana residents who expect to owe more than $1,000 in state income tax for the year, and do not have enough tax withheld from their income, should use Form IT-540ES.

Q: What is the purpose of Form IT-540ES?

A: The purpose of Form IT-540ES is to declare and make estimated tax payments on a quarterly basis to avoid underpayment penalties.

Q: When are the estimated tax payments due?

A: The estimated tax payments are due on the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

Q: Is there a penalty for not filing Form IT-540ES?

A: Yes, if you do not file Form IT-540ES or pay enough estimated tax throughout the year, you may be subject to underpayment penalties.

Form Details:

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-540ES by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.