This version of the form is not currently in use and is provided for reference only. Download this version of

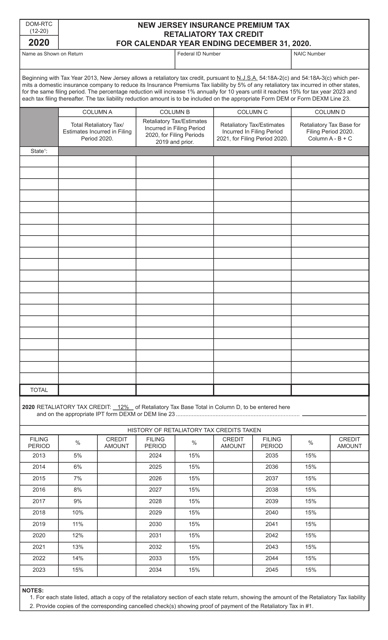

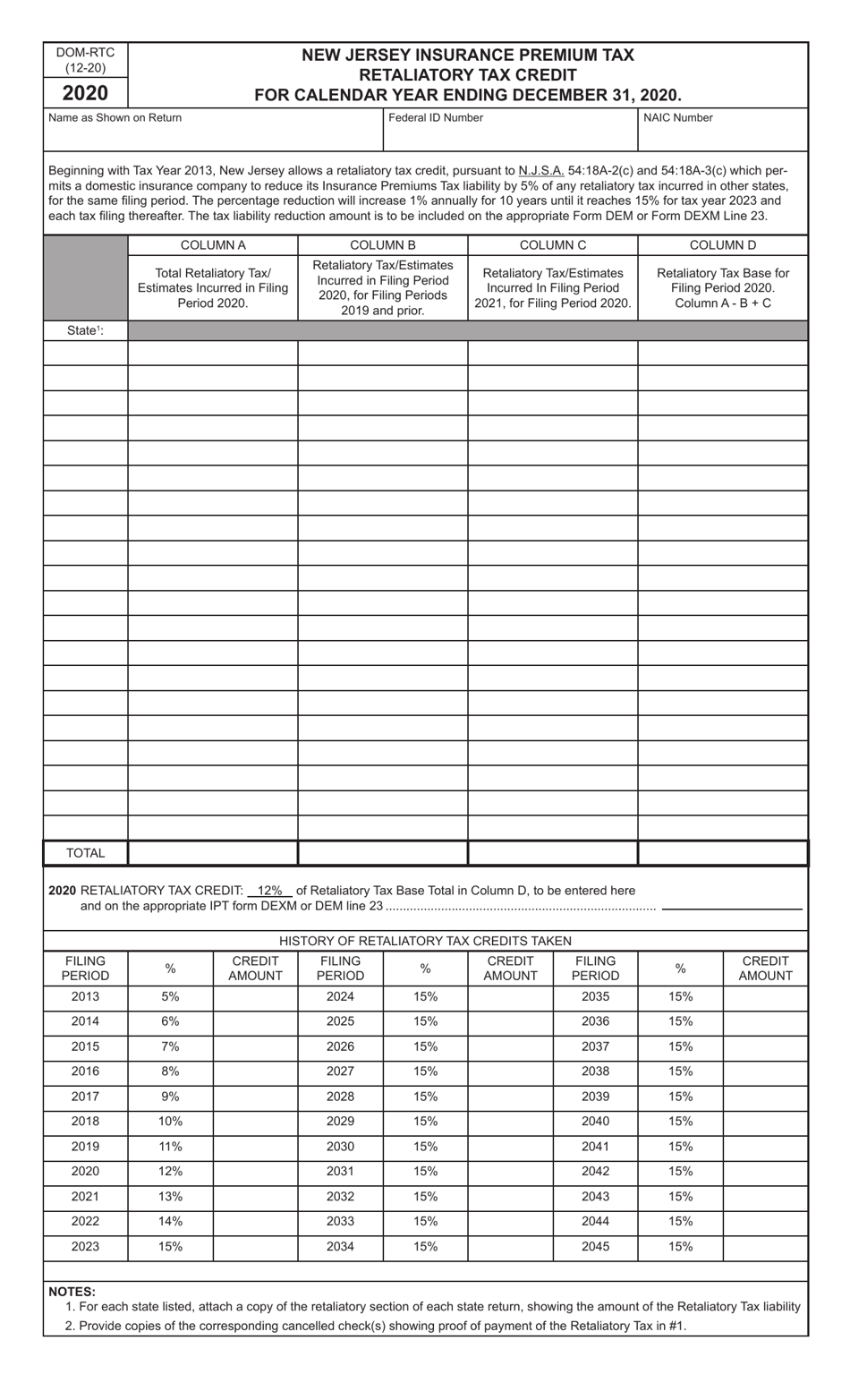

Form DOM-RTC

for the current year.

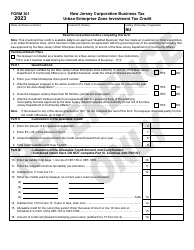

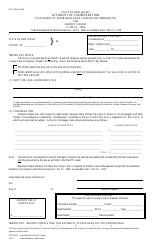

Form DOM-RTC Retaliatory Tax Credit - New Jersey

What Is Form DOM-RTC?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is DOM-RTC Retaliatory Tax Credit?

A: DOM-RTC Retaliatory Tax Credit is a tax credit offered by the state of New Jersey.

Q: Who is eligible for DOM-RTC Retaliatory Tax Credit?

A: Eligibility for DOM-RTC Retaliatory Tax Credit varies depending on specific criteria set by the state of New Jersey.

Q: How can I apply for DOM-RTC Retaliatory Tax Credit?

A: To apply for DOM-RTC Retaliatory Tax Credit, you need to follow the guidelines provided by the state of New Jersey.

Q: What are the benefits of DOM-RTC Retaliatory Tax Credit?

A: The benefits of DOM-RTC Retaliatory Tax Credit include potential tax savings for eligible individuals or businesses.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DOM-RTC by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.