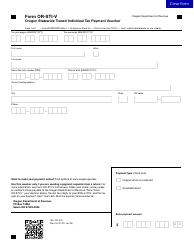

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form OR-STT-1, 150-206-003

for the current year.

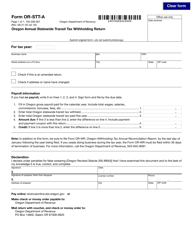

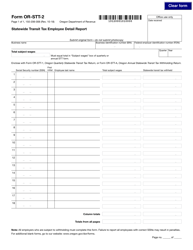

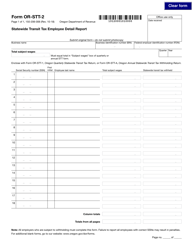

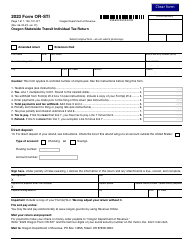

Instructions for Form OR-STT-1, 150-206-003 Oregon Quarterly Statewide Transit Tax Withholding Return - Oregon

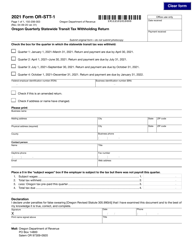

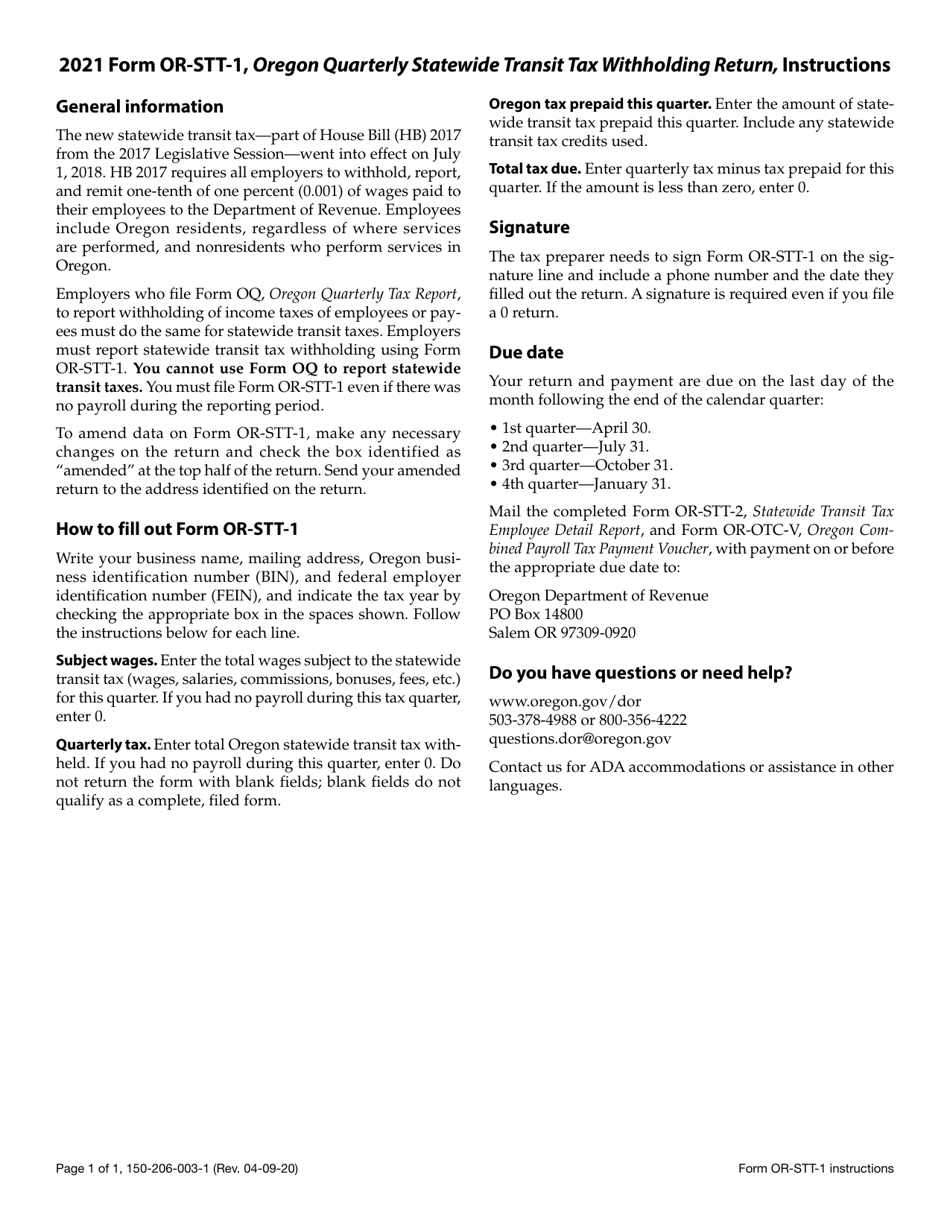

This document contains official instructions for Form OR-STT-1 , and Form 150-206-003 . Both forms are released and collected by the Oregon Department of Revenue. An up-to-date fillable Form OR-STT-1 (150-206-003) is available for download through this link.

FAQ

Q: What is Form OR-STT-1?

A: Form OR-STT-1 is the Oregon Quarterly Statewide Transit Tax Withholding Return.

Q: Why do I need to file Form OR-STT-1?

A: You need to file Form OR-STT-1 if you are an employer required to withhold statewide transit tax from employee wages.

Q: When is Form OR-STT-1 due?

A: Form OR-STT-1 is due on the last day of the month following the end of each calendar quarter.

Q: How do I fill out Form OR-STT-1?

A: You should report the total amount of statewide transit tax withheld for the quarter, along with other required information such as your business information and employee count.

Q: What if I have no statewide transit tax to report for the quarter?

A: If you have no statewide transit tax to report for the quarter, you still need to file a zero return.

Q: Are there any penalties for not filing Form OR-STT-1?

A: Yes, there are penalties for not filing Form OR-STT-1 or filing it late. It is important to comply with the filing requirements to avoid these penalties.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.