This version of the form is not currently in use and is provided for reference only. Download this version of

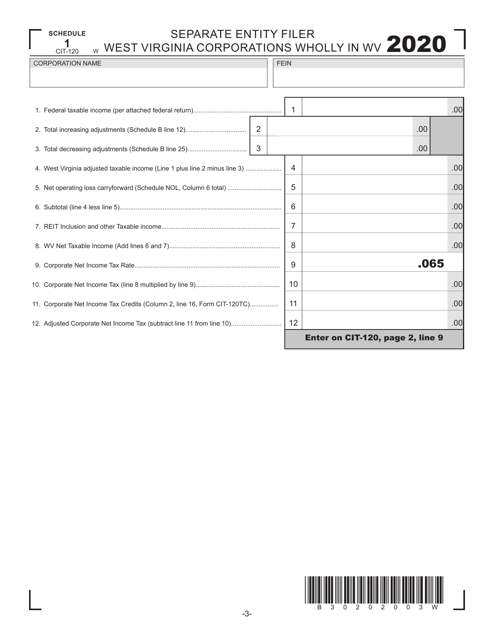

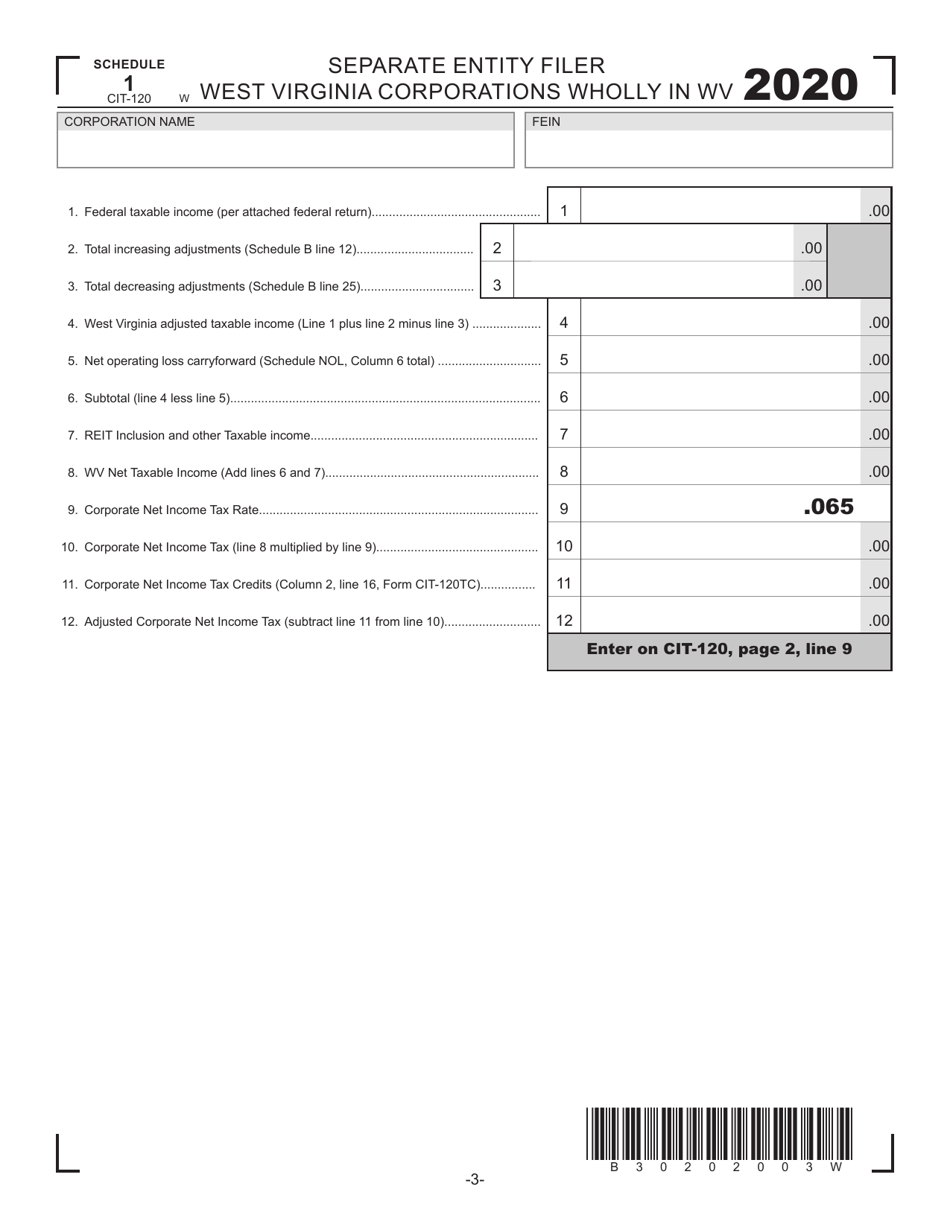

Form CIT-120 Schedule 1

for the current year.

Form CIT-120 Schedule 1 Separate Entity Filer West Virginia Corporations Wholly in Wv - West Virginia

What Is Form CIT-120 Schedule 1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CIT-120 Schedule 1?

A: CIT-120 Schedule 1 is a tax form used by corporations in West Virginia to calculate their state income tax liability.

Q: Who should use CIT-120 Schedule 1?

A: Corporations that are separate entities and wholly located in West Virginia should use CIT-120 Schedule 1.

Q: What is the purpose of CIT-120 Schedule 1?

A: The purpose of CIT-120 Schedule 1 is to determine the West Virginia income tax owed by corporations that are based and operated solely in the state.

Q: When should CIT-120 Schedule 1 be filed?

A: CIT-120 Schedule 1 should be filed annually by the due date specified by the West Virginia Department of Revenue.

Q: Can corporations based in other states use CIT-120 Schedule 1?

A: No, CIT-120 Schedule 1 is specifically for corporations that are wholly located in West Virginia; corporations from other states should use the appropriate tax forms for their own state.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CIT-120 Schedule 1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.