This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form CT-1

for the current year.

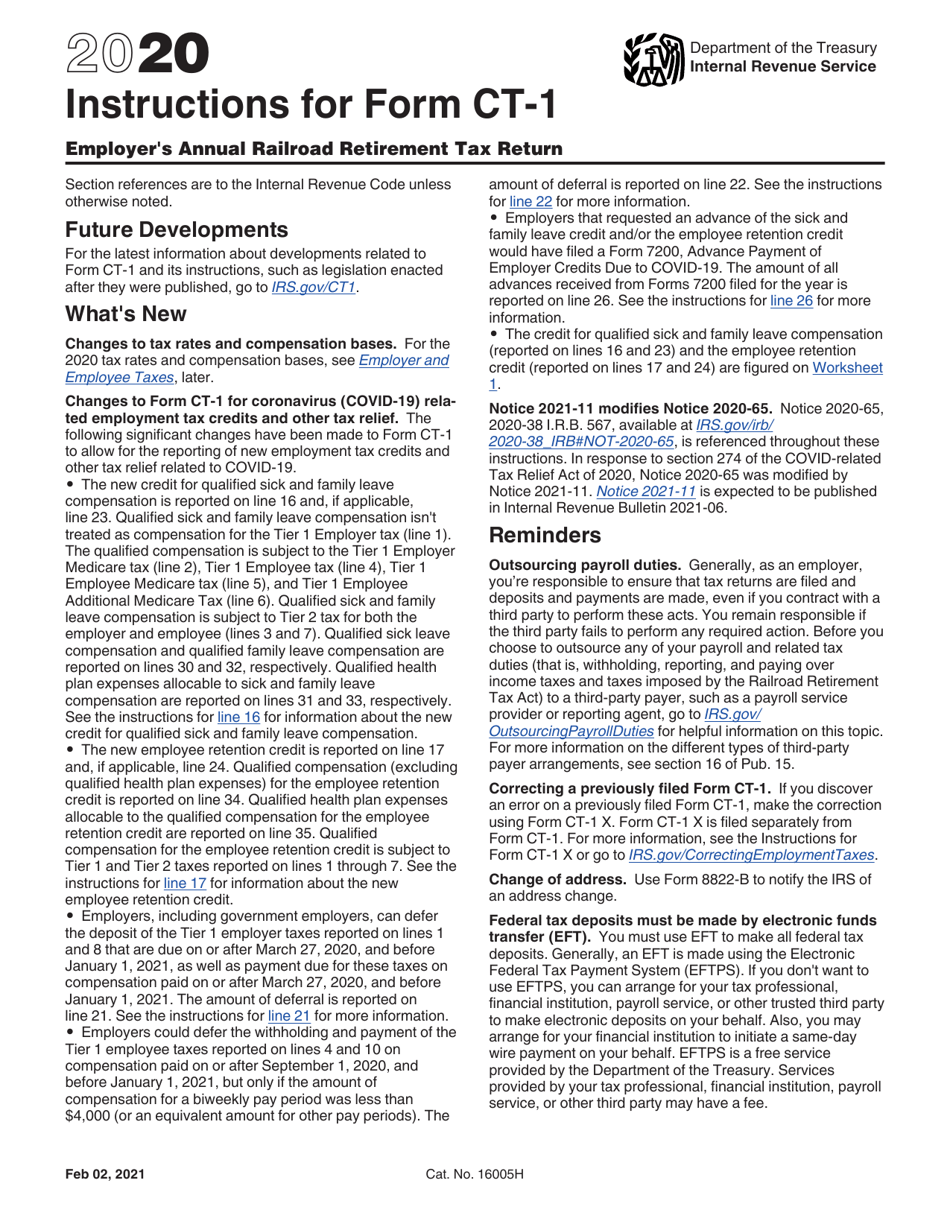

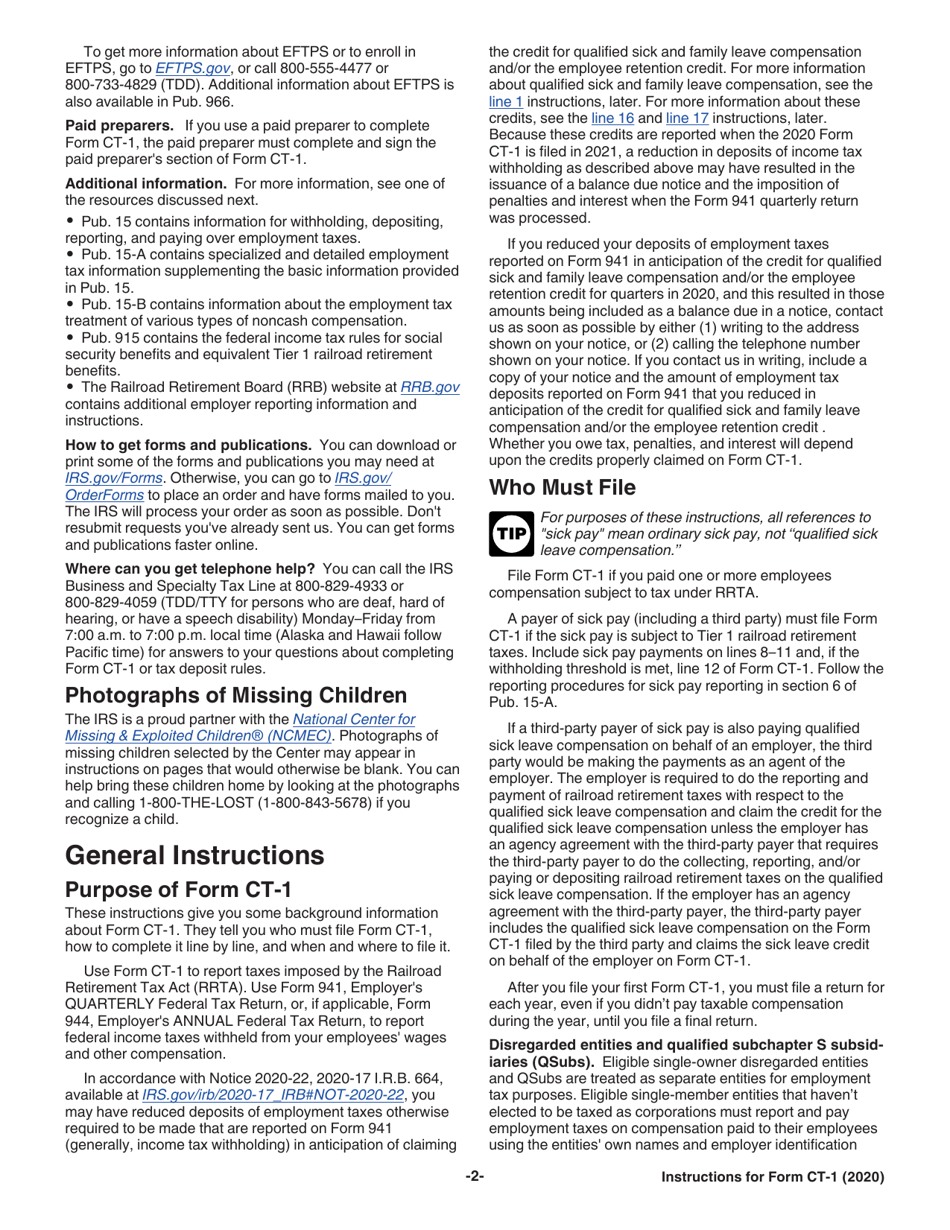

Instructions for IRS Form CT-1 Employer's Annual Railroad Retirement Tax Return

This document contains official instructions for IRS Form CT-1 , Employer's Annual Railroad Retirement Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form CT-1?

A: IRS Form CT-1 is the Employer's Annual Railroad Retirement Tax Return.

Q: Who needs to file IRS Form CT-1?

A: Employers who are liable for the railroad retirement tax must file IRS Form CT-1.

Q: What is the purpose of IRS Form CT-1?

A: The purpose of IRS Form CT-1 is to report railroad retirement taxes.

Q: How often do employers need to file IRS Form CT-1?

A: Employers need to file IRS Form CT-1 annually.

Q: What information is required on IRS Form CT-1?

A: Employers need to provide information such as total compensation, taxable compensation, and taxes withheld.

Q: Is there a deadline for filing IRS Form CT-1?

A: Yes, the deadline for filing IRS Form CT-1 is usually January 31 of the following year.

Instruction Details:

- This 16-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.