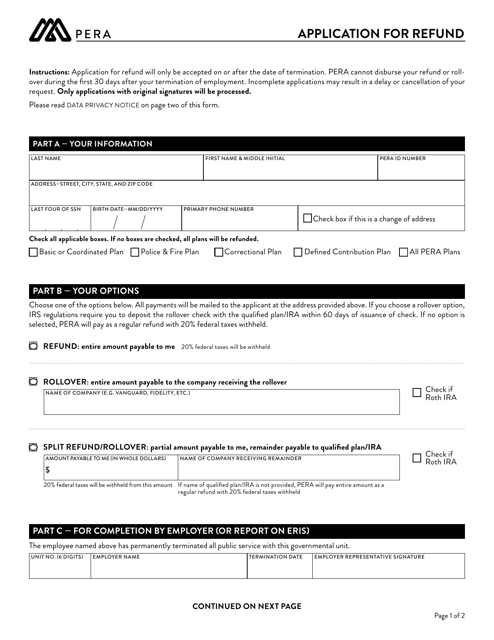

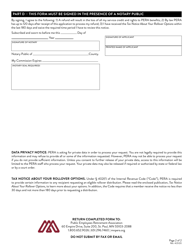

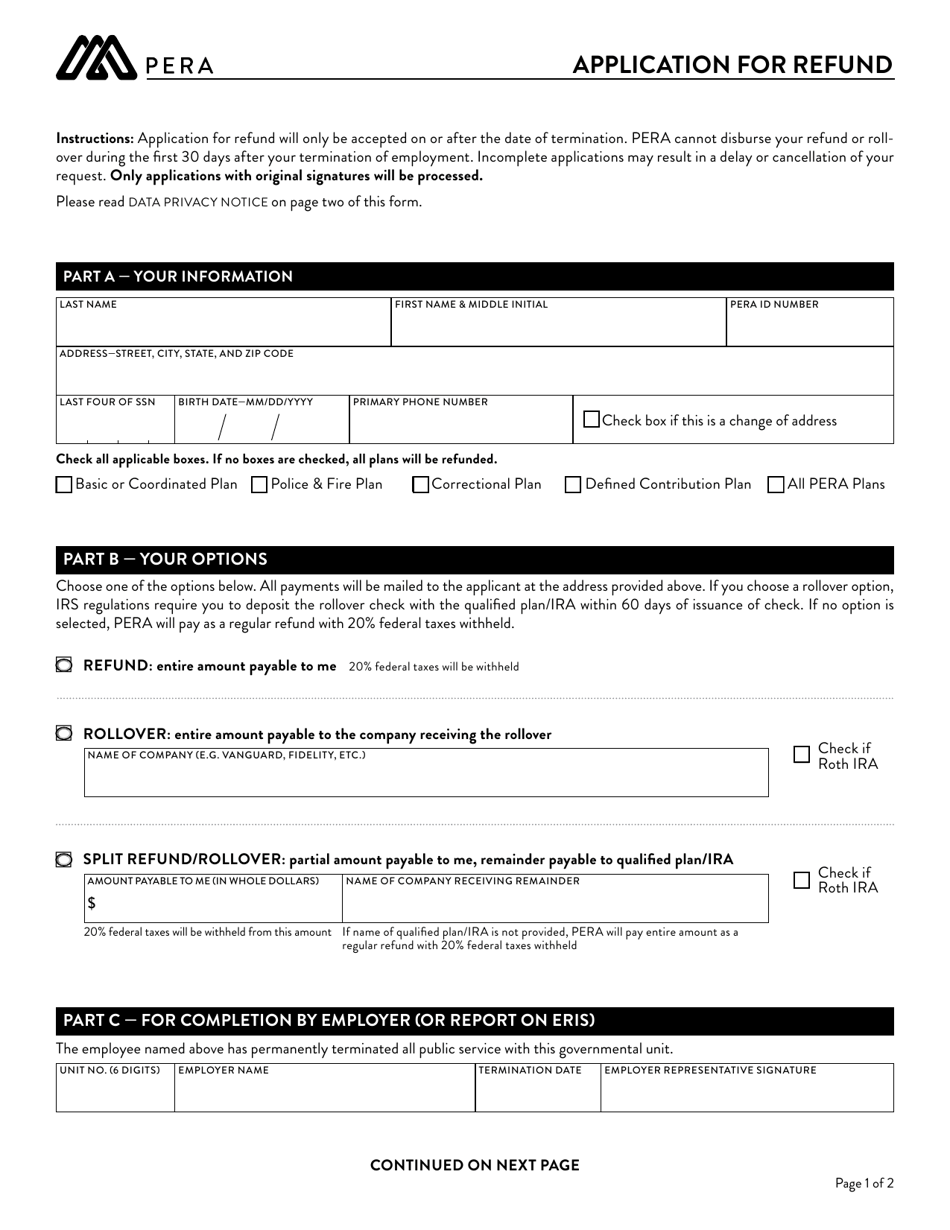

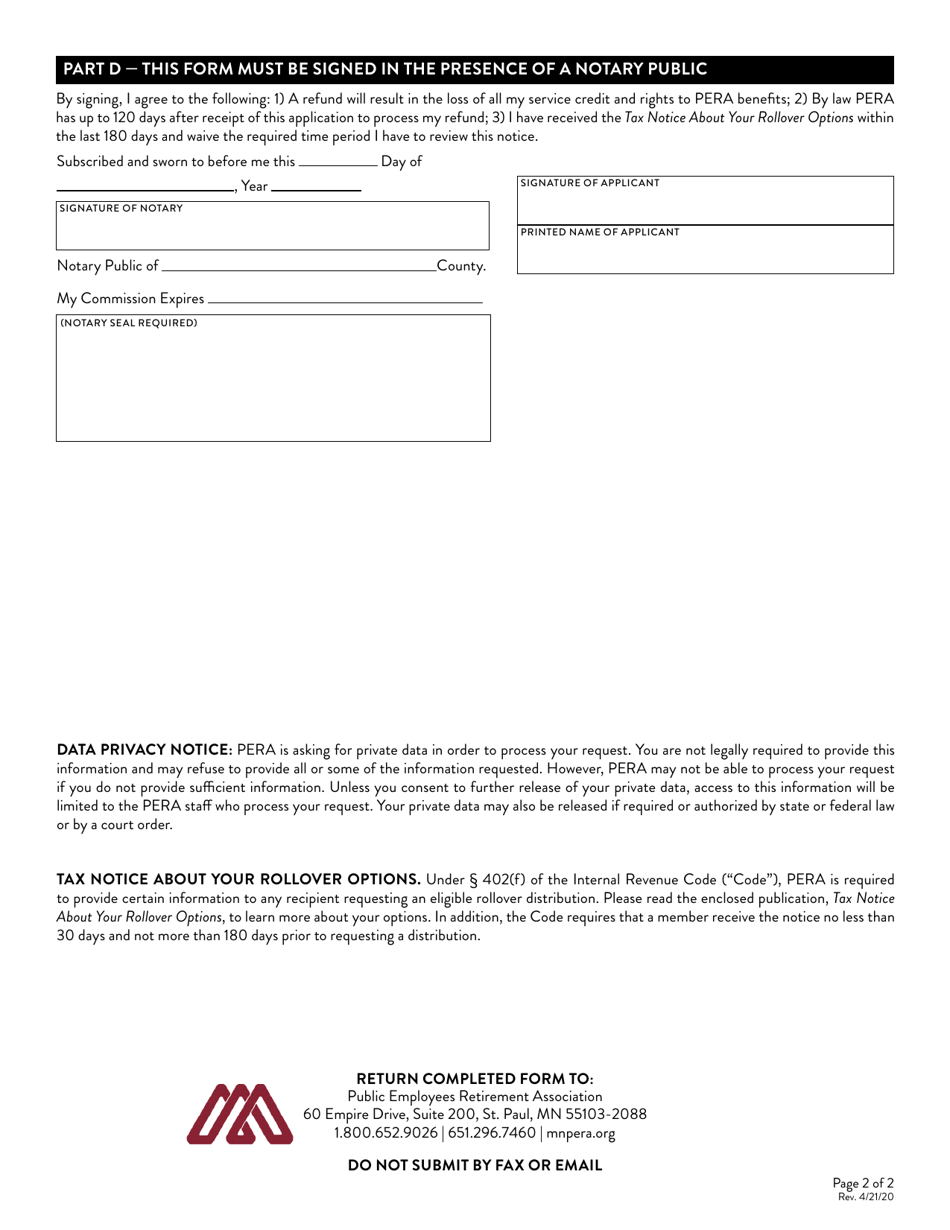

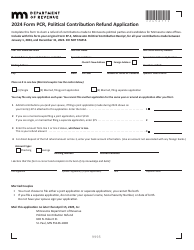

Application for Refund - Minnesota

Application for Refund is a legal document that was released by the Minnesota Public Employees Retirement Association - a government authority operating within Minnesota.

FAQ

Q: Who can apply for a refund in Minnesota?

A: Any taxpayer in Minnesota who has overpaid their taxes can apply for a refund.

Q: How can I apply for a refund in Minnesota?

A: You can apply for a refund in Minnesota by filing a Form M1, Individual Income Tax Return.

Q: When is the deadline to apply for a refund in Minnesota?

A: The deadline to apply for a refund in Minnesota is typically April 15th, unless an extension has been granted.

Q: What documents do I need to apply for a refund in Minnesota?

A: You will need your W-2 forms, 1099 forms, and any other relevant tax documents to apply for a refund in Minnesota.

Q: How long does it take to receive a refund in Minnesota?

A: Typically, it takes about 4-6 weeks to receive a refund in Minnesota if you filed your return electronically, and 8-12 weeks if you filed a paper return.

Form Details:

- Released on April 21, 2020;

- The latest edition currently provided by the Minnesota Public Employees Retirement Association;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Public Employees Retirement Association.