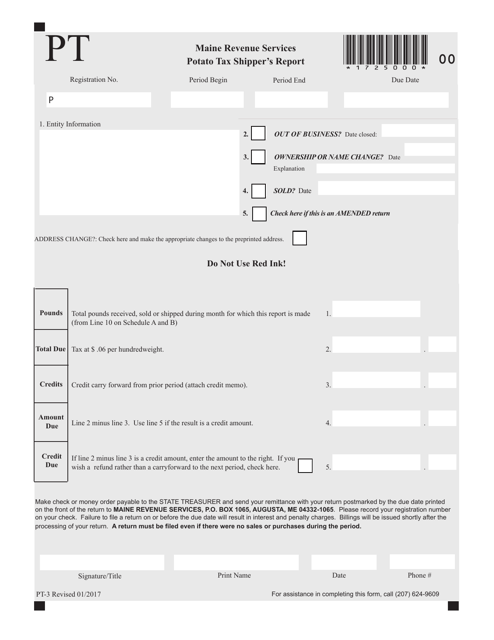

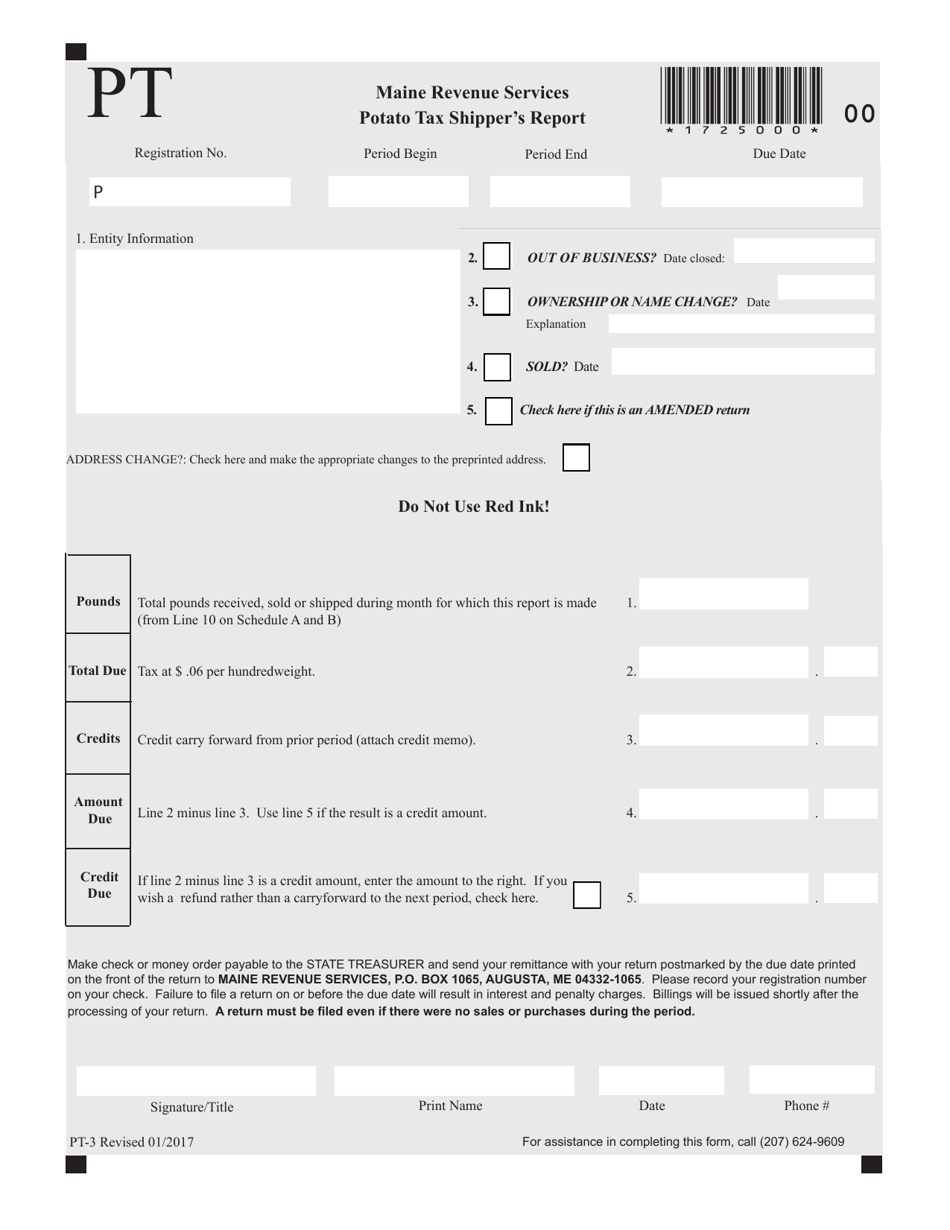

Form PT-3 Potato Tax Shipper's Report - Maine

What Is Form PT-3?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-3?

A: Form PT-3 is the Potato Tax Shipper's Report.

Q: Who needs to file Form PT-3?

A: Potato shippers in Maine need to file Form PT-3.

Q: What is the purpose of Form PT-3?

A: Form PT-3 is used to report and pay potato taxes in Maine.

Q: When is the deadline to file Form PT-3?

A: The deadline to file Form PT-3 is usually on or before the 20th day of the month following the shipment of potatoes.

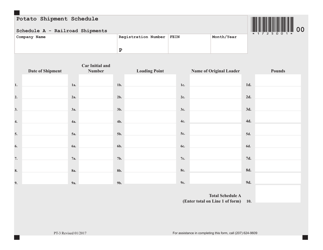

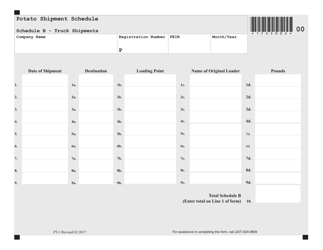

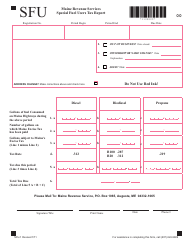

Q: How do I fill out Form PT-3?

A: You need to provide information about the quantity and value of potatoes shipped, as well as calculate and pay the required taxes.

Q: What happens if I don't file Form PT-3?

A: Failure to file Form PT-3 or pay the potato taxes can result in penalties and interest charges.

Q: Are there any exemptions or deductions available on Form PT-3?

A: Yes, there are certain exemptions and deductions available. You should consult the instructions provided with the form for more details.

Q: Who can I contact for more information about Form PT-3?

A: You can contact the Maine Revenue Services office for more information about Form PT-3.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PT-3 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.