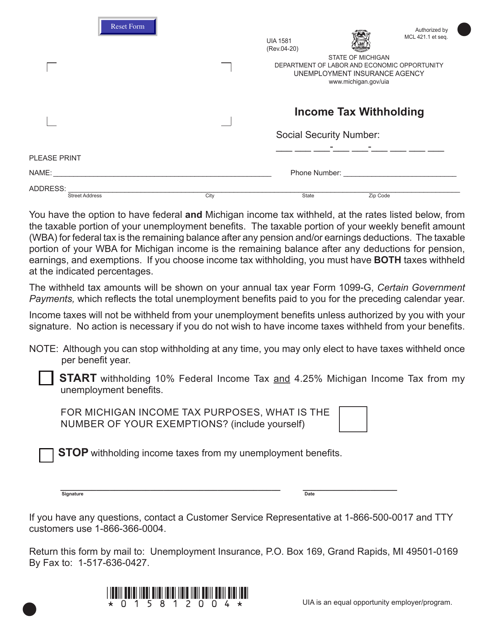

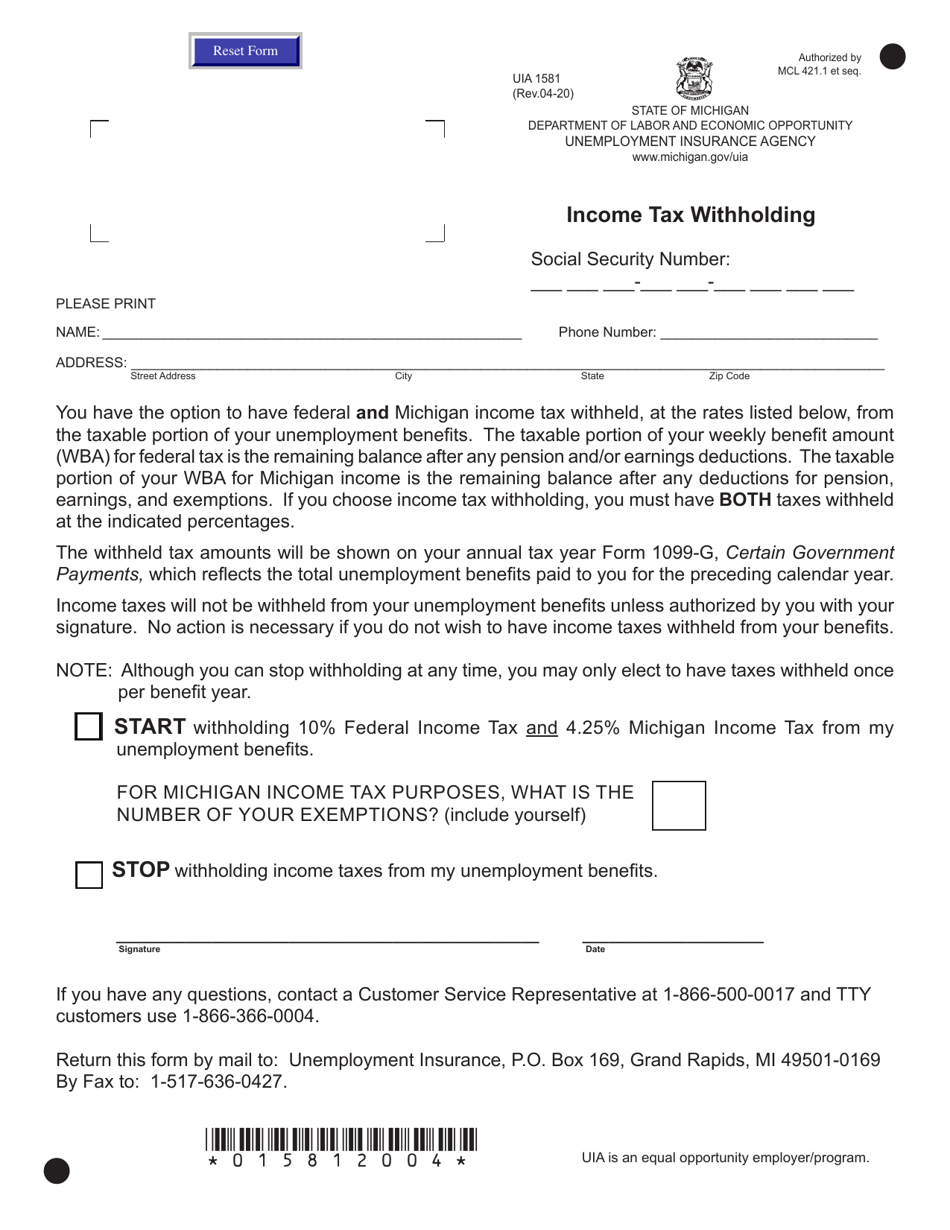

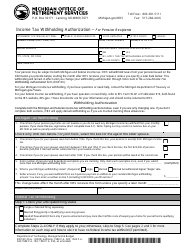

Form UIA1581 Income Tax Withholding - Michigan

What Is Form UIA1581?

This is a legal form that was released by the Michigan Department of Labor and Economic Opportunity - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form UIA1581?

A: Form UIA1581 is the Michigan Income Tax Withholding form.

Q: Who needs to fill out form UIA1581?

A: Employers in Michigan need to fill out form UIA1581.

Q: What is the purpose of form UIA1581?

A: The purpose of form UIA1581 is to report and remit income tax withholding from employees' wages to the state of Michigan.

Q: What information is required on form UIA1581?

A: Employers need to provide their business information, employee information, and details of income tax withheld.

Q: When is form UIA1581 due?

A: Form UIA1581 must be filed and taxes must be remitted on a quarterly basis.

Q: Are there any penalties for not filing form UIA1581?

A: Yes, failure to file form UIA1581 or make timely tax payments may result in penalties and interest charges.

Q: Is form UIA1581 applicable to individuals?

A: No, form UIA1581 is specifically for employers to report income tax withholding for their employees.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Michigan Department of Labor and Economic Opportunity;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UIA1581 by clicking the link below or browse more documents and templates provided by the Michigan Department of Labor and Economic Opportunity.