This version of the form is not currently in use and is provided for reference only. Download this version of

Form 17

for the current year.

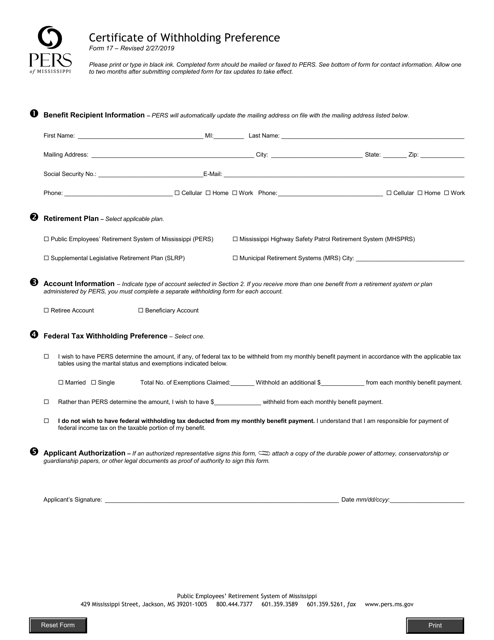

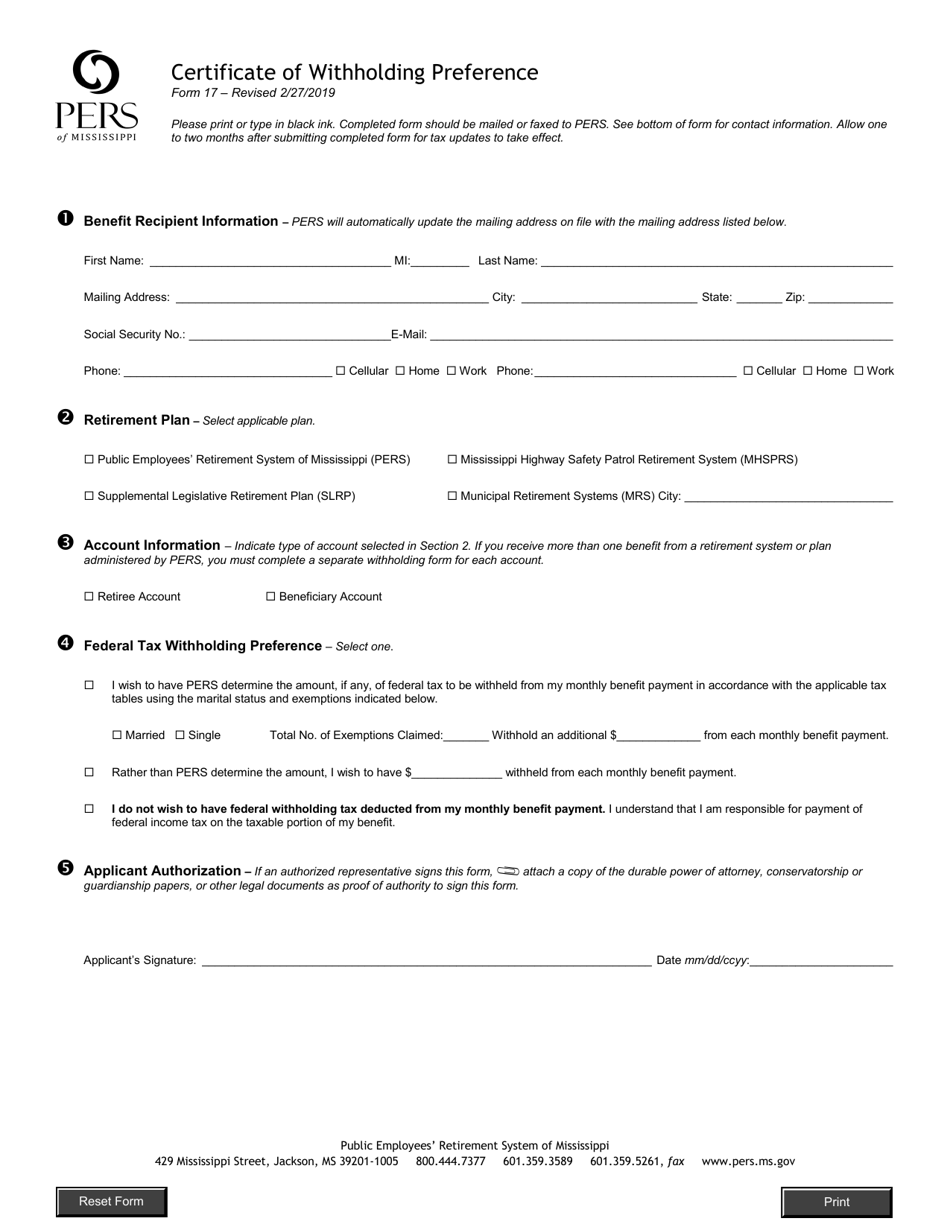

Form 17 Certificate of Withholding Preference - Mississippi

What Is Form 17?

This is a legal form that was released by the Public Employees' Retirement System of Mississippi - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 17 Certificate of Withholding Preference?

A: Form 17 Certificate of Withholding Preference is a document used in Mississippi to indicate an individual's preference for the amount of tax to be withheld from their income.

Q: What is the purpose of Form 17?

A: The purpose of Form 17 is to allow individuals to specify their withholding preference, either by claiming exemptions or requesting additional withholdings.

Q: Who should file Form 17?

A: Individuals who are employees or recipients of pensions or annuities and wish to modify their withholding preferences should file Form 17.

Q: What information is required on Form 17?

A: Form 17 requires personal information such as name, social security number, and address, as well as information regarding exemptions and additional withholding amounts.

Q: When should Form 17 be filed?

A: Form 17 should be filed within 10 days of starting employment or receiving a pension or annuity.

Q: Can Form 17 be modified after filing?

A: Yes, Form 17 can be modified at any time by submitting a new form to the employer or the Mississippi Department of Revenue.

Form Details:

- Released on February 27, 2019;

- The latest edition provided by the Public Employees' Retirement System of Mississippi;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 17 by clicking the link below or browse more documents and templates provided by the Public Employees' Retirement System of Mississippi.