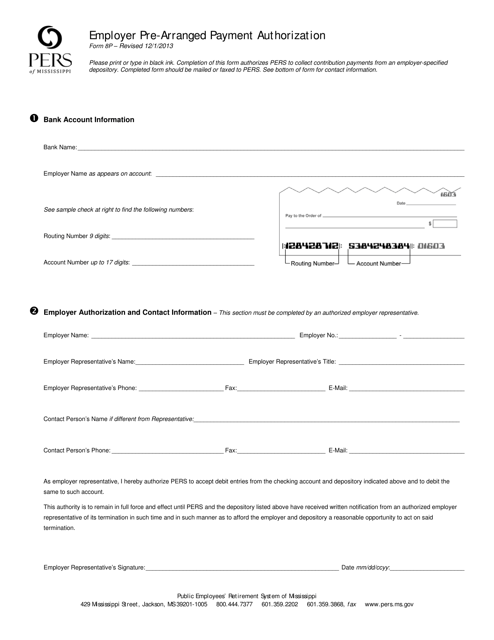

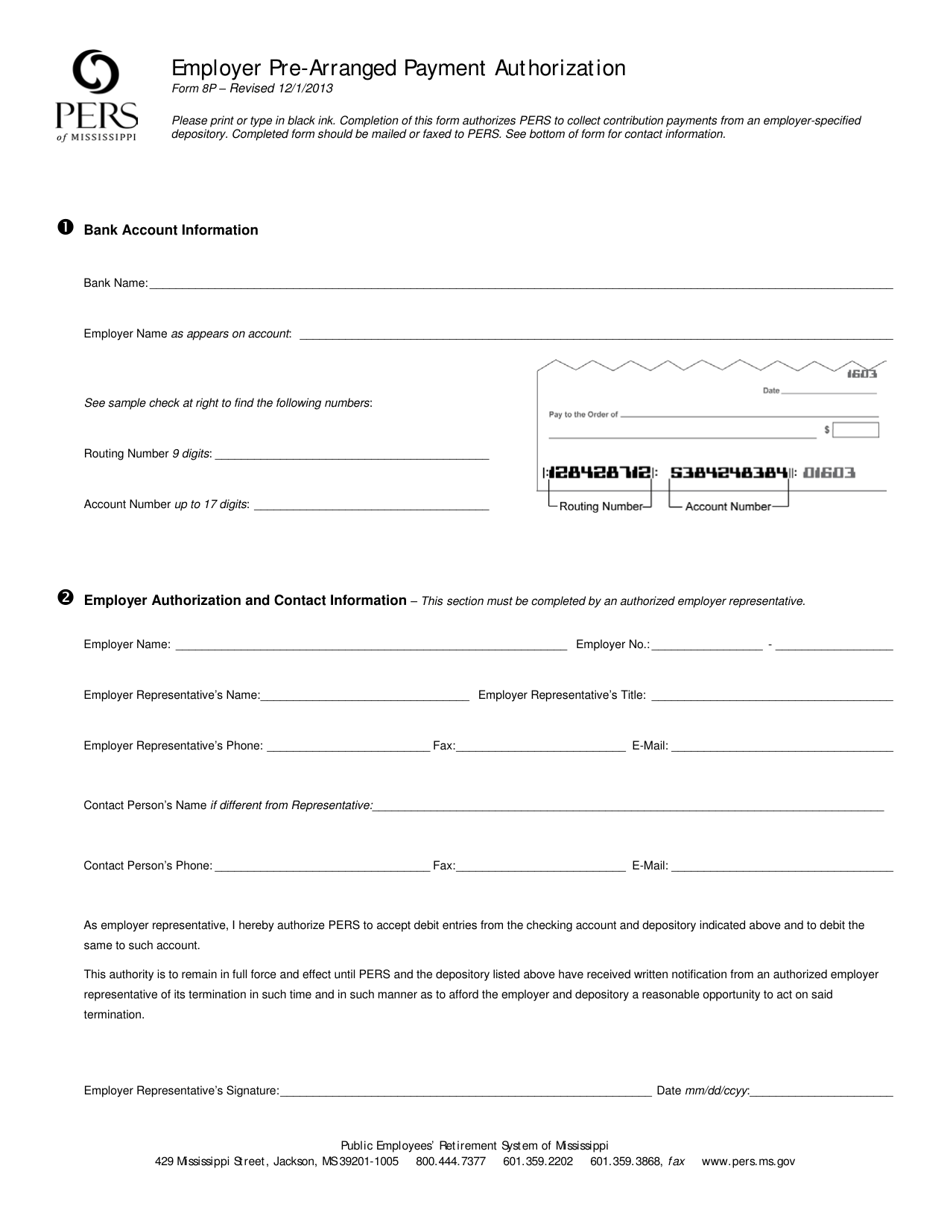

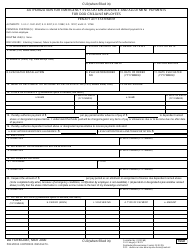

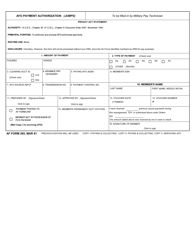

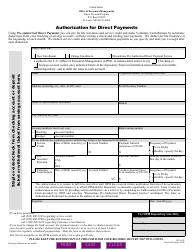

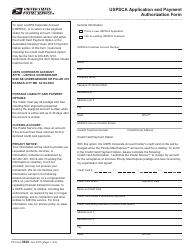

Form 8P Employer Pre-arranged Payment Authorization - Mississippi

What Is Form 8P?

This is a legal form that was released by the Public Employees' Retirement System of Mississippi - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 8P Employer Pre-arranged Payment Authorization?

A: Form 8P Employer Pre-arranged Payment Authorization is a document used in Mississippi to authorize employers to deduct pre-arranged payments from an employee's wages.

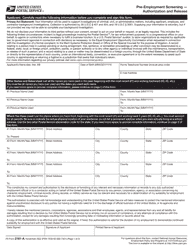

Q: Who needs to use Form 8P Employer Pre-arranged Payment Authorization?

A: Employees in Mississippi who want to authorize their employers to deduct pre-arranged payments from their wages need to use Form 8P.

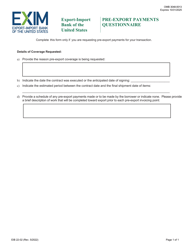

Q: What kind of deductions can be authorized using this form?

A: Form 8P can be used to authorize deductions such as insurance premiums, retirement contributions, and other authorized payments.

Q: Is Form 8P a legally binding document?

A: Yes, Form 8P is a legally binding document once signed by the employee and the employer.

Form Details:

- Released on December 1, 2013;

- The latest edition provided by the Public Employees' Retirement System of Mississippi;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 8P by clicking the link below or browse more documents and templates provided by the Public Employees' Retirement System of Mississippi.