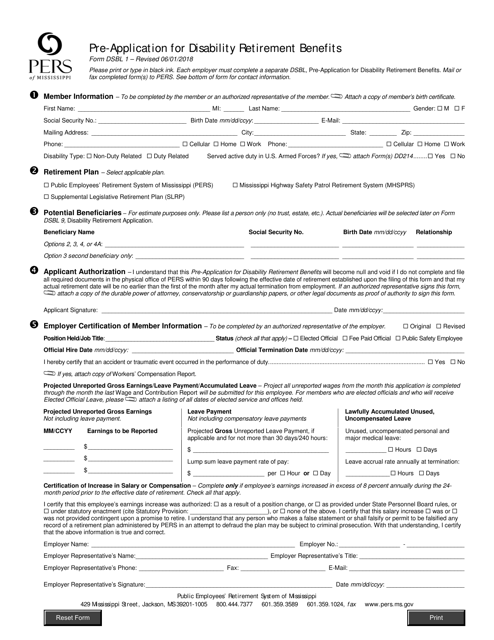

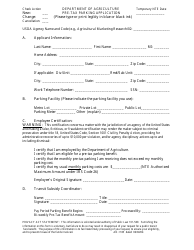

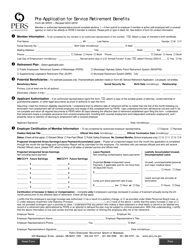

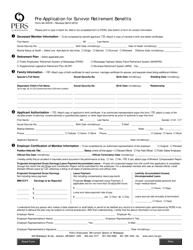

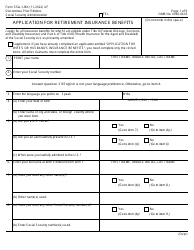

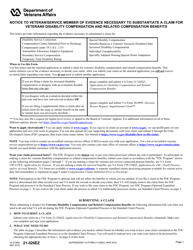

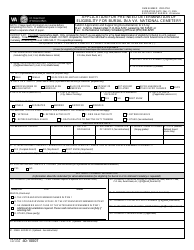

Form DSBL1 Pre-application for Disability Retirement Benefits - Mississippi

What Is Form DSBL1?

This is a legal form that was released by the Public Employees' Retirement System of Mississippi - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DSBL1?

A: Form DSBL1 is the Pre-application for Disability Retirement Benefits in Mississippi.

Q: What is disability retirement?

A: Disability retirement is a type of retirement that provides benefits to individuals who are unable to work due to a disabling condition.

Q: Who is eligible for disability retirement benefits in Mississippi?

A: To be eligible for disability retirement benefits in Mississippi, you must be a member of the Public Employees' Retirement System (PERS) and have a qualifying disabling condition.

Q: How do I apply for disability retirement benefits in Mississippi?

A: You can apply for disability retirement benefits in Mississippi by completing and submitting Form DSBL1, the Pre-application for Disability Retirement Benefits.

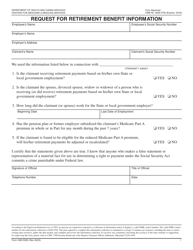

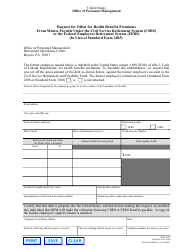

Q: What documents do I need to submit with Form DSBL1?

A: You may need to submit supporting documentation such as medical records and proof of employment.

Q: Can I apply for disability retirement benefits if I am not a member of the Public Employees' Retirement System (PERS)?

A: No, to be eligible for disability retirement benefits in Mississippi, you must be a member of the Public Employees' Retirement System (PERS).

Q: How long does it take to process a disability retirement application?

A: The processing time for a disability retirement application can vary, but it generally takes several months.

Q: What happens after I submit my disability retirement application?

A: After you submit your disability retirement application, it will be reviewed by the Public Employees' Retirement System (PERS). If approved, you will begin receiving disability retirement benefits.

Q: Are disability retirement benefits taxable?

A: Yes, disability retirement benefits are generally taxable. However, you should consult with a tax professional to determine the specific tax implications for your situation.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Public Employees' Retirement System of Mississippi;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DSBL1 by clicking the link below or browse more documents and templates provided by the Public Employees' Retirement System of Mississippi.