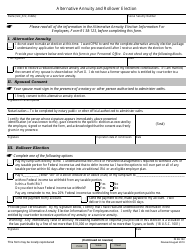

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5C

for the current year.

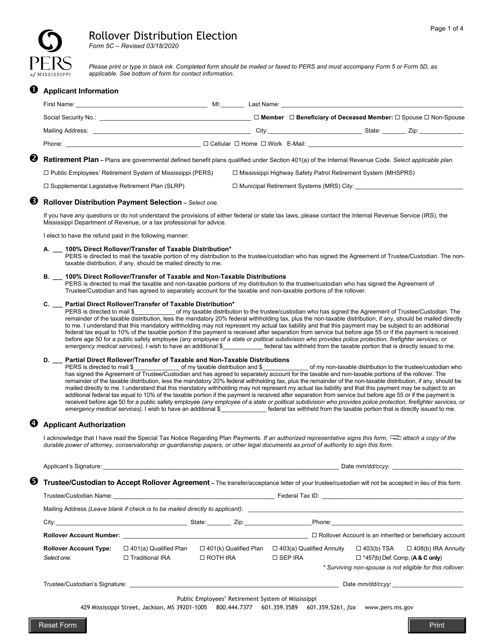

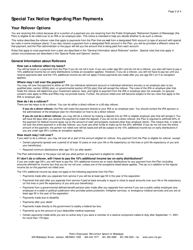

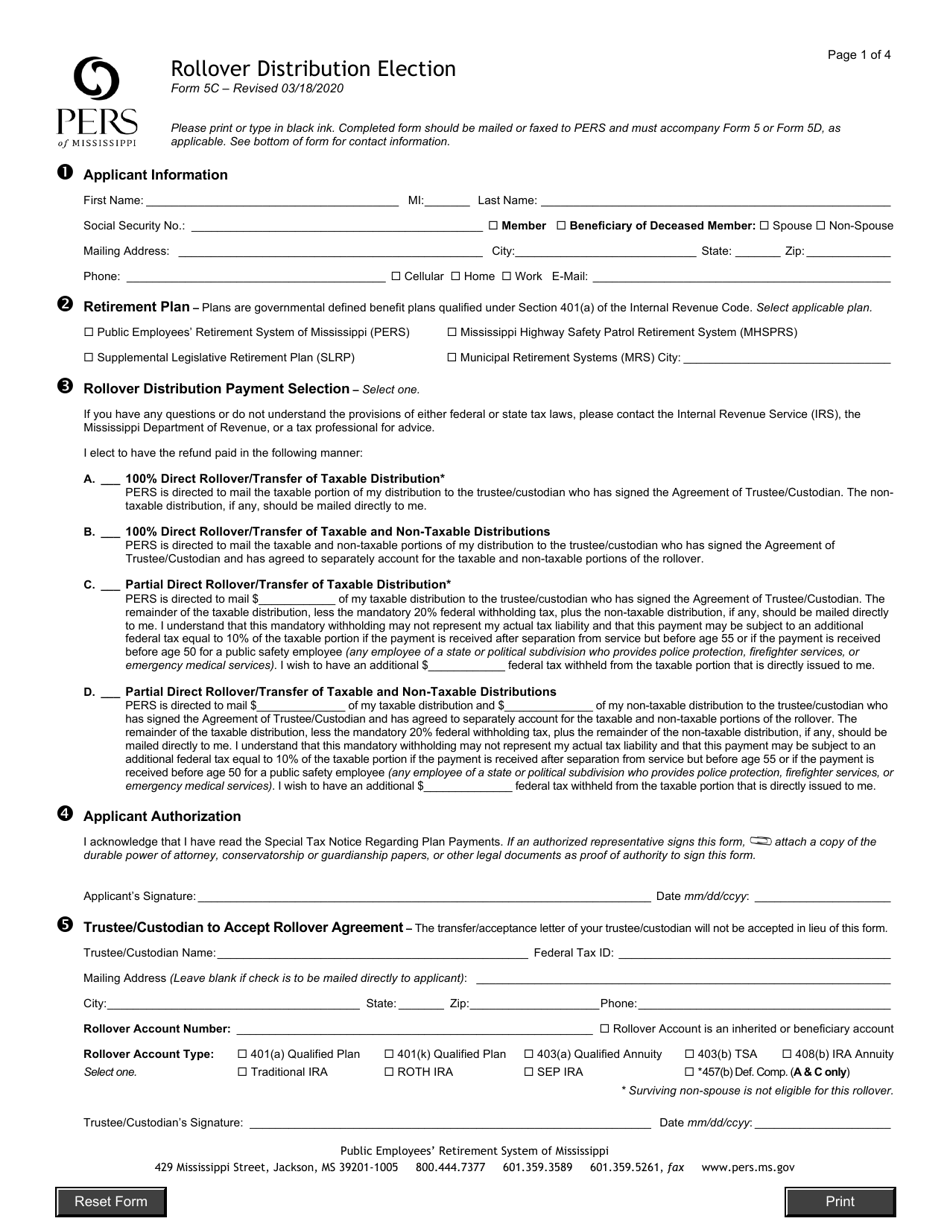

Form 5C Rollover Distribution Election - Mississippi

What Is Form 5C?

This is a legal form that was released by the Public Employees' Retirement System of Mississippi - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form 5C Rollover Distribution Election?

A: The Form 5C Rollover Distribution Election is a tax form used to elect to rollover a distribution from a retirement plan into an IRA or another eligible retirement plan.

Q: Who is eligible to use the Form 5C Rollover Distribution Election?

A: Anyone who has received a distribution from a retirement plan and wants to roll it over into an IRA or another eligible retirement plan can use the Form 5C Rollover Distribution Election.

Q: Why would someone use a Form 5C Rollover Distribution Election?

A: Using a Form 5C Rollover Distribution Election allows individuals to defer tax on the distribution and continue to save for retirement in a tax-advantaged account.

Q: Are there any deadlines for using the Form 5C Rollover Distribution Election?

A: Yes, the Form 5C Rollover Distribution Election must generally be made within 60 days of receiving the distribution.

Q: What happens if I don't use the Form 5C Rollover Distribution Election within the deadline?

A: If you don't use the Form 5C Rollover Distribution Election within the deadline, the distribution will be treated as taxable income in the year received.

Q: Can I use the Form 5C Rollover Distribution Election for a Roth IRA?

A: No, the Form 5C Rollover Distribution Election is specifically used for traditional IRAs and other eligible retirement plans.

Q: Are there any limitations on the amount that can be rolled over using the Form 5C Rollover Distribution Election?

A: No, there are generally no limitations on the amount that can be rolled over using the Form 5C Rollover Distribution Election.

Q: Do I need to include a Form 5C Rollover Distribution Election with my tax return?

A: No, the Form 5C Rollover Distribution Election is not required to be included with your tax return, but you should keep a copy for your records.

Q: Are there any tax consequences associated with using the Form 5C Rollover Distribution Election?

A: No, as long as the distribution is rolled over into an IRA or another eligible retirement plan within the deadline, there are generally no immediate tax consequences.

Form Details:

- Released on March 18, 2020;

- The latest edition provided by the Public Employees' Retirement System of Mississippi;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5C by clicking the link below or browse more documents and templates provided by the Public Employees' Retirement System of Mississippi.