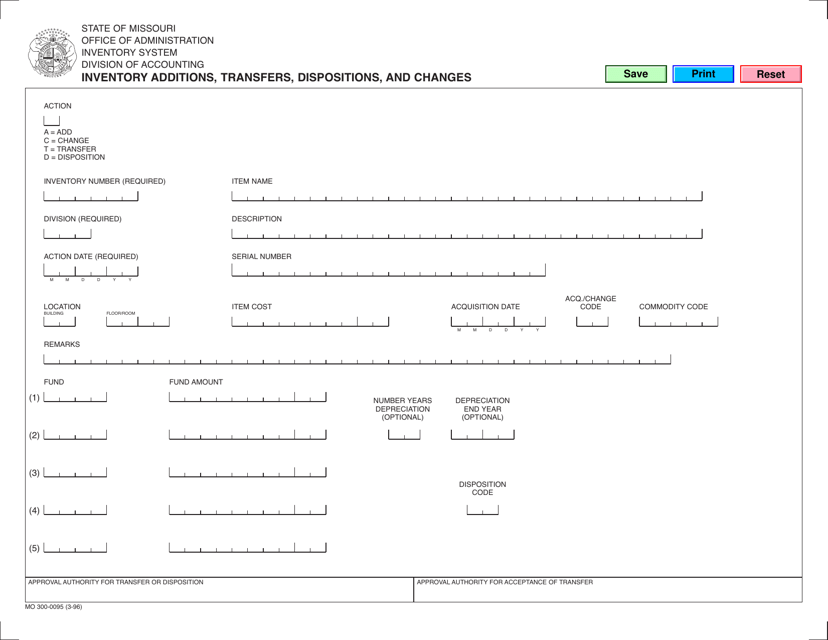

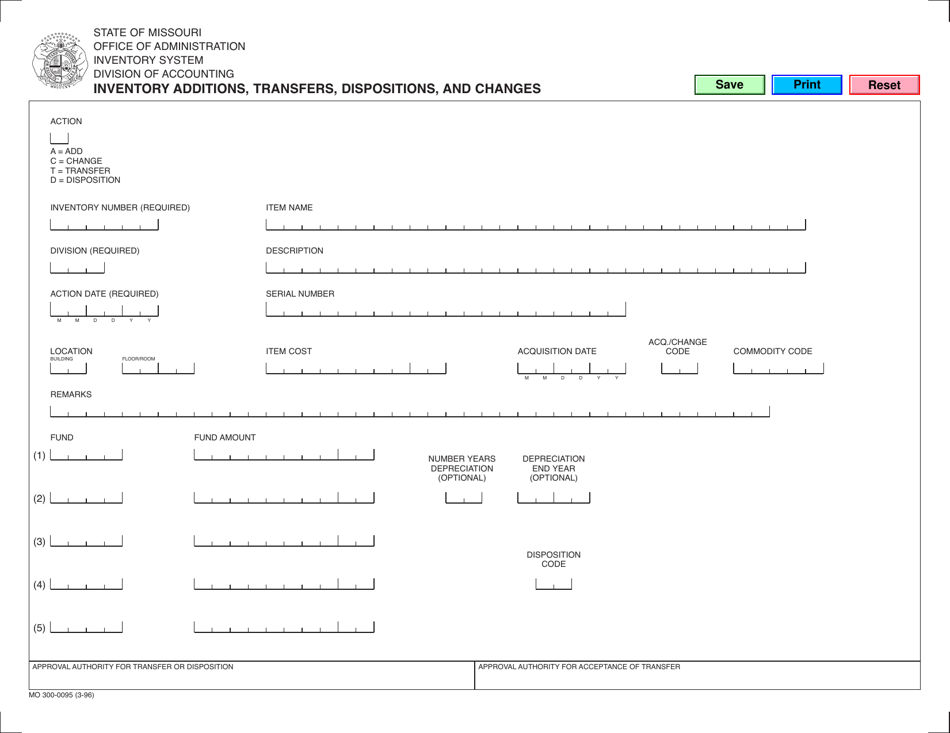

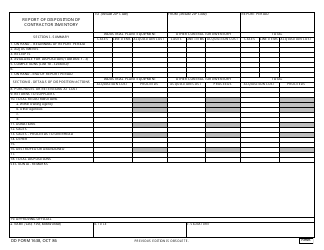

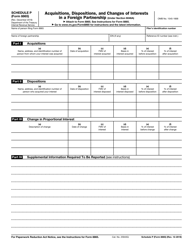

Form MO300-0095 Inventory Additions, Transfers, Dispositions, and Changes - Missouri

What Is Form MO300-0095?

This is a legal form that was released by the Missouri Office of Administration - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO300-0095?

A: Form MO300-0095 is a document used in the state of Missouri for reporting inventory additions, transfers, dispositions, and changes.

Q: Who needs to use Form MO300-0095?

A: Businesses in Missouri that have inventory and need to report additions, transfers, dispositions, and changes.

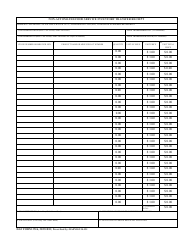

Q: What information is required on Form MO300-0095?

A: Form MO300-0095 requires information such as the description of the inventory item, quantity, cost, date of addition/transfer/disposition/change, and the reason for the change.

Q: When is Form MO300-0095 due?

A: Form MO300-0095 is due annually by the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for not filing Form MO300-0095?

A: Yes, failure to file Form MO300-0095 or filing it late may result in penalties and interest.

Q: Can I submit Form MO300-0095 electronically?

A: Yes, the Missouri Department of Revenue accepts electronic filing of Form MO300-0095.

Q: Is there a fee to file Form MO300-0095?

A: No, there is no fee to file Form MO300-0095.

Q: What if there are no changes or transactions to report on Form MO300-0095?

A: If there are no changes or transactions to report, you are still required to submit Form MO300-0095 with a notation indicating no activity.

Q: Can I amend a previously filed Form MO300-0095?

A: Yes, if you need to make changes to a previously filed Form MO300-0095, you can file an amended form.

Form Details:

- Released on March 1, 1996;

- The latest edition provided by the Missouri Office of Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO300-0095 by clicking the link below or browse more documents and templates provided by the Missouri Office of Administration.