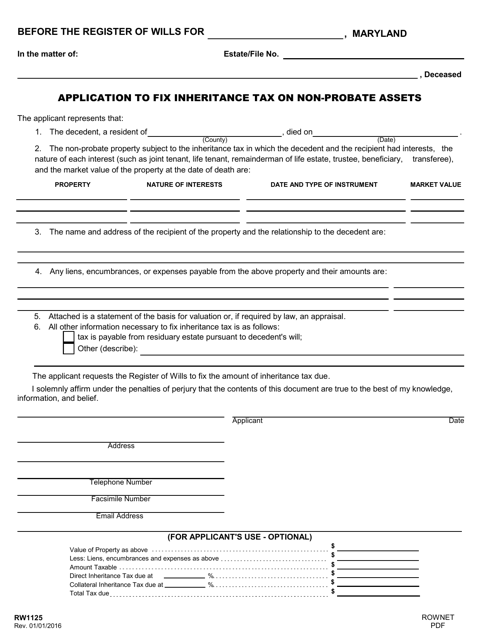

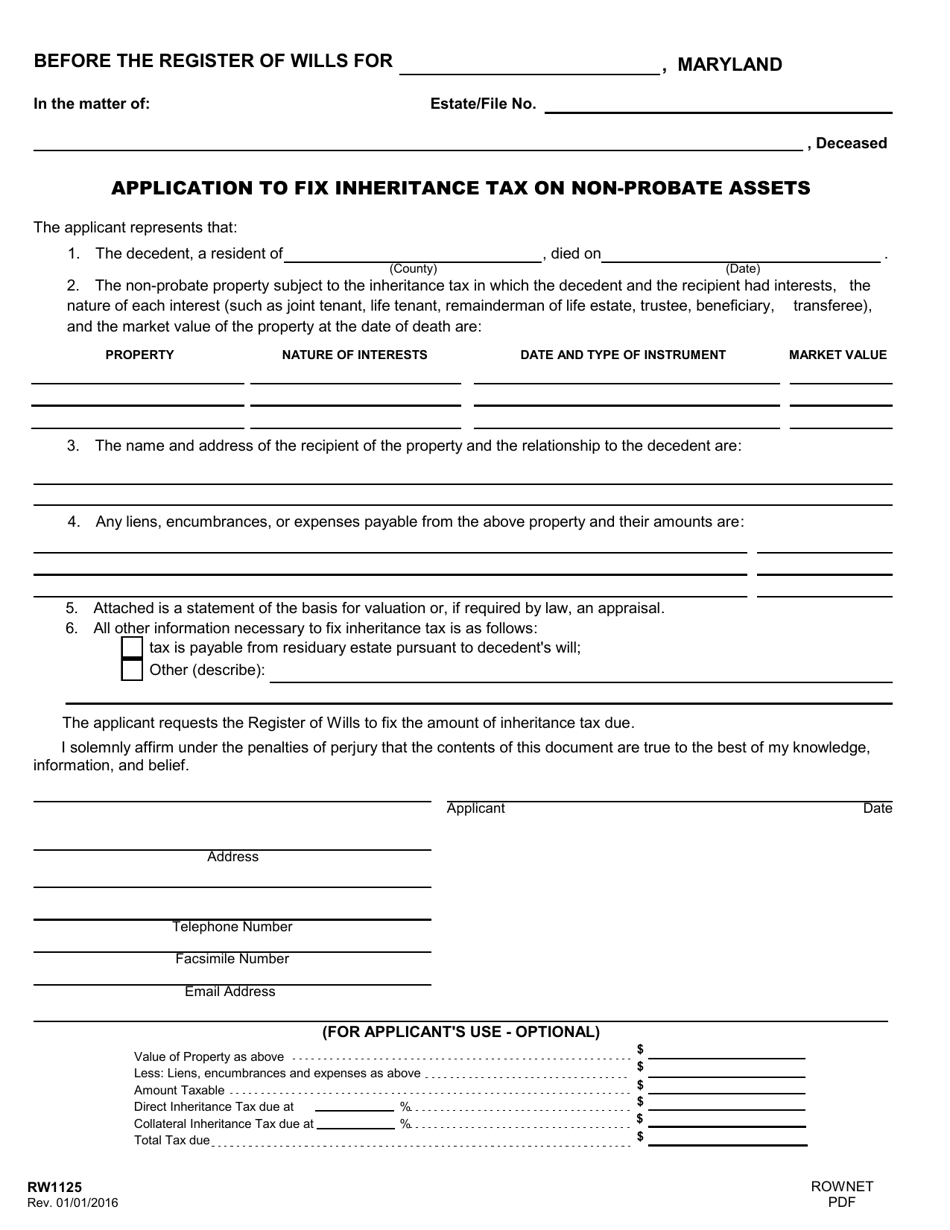

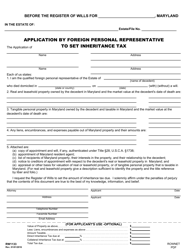

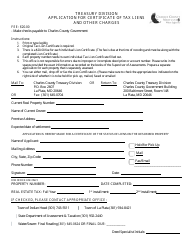

Form RW1125 Application to Fix Inheritance Tax on Non-probate Assets - Maryland

What Is Form RW1125?

This is a legal form that was released by the Maryland Offices of the Registers of Wills - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RW1125?

A: Form RW1125 is the Application to Fix Inheritance Tax on Non-probate Assets in Maryland.

Q: What is inheritance tax?

A: Inheritance tax is a tax imposed on the transfer of assets from a deceased person to their beneficiaries.

Q: What are non-probate assets?

A: Non-probate assets are assets that are not subject to the probate process, such as jointly owned property, life insurance proceeds, retirement accounts, and payable-on-death accounts.

Q: Who needs to file Form RW1125?

A: Form RW1125 needs to be filed by the personal representative of the deceased person's estate.

Q: What information is required on Form RW1125?

A: Form RW1125 requires information about the deceased person, the non-probate assets, and the beneficiaries.

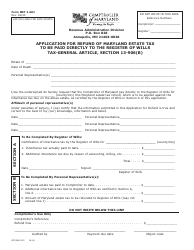

Q: When do I need to file Form RW1125?

A: Form RW1125 needs to be filed within nine months from the date of the deceased person's death.

Q: Is there a fee to file Form RW1125?

A: Yes, there is a fee to file Form RW1125. The fee is based on the value of the non-probate assets subject to inheritance tax.

Q: What happens after I file Form RW1125?

A: After filing Form RW1125, the Register of Wills will review the application and determine the amount of inheritance tax due on the non-probate assets.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Maryland Offices of the Registers of Wills;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RW1125 by clicking the link below or browse more documents and templates provided by the Maryland Offices of the Registers of Wills.