Mileage Reimbursement Form

What Is Mileage Reimbursement?

There are certain jobs out there that require a staff member to use a personal vehicle for business-related trips. An employer may offer Mileage Reimbursement to help compensate some costs that an employee encounters which is usually based on a fixed amount. To request mileage reimbursement from your employer, you will need to fill in a Mileage Reimbursement Form.

Alternate Names:

- IRS Mileage Reimbursement Form;

- Mileage Log Reimbursement Form;

- Employee Mileage Reimbursement Form.

A printable Mileage Reimbursement Form template can be downloaded by clicking the link below. The Internal Revenue Service (IRS) has a standard mile reimbursement rate which is currently 56 cents per mile (as of 2021). If an employee receives the standard reimbursement rate or something below this, the sum you get paid does not get taxed. However, any reimbursement received over this rate will be taxable so it may not always be in the best interests to request a higher rate from your employer.

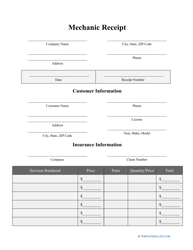

Before agreeing to be reimbursed, it is important to consider all the costs and whether or not you will still be losing money. Petrol is just one of many things a vehicle requires. Think about what other costs are involved, weigh up the price of oil changes, tires, and general maintenance to ensure that you are not on the losing end of the deal.

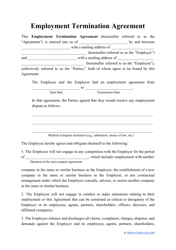

How to Calculate Mileage Reimbursement?

Firstly, it is important to understand what your mileage rate is. This should be clarified with the employer. Do not automatically assume that you fall under the qualifying category for the IRS Mileage Reimbursement Rate as the IRS has its own specific guidelines in order for an individual to qualify. Also remember, if your reimbursement rate is above the IRS Mileage Reimbursement Rate, then you will be liable for tax.

If we take the Mileage Reimbursement Rate for 2021 which totals 56 cents per mile, the formula is fairly straightforward. If you have covered 500 miles then: [miles] x [rate] 500 x $0.56 = $280

This rate only applies in circumstances when an employee uses a private vehicle for work-related purposes. It takes into accordance the maintenance of the car as well. In situations where you are provided with a company car for business trips, the rate will be somewhat lower as the employee is only paid for operating the car. This rate should be clarified with your employer.

The method of tracking business miles as opposed to personal miles differs between different companies. An employer may make the employee responsible for controlling and reporting mileage independently. Other companies may install a GPS tracking device in vehicles to keep tighter control of the realistic mileage covered during business trips.

What Are the IRS Guidelines for Mileage Reimbursement?

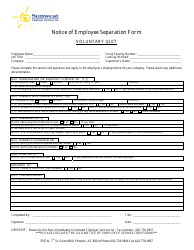

In order to meet the guidelines for the standard IRS Mileage Reimbursement, the following criteria have to be met:

- The employee must either be the owner of the vehicle or be leasing it.

- The maximum number of cars that an employee drives should not exceed five.

- No previous claiming for any deductions using Section 179 for the vehicle.

- No previous claiming for special depreciation allowances on the vehicle.

- No previous claiming for actual expenses after 1997 for a vehicle under a lease.

If an employee is the owner of the car then they are permitted to use the standard mileage reimbursement from the year that the car was first used under a company. After this, the employee can opt to use standard mileage or actual expenses to calculate this. If a car is being leased, then you can only use the standard mileage rate if you choose to do so.

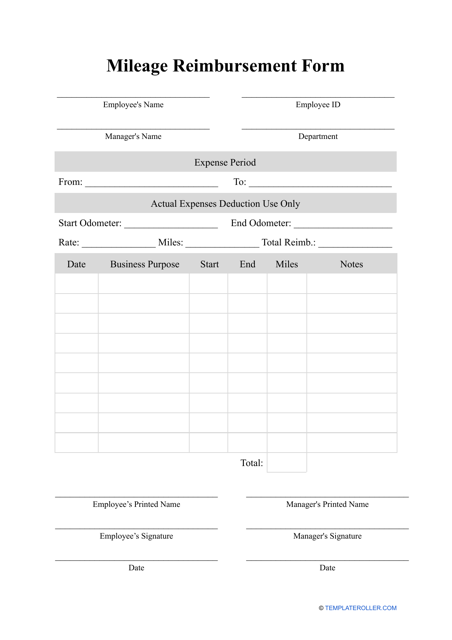

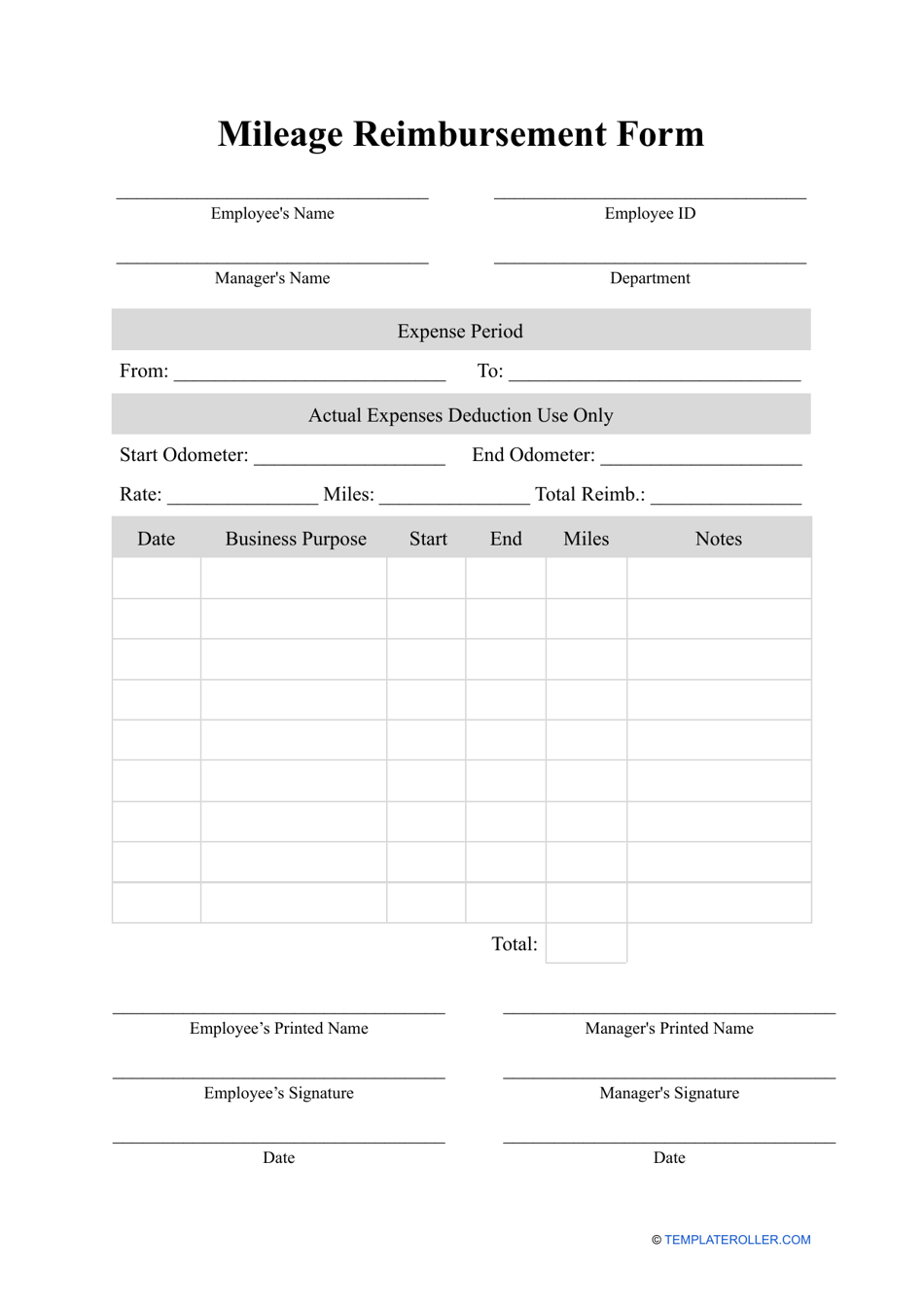

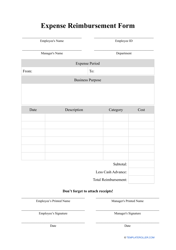

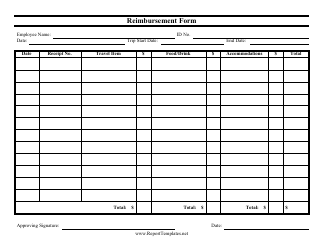

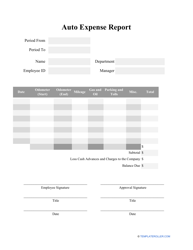

How to Fill Out a Mileage Reimbursement Form?

Filling out a Mileage Reimbursement Form is relatively easy providing you have the records on hand. Ensure you include the following:

- The employee's full name.

- The employee's position.

- The department that the employee works for.

- The employee's contact details (including their email address and phone number).

- The date when coverage started.

- The date when coverage ended.

- Mileage calculations. If the employee is responsible for making these recordings, they should enter the date, destination, short details on the reason for the business trip along with the start and end odometer readings for each trip. Every trip should then be calculated as 'Total Mileage' and included on the form. If your company has installed GPS tracking software, instead of odometer readings, take the readings from the installed application.

- A summary of the expenses. Note the reimbursement rate (details of this come from the employer) and the total reimbursement fee that you are entitled to as you have calculated.

Attach any relevant receipts for topping up the gas or general maintenance, if this is required by your employer.

Not what you were looking for? Check out these related forms: