Multi-Member LLC Operating Agreement Template

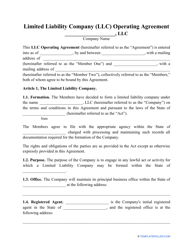

A Multi-Member LLC Operating Agreement confirms that a business entity is not related to the personal assets of its owners. The big bonus of these types of contracts lies in the fact that they are registered with a state and recognized as genuine. In order to make this official, the signers of this agreement must legally obtain this status by completing a Multi-Member LLC Operating Agreement, which can be downloaded through the link below.

What Is a Multi-Member LLC?

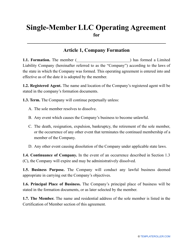

Multi-Member LLCs are limited liability companies (LLC), the only difference being that they consist of several members as opposed to just one. Structurally, it does not differ too much from a Single-Member LLC, which provides personal liability protections.

There aren't a set amount of limitations on the exact number of people who can join a Multi-Member LLC. This gives all owners an opportunity to get involved in operational tasks associated with running a business. Eligibility criteria may differ, this is state-dependent. The most crucial criterion is that the individual applying must be over the age of 18.

Multi-Member LLCs may be governed by one, all, or some members - sometimes even by a third party. Although the experience and knowledge of several members have obvious advantages, problems could arise if even just one member makes a mistake, particularly something serious such as fraud. The result of this will mean that all members will be held accountable for the error of a single person.

This type of agreement outlines how the business is divided and provides a detailed explanation of the way in which the company will function.

How to File a Multi-Member LLC?

To file a Multi-Member LLC Operating Agreement correctly, you will need to include the following:

- First, pick a name for the company . Keep in mind that you need to be certain of the availability first.

- Employer Identification Number . Step two requires an EIA which permits the owner(s) to carry out vital functions associated with managing and opening a business such as hiring staff, opening a bank account etc.

- State registration . Although specific details will vary between different states, generally it consists of the name and address of the company, information about all members of the LLC and the proposed business services offered. If your state requires you to do so, you may also need to submit information regarding a registered agent.

- Creating an operating agreement . This section needs to outline how the roles, responsibilities and profits are delegated between members or managers. This is a good preventative measure against potential disputes.

- Licenses and permits . These will differ depending on your services, but at this stage all of the licenses and permits that are required for your business to operate need to be obtained.

- Opening a business bank account . This account should be used purely for the business - for personal, individual finances.

How Does a Multi-Member LLC File Taxes?

When concerning federal taxes a Multi-Member LLC will be handled like a partnership - unless otherwise agreed prior to this. Unlike a Single Member LLC which can file taxes using their personal income taxes annually, a Multi-Member LLC cannot.

The members all hold equal responsibility to pay their taxes based on the profit/loss encountered during the year. Companies need to ensure that every member files a Schedule E (Form 1040) tax form which needs to be filed along with their own personal tax return form.

The distribution varies and may be dependent on the level of investment or involvement in a company. All of this information is outlined in the operating agreement. It is crucial that before opening a Multi-Member LLC, you are aware of which taxes need to be filed, not only from the side of each individual member, but also from the side of the company.

Still looking for a particular template? Take a look at the related templates below: