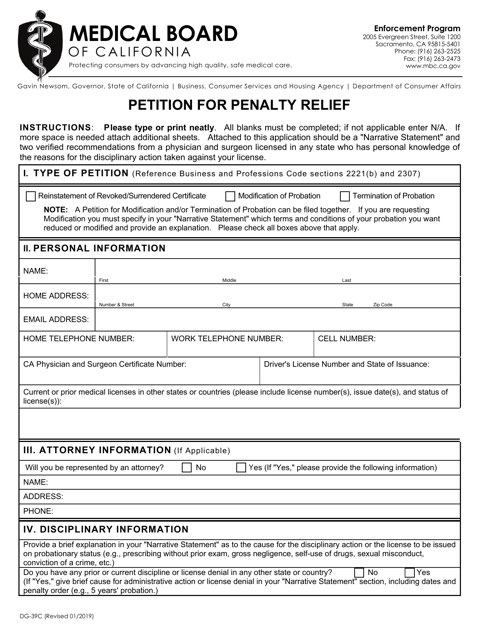

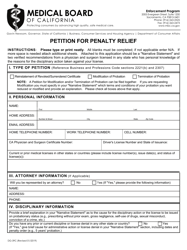

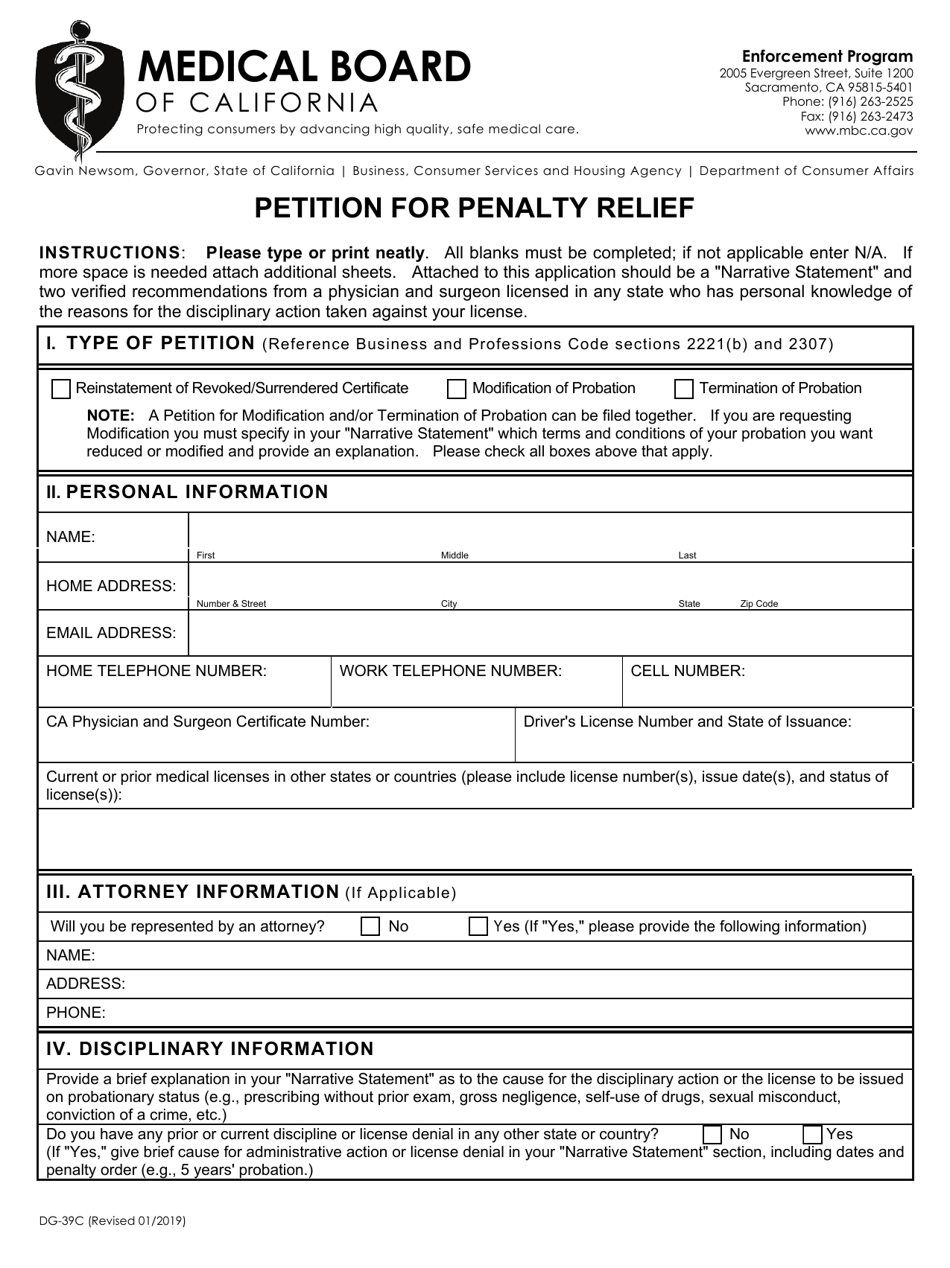

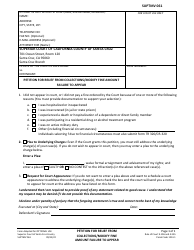

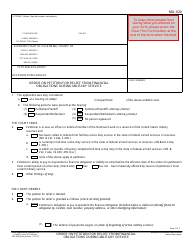

Form DG-39C Petition for Penalty Relief - California

What Is Form DG-39C?

This is a legal form that was released by the Medical Board of California - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

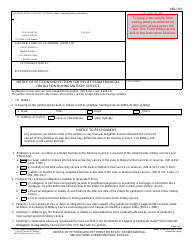

Q: What is DG-39C Petition for Penalty Relief?

A: DG-39C Petition for Penalty Relief is a form used in California to request relief from certain penalties.

Q: What penalties can be relieved with DG-39C Petition?

A: DG-39C Petition for Penalty Relief can be used to request relief from penalties related to the failure to file a tax return, pay taxes, or deposit taxes.

Q: Who can use DG-39C Petition?

A: Anyone who has been assessed penalties in California can use DG-39C Petition for Penalty Relief.

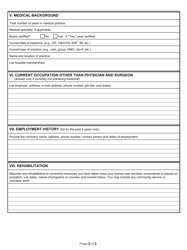

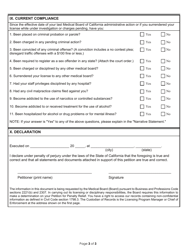

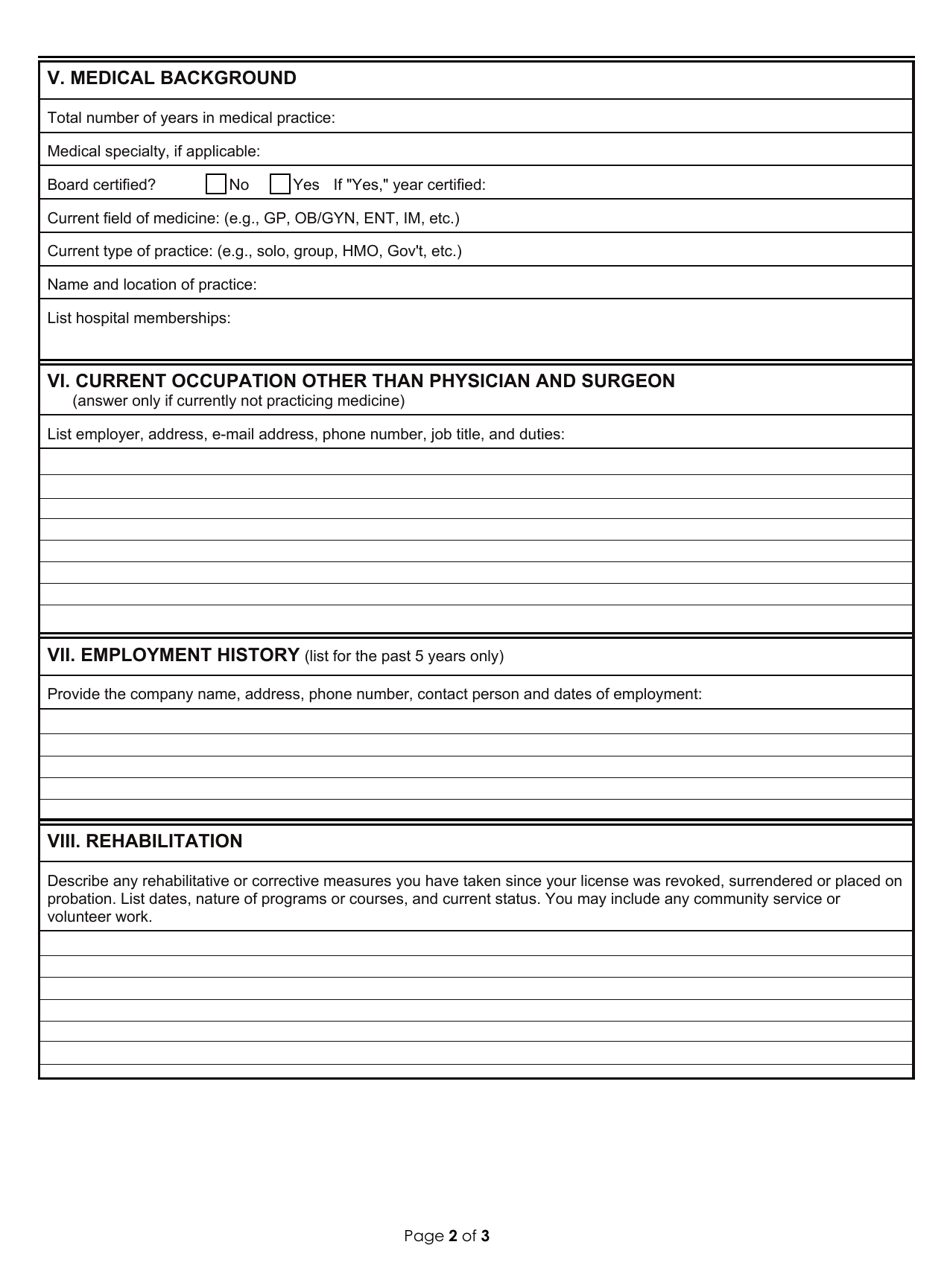

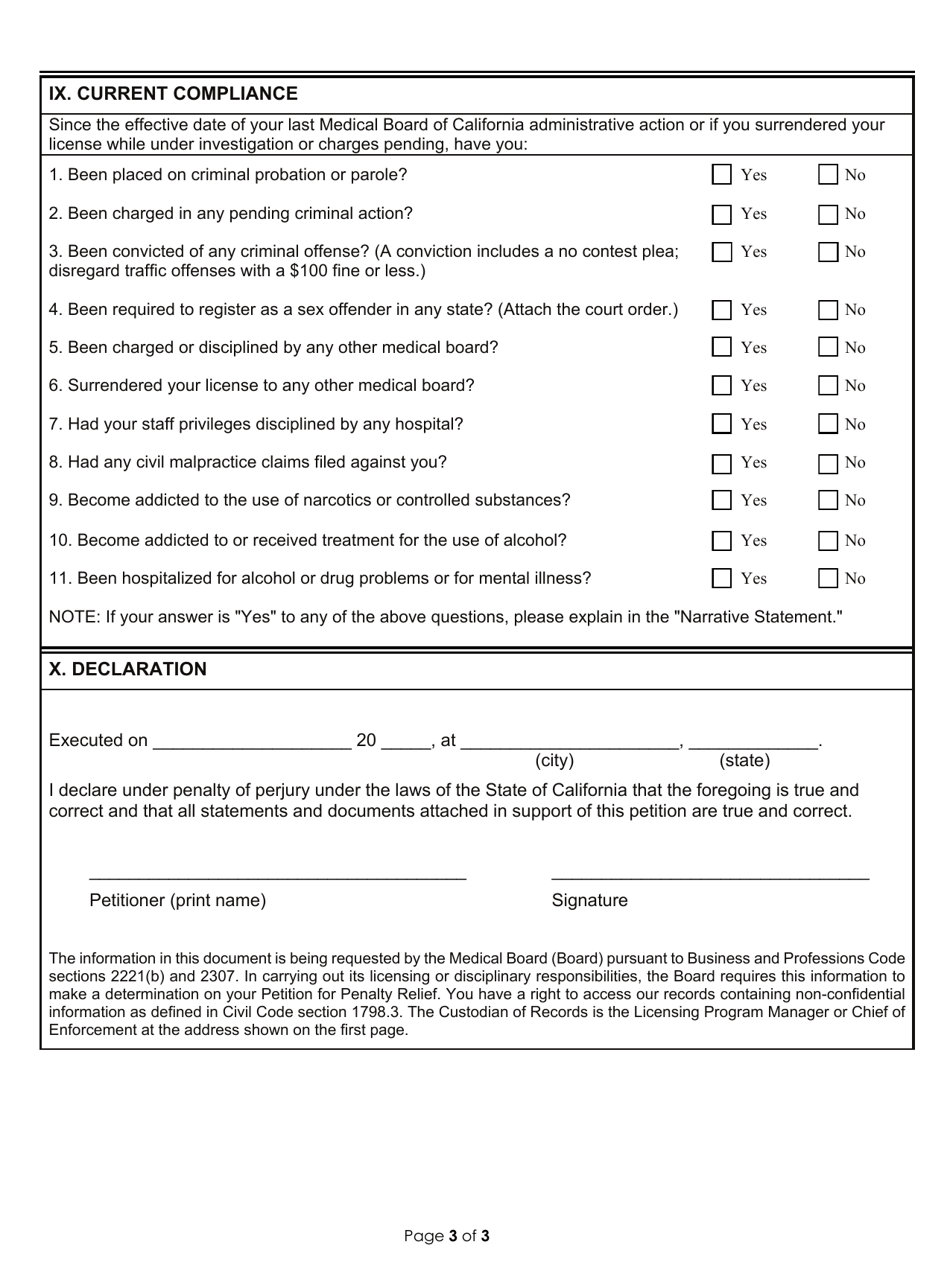

Q: How do I fill out DG-39C Petition?

A: You need to provide your personal information, details about the penalties you are requesting relief from, and any supporting documentation.

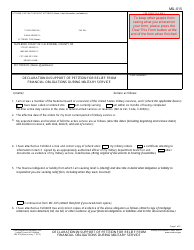

Q: Is there a deadline for filing DG-39C Petition?

A: Yes, the petition must be filed within 30 days from the date of the notice imposing the penalty.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Medical Board of California;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DG-39C by clicking the link below or browse more documents and templates provided by the Medical Board of California.