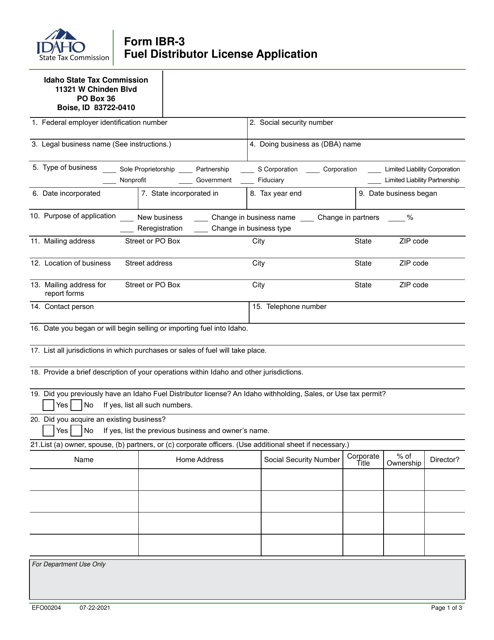

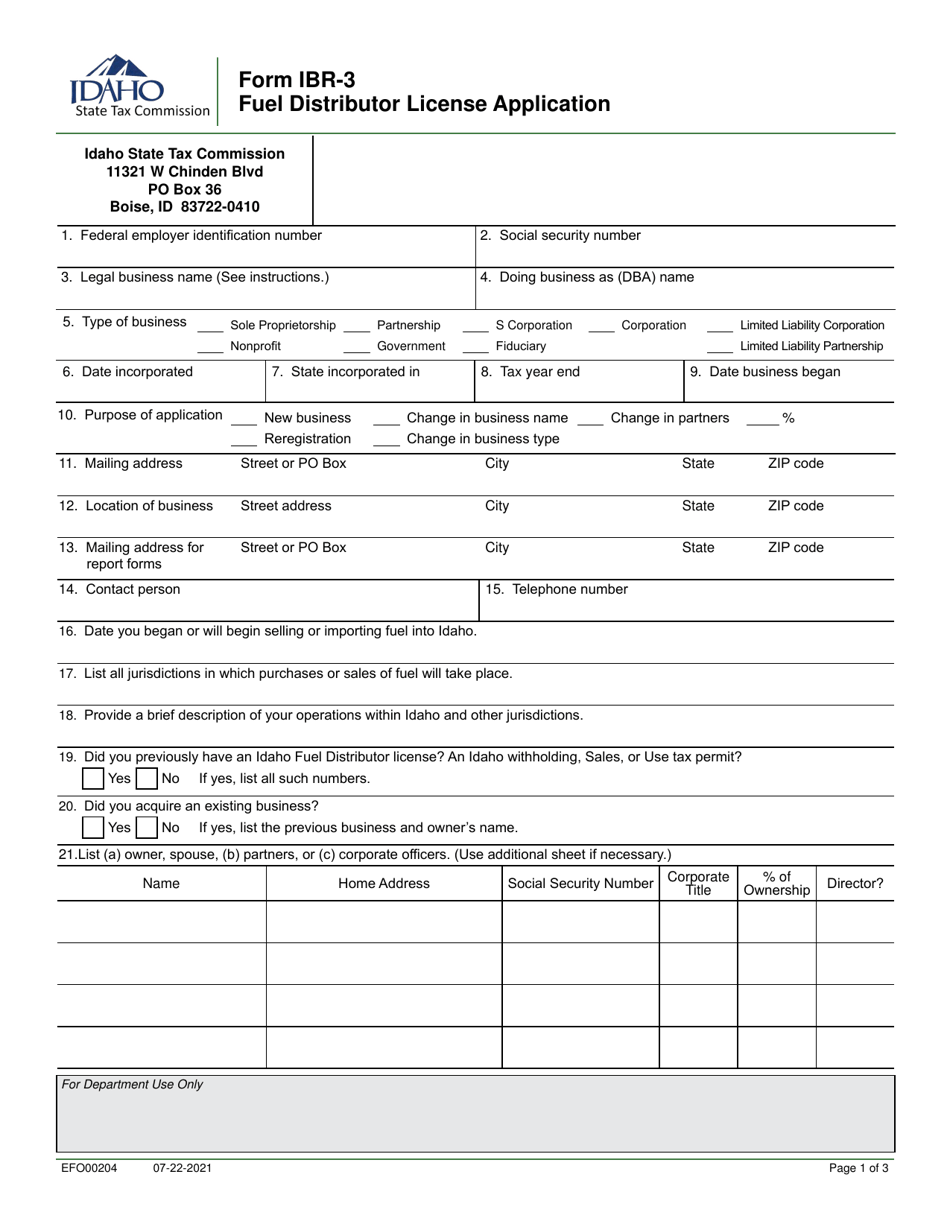

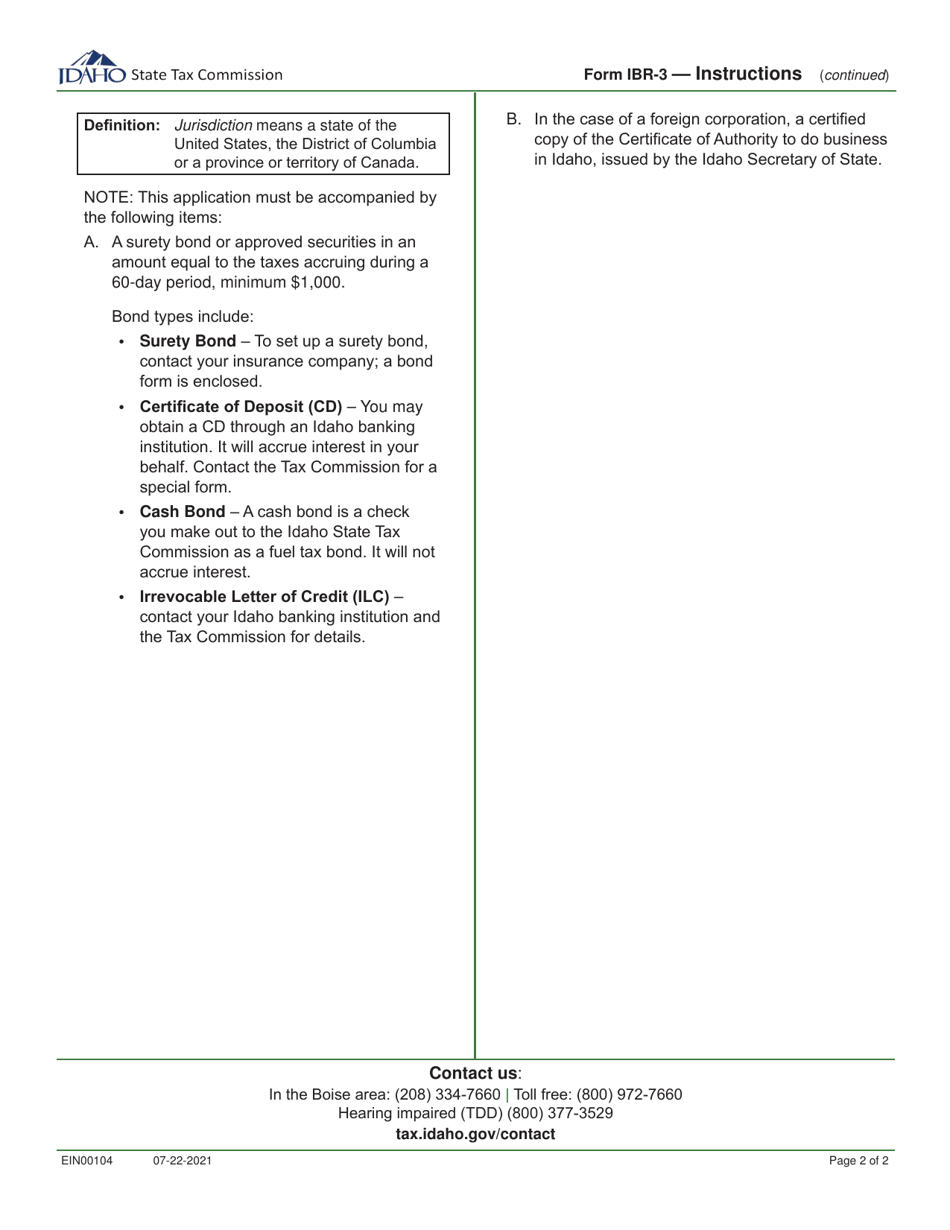

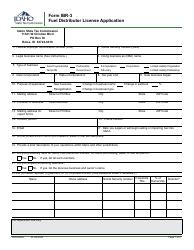

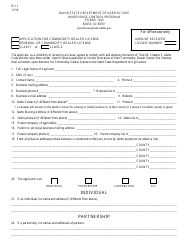

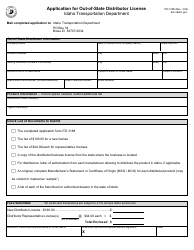

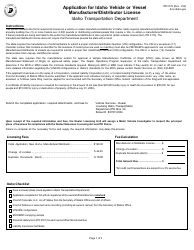

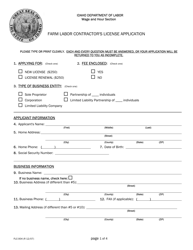

Form IBR-3 Fuel Distributor License Application - Idaho

What Is Form IBR-3?

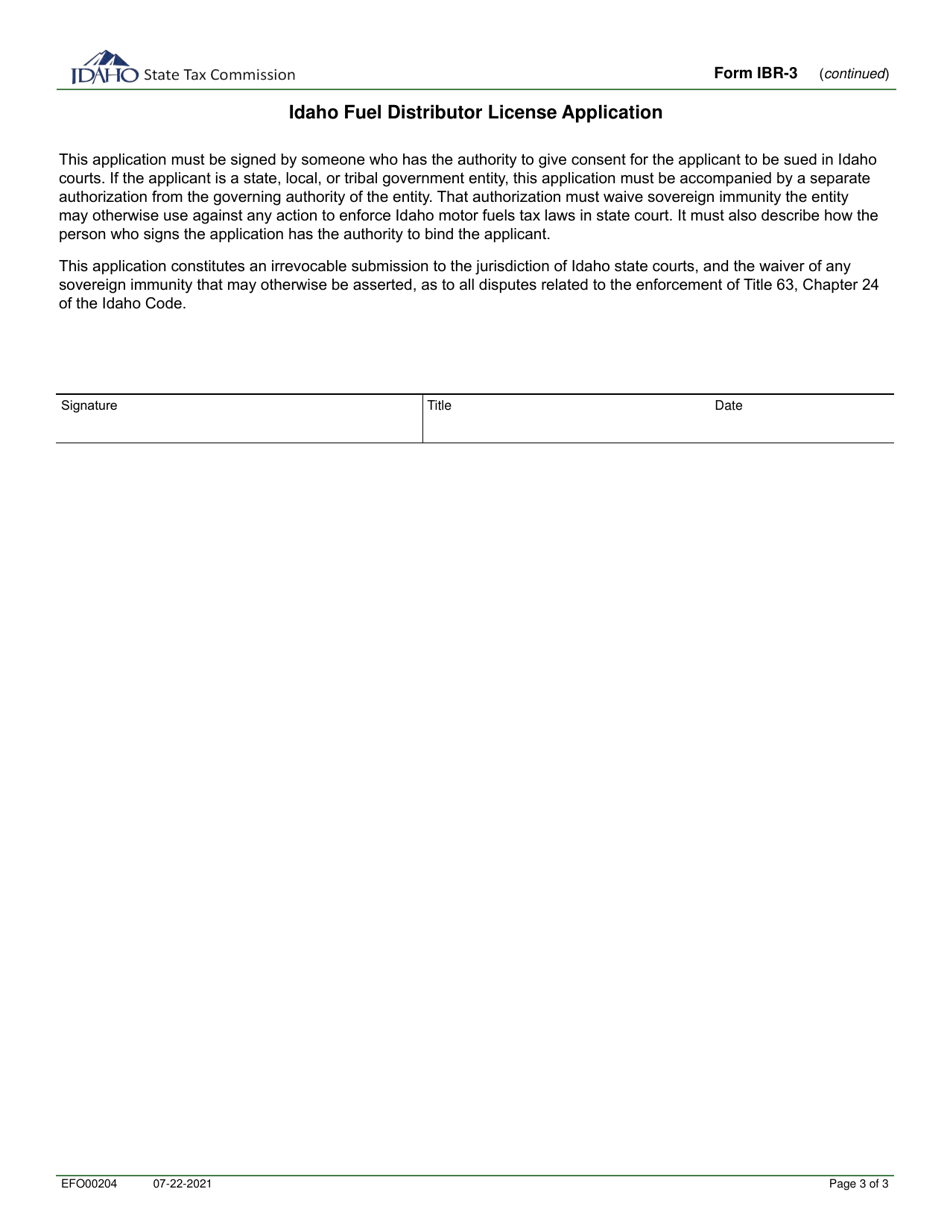

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form IBR-3?

A: Form IBR-3 is the Fuel Distributor License Application for Idaho.

Q: Who needs to file Form IBR-3?

A: Fuel distributors in Idaho need to file Form IBR-3.

Q: What is the purpose of Form IBR-3?

A: The purpose of Form IBR-3 is to apply for a fuel distributor license in Idaho.

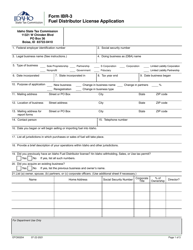

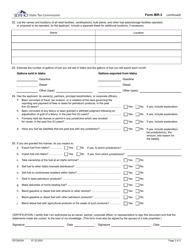

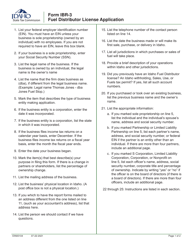

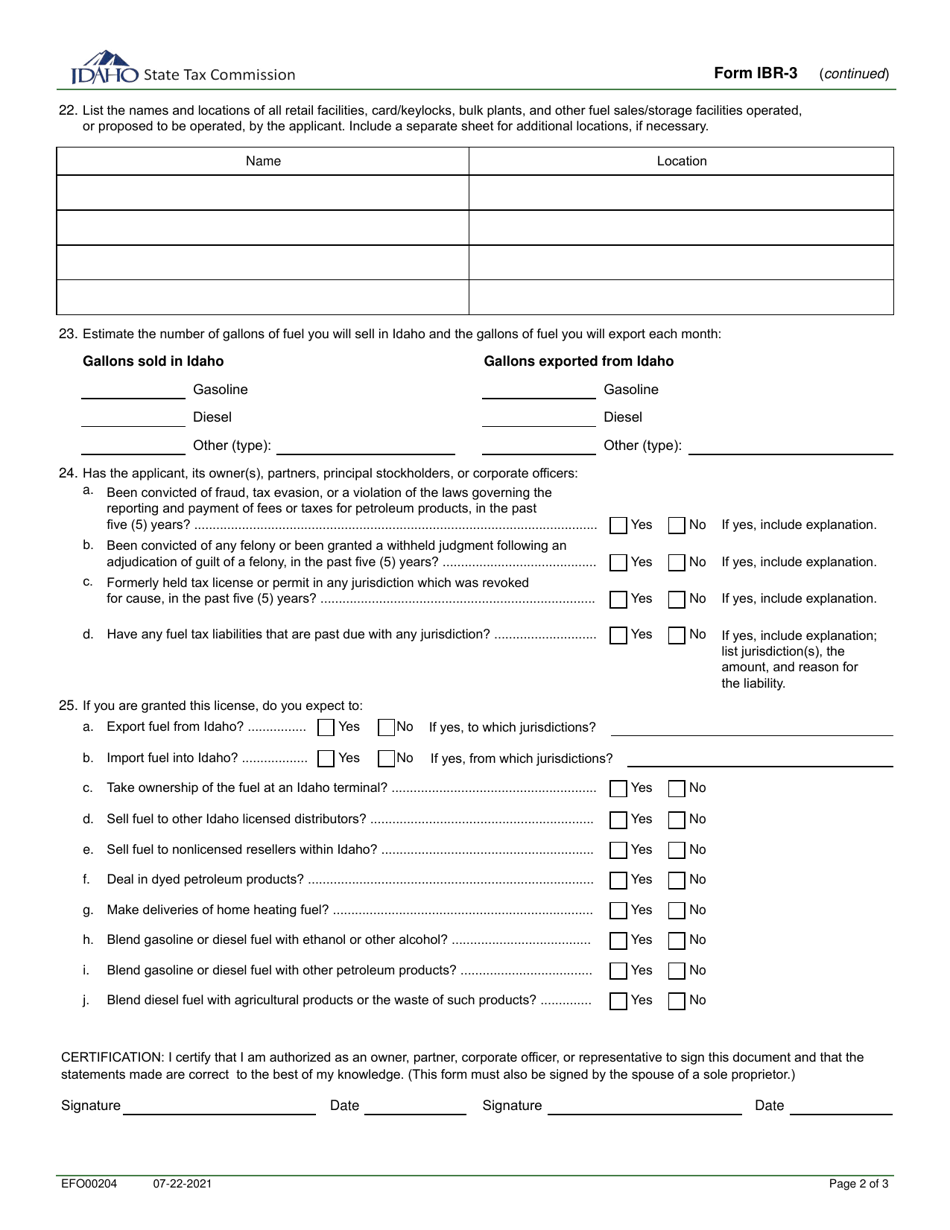

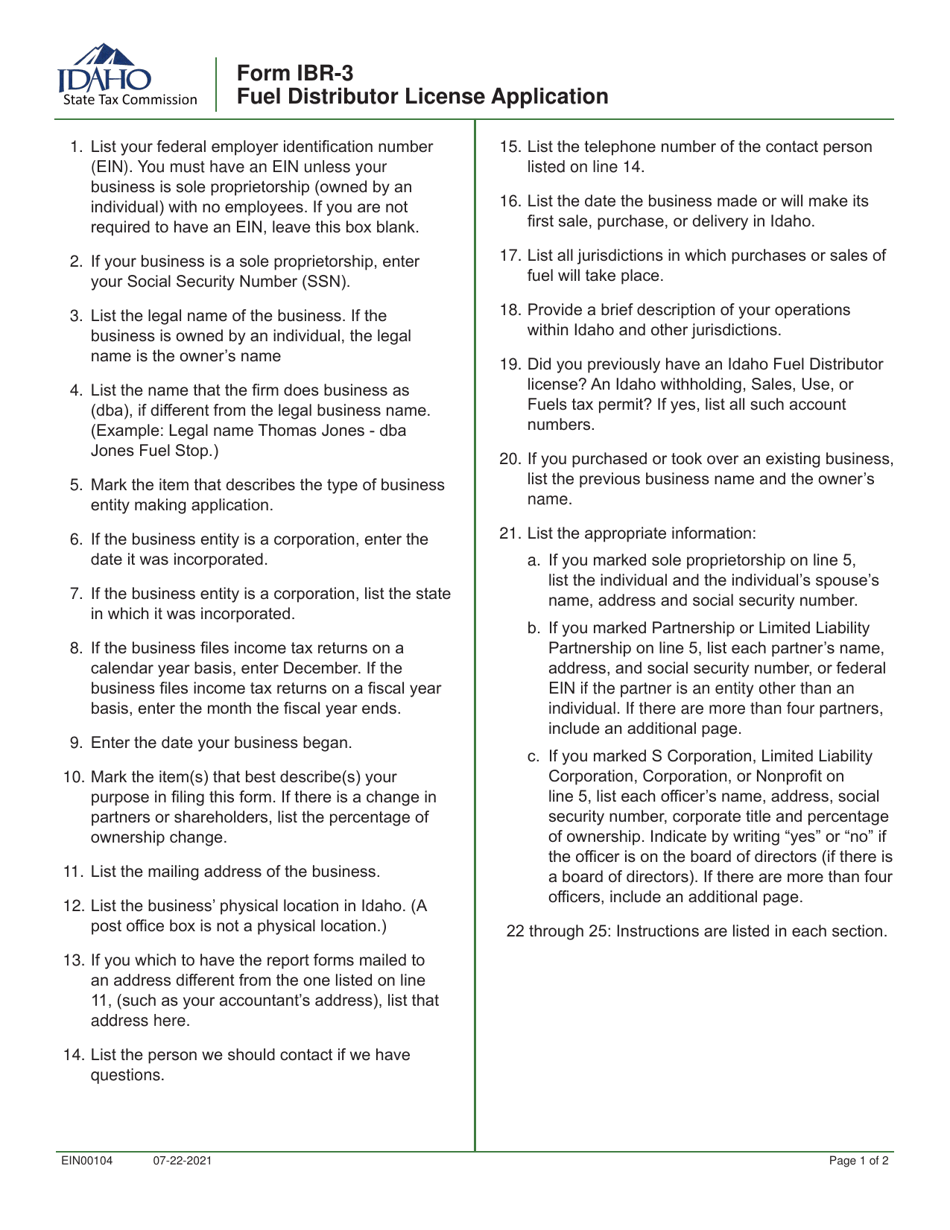

Q: What information do I need to provide on Form IBR-3?

A: You will need to provide information such as your business details, fuel types, storage facilities, and other related information.

Q: Are there any deadlines for filing Form IBR-3?

A: Yes, Form IBR-3 must be filed by the due date specified by the Idaho State Tax Commission.

Q: What happens after I file Form IBR-3?

A: After you file Form IBR-3, the Idaho State Tax Commission will review your application and notify you of the status of your fuel distributor license.

Q: Are there any penalties for not filing Form IBR-3?

A: Yes, there may be penalties for not filing Form IBR-3 or for late filing. It is important to comply with the filing requirements to avoid penalties.

Form Details:

- Released on July 22, 2021;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IBR-3 by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.