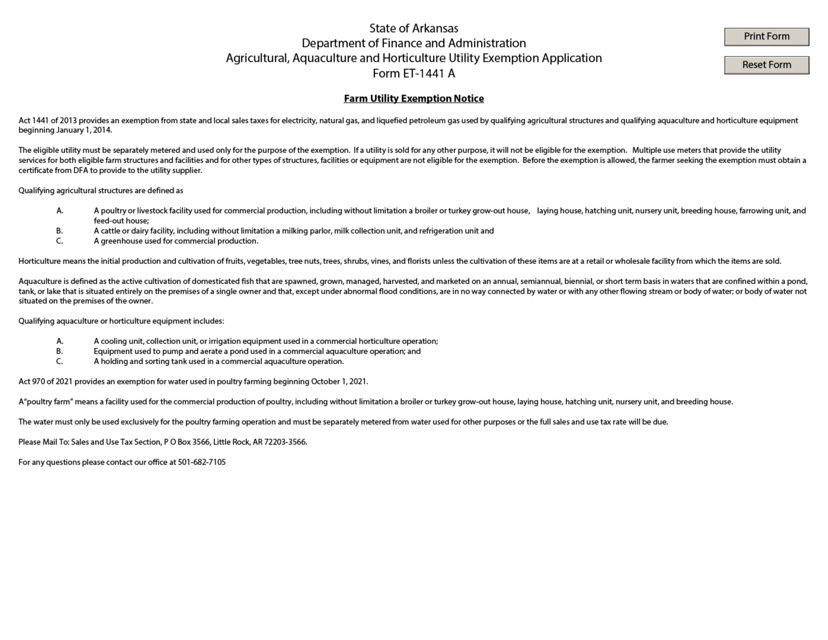

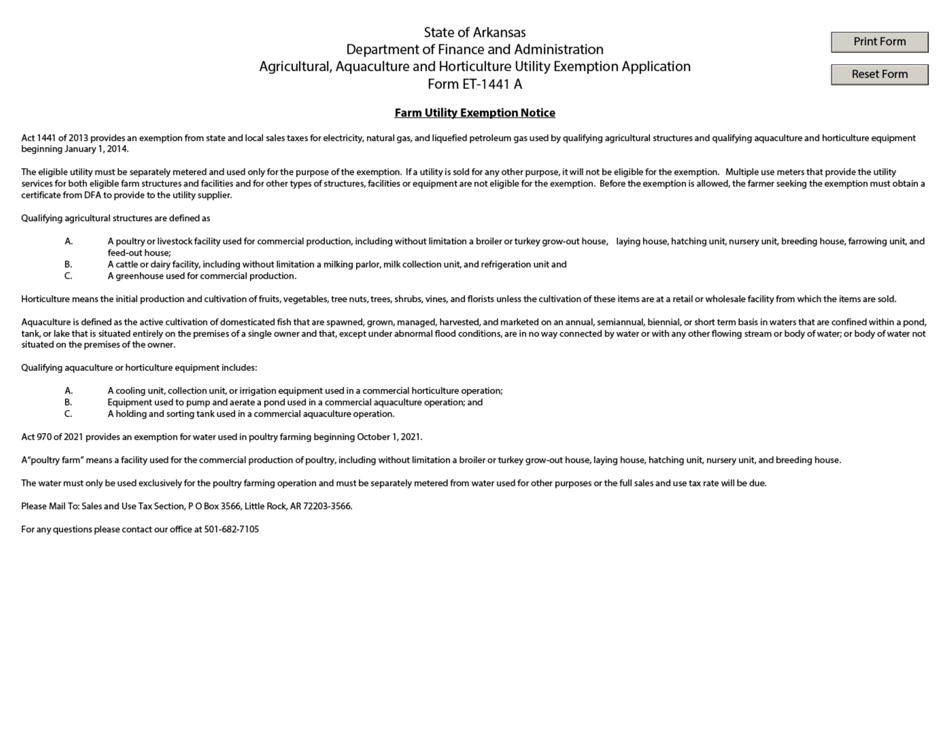

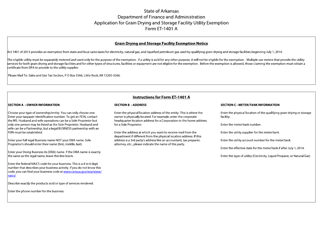

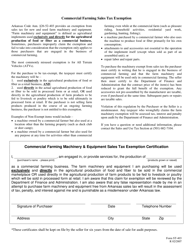

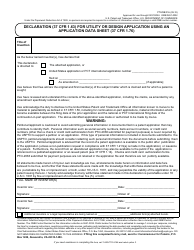

Form ET-1441 A Farm Utility Exemption Application - Arkansas

What Is Form ET-1441 A?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

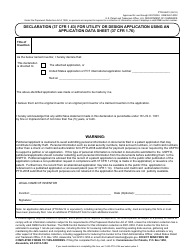

Q: What is Form ET-1441?

A: Form ET-1441 is a Farm Utility Exemption Application.

Q: What is the purpose of Form ET-1441?

A: The purpose of Form ET-1441 is to apply for a farm utility exemption in Arkansas.

Q: Who should file Form ET-1441?

A: Farmers in Arkansas who want to request a farm utility exemption should file Form ET-1441.

Q: What is a farm utility exemption?

A: A farm utility exemption is a tax exemption for certain farm equipment and machinery in Arkansas.

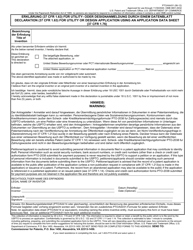

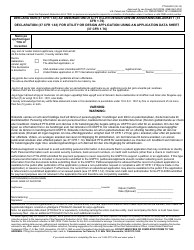

Q: Are there any eligibility requirements for the farm utility exemption?

A: Yes, there are specific eligibility requirements for the farm utility exemption. You should refer to the instructions and guidelines provided with Form ET-1441 for more information.

Q: When should I file Form ET-1441?

A: Form ET-1441 should be filed before the tax assessment date in Arkansas, which is usually May 31st of each year.

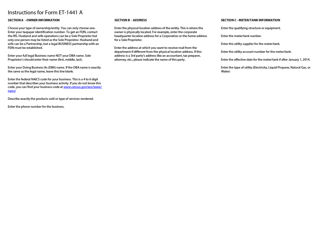

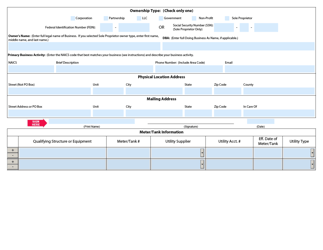

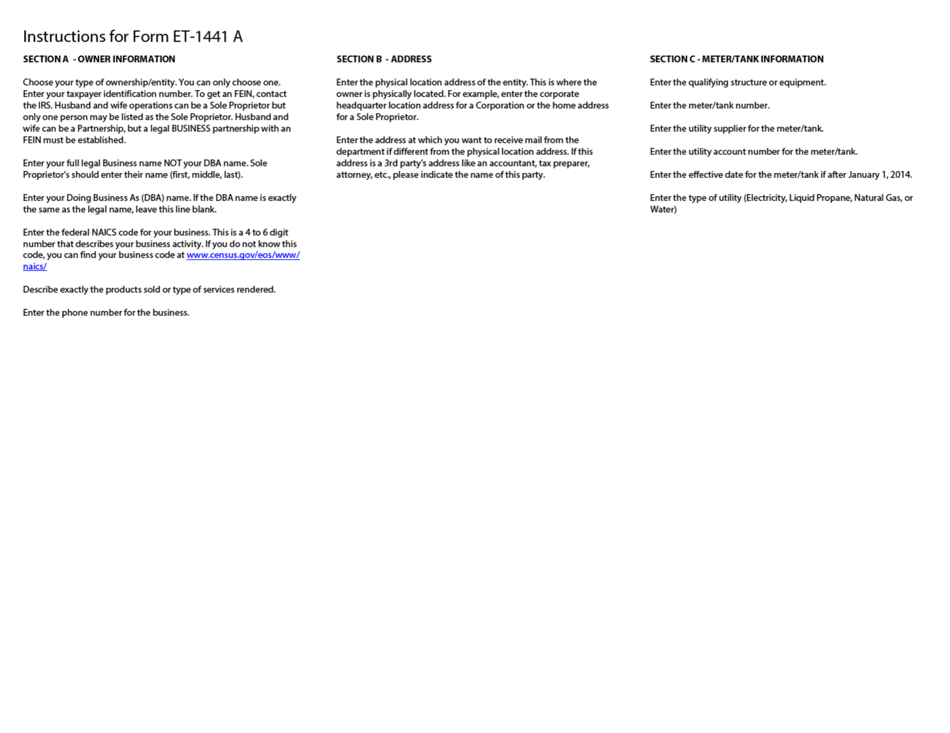

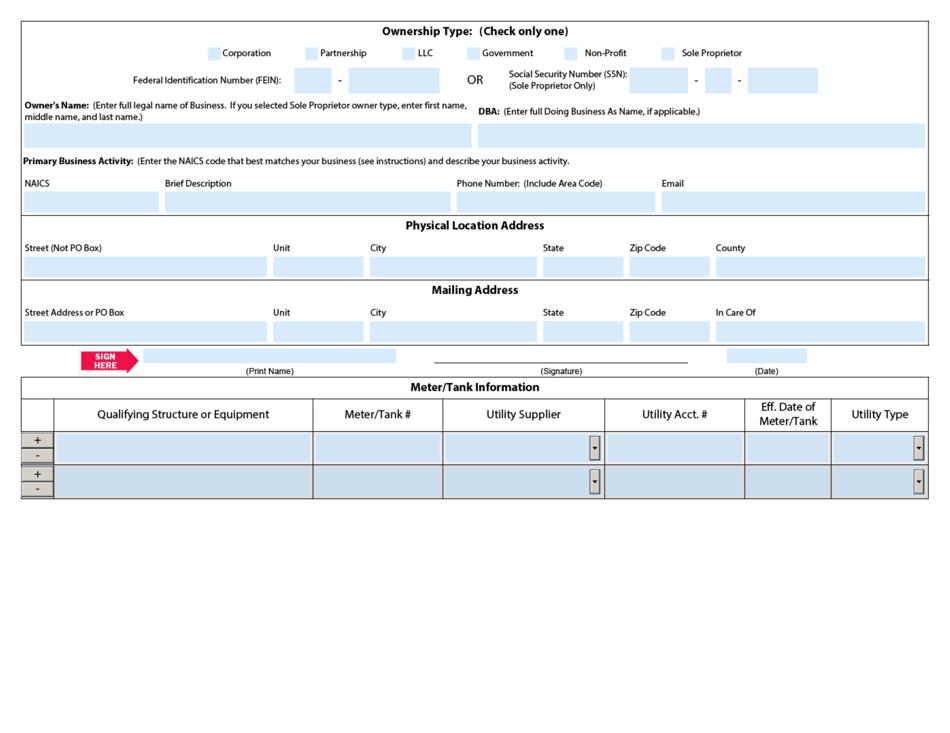

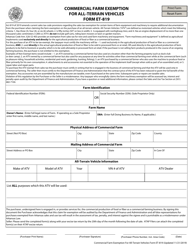

Q: What information is required on Form ET-1441?

A: Form ET-1441 requires information about the applicant, farm property, and the equipment or machinery being claimed for exemption.

Q: Is there a fee for filing Form ET-1441?

A: No, there is no fee for filing Form ET-1441.

Q: What should I do after filing Form ET-1441?

A: After filing Form ET-1441, you should retain a copy of the form for your records and follow any further instructions provided by the Arkansas Department of Finance and Administration.

Form Details:

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET-1441 A by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.