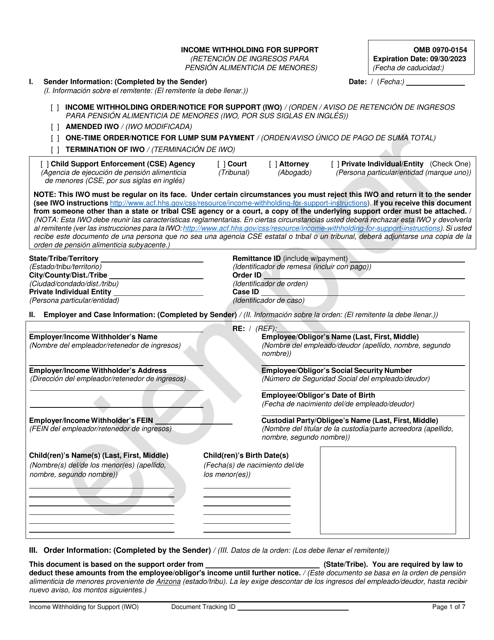

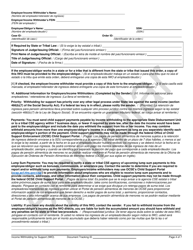

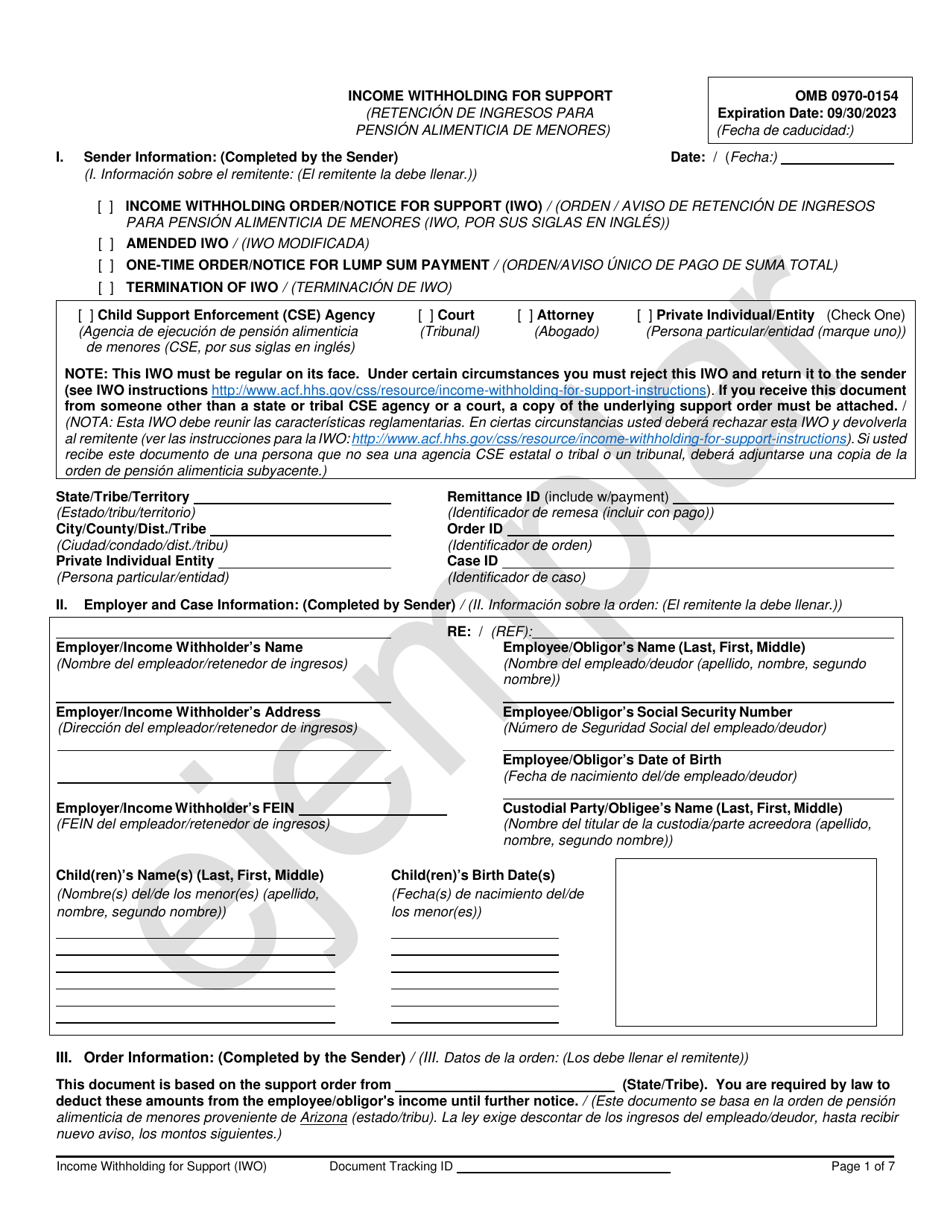

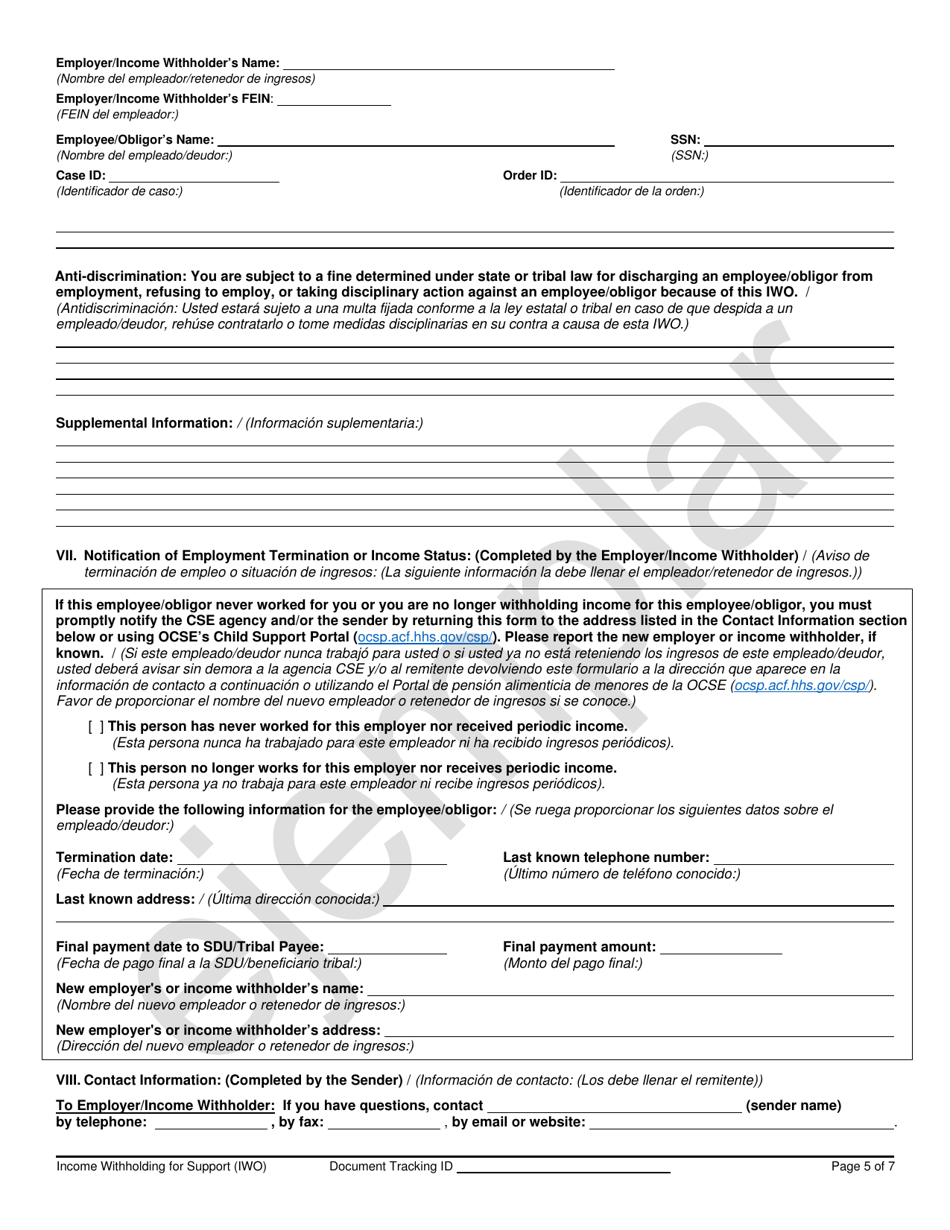

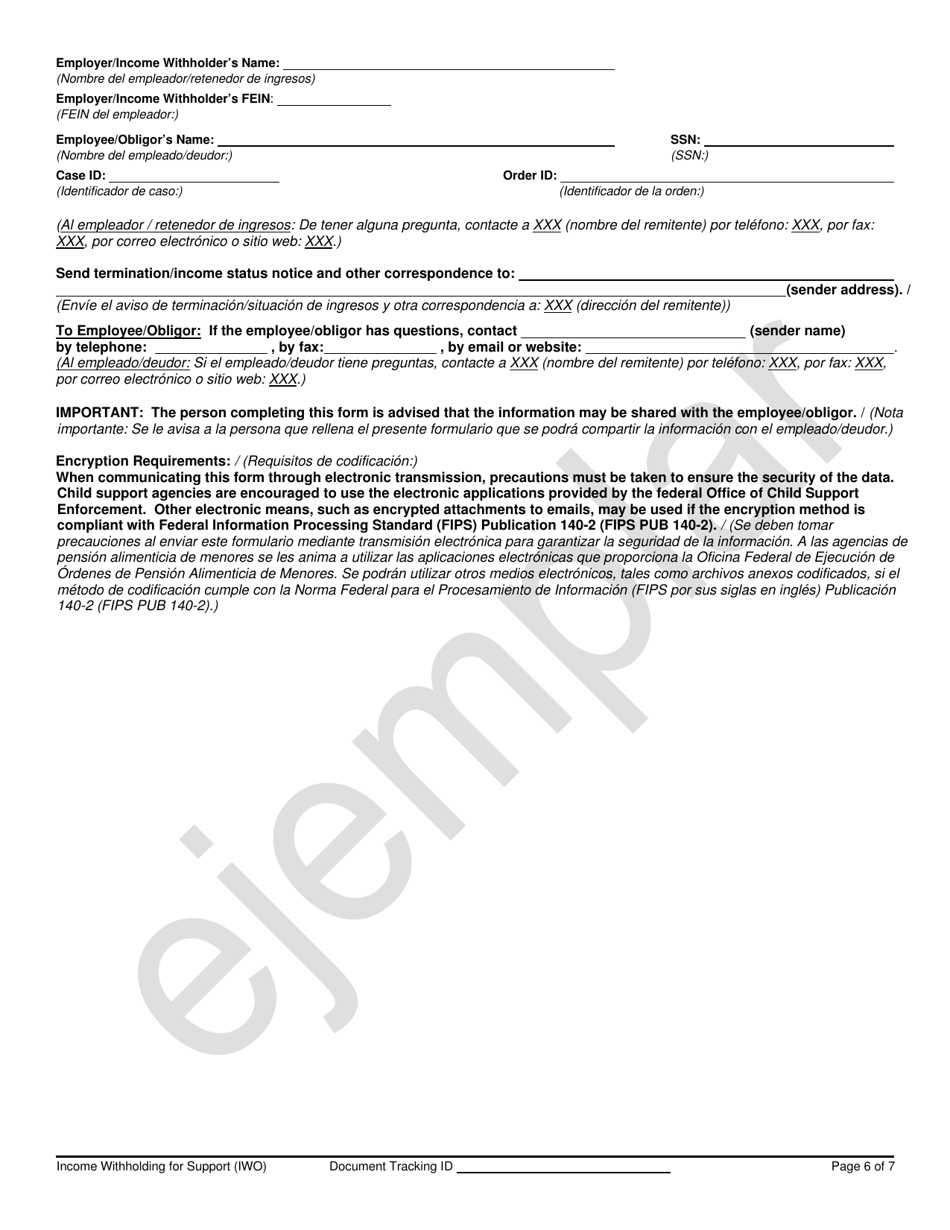

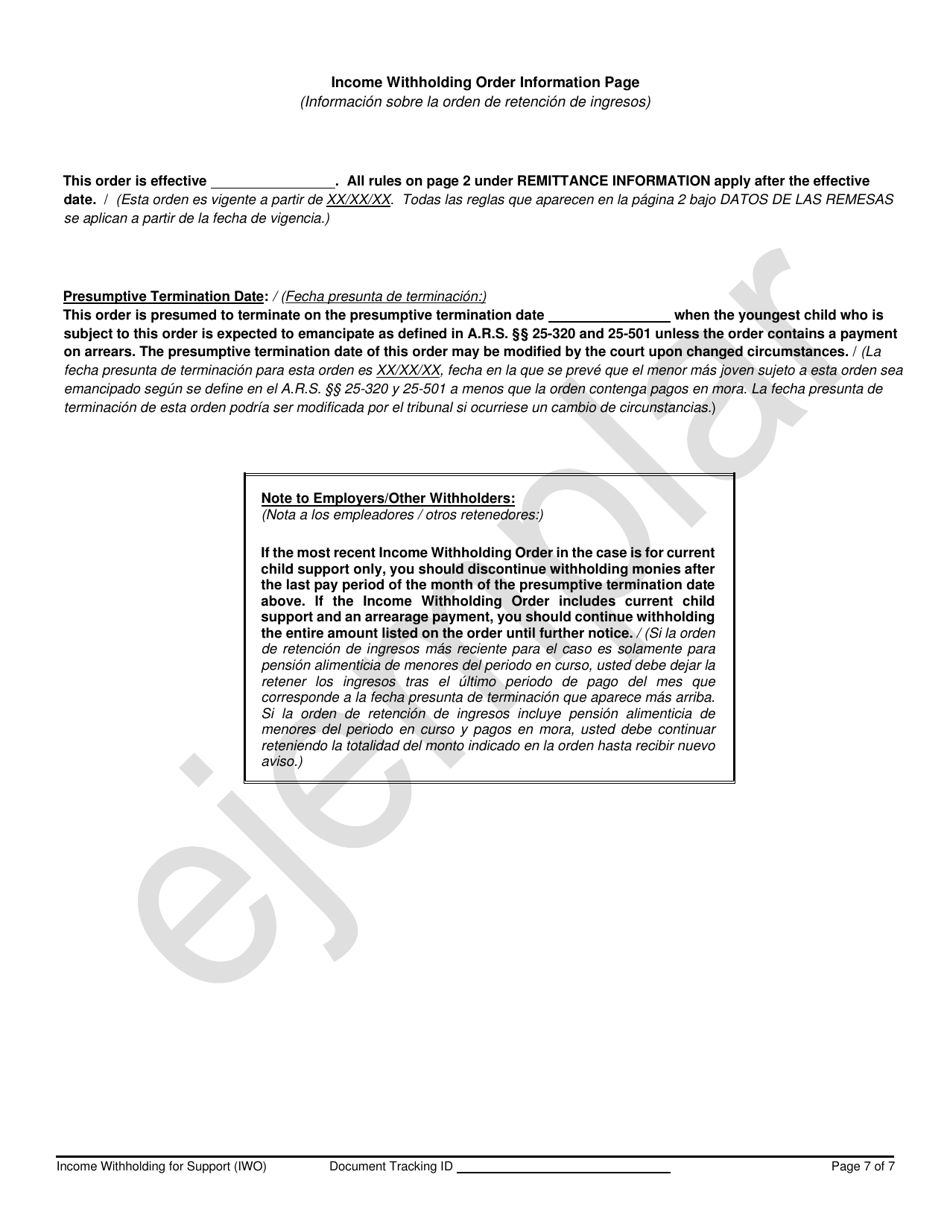

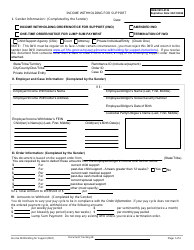

Income Withholding for Support - Sample - Arizona (English / Spanish)

Income Withholding for Support - Sample is a legal document that was released by the Arizona Supreme Court - a government authority operating within Arizona.

FAQ

Q: What is income withholding for support?

A: Income withholding for support is a legal process of deducting child support or alimony payments from a person's income.

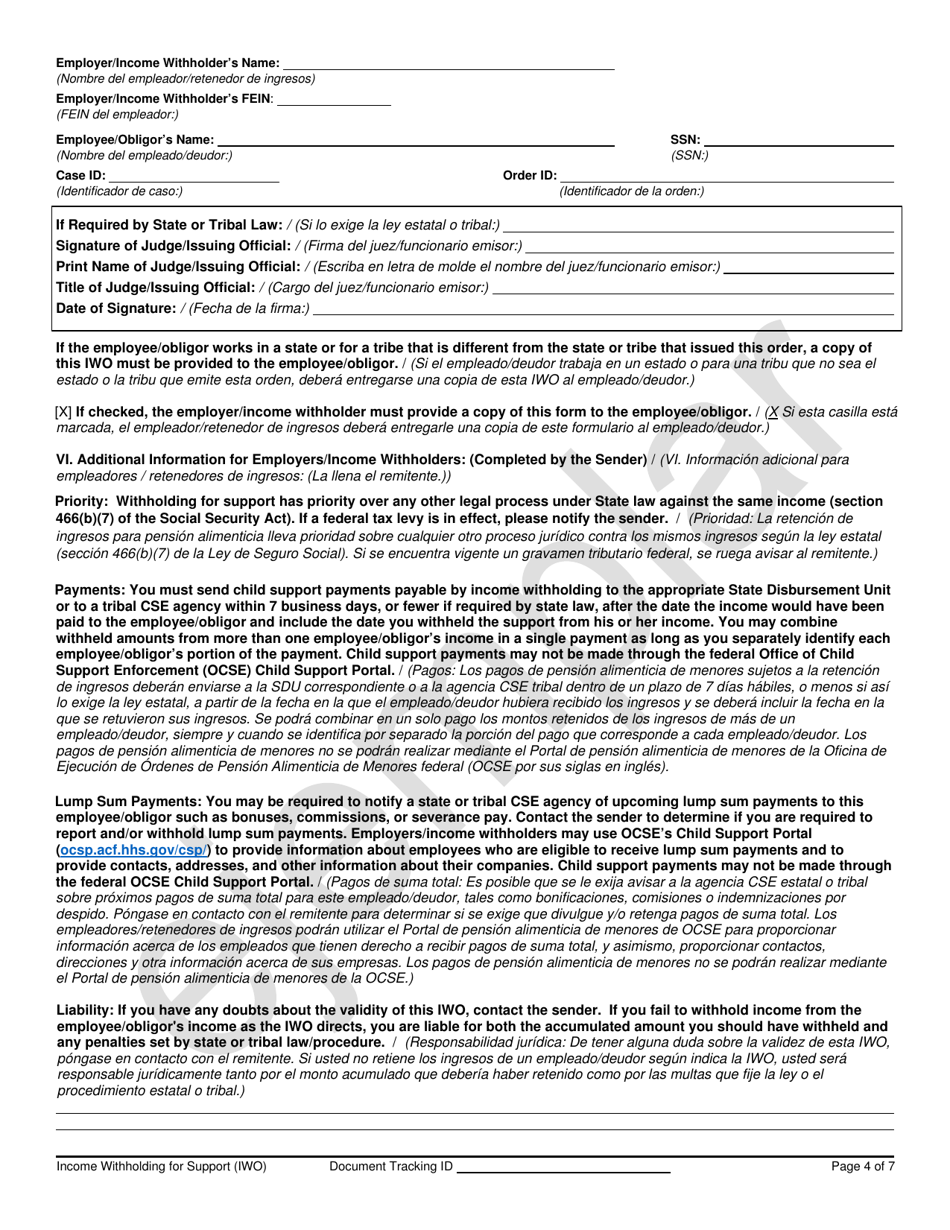

Q: Who is responsible for income withholding for support?

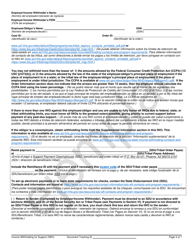

A: The person's employer is responsible for withholding child support or alimony payments from their income.

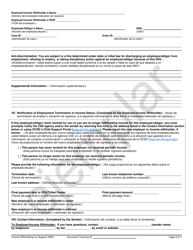

Q: What is the purpose of income withholding for support?

A: The purpose of income withholding for support is to ensure consistent and timely payment of child support or alimony.

Q: Is income withholding for support mandatory in Arizona?

A: Yes, income withholding for support is mandatory in Arizona.

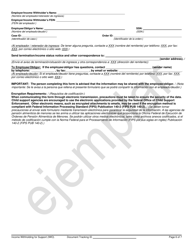

Q: Can income withholding be used for other types of support?

A: Yes, income withholding can be used for both child support and alimony payments.

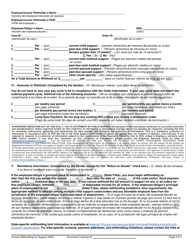

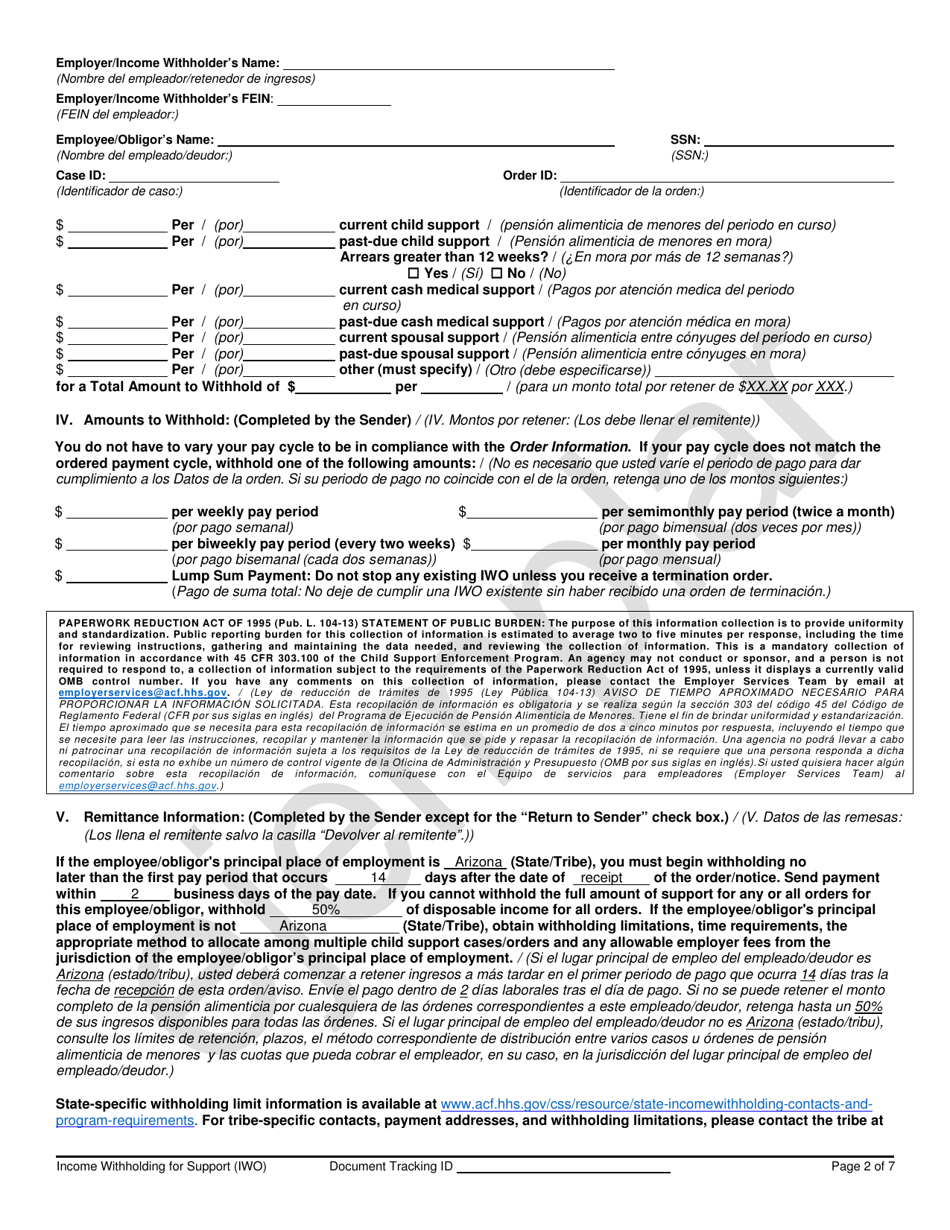

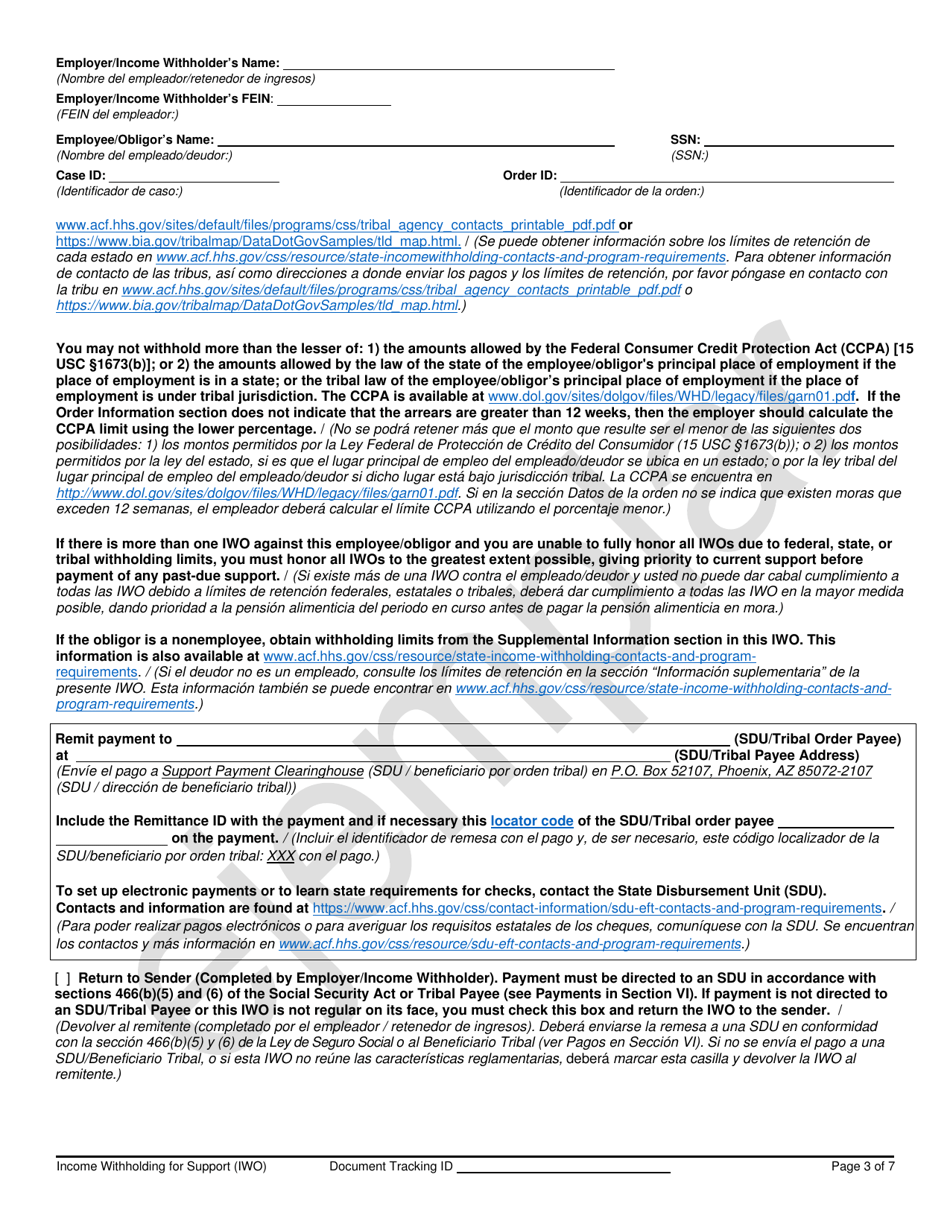

Q: How much of the income can be withheld for support?

A: The amount that can be withheld for support depends on the individual's income and the court order.

Q: What should an employee do if their income is being withheld for support?

A: The employee should contact their employer or the appropriate agency to address any issues or concerns regarding income withholding for support.

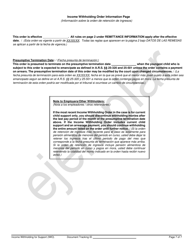

Q: Is income withholding for support available in Spanish?

A: Yes, the sample form is available in both English and Spanish.

Form Details:

- The latest edition currently provided by the Arizona Supreme Court;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Arizona Supreme Court.