This version of the form is not currently in use and is provided for reference only. Download this version of

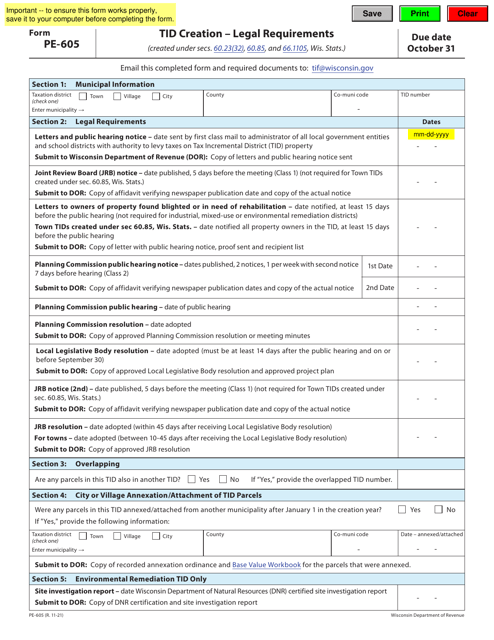

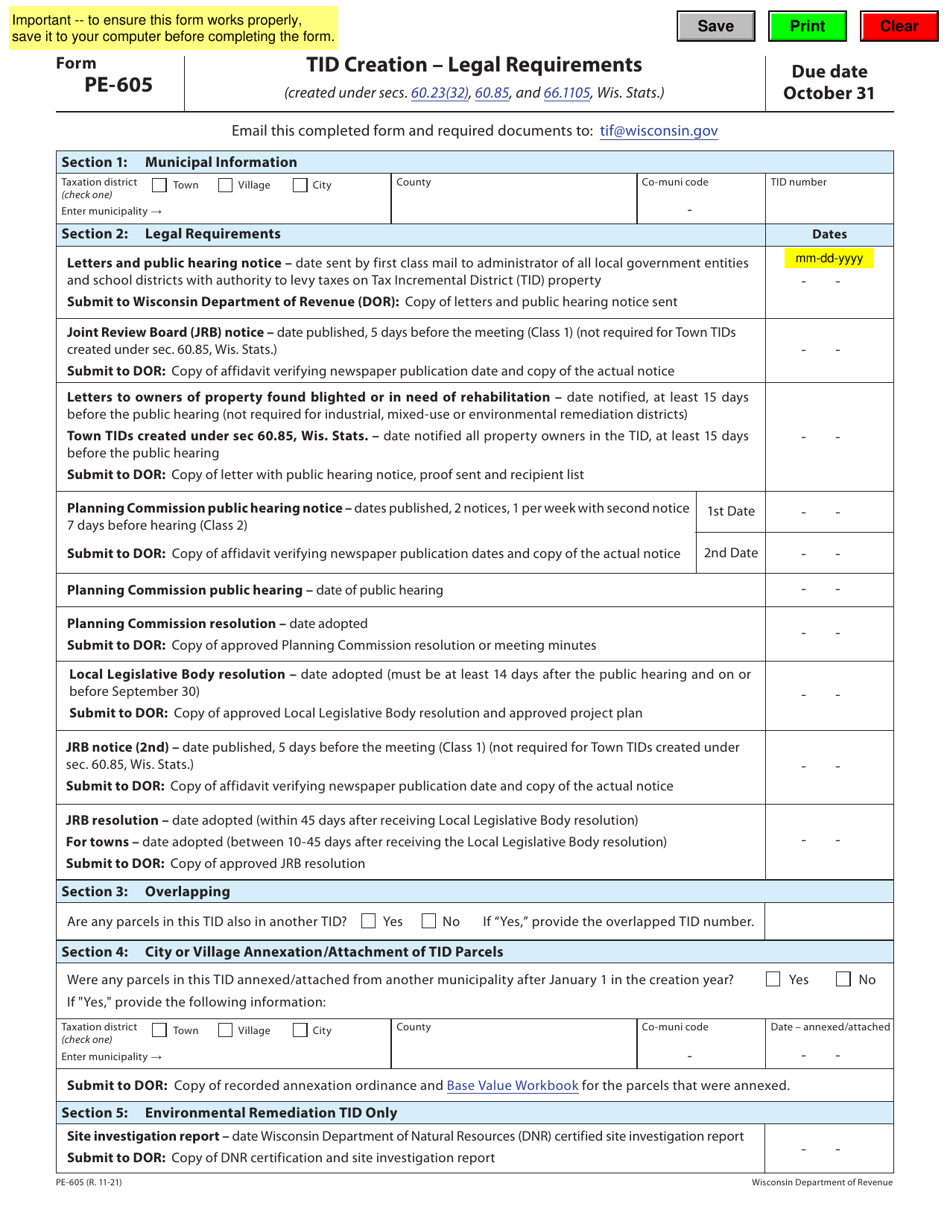

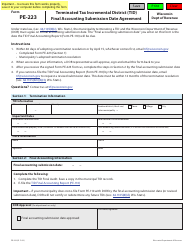

Form PE-605

for the current year.

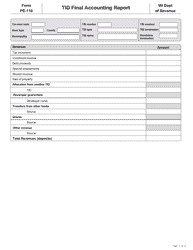

Form PE-605 Tid Creation - Legal Requirements - Wisconsin

What Is Form PE-605?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PE-605 TID Creation?

A: Form PE-605 TID Creation is a legal document used in Wisconsin for the purpose of creating a Tax Incremental District (TID).

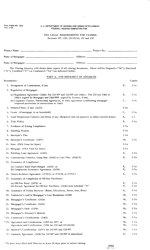

Q: What are the legal requirements for completing Form PE-605 TID Creation?

A: The legal requirements for completing Form PE-605 TID Creation in Wisconsin include providing detailed information about the proposed TID, such as its boundaries, estimated costs, and expected benefits to the community.

Q: Why would someone need to complete Form PE-605 TID Creation?

A: Someone would need to complete Form PE-605 TID Creation in order to establish a Tax Incremental District (TID) in Wisconsin, which allows for the financing of redevelopment or infrastructure projects.

Q: Are there any fees associated with completing Form PE-605 TID Creation?

A: Yes, there are fees associated with completing Form PE-605 TID Creation in Wisconsin. The specific fees may vary depending on the municipality where the TID is being established.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PE-605 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.