This version of the form is not currently in use and is provided for reference only. Download this version of

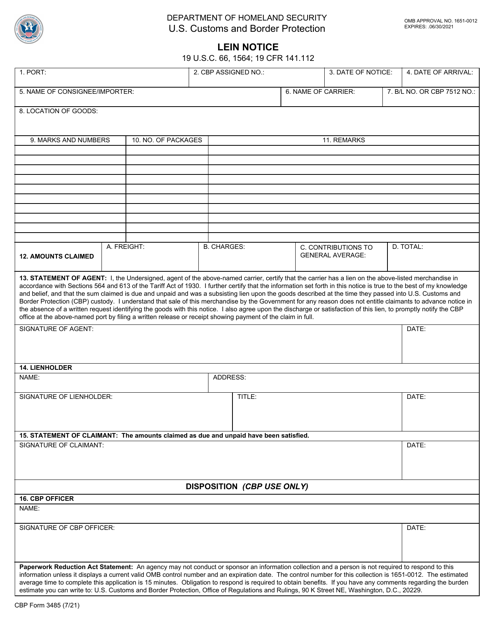

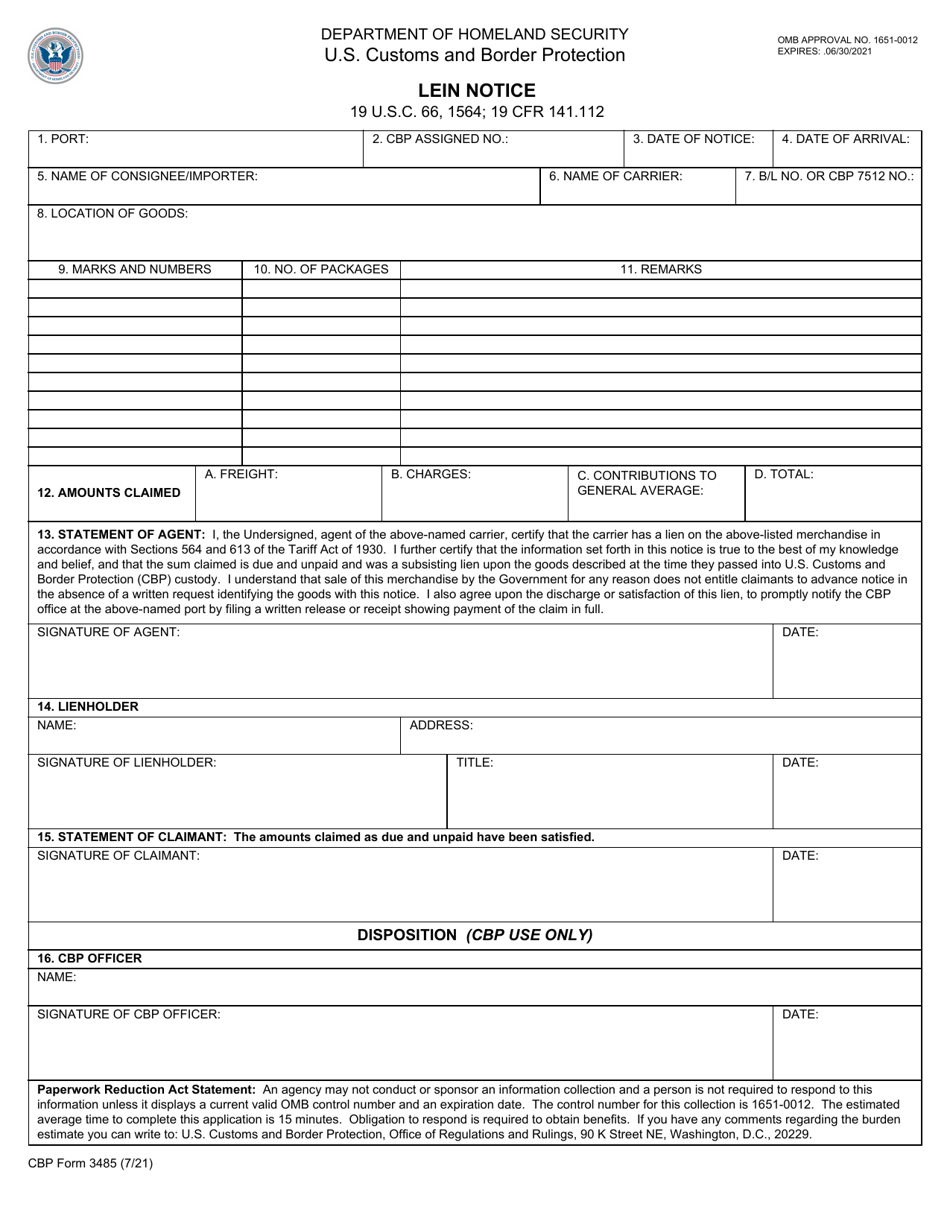

CBP Form 3485

for the current year.

CBP Form 3485 Lein Notice

What Is CBP Form 3485?

This is a legal form that was released by the U.S. Department of Homeland Security - Customs and Border Protection on July 1, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CBP Form 3485 Lein Notice?

A: CBP Form 3485 Lein Notice is a notice issued by the U.S. Customs and Border Protection (CBP) to inform an individual or entity of a lien against their property or assets.

Q: Why would I receive a CBP Form 3485 Lein Notice?

A: You may receive a CBP Form 3485 Lein Notice if you owe unpaid duties, taxes, or penalties to CBP, and they are placing a lien on your property or assets as a way to secure payment.

Q: What should I do if I receive a CBP Form 3485 Lein Notice?

A: If you receive a CBP Form 3485 Lein Notice, you should carefully review the notice and take action to address the unpaid duties, taxes, or penalties. It is advisable to consult with a lawyer or financial advisor for guidance on how to proceed.

Q: Can I dispute a CBP Form 3485 Lein Notice?

A: Yes, you can dispute a CBP Form 3485 Lein Notice if you believe there is an error or if you have valid reasons for not owing the unpaid duties, taxes, or penalties. You should follow the instructions provided on the notice to initiate the dispute process.

Q: What are the consequences of not addressing a CBP Form 3485 Lein Notice?

A: If you do not address a CBP Form 3485 Lein Notice and resolve the unpaid duties, taxes, or penalties, CBP may take further action, such as seizing or auctioning off your property or assets to satisfy the debt.

Form Details:

- Released on July 1, 2021;

- The latest available edition released by the U.S. Department of Homeland Security - Customs and Border Protection;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of CBP Form 3485 by clicking the link below or browse more documents and templates provided by the U.S. Department of Homeland Security - Customs and Border Protection.