This version of the form is not currently in use and is provided for reference only. Download this version of

Form 50-883

for the current year.

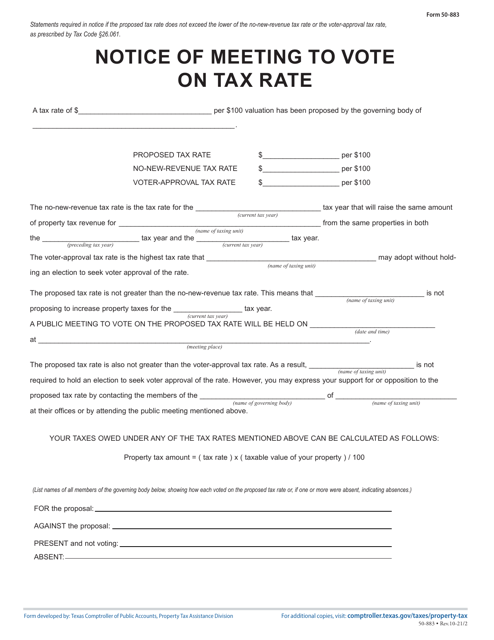

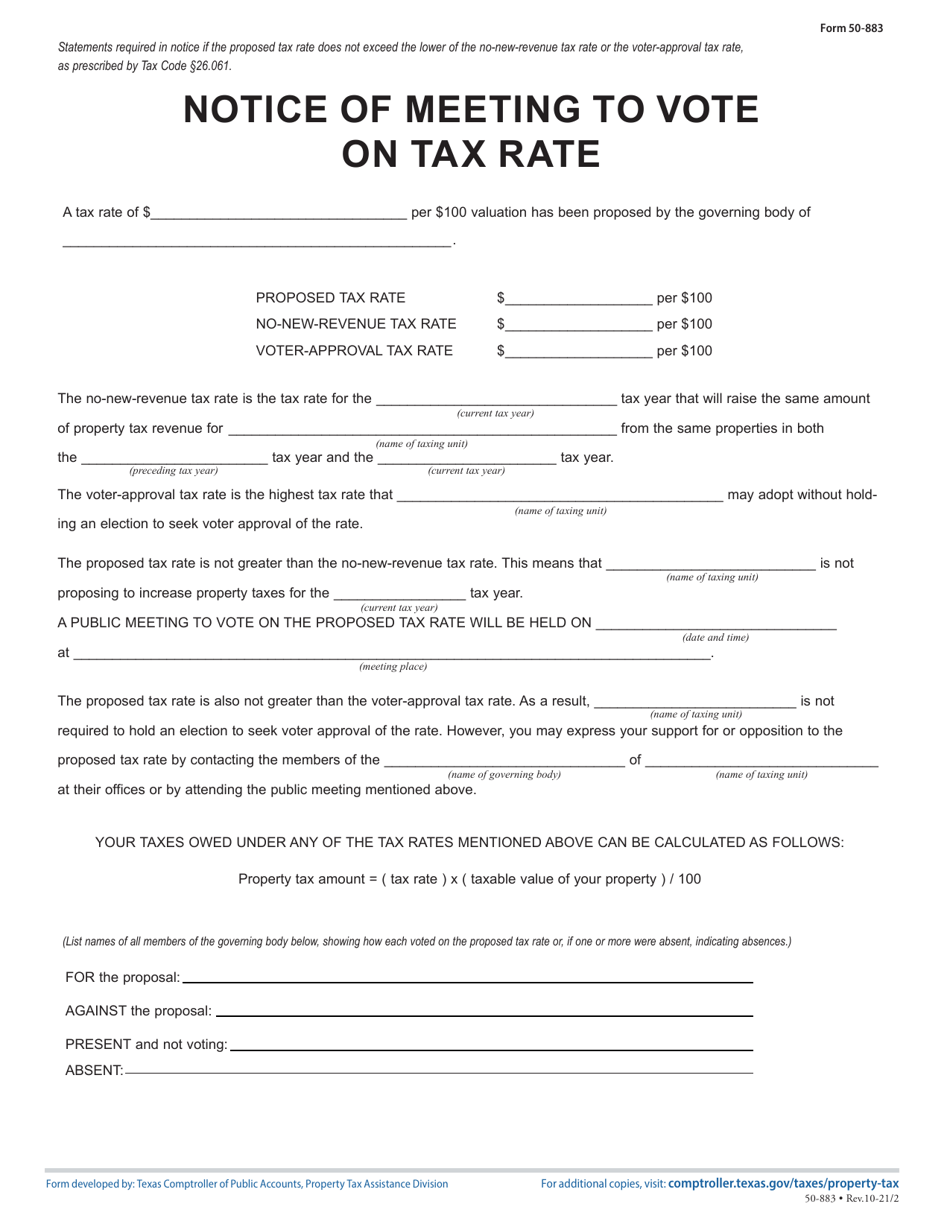

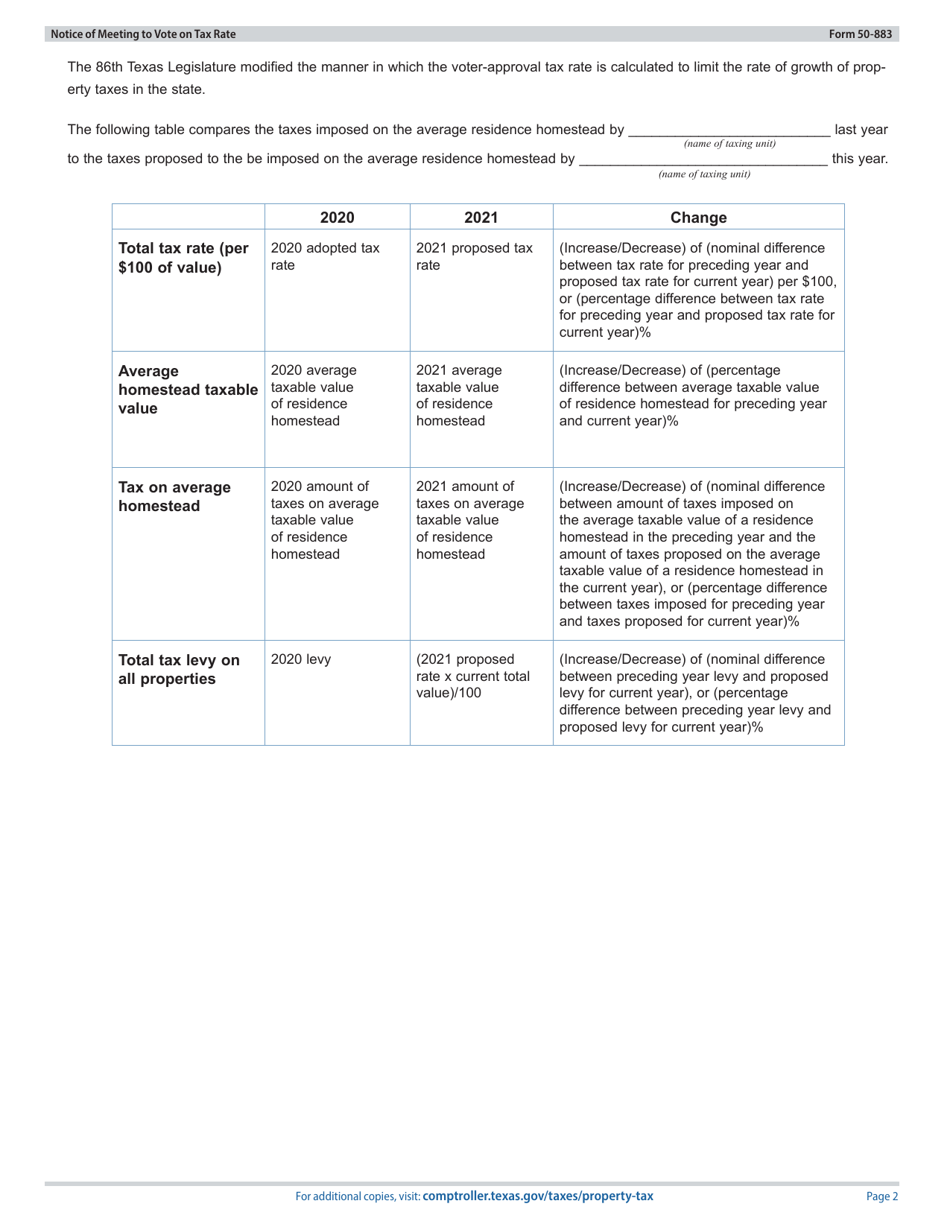

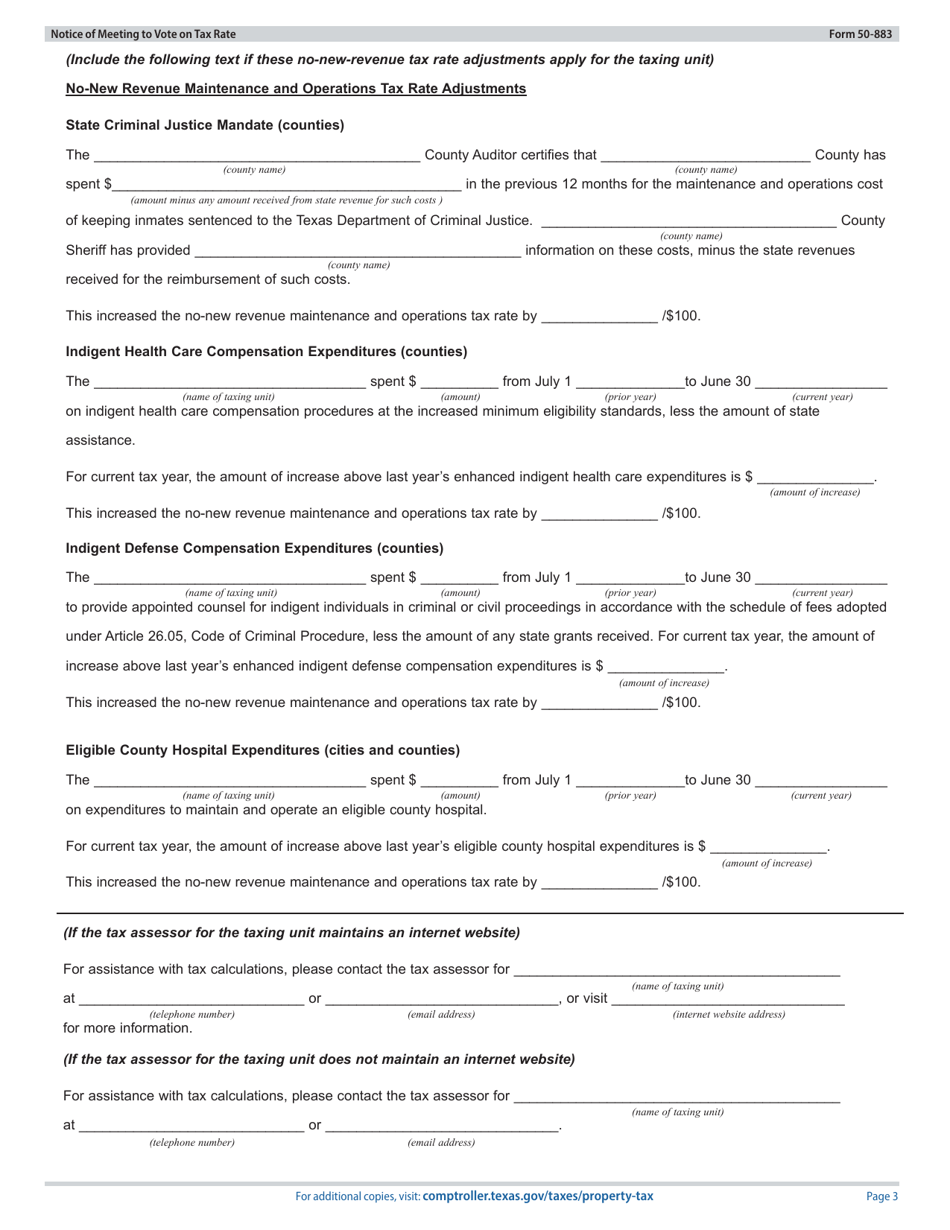

Form 50-883 Notice of Meeting to Vote on Tax Rate - Proposed Rate Does Not Exceed No-New-Revenue or Voter-Approval Tax Rate - Texas

What Is Form 50-883?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-883?

A: Form 50-883 is the Notice of Meeting to Vote on Tax Rate.

Q: What does the form address?

A: The form addresses the proposed tax rate, specifically whether it exceeds the No-New-Revenue or Voter-Approval Tax Rate in Texas.

Q: What is the purpose of the form?

A: The purpose of the form is to provide notice of a meeting where a vote on the tax rate will take place.

Q: What is the No-New-Revenue Tax Rate?

A: The No-New-Revenue Tax Rate is the tax rate that would generate the same amount of revenue as the previous year, adjusted for changes in property values.

Q: What is the Voter-Approval Tax Rate?

A: The Voter-Approval Tax Rate is the maximum tax rate that can be imposed without voter approval.

Q: What happens if the proposed tax rate exceeds these rates?

A: If the proposed tax rate exceeds the No-New-Revenue or Voter-Approval Tax Rate, it may require voter approval before it can be imposed.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 50-883 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.