This version of the form is not currently in use and is provided for reference only. Download this version of

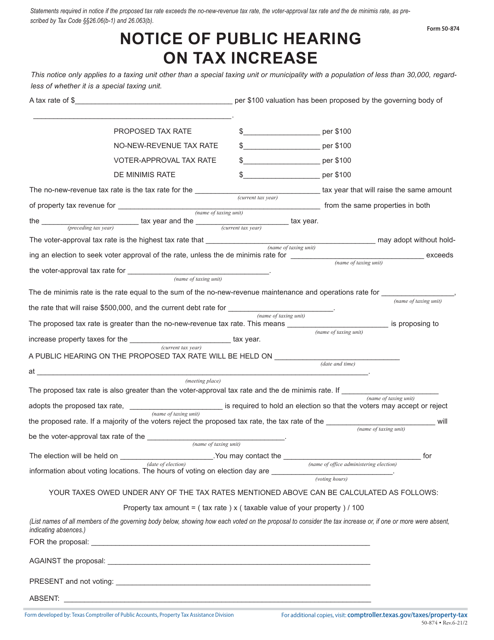

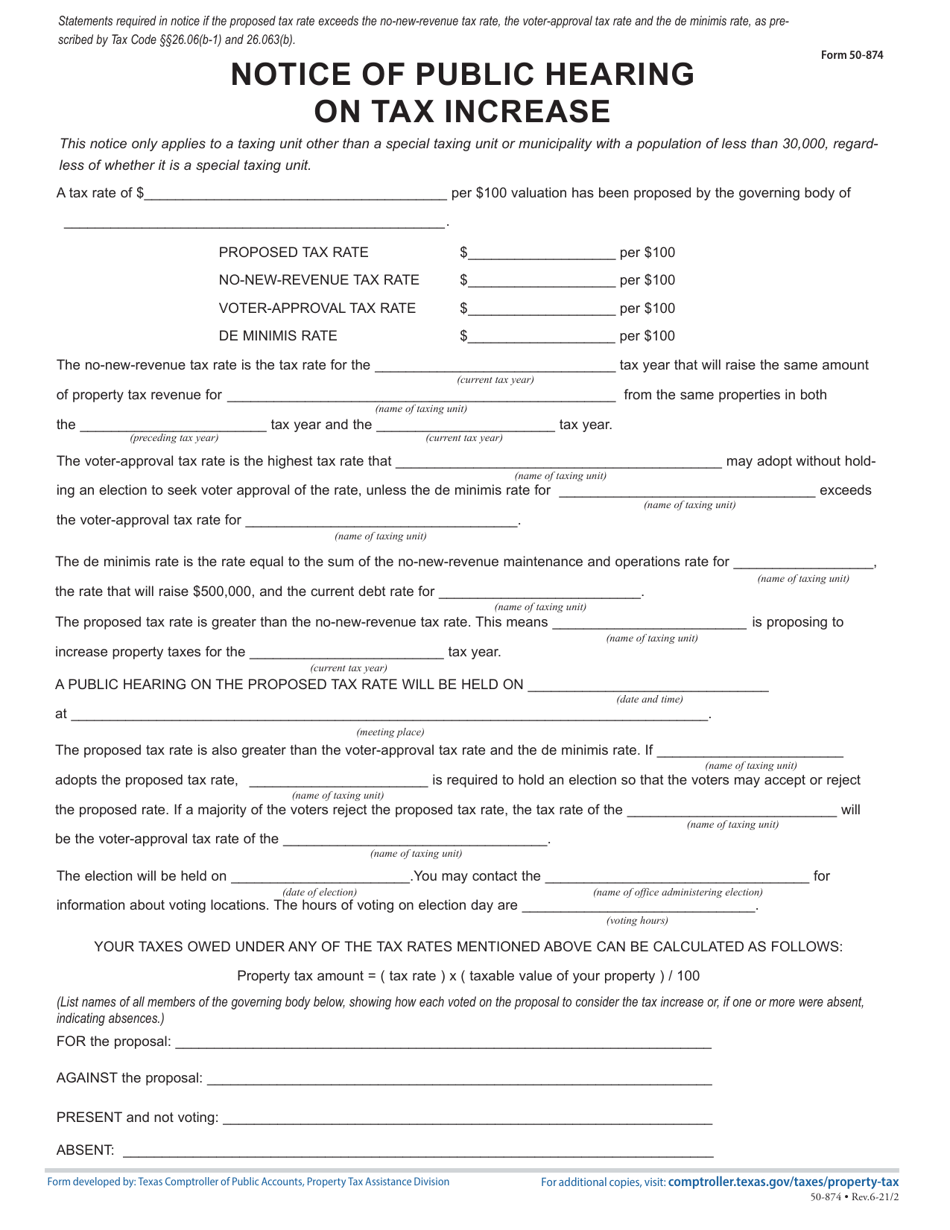

Form 50-874

for the current year.

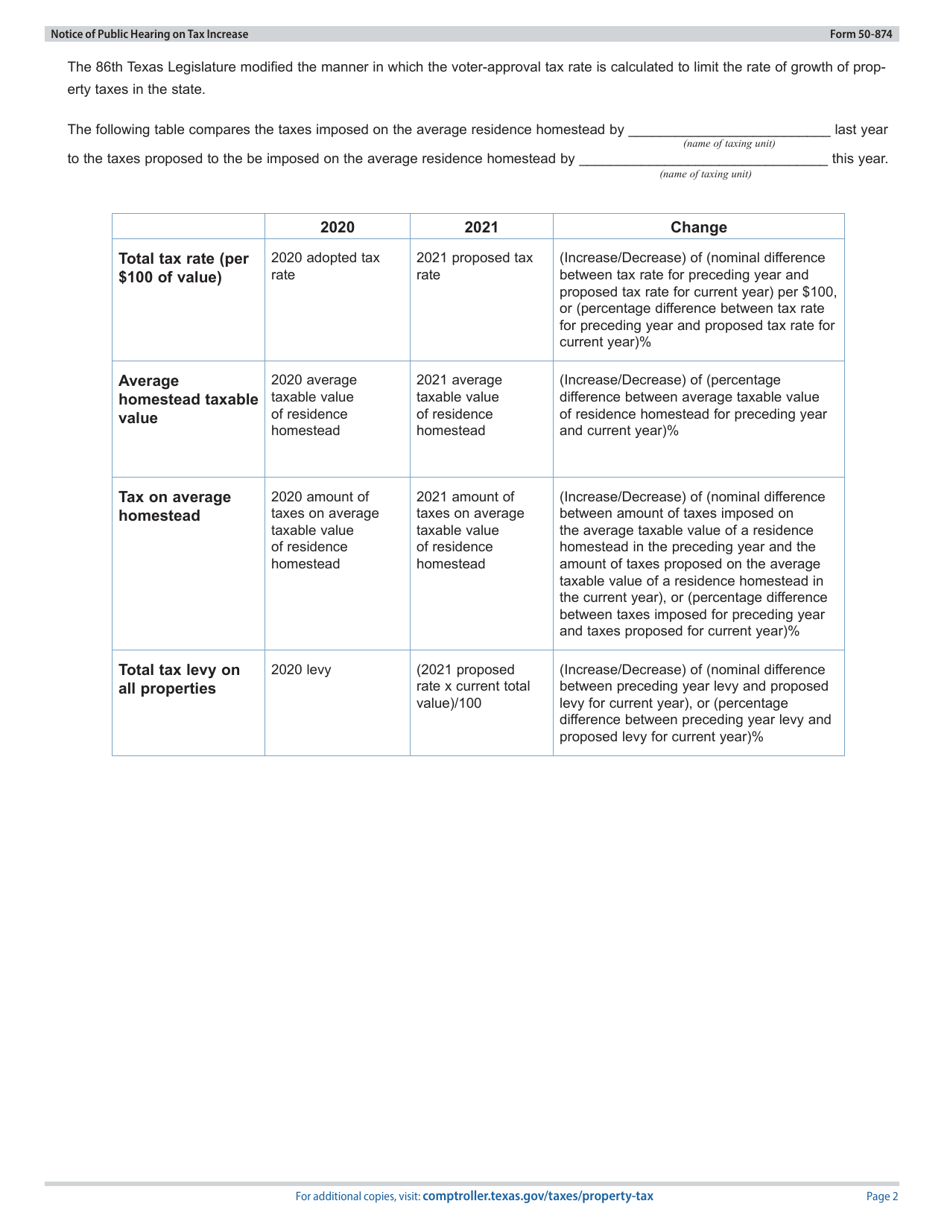

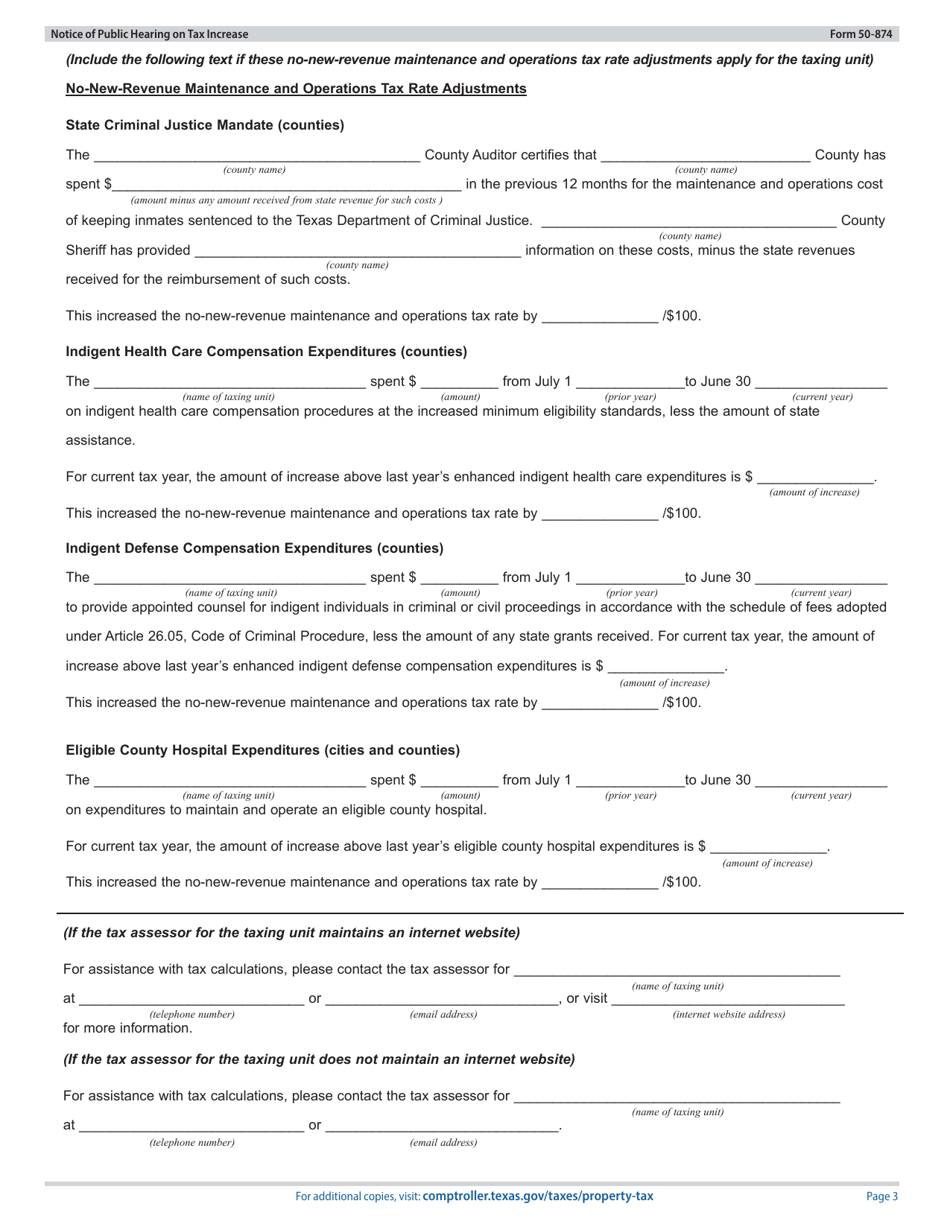

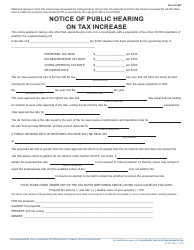

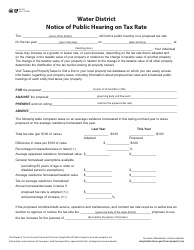

Form 50-874 Notice of Public Hearing on Tax Increase - Proposed Rate Greater Than Voter-Approval Tax Rate and De Minimis Rate - Texas

What Is Form 50-874?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-874?

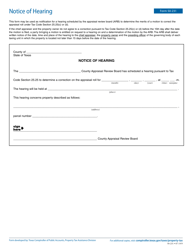

A: Form 50-874 is a notice of public hearing on tax increase.

Q: What does the form notify about?

A: The form notifies about a proposed tax rate that is greater than the voter-approval tax rate and the de minimis rate.

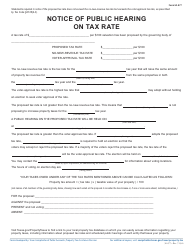

Q: What is the purpose of the public hearing?

A: The public hearing is held to discuss and gather feedback on the proposed increase in tax rate.

Q: What is the voter-approval tax rate?

A: The voter-approval tax rate is the maximum tax rate that can be adopted without voter approval.

Q: What is the de minimis rate?

A: The de minimis rate is the lowest tax rate that requires notice and a public hearing.

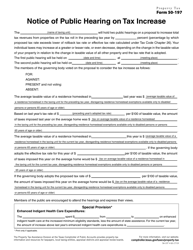

Q: Why is this notice important?

A: This notice allows residents to understand and participate in the decision-making process regarding tax increases.

Q: What should residents do if they have concerns about the proposed tax increase?

A: Residents should attend the public hearing and provide their feedback or submit written comments.

Q: Who is responsible for filing this form?

A: The taxing unit or the governing body is responsible for filing this form.

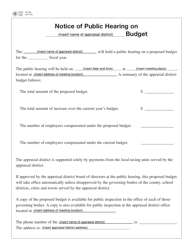

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 50-874 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.