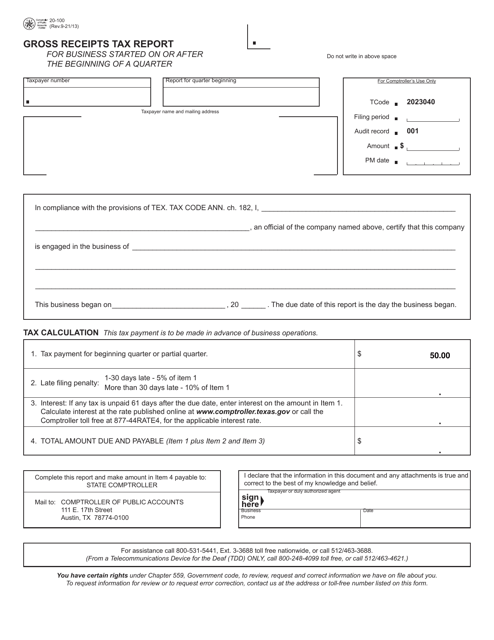

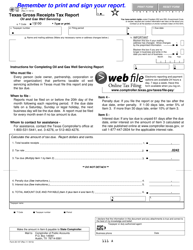

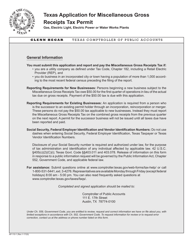

Form 20-100 Gross Receipts Tax Report for Business Started on or After the Beginning of a Quarter - Texas

What Is Form 20-100?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

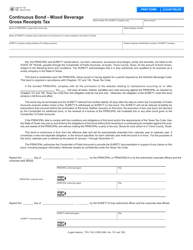

Q: What is Form 20-100?

A: Form 20-100 is the Gross ReceiptsTax Report for businesses in Texas.

Q: Who needs to file Form 20-100?

A: Businesses that started on or after the beginning of a quarter in Texas need to file Form 20-100.

Q: What is the purpose of Form 20-100?

A: The purpose of Form 20-100 is to report and pay the gross receipts tax for businesses in Texas.

Q: How often do businesses need to file Form 20-100?

A: Businesses need to file Form 20-100 quarterly.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 20-100 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.