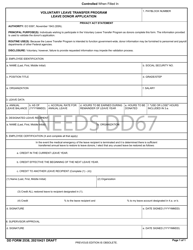

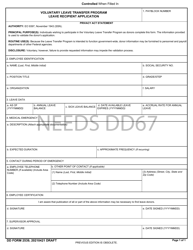

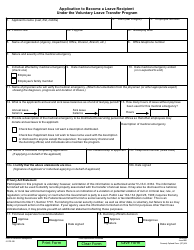

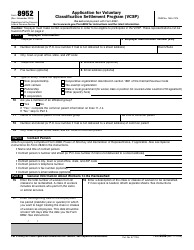

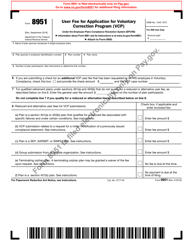

This version of the form is not currently in use and is provided for reference only. Download this version of

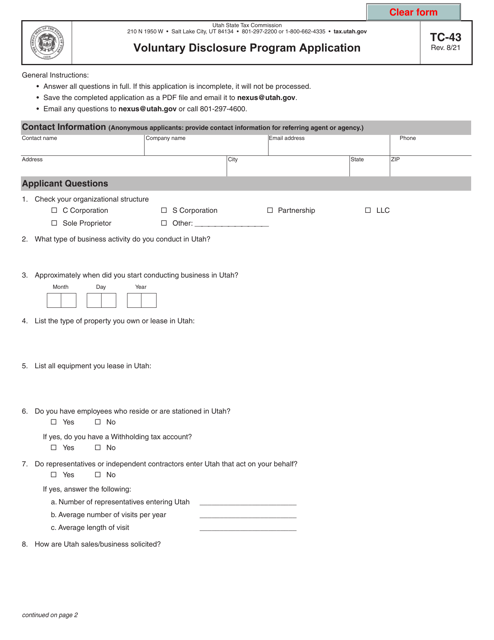

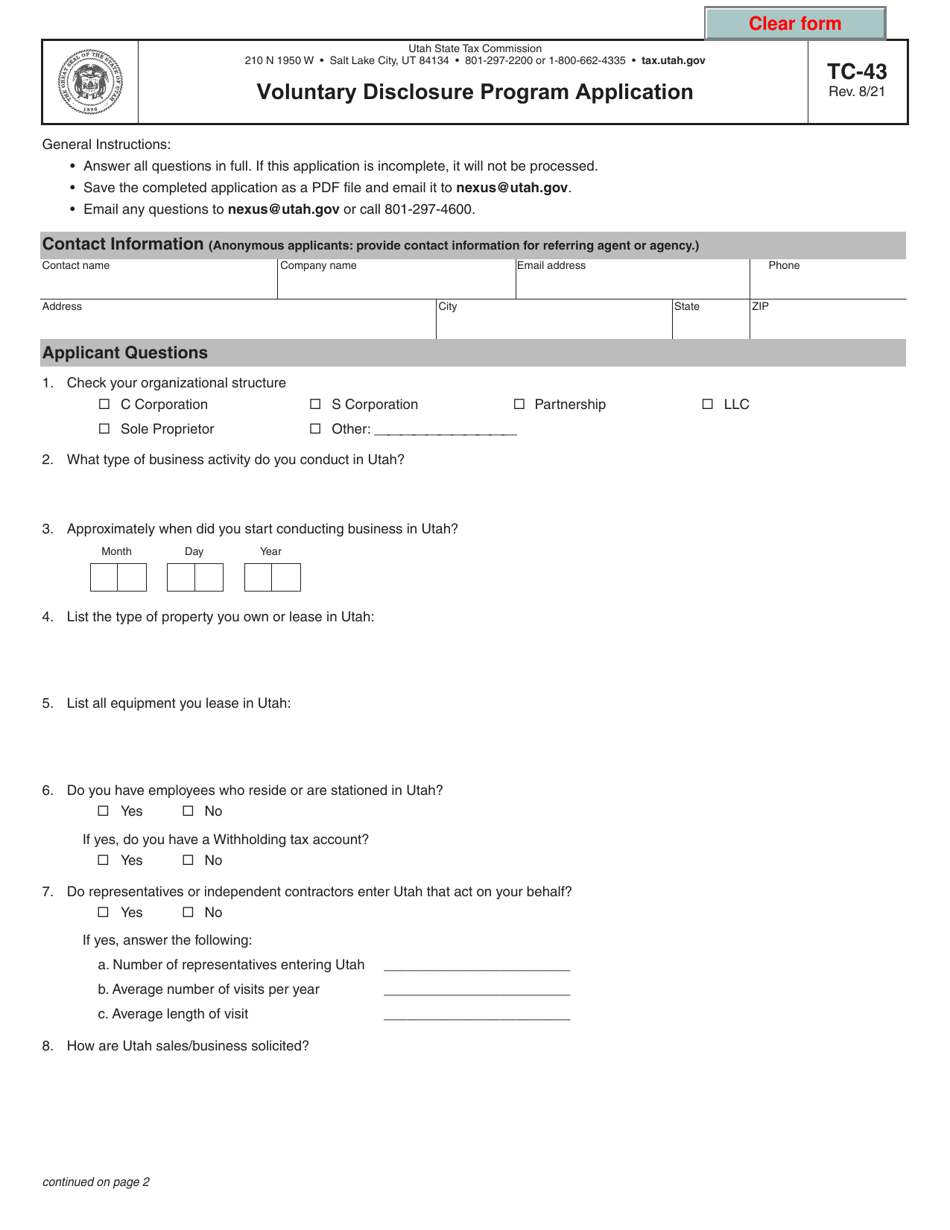

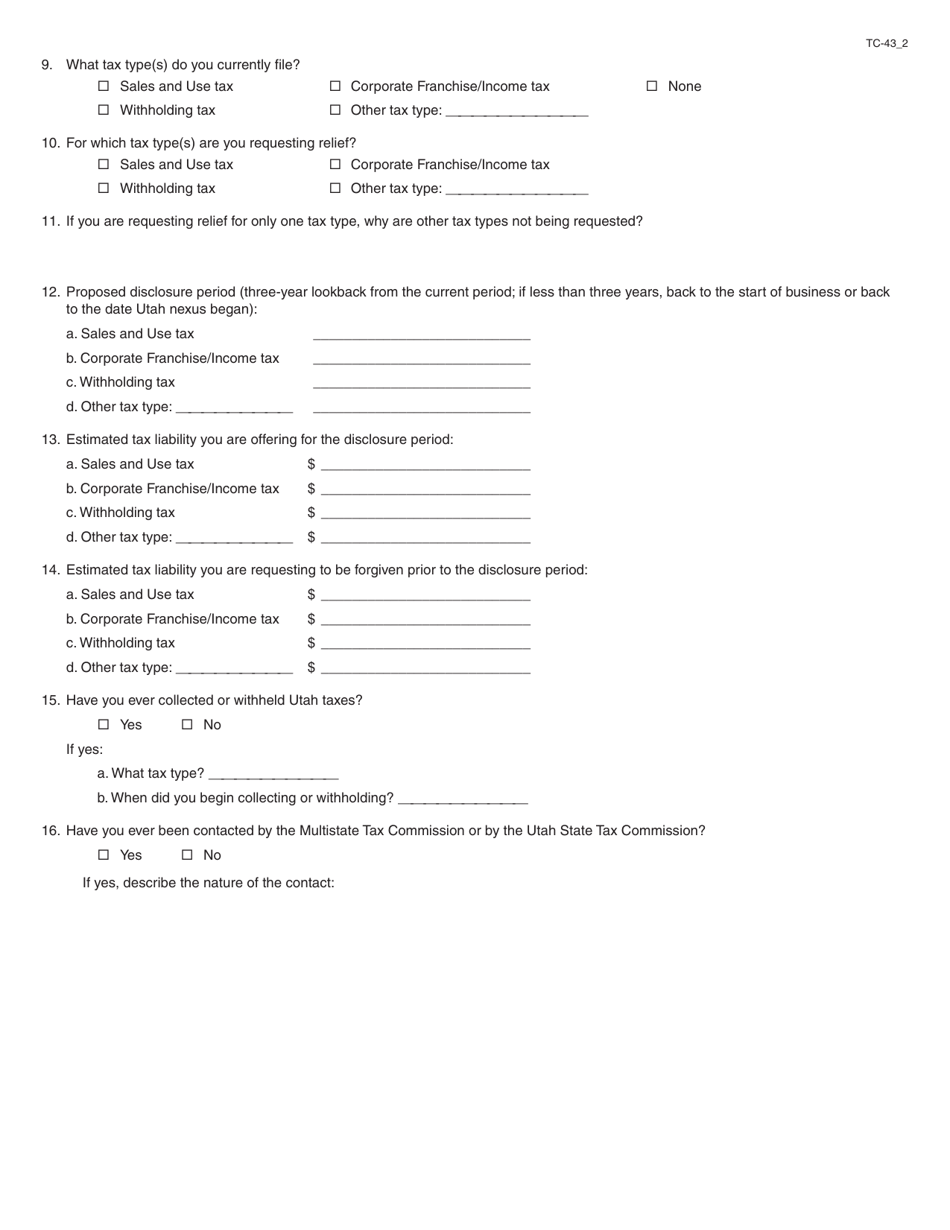

Form TC-43

for the current year.

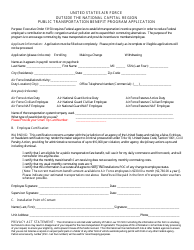

Form TC-43 Voluntary Disclosure Program Application - Utah

What Is Form TC-43?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

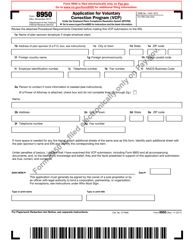

Q: What is Form TC-43?

A: Form TC-43 is a Voluntary Disclosure Program Application in Utah.

Q: What is the Voluntary Disclosure Program?

A: The Voluntary Disclosure Program is a program that allows taxpayers to voluntarily come forward to resolve any prior noncompliance with Utah tax laws.

Q: Who is required to file Form TC-43?

A: Taxpayers who wish to participate in the Voluntary Disclosure Program are required to file Form TC-43.

Q: What is the purpose of the Voluntary Disclosure Program Application?

A: The purpose of the Voluntary Disclosure Program Application is to provide complete and accurate information about the taxpayer's noncompliance and tax liabilities.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-43 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.