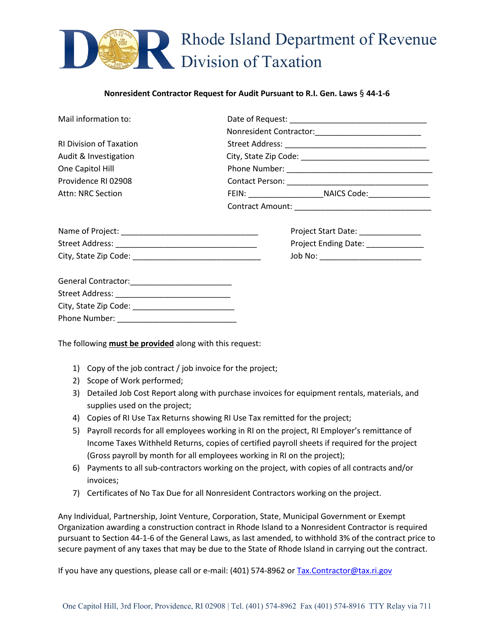

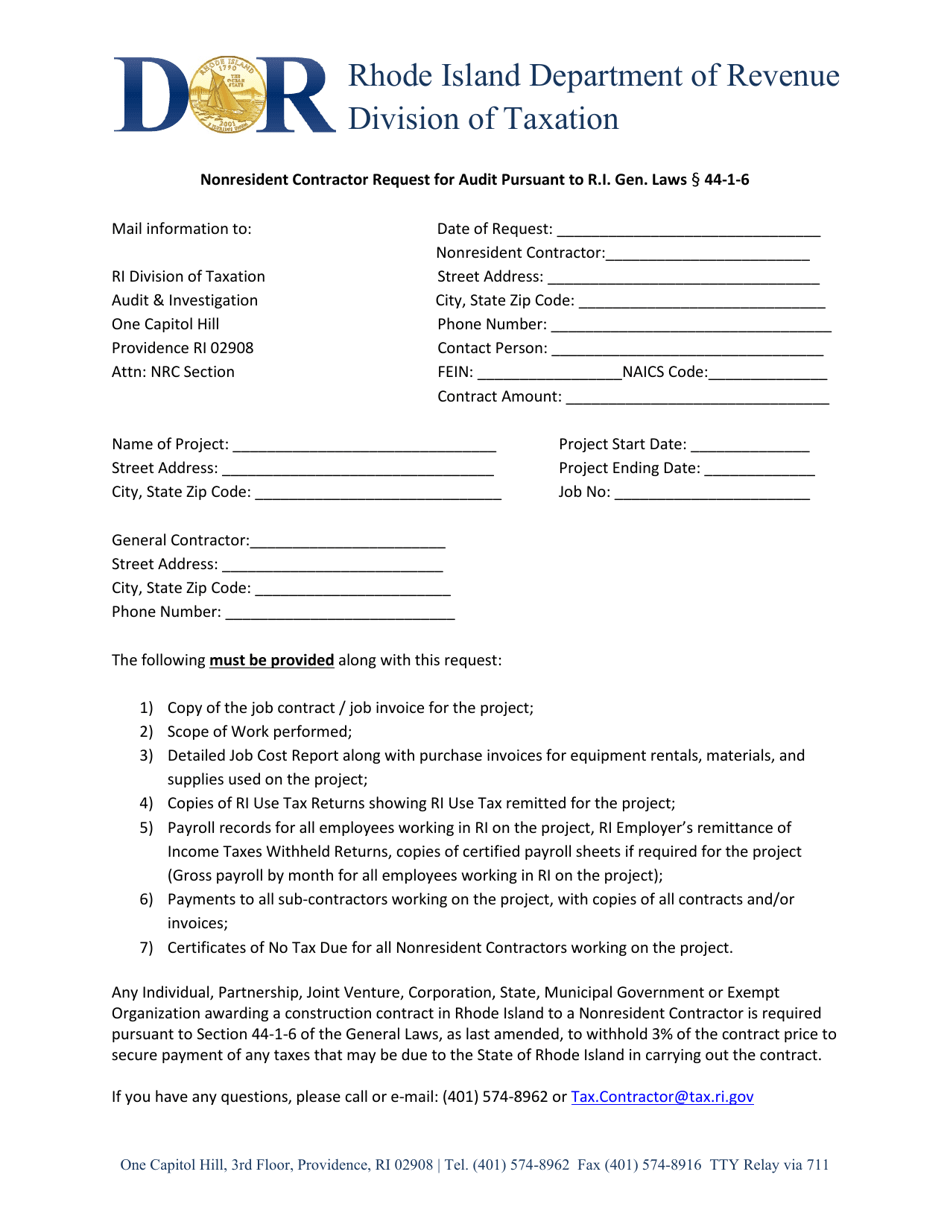

Nonresident Contractor Request for Audit Pursuant to R.i. Gen. Laws 44-1-6 - Rhode Island

Nonresident Contractor Request for Audit Pursuant to R.i. Gen. Laws 44-1-6 is a legal document that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.

FAQ

Q: What is a nonresident contractor?

A: A nonresident contractor is a contractor who does not maintain a physical presence or permanent establishment in the state of Rhode Island.

Q: What is R.i. Gen. Laws 44-1-6?

A: R.i. Gen. Laws 44-1-6 is a law in Rhode Island that allows the state to request an audit from a nonresident contractor.

Q: What is the purpose of the audit?

A: The purpose of the audit is to ensure that the nonresident contractor is complying with all Rhode Island tax and licensing requirements.

Q: How does the audit process work?

A: The state will request relevant records and documents from the nonresident contractor to review their financial and tax information.

Q: What happens if a nonresident contractor fails the audit?

A: If a nonresident contractor fails the audit, they may be subject to penalties, fines, or further legal action.

Q: What should a nonresident contractor do if they receive a request for audit?

A: A nonresident contractor should gather all requested documentation and cooperate with the audit process to ensure compliance with Rhode Island laws.

Q: Is this law specific to Rhode Island?

A: Yes, R.i. Gen. Laws 44-1-6 is specific to Rhode Island and may not apply to nonresident contractors in other states.

Form Details:

- The latest edition currently provided by the Rhode Island Department of Revenue - Division of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.