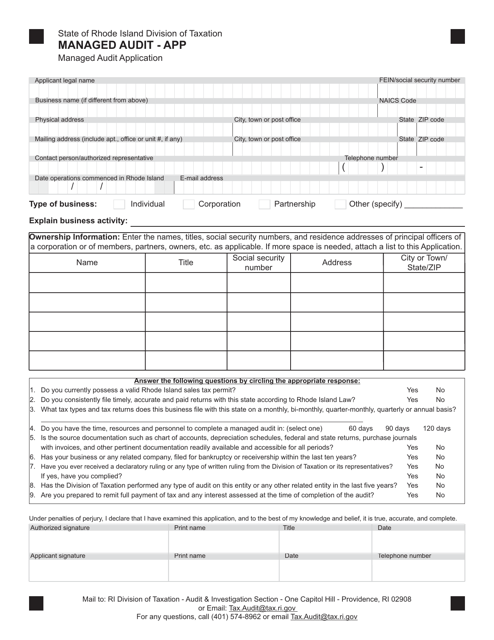

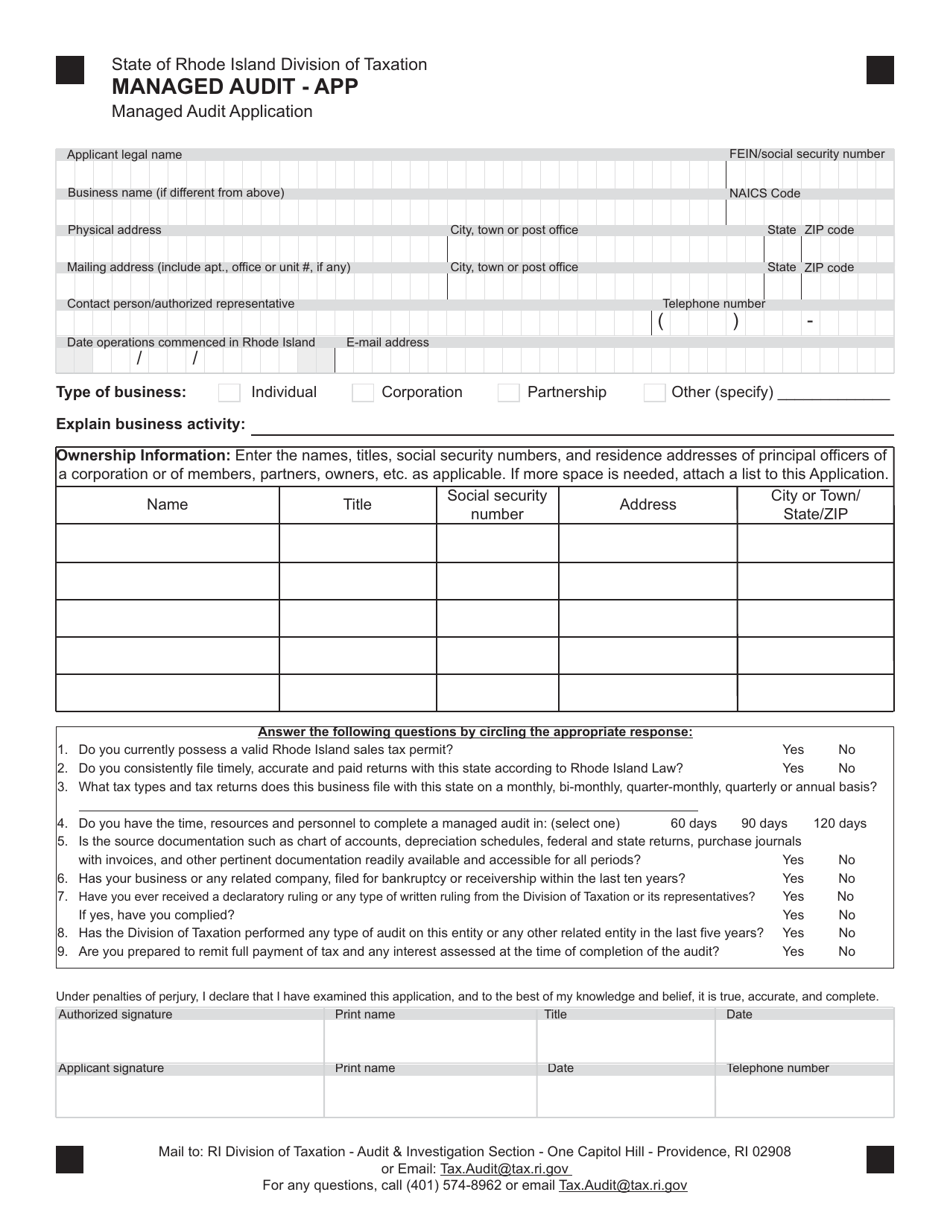

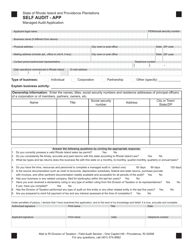

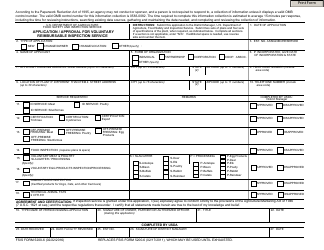

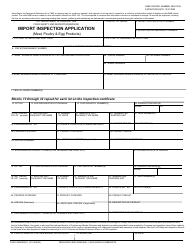

Managed Audit Application - Rhode Island

Managed Audit Application is a legal document that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.

FAQ

Q: What is a Managed Audit Application in Rhode Island?

A: A Managed Audit Application in Rhode Island is a process designed to help businesses resolve outstanding tax liabilities through a managed audit program.

Q: Who is eligible for a Managed Audit Application in Rhode Island?

A: Businesses that have outstanding tax liabilities in Rhode Island may be eligible for a Managed Audit Application.

Q: How does a Managed Audit Application work in Rhode Island?

A: Once a business applies for a Managed Audit Application in Rhode Island, it enters into an agreement with the state to conduct a thorough audit of its tax records. The purpose of the audit is to determine the accurate amount of tax owed and to establish a payment plan to resolve the outstanding liabilities.

Q: What are the benefits of a Managed Audit Application in Rhode Island?

A: The benefits of a Managed Audit Application in Rhode Island include an opportunity to resolve outstanding tax liabilities, avoid penalties and interest, and establish a manageable payment plan.

Q: How can a business apply for a Managed Audit Application in Rhode Island?

A: Businesses interested in applying for a Managed Audit Application in Rhode Island should contact the Rhode Island Division of Taxation for more information and guidance on the application process.

Form Details:

- The latest edition currently provided by the Rhode Island Department of Revenue - Division of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.