This version of the form is not currently in use and is provided for reference only. Download this version of

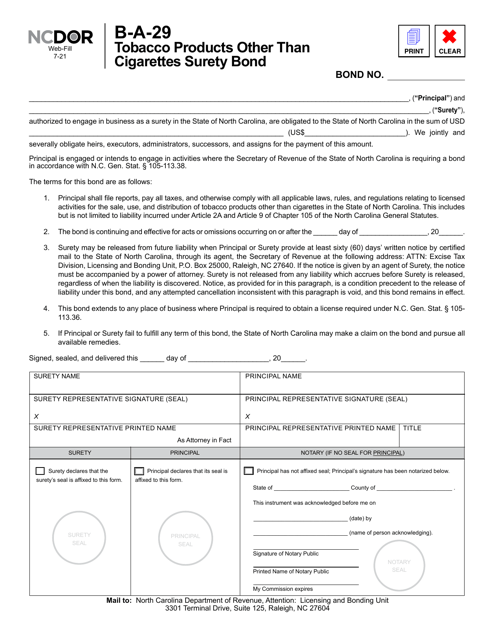

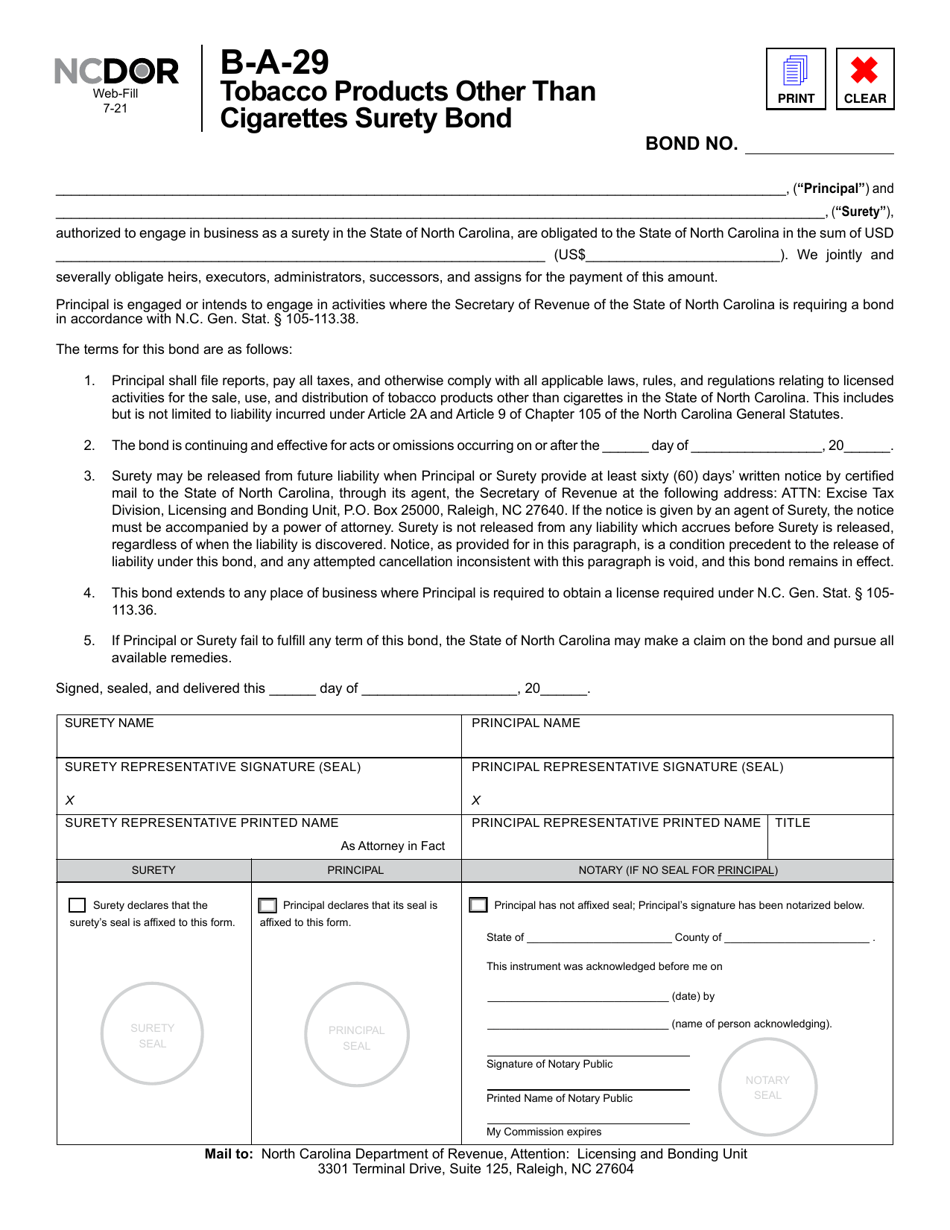

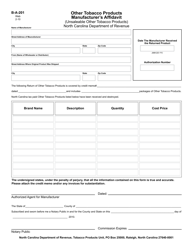

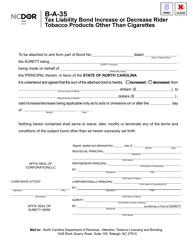

Form B-A-29

for the current year.

Form B-A-29 Tobacco Products Other Than Cigarettes Surety Bond - North Carolina

What Is Form B-A-29?

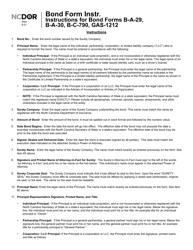

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is a Form B-A-29 Surety Bond?

A: Form B-A-29 is a surety bond related to tobacco productsother than cigarettes in North Carolina.

Q: Who needs to have a Form B-A-29 Surety Bond?

A: Wholesalers, distributors, or importers of tobacco products other than cigarettes in North Carolina need to have a Form B-A-29 Surety Bond.

Q: Why is a Form B-A-29 Surety Bond required?

A: The bond is required by the North Carolina Department of Revenue to ensure compliance with the state's tobacco laws and regulations.

Q: How much is the required bond amount for a Form B-A-29 Surety Bond?

A: The required bond amount for a Form B-A-29 Surety Bond in North Carolina is $1,000.

Q: Are there any other requirements besides the surety bond for tobacco products other than cigarettes in North Carolina?

A: Yes, in addition to the surety bond, you may be required to obtain a license from the North Carolina Department of Revenue and comply with other applicable laws and regulations.

Q: What happens if I fail to comply with the tobacco laws and regulations in North Carolina?

A: Failure to comply with the tobacco laws and regulations in North Carolina can result in penalties, fines, and the suspension or revocation of your license.

Q: Can I cancel a Form B-A-29 Surety Bond?

A: Yes, you can cancel a Form B-A-29 Surety Bond by providing written notice to the North Carolina Department of Revenue and the surety bond company.

Q: How long does a Form B-A-29 Surety Bond remain in effect?

A: A Form B-A-29 Surety Bond remains in effect until it is canceled by the surety bond company or the bond is no longer required.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B-A-29 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.