This version of the form is not currently in use and is provided for reference only. Download this version of

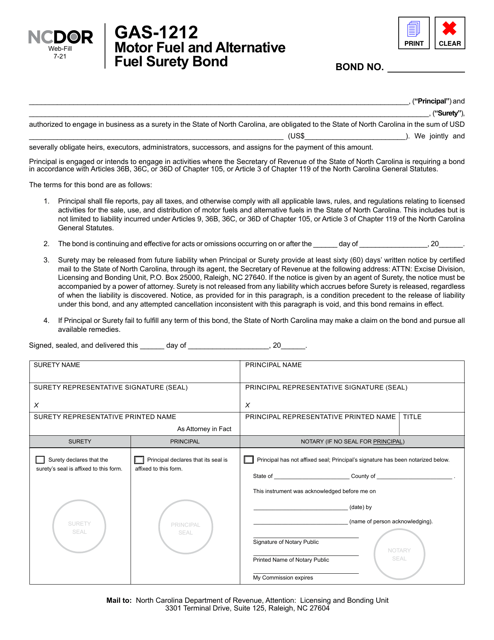

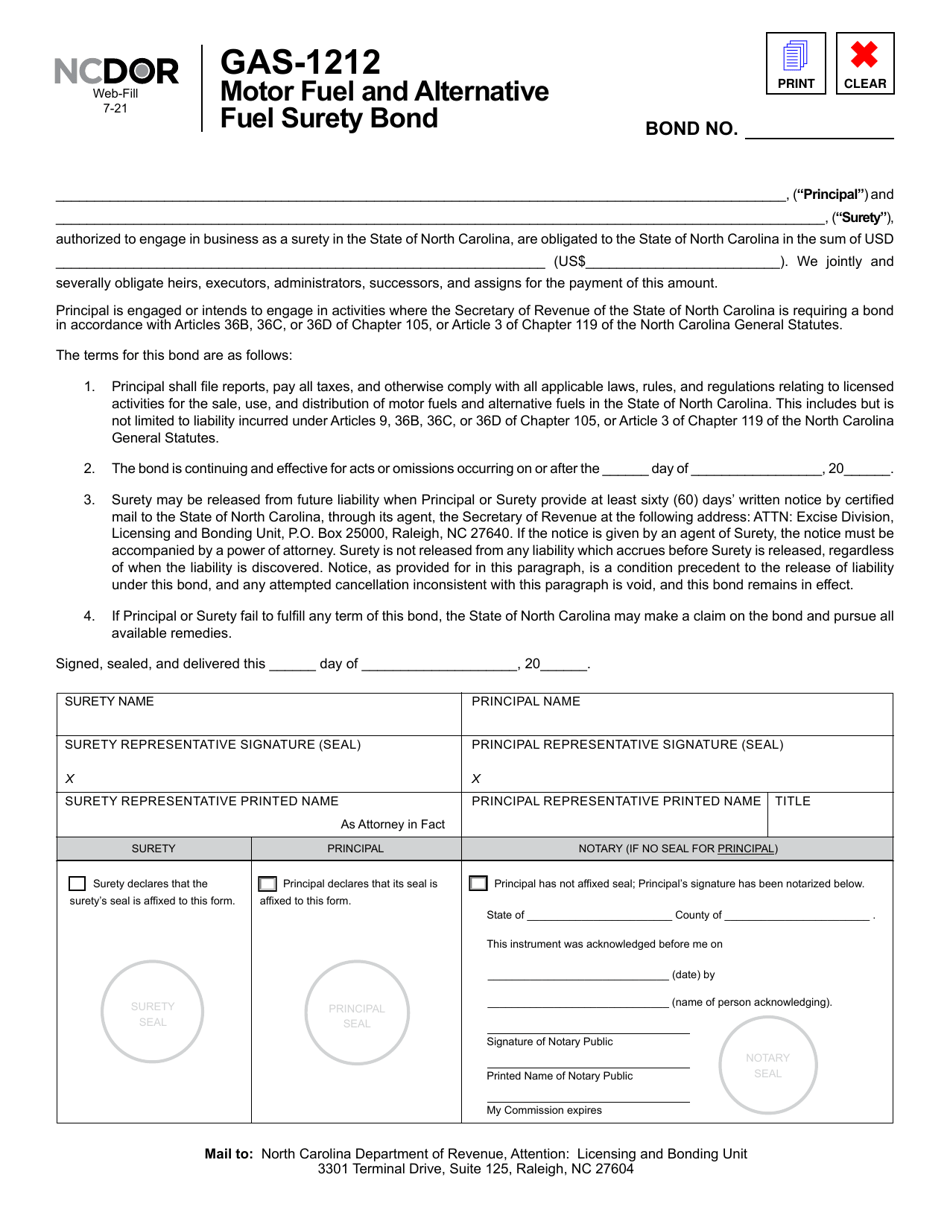

Form GAS-1212

for the current year.

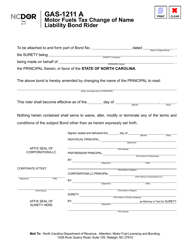

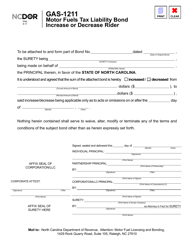

Form GAS-1212 Motor Fuel and Alternative Fuel Surety Bond - North Carolina

What Is Form GAS-1212?

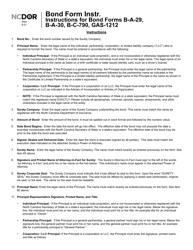

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is GAS-1212?

A: GAS-1212 is a form for the Motor Fuel and Alternative Fuel Surety Bond in North Carolina.

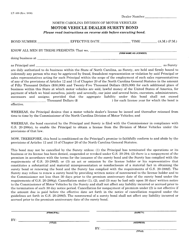

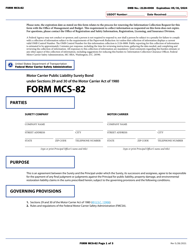

Q: What is the purpose of the Motor Fuel and Alternative Fuel Surety Bond?

A: The bond ensures that fuel suppliers pay the required taxes on motor fuel and alternative fuel.

Q: Who needs to file a Motor Fuel and Alternative Fuel Surety Bond in North Carolina?

A: Fuel suppliers who sell motor fuel or alternative fuel in North Carolina need to file this bond.

Q: What is the amount of the surety bond?

A: The amount of the bond varies depending on the volume of motor fuel or alternative fuel sold.

Q: How long is the Motor Fuel and Alternative Fuel Surety Bond valid for?

A: The bond is valid for one year and needs to be renewed annually.

Q: Are there any other requirements for fuel suppliers in North Carolina?

A: Yes, fuel suppliers also need to obtain a license from the North Carolina Department of Revenue.

Q: What happens if a fuel supplier fails to pay the required taxes?

A: If a fuel supplier fails to pay the required taxes, the surety bond can be used to cover the unpaid taxes.

Q: Can the bond be canceled or revoked?

A: The bond can be canceled or revoked if the fuel supplier fails to comply with the terms and conditions of the bond.

Q: Who should I contact for more information about the Motor Fuel and Alternative Fuel Surety Bond in North Carolina?

A: For more information, you should contact the North Carolina Department of Revenue.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GAS-1212 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.