This version of the form is not currently in use and is provided for reference only. Download this version of

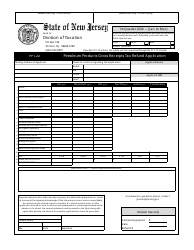

Form RU-9

for the current year.

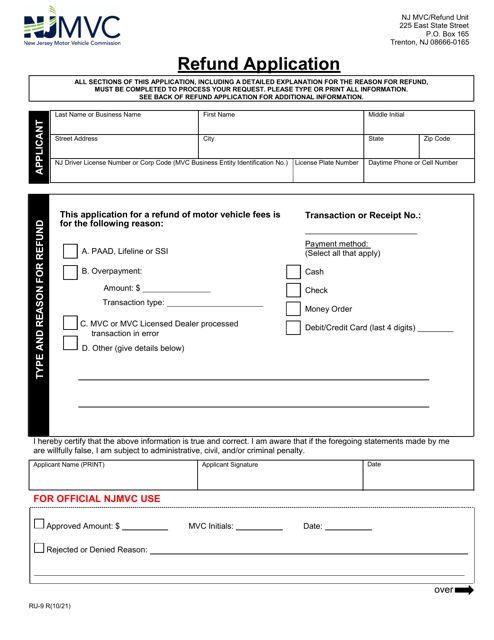

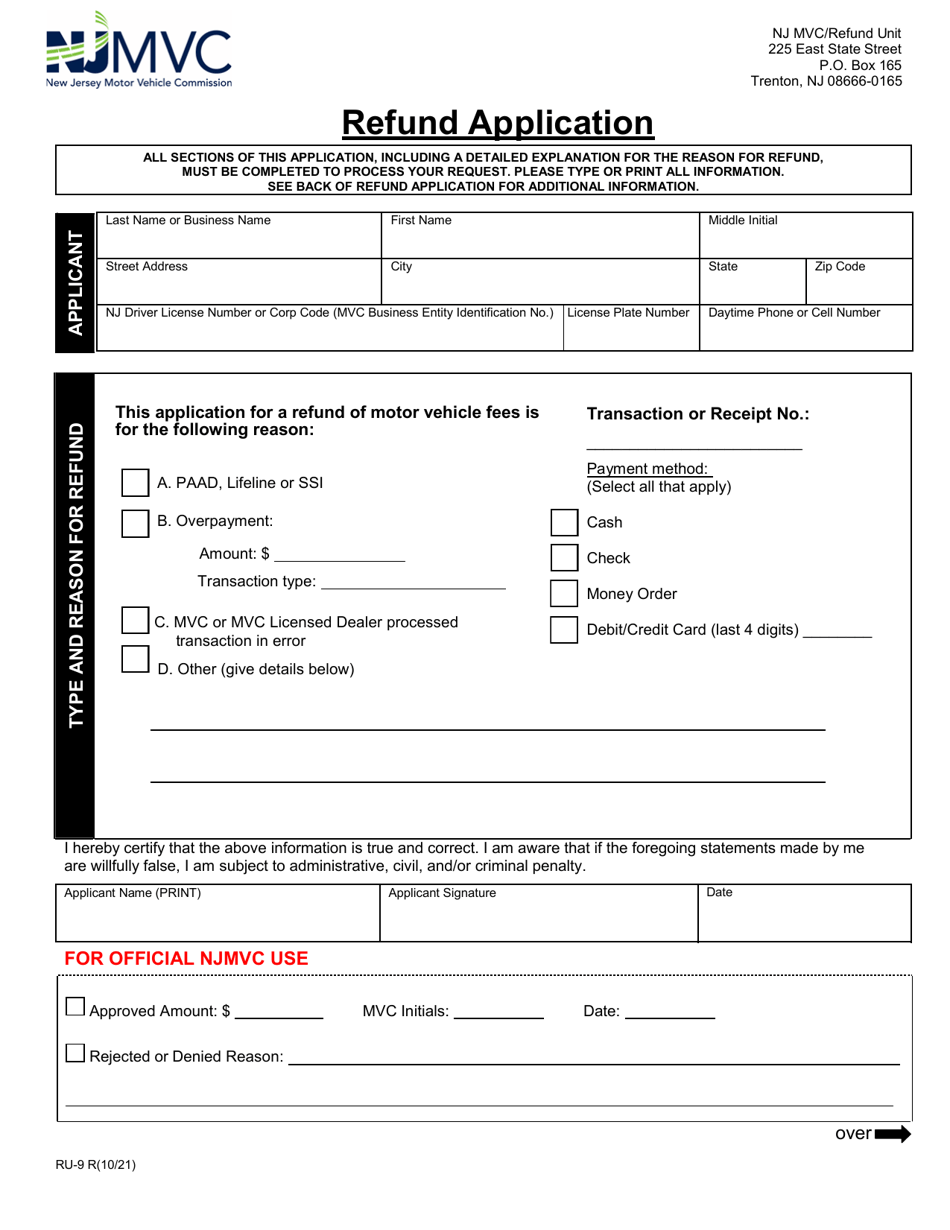

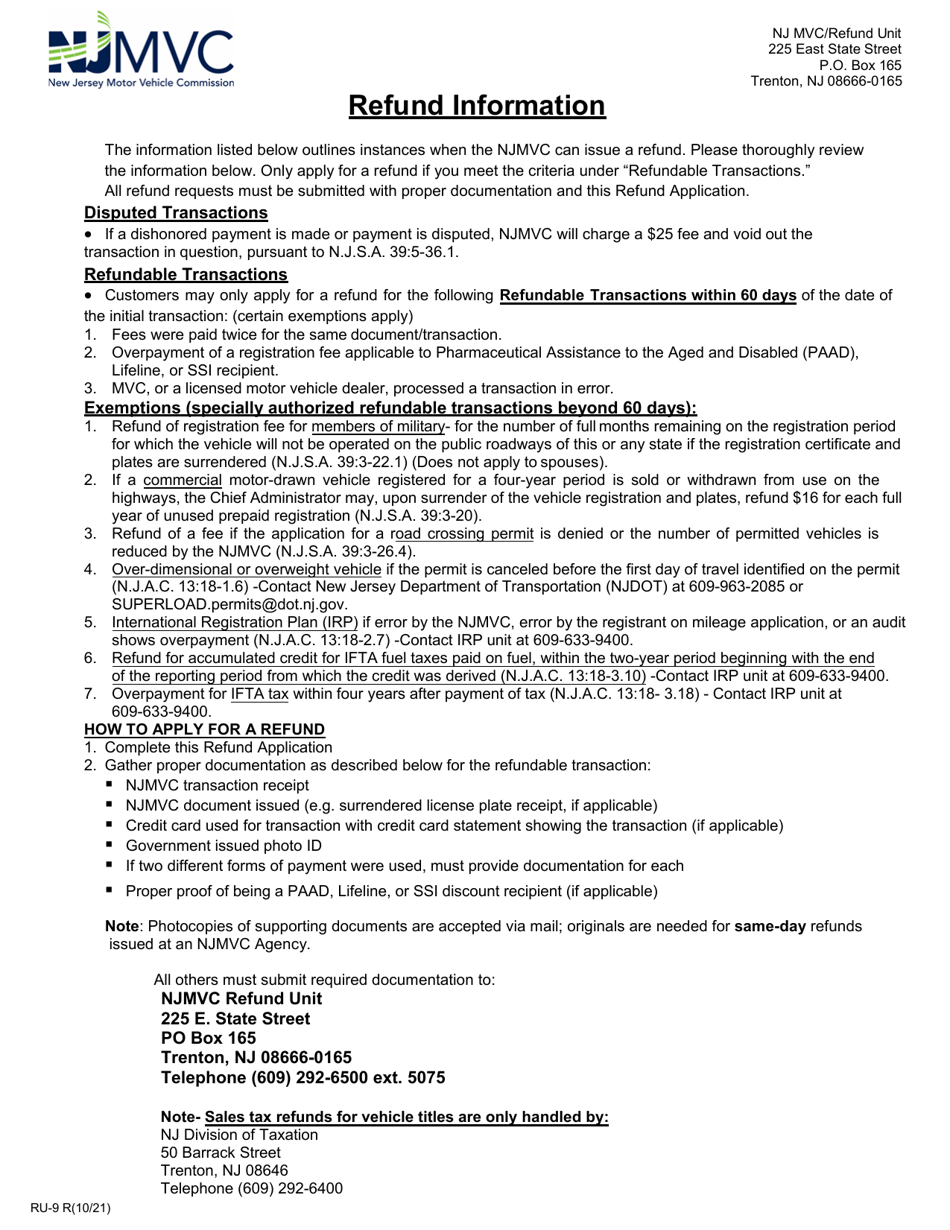

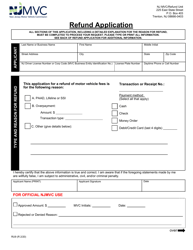

Form RU-9 Refund Application - New Jersey

What Is Form RU-9?

This is a legal form that was released by the New Jersey Motor Vehicle Commission - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form RU-9?

A: Form RU-9 is a refund application form in the state of New Jersey.

Q: Who can use form RU-9?

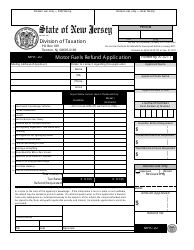

A: Form RU-9 can be used by individuals and businesses to apply for a refund of sales tax paid in New Jersey.

Q: What is the purpose of form RU-9?

A: The purpose of form RU-9 is to request a refund of sales tax that was overpaid or incorrectly paid to the state of New Jersey.

Q: What information is required on form RU-9?

A: Form RU-9 requires information such as the taxpayer's name, contact information, and details about the sales tax overpayment.

Q: Is there a deadline to file form RU-9?

A: Yes, form RU-9 must be filed within 4 years from the date of the overpayment to be eligible for a refund.

Q: How long does it take to receive a refund after filing form RU-9?

A: The processing time for refund applications can vary, but it typically takes several weeks to receive a refund after filing form RU-9.

Q: What should I do if my form RU-9 is rejected?

A: If your form RU-9 is rejected, you can follow the instructions provided by the New Jersey Division of Taxation to appeal the decision or correct any errors.

Q: Are there any fees associated with filing form RU-9?

A: No, there are no fees associated with filing form RU-9.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the New Jersey Motor Vehicle Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RU-9 by clicking the link below or browse more documents and templates provided by the New Jersey Motor Vehicle Commission.