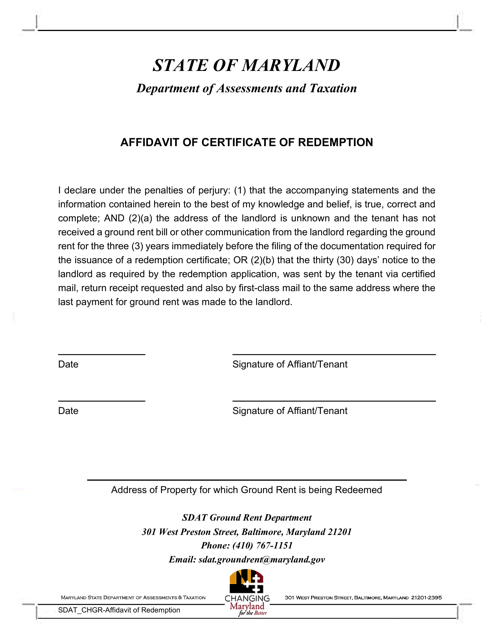

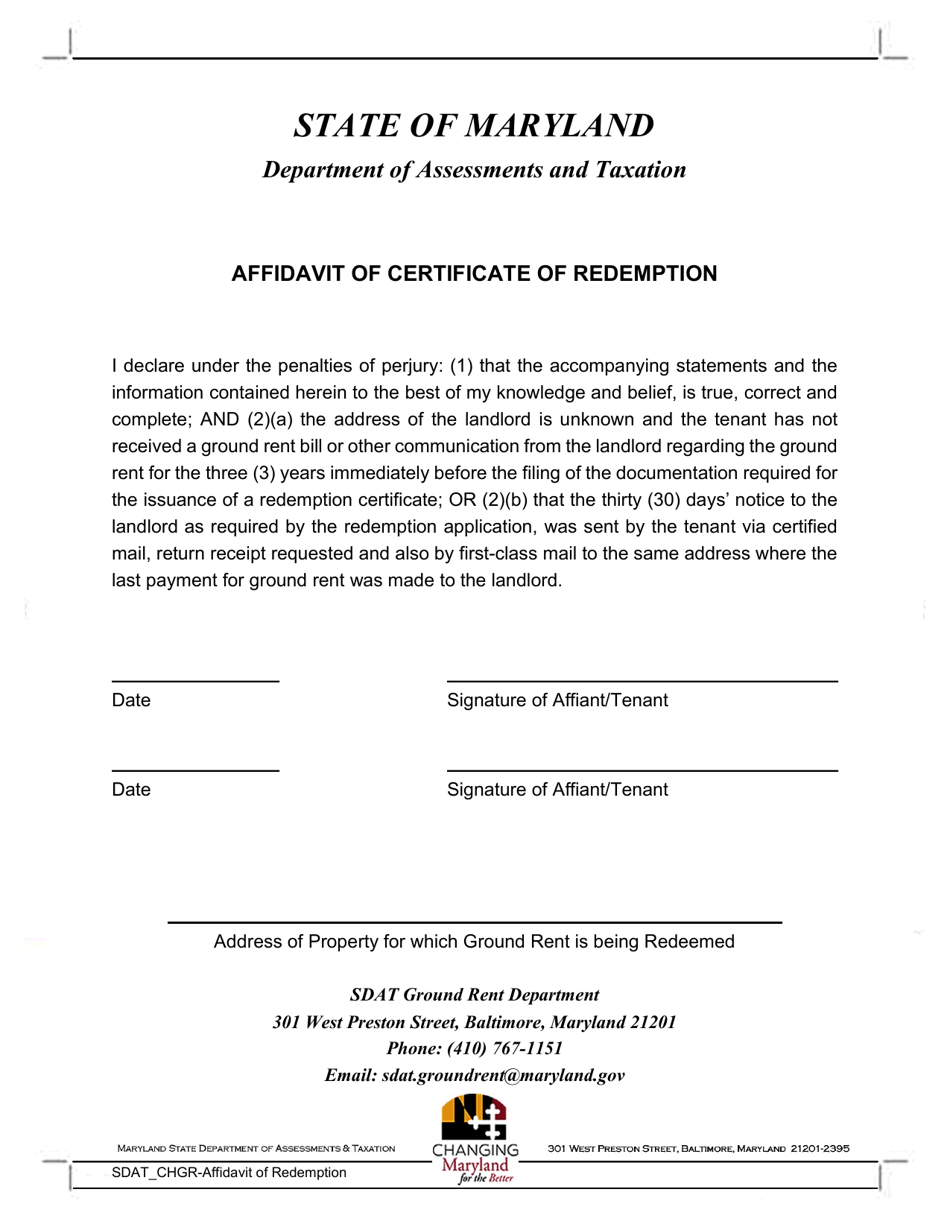

Affidavit of Certificate of Redemption - Maryland

Affidavit of Certificate of Redemption is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

Q: What is an Affidavit of Certificate of Redemption in Maryland?

A: An Affidavit of Certificate of Redemption is a legal document used in Maryland to confirm the redemption of a property that was previously sold at a tax sale.

Q: When is an Affidavit of Certificate of Redemption needed?

A: An Affidavit of Certificate of Redemption is needed when a property owner wants to redeem their property after it has been sold at a tax sale in Maryland.

Q: Who can file an Affidavit of Certificate of Redemption?

A: The property owner or their authorized representative can file an Affidavit of Certificate of Redemption.

Q: What information is typically included in an Affidavit of Certificate of Redemption?

A: An Affidavit of Certificate of Redemption typically includes details about the property, the tax sale, the redemption amount, and any other relevant information.

Q: Are there any fees associated with filing an Affidavit of Certificate of Redemption?

A: Yes, there are usually fees associated with filing an Affidavit of Certificate of Redemption. The specific fees vary depending on the county where the tax sale was conducted.

Q: What happens after filing an Affidavit of Certificate of Redemption?

A: After filing an Affidavit of Certificate of Redemption, the property owner's rights to the property are restored, and the property is no longer subject to the tax sale.

Q: Is legal assistance required to file an Affidavit of Certificate of Redemption?

A: While legal assistance is not required, it is recommended to seek the advice of an attorney or a qualified professional to ensure that the process is completed correctly.

Q: Can an Affidavit of Certificate of Redemption be filed after a certain deadline?

A: Yes, there is a specific redemption period during which an Affidavit of Certificate of Redemption can be filed. The redemption period varies depending on the county where the tax sale was conducted.

Q: What happens if an Affidavit of Certificate of Redemption is not filed within the redemption period?

A: If an Affidavit of Certificate of Redemption is not filed within the redemption period, the tax sale purchaser may obtain a deed to the property and become the new owner.

Form Details:

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.