This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

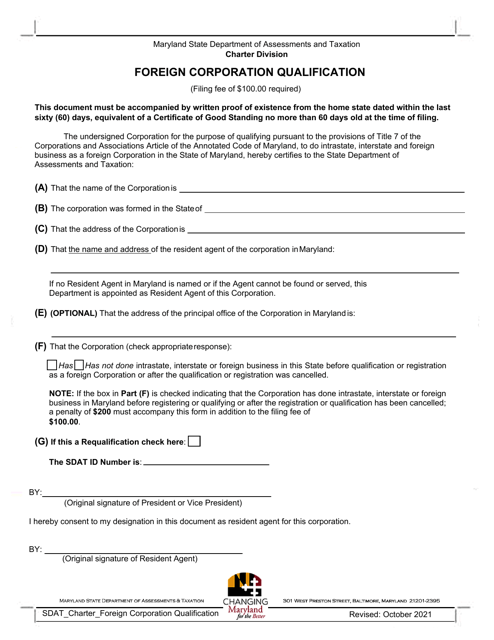

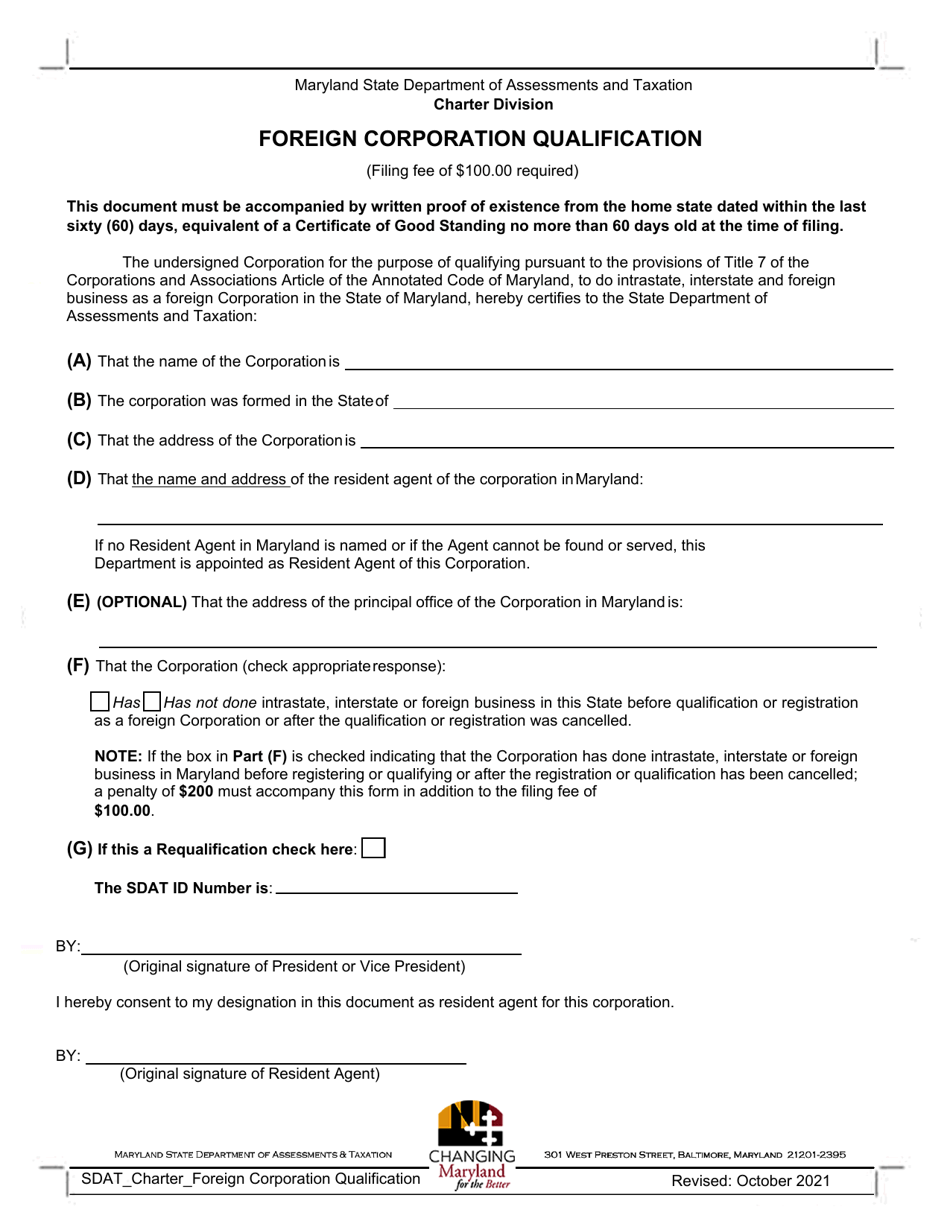

Foreign Corporation Qualification - Maryland

Foreign Corporation Qualification is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

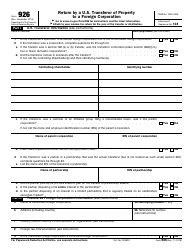

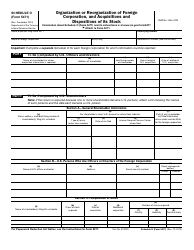

Q: What is foreign corporation qualification?

A: Foreign corporation qualification is the process by which a corporation that was formed in a different state or country is authorized to do business in Maryland.

Q: Why would a corporation need to qualify as a foreign corporation in Maryland?

A: A corporation would need to qualify as a foreign corporation in Maryland if it wants to conduct business, own property, or have employees in the state.

Q: What are the requirements for foreign corporation qualification in Maryland?

A: The requirements for foreign corporation qualification in Maryland include submitting a completed application, paying the required fee, and providing certain documents such as a certificate of good standing from the home state.

Q: How do I apply for foreign corporation qualification in Maryland?

A: To apply for foreign corporation qualification in Maryland, you need to complete the Application for Qualification as a Foreign Corporation form and submit it along with the required fee and documents to the Maryland Department of Assessments and Taxation.

Q: How long does it take to process the foreign corporation qualification application in Maryland?

A: The processing time for a foreign corporation qualification application in Maryland can vary, but it typically takes around 7-10 business days.

Q: What is the fee for foreign corporation qualification in Maryland?

A: The fee for foreign corporation qualification in Maryland is $100 for standard processing or $150 for expedited processing.

Q: Do I need to have a registered agent in Maryland to qualify as a foreign corporation?

A: Yes, as part of the qualification process, a foreign corporation is required to appoint and maintain a registered agent in Maryland who can accept legal documents on behalf of the corporation.

Q: What happens after my foreign corporation is qualified in Maryland?

A: Once your foreign corporation is qualified in Maryland, you are authorized to conduct business in the state and are subject to the laws and regulations governing corporations.

Q: Do I need to file annual reports for my qualified foreign corporation in Maryland?

A: Yes, after qualifying as a foreign corporation in Maryland, you are required to file annual reports with the Maryland Department of Assessments and Taxation and pay the associated fees.

Form Details:

- Released on October 1, 2021;

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.