This version of the form is not currently in use and is provided for reference only. Download this version of

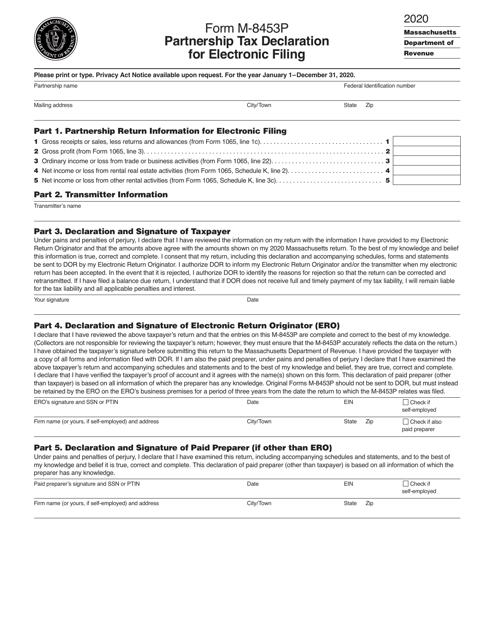

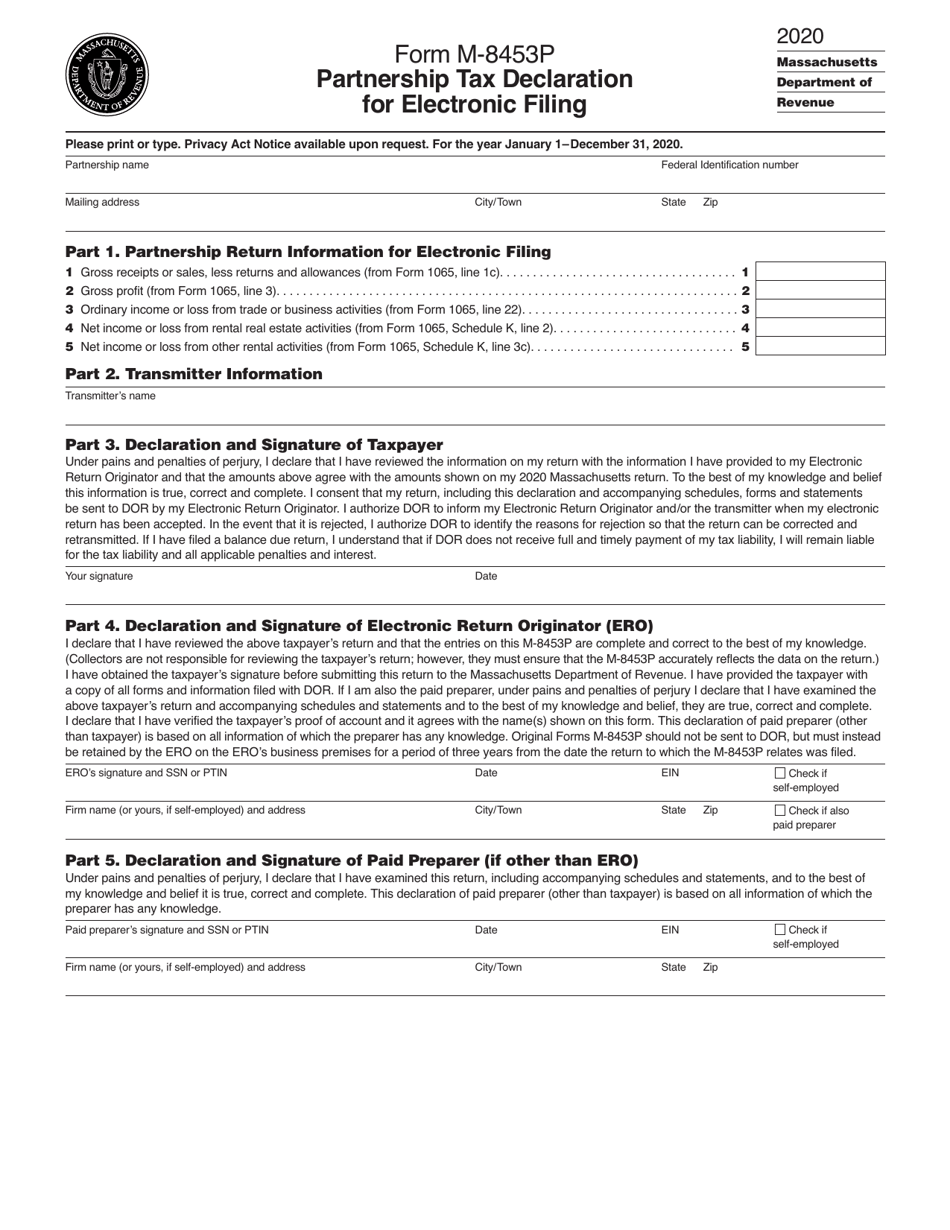

Form M-8453P

for the current year.

Form M-8453P Partnership Tax Declaration for Electronic Filing - Massachusetts

What Is Form M-8453P?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-8453P?

A: Form M-8453P is the Partnership Tax Declaration for Electronic Filing in Massachusetts.

Q: Who needs to file Form M-8453P?

A: Partnerships in Massachusetts that are filing their tax return electronically need to file Form M-8453P.

Q: What is the purpose of Form M-8453P?

A: Form M-8453P is used to declare that the partnership agrees to electronically file their tax return and acknowledges the penalties for filing a false or fraudulent return.

Q: Is Form M-8453P required for paper filing?

A: No, Form M-8453P is only required for electronic filing of partnership tax returns in Massachusetts.

Q: What should I do with Form M-8453P once I fill it out?

A: Once you have filled out Form M-8453P, you should sign and submit it along with your electronically filed partnership tax return.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-8453P by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.