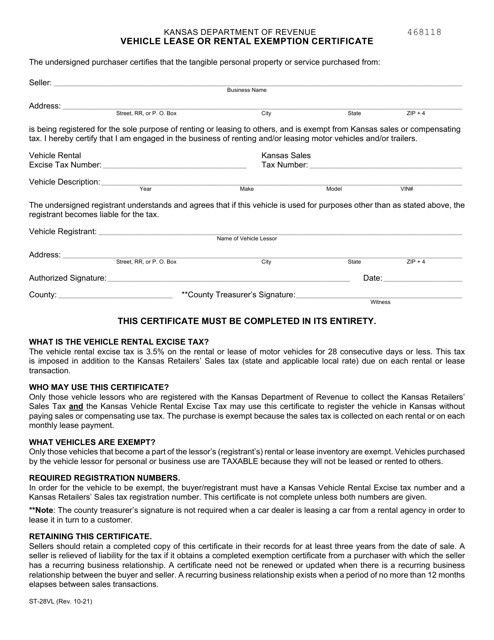

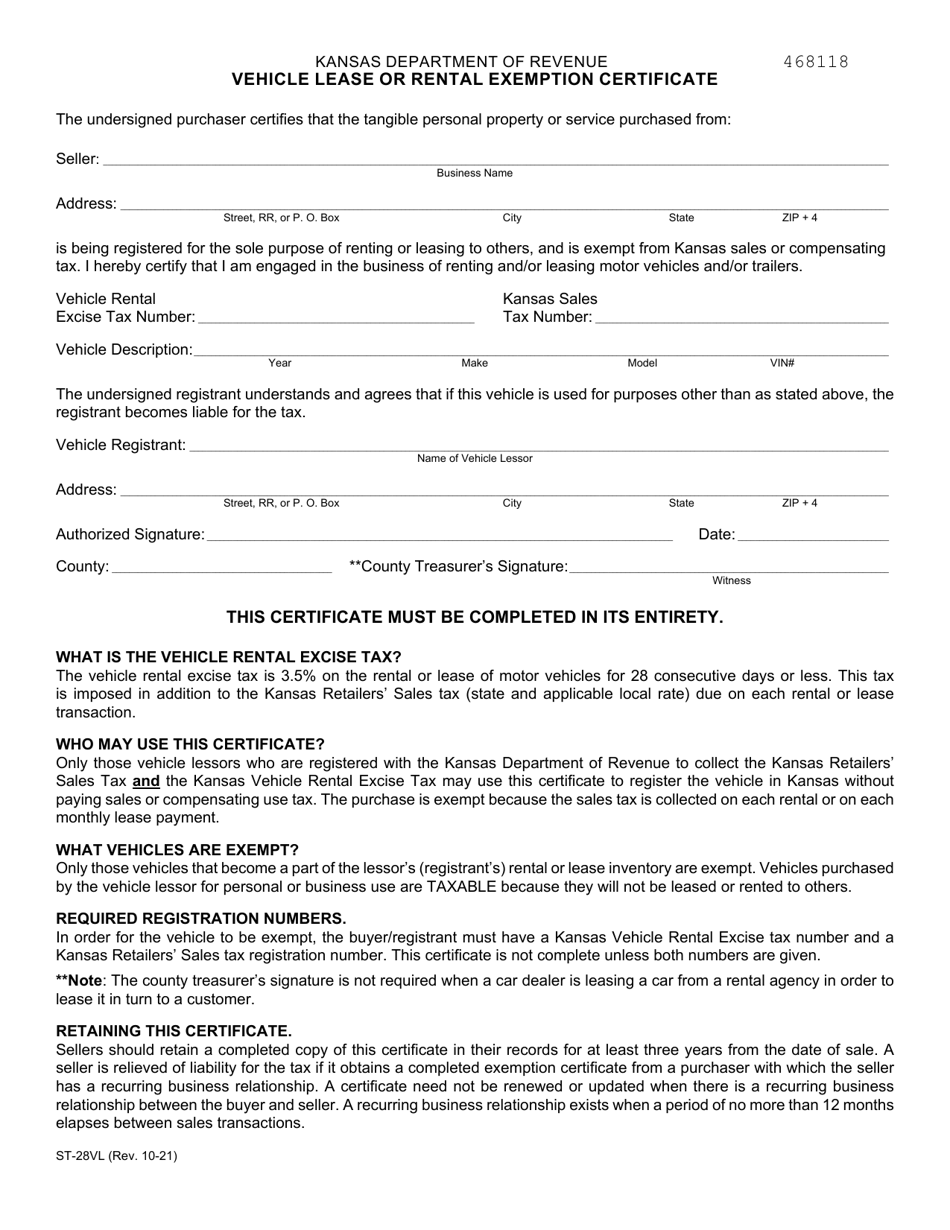

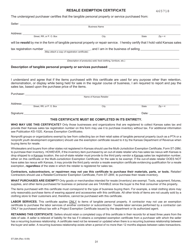

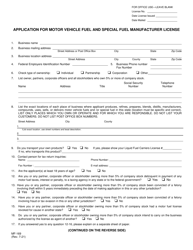

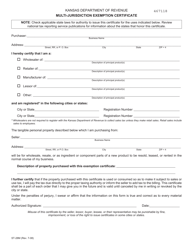

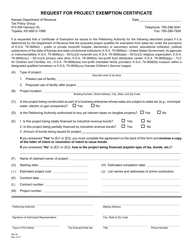

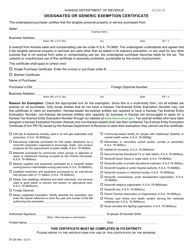

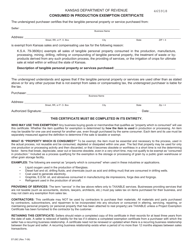

Form ST-28VL Vehicle Lease or Rental Exemption Certificate - Kansas

What Is Form ST-28VL?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-28VL?

A: Form ST-28VL is a Vehicle Lease or Rental Exemption Certificate in Kansas.

Q: What is the purpose of Form ST-28VL?

A: Form ST-28VL is used to claim an exemption from sales tax on leased or rented vehicles in Kansas.

Q: Who should use Form ST-28VL?

A: Form ST-28VL should be used by individuals or businesses who lease or rent vehicles in Kansas and want to claim a sales tax exemption.

Q: What information is required on Form ST-28VL?

A: Form ST-28VL requires the lessee's or renter's information, the lessor's information, details of the lease or rental agreement, and a statement explaining the reason for claiming the exemption.

Q: Are there any filing fees for Form ST-28VL?

A: No, there are no filing fees for submitting Form ST-28VL in Kansas.

Q: When should Form ST-28VL be submitted?

A: Form ST-28VL should be submitted to the Kansas Department of Revenue within 30 days of entering into the lease or rental agreement.

Q: Can I claim a sales tax exemption on all leased or rented vehicles in Kansas?

A: No, there are specific requirements and conditions for claiming a sales tax exemption on leased or rented vehicles in Kansas. Form ST-28VL should be used to determine eligibility and claim the exemption.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-28VL by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.