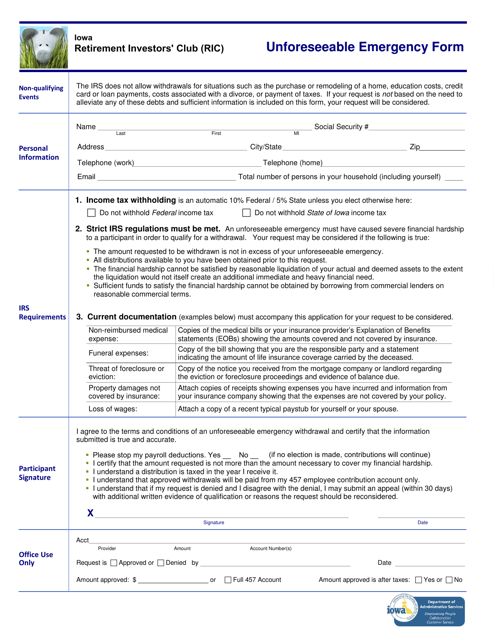

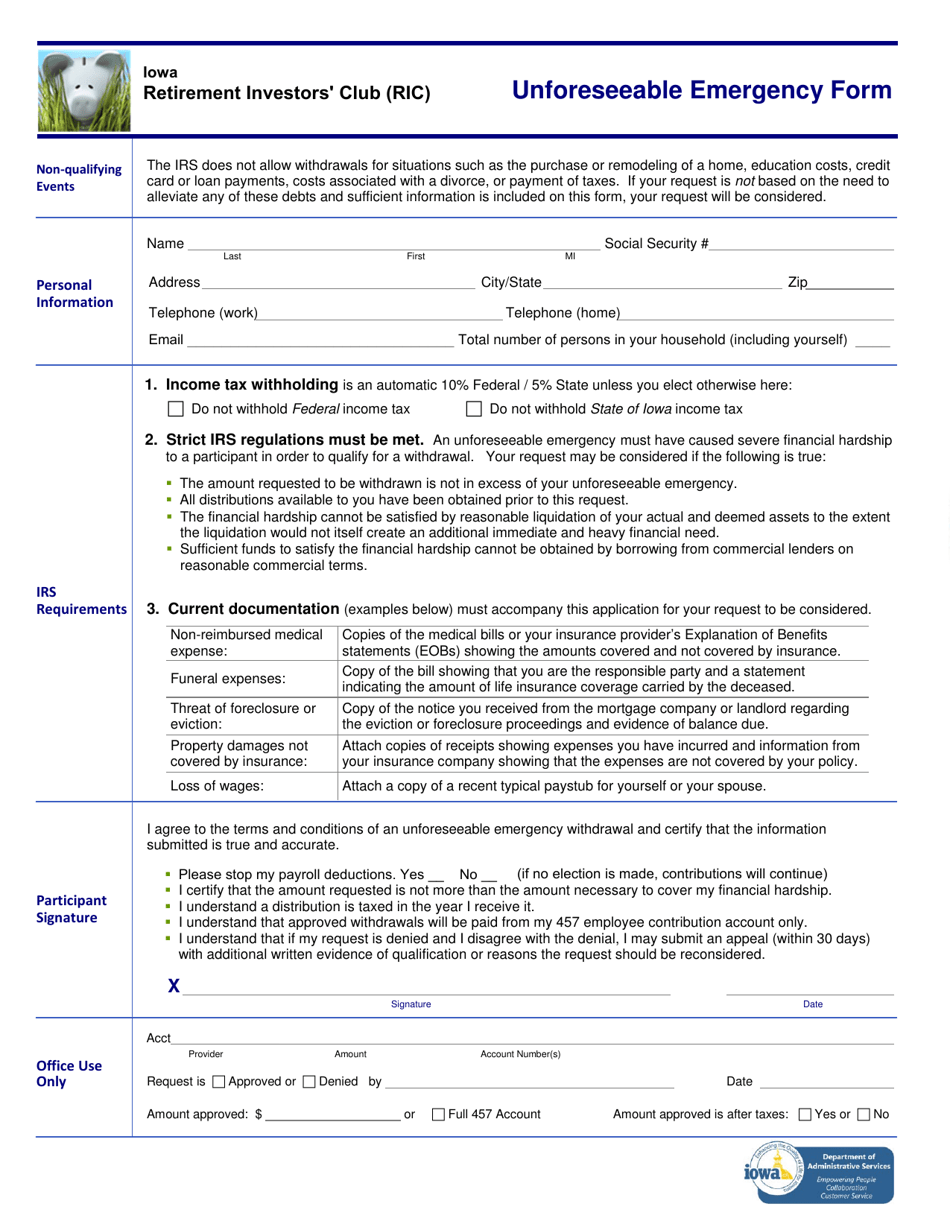

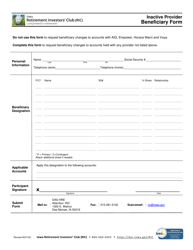

Unforeseeable Emergency Form - Retirement Investors' Club (Ric) - Iowa

Unforeseeable Emergency Form - Retirement Investors' Club (Ric) is a legal document that was released by the Iowa Department of Administrative Services - a government authority operating within Iowa.

FAQ

Q: What is the Unforeseeable Emergency Form?

A: The Unforeseeable Emergency Form is a document related to the Retirement Investors' Club (RIC) in Iowa.

Q: What is the Retirement Investors' Club (RIC)?

A: The Retirement Investors' Club (RIC) is a retirement savings plan available to employees of the State of Iowa and participating political subdivisions.

Q: What is an unforeseeable emergency?

A: An unforeseeable emergency refers to a serious financial hardship that an individual could not reasonably anticipate.

Q: When would you need to use the Unforeseeable Emergency Form?

A: You would need to use the Unforeseeable Emergency Form if you have experienced a financial hardship that qualifies as an unforeseeable emergency and you need to access funds from your RIC account.

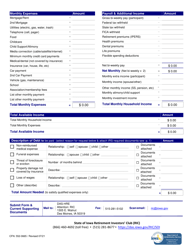

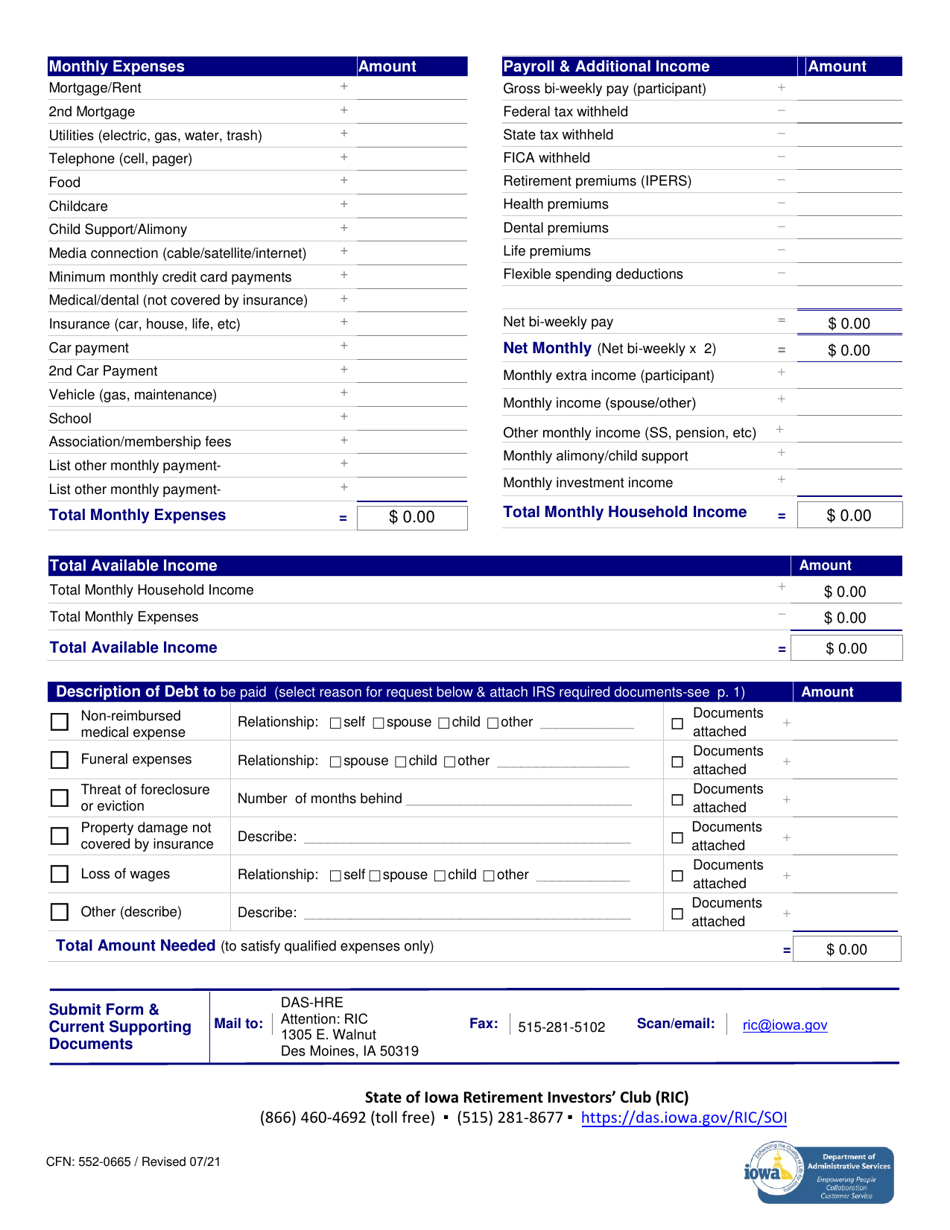

Q: What information is required in the Unforeseeable Emergency Form?

A: The Unforeseeable Emergency Form may require you to provide information about the nature of the emergency, the amount of funds needed, and any supporting documentation.

Q: Is there a limit to how much I can withdraw using the Unforeseeable Emergency Form?

A: Yes, there may be limits on the amount you can withdraw from your RIC account using the Unforeseeable Emergency Form. These limits are set by the RIC program and may vary depending on the circumstances.

Q: Do I need to pay taxes or penalties on the funds withdrawn using the Unforeseeable Emergency Form?

A: The withdrawn funds may be subject to taxes and penalties, depending on your individual circumstances and the rules of the RIC program. It is recommended to consult with a tax professional for specific advice.

Q: Can I repay the funds withdrawn through the Unforeseeable Emergency Form?

A: The ability to repay the withdrawn funds may depend on the rules and provisions of the RIC program. It is advisable to check with the administrators or custodians of your RIC account for detailed information.

Q: What happens if I don't repay the funds withdrawn through the Unforeseeable Emergency Form?

A: If you do not repay the funds withdrawn through the Unforeseeable Emergency Form as required, there may be consequences such as additional taxes or penalties, and it could impact your retirement savings.

Form Details:

- Released on July 1, 2021;

- The latest edition currently provided by the Iowa Department of Administrative Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Iowa Department of Administrative Services.