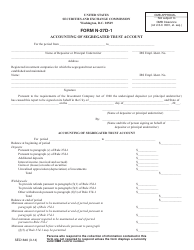

This version of the form is not currently in use and is provided for reference only. Download this version of

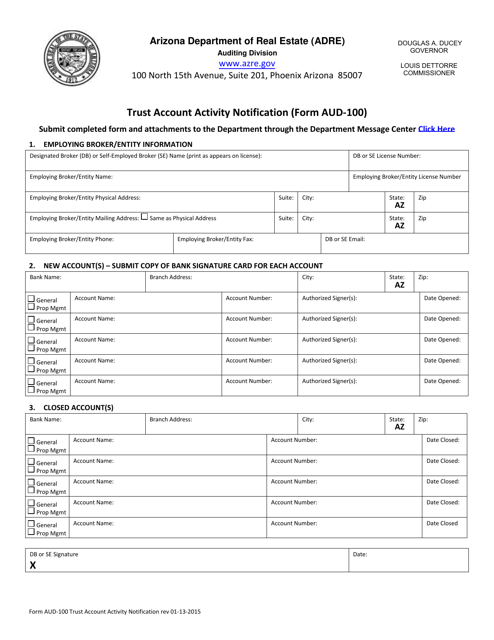

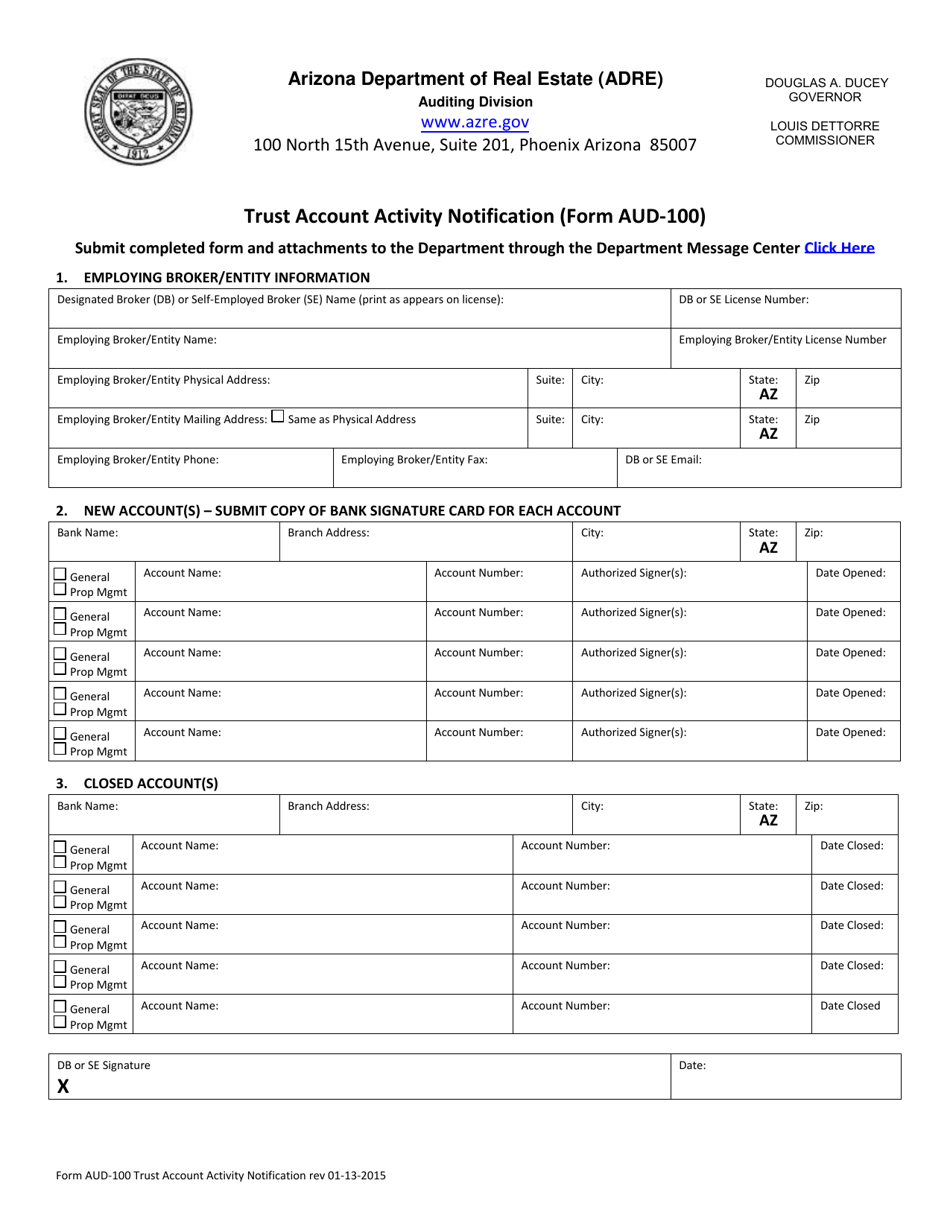

Form AUD-100

for the current year.

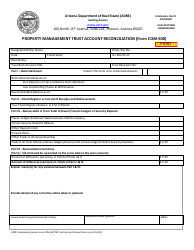

Form AUD-100 Trust Account Activity Notification - Arizona

What Is Form AUD-100?

This is a legal form that was released by the Arizona Department of Real Estate - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AUD-100?

A: Form AUD-100 is the Trust Account Activity Notification form in Arizona.

Q: Who needs to file Form AUD-100?

A: Any individual or entity that holds or controls escrow funds or trust funds in Arizona must file Form AUD-100.

Q: What is the purpose of Form AUD-100?

A: The purpose of Form AUD-100 is to report the activity of trust accounts and provide information about the balances held in those accounts.

Q: When is Form AUD-100 due?

A: Form AUD-100 must be filed on or before the 15th day of the month following the calendar quarter.

Q: What happens if I do not file Form AUD-100?

A: Failure to timely file Form AUD-100 may result in penalties and fines.

Q: Are there any exemptions to filing Form AUD-100?

A: Yes, certain individuals or entities may be exempt from filing Form AUD-100. It is recommended to review the instructions or consult with the Arizona Department of Real Estate for specific exemptions.

Form Details:

- Released on January 13, 2015;

- The latest edition provided by the Arizona Department of Real Estate;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AUD-100 by clicking the link below or browse more documents and templates provided by the Arizona Department of Real Estate.