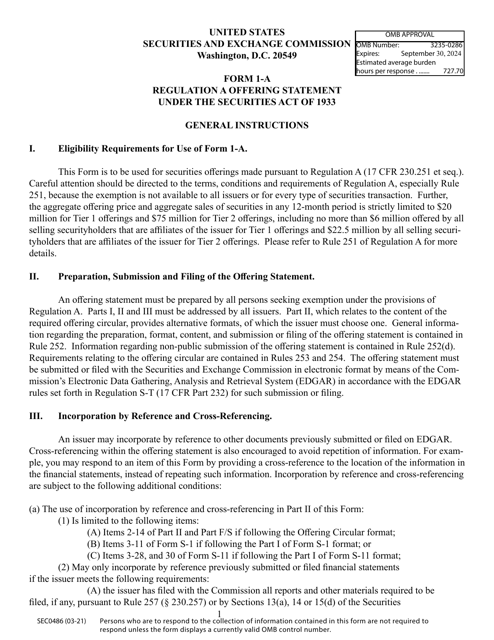

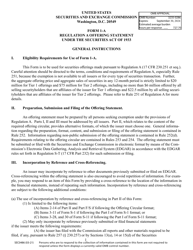

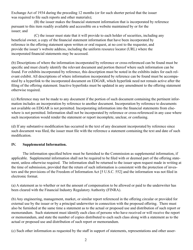

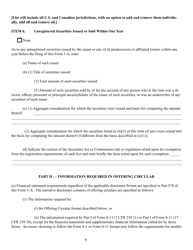

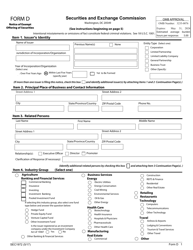

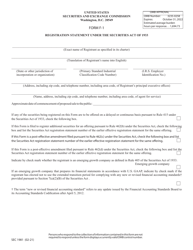

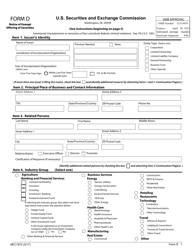

SEC Form 0486 (1-A) Regulation a Offering Statement Under the Securities Act of 1933

What Is SEC Form 0486 (1-A)?

This is a legal form that was released by the U.S. Securities and Exchange Commission on March 1, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SEC Form 0486 (1-A)?

A: SEC Form 0486 (1-A) is a form used for filing an offering statement under the Securities Act of 1933.

Q: What is the Securities Act of 1933?

A: The Securities Act of 1933 is a federal law that regulates the offer and sale of securities to protect investors.

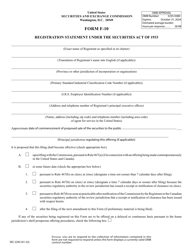

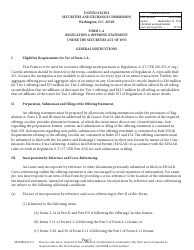

Q: Who needs to file SEC Form 0486 (1-A)?

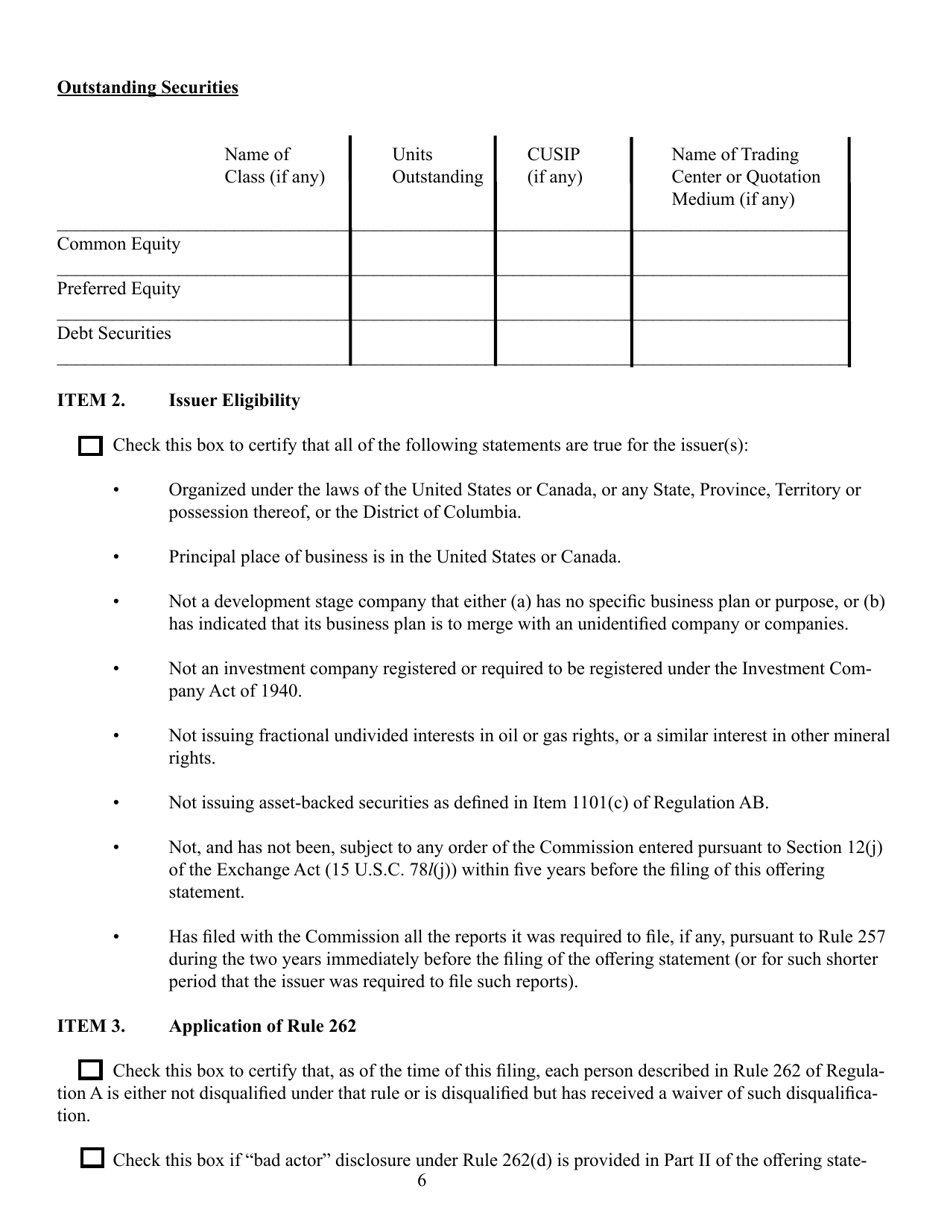

A: Companies that want to sell securities to the public in an exempt offering under Regulation A of the Securities Act of 1933 must file SEC Form 0486 (1-A).

Q: What is Regulation A?

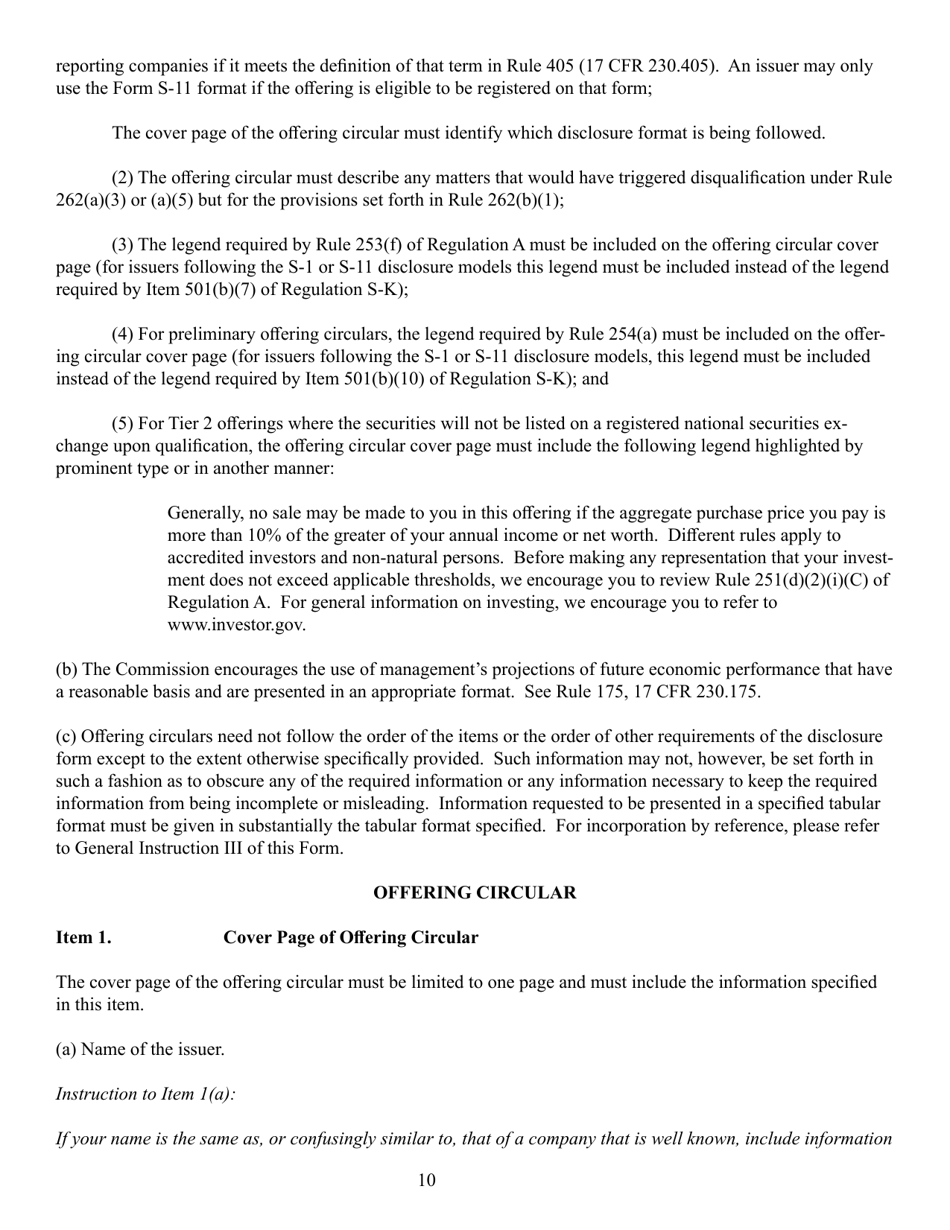

A: Regulation A is an exemption from registration requirements under the Securities Act of 1933 that allows companies to offer and sell securities to the public with lower regulatory requirements than a traditional initial public offering (IPO).

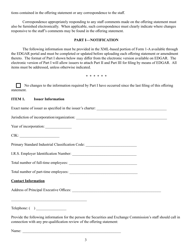

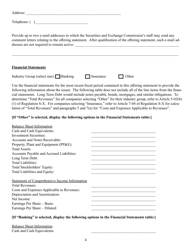

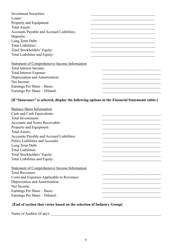

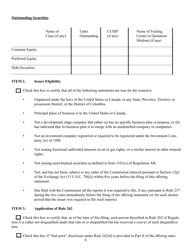

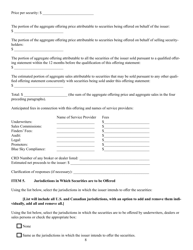

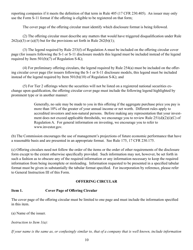

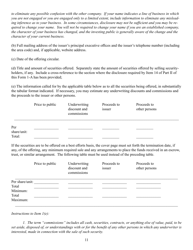

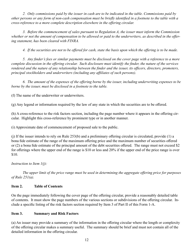

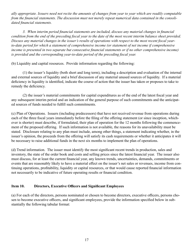

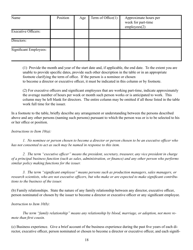

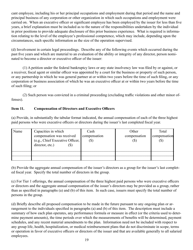

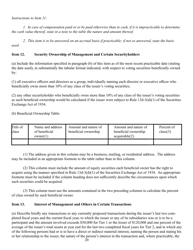

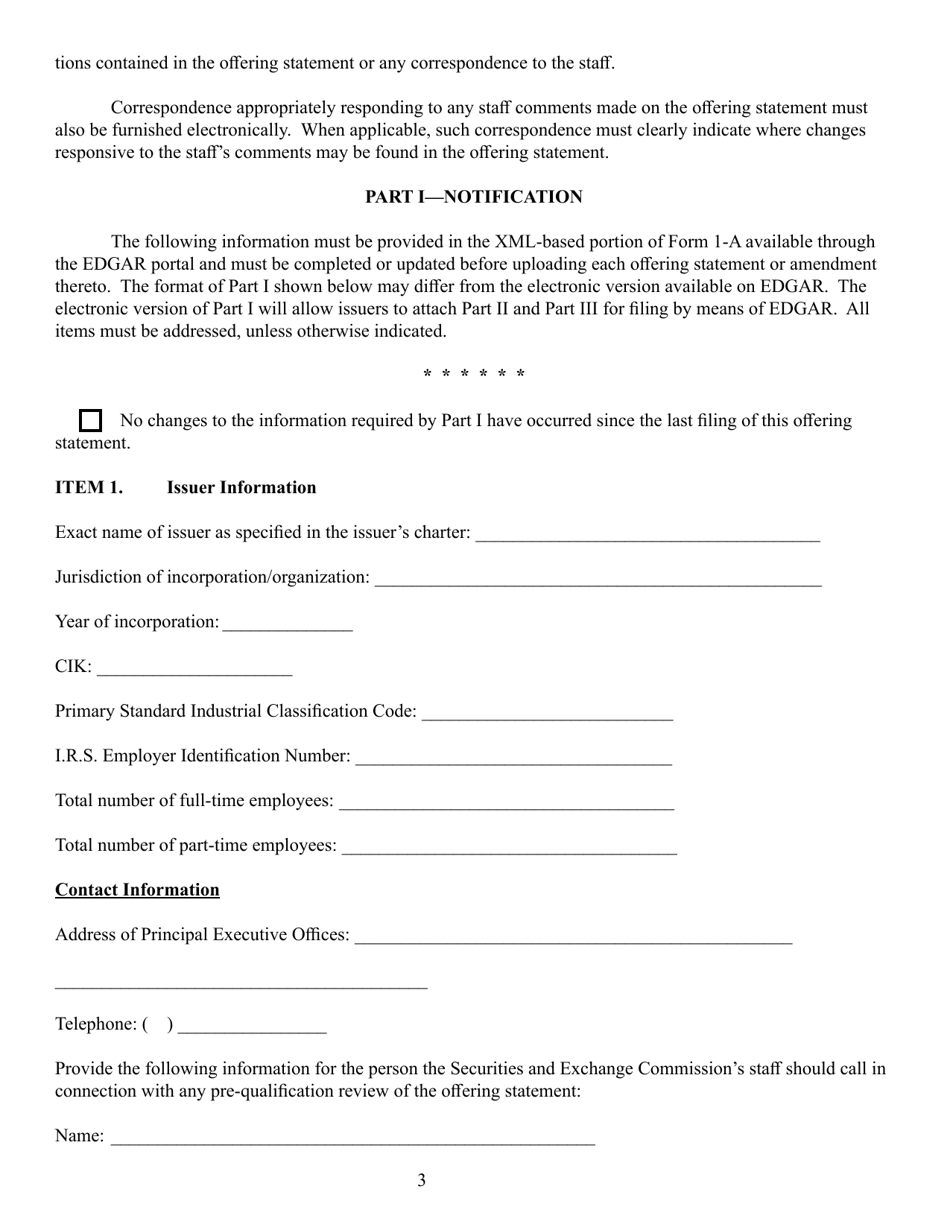

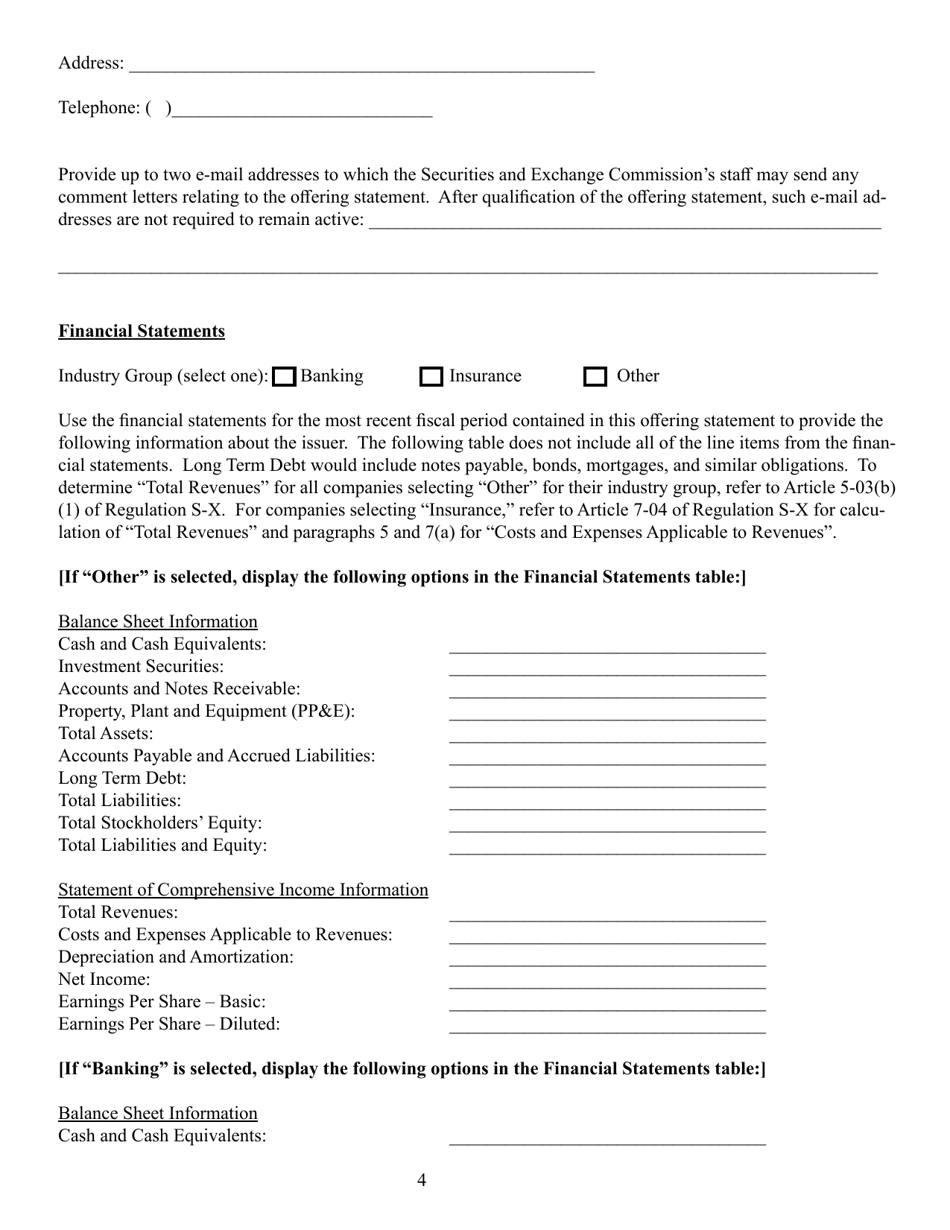

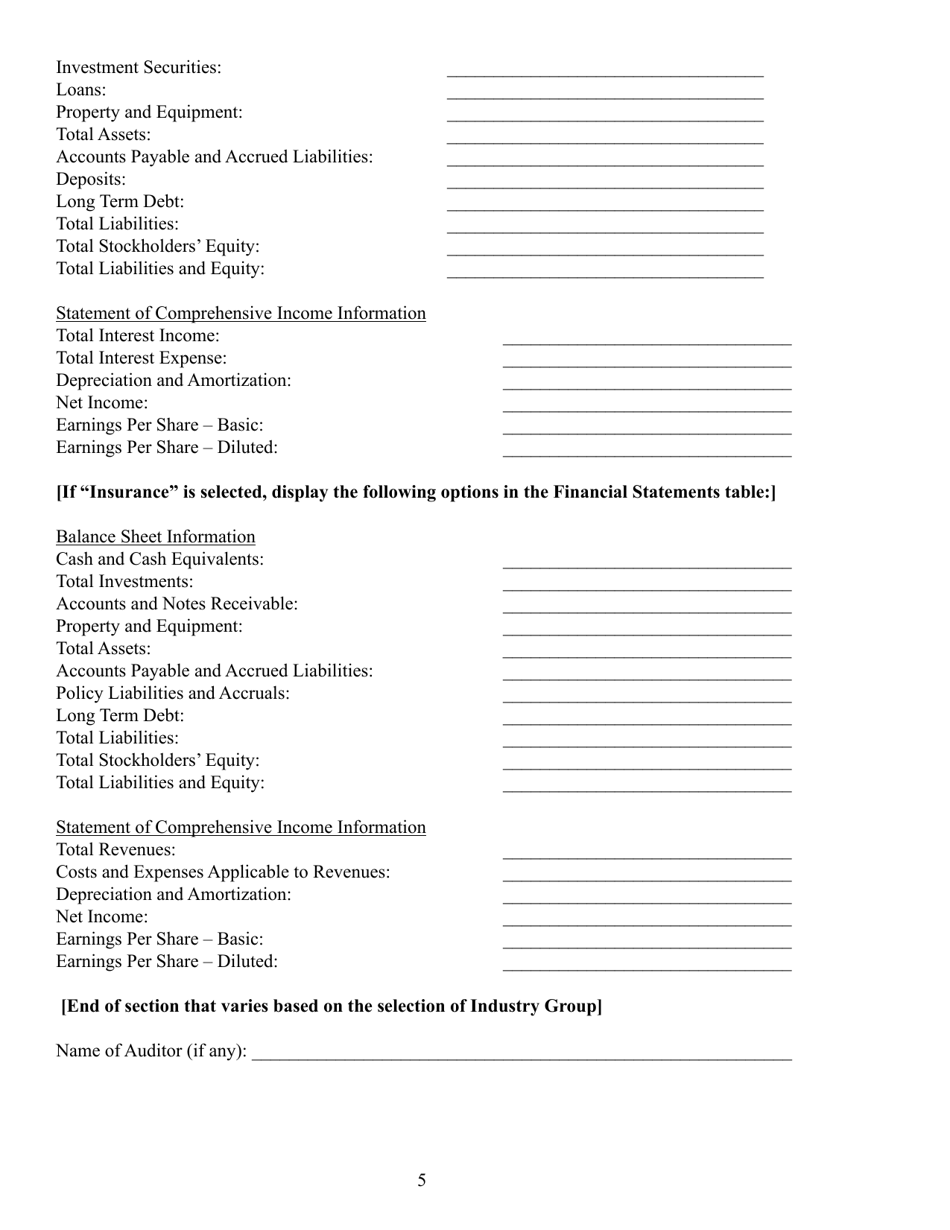

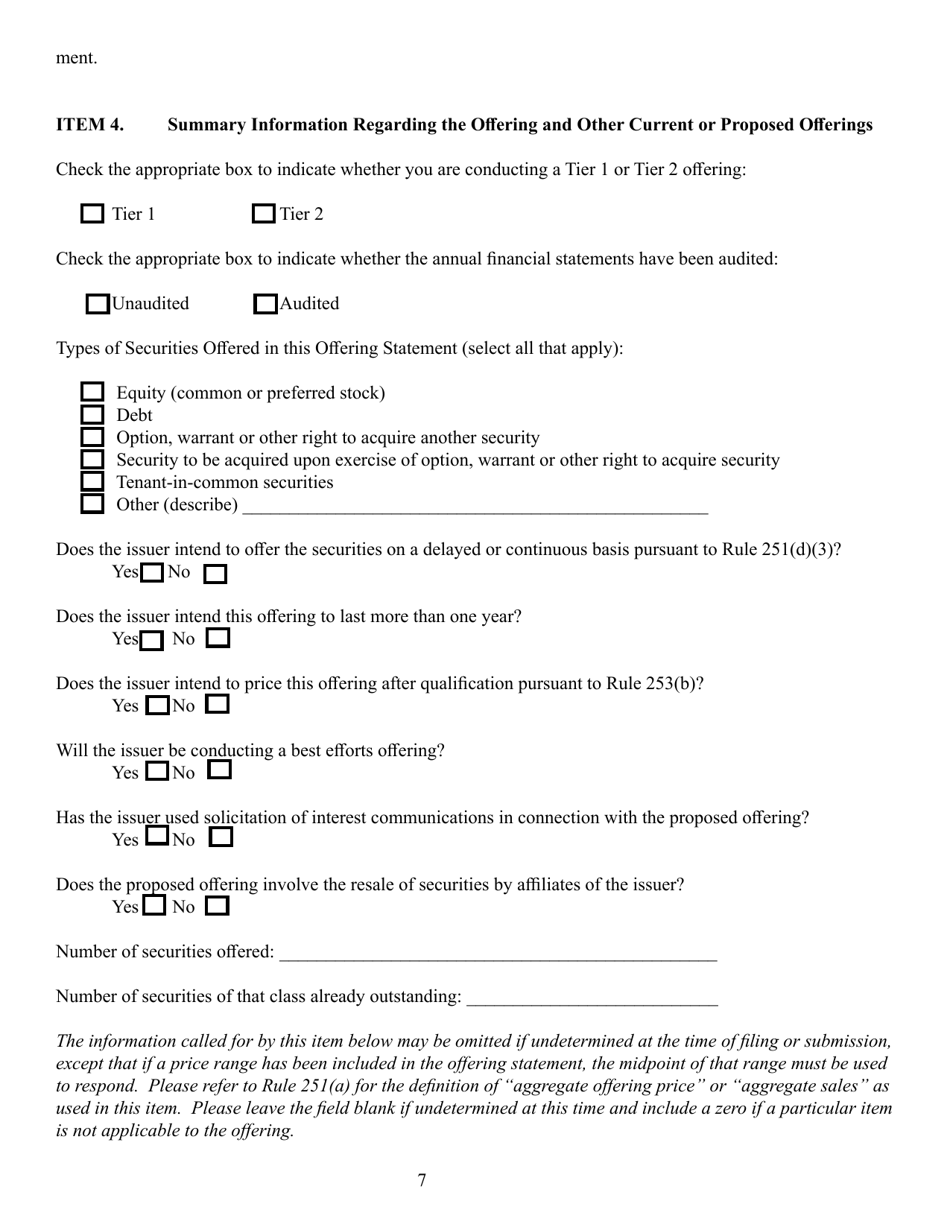

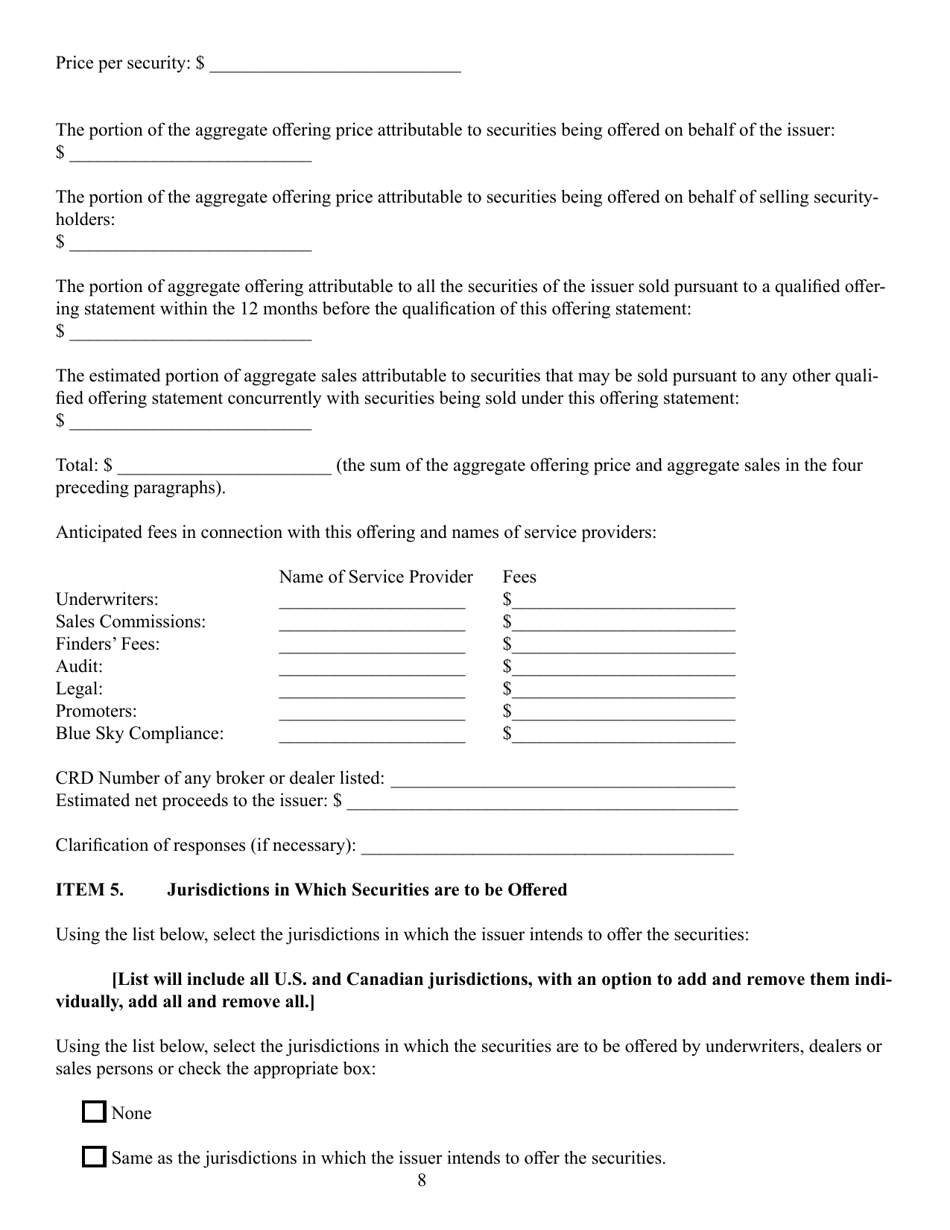

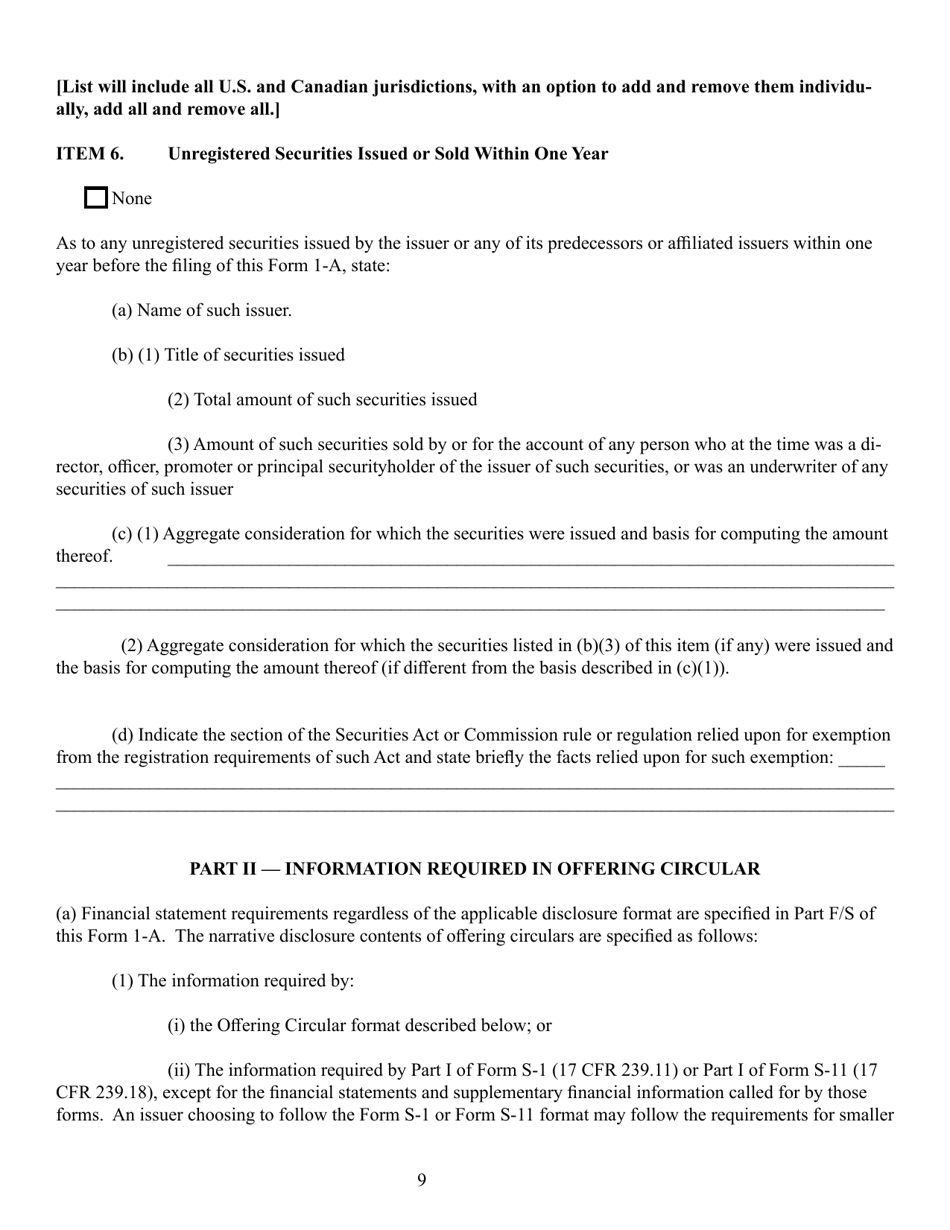

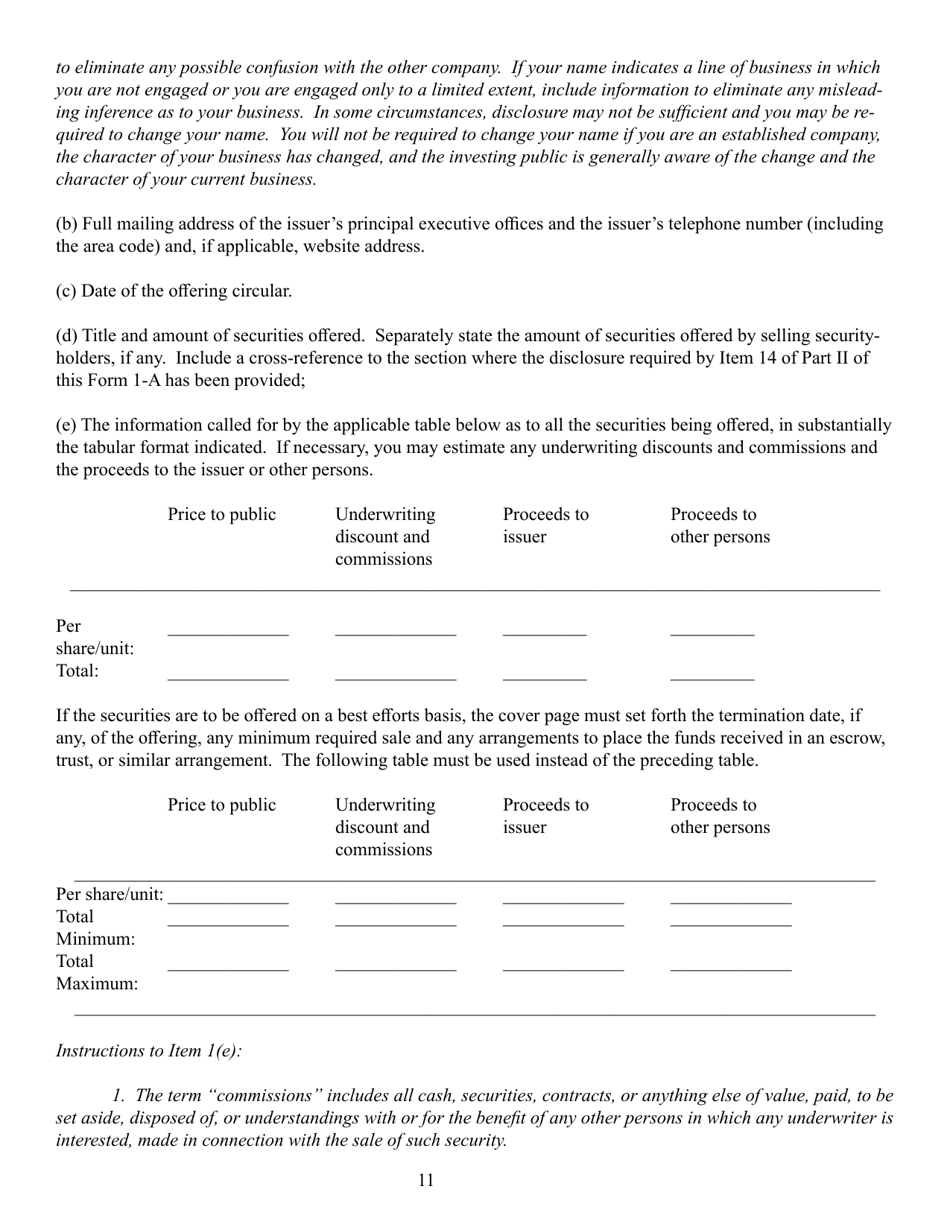

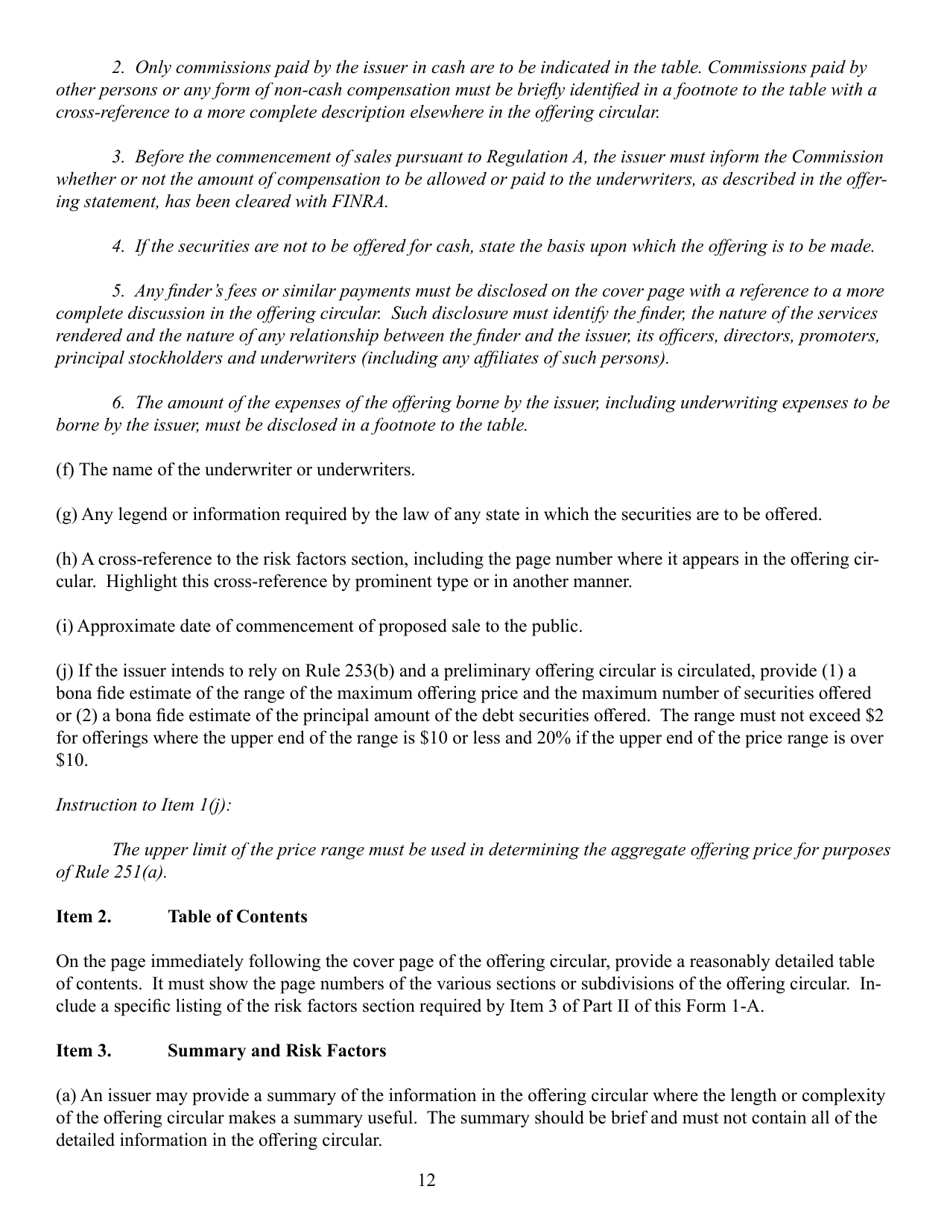

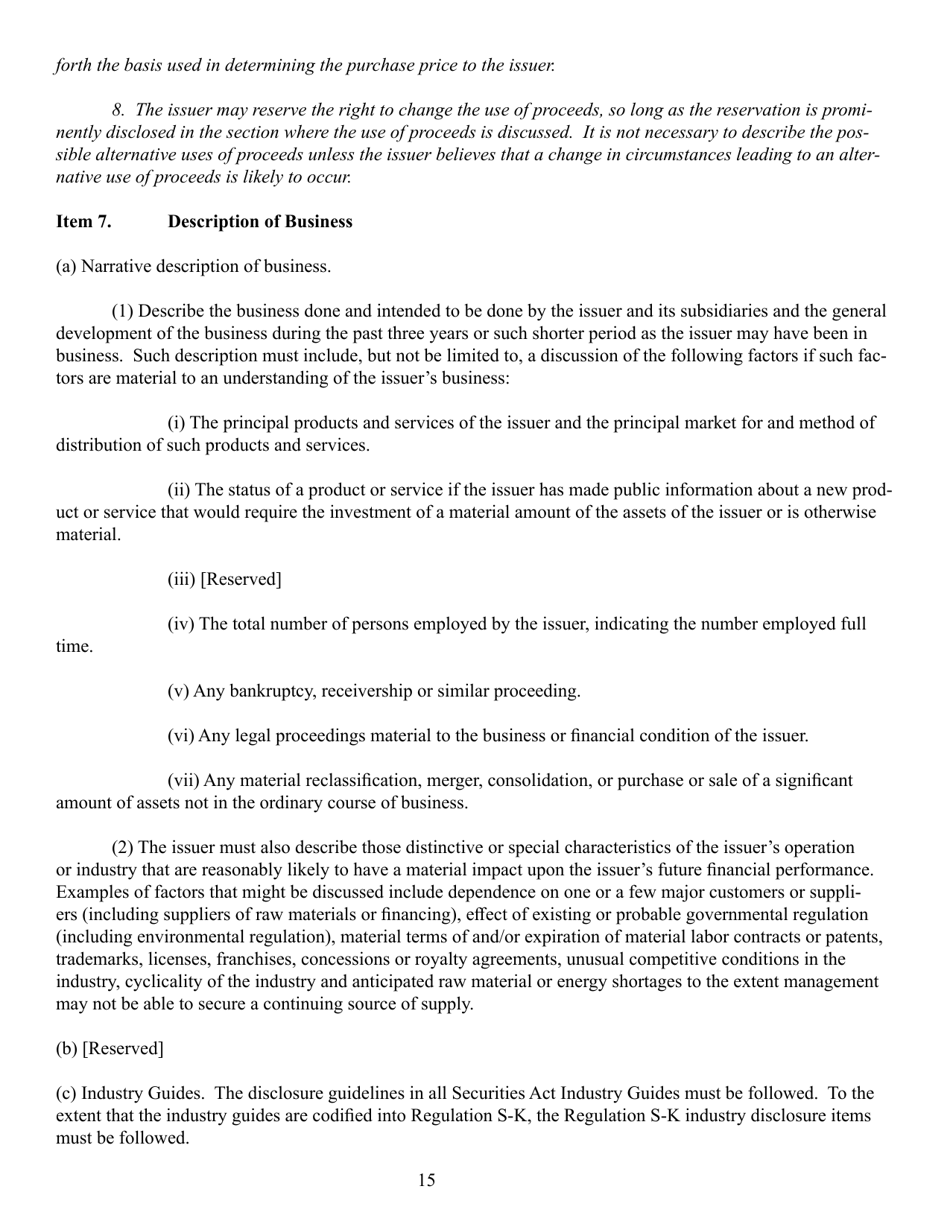

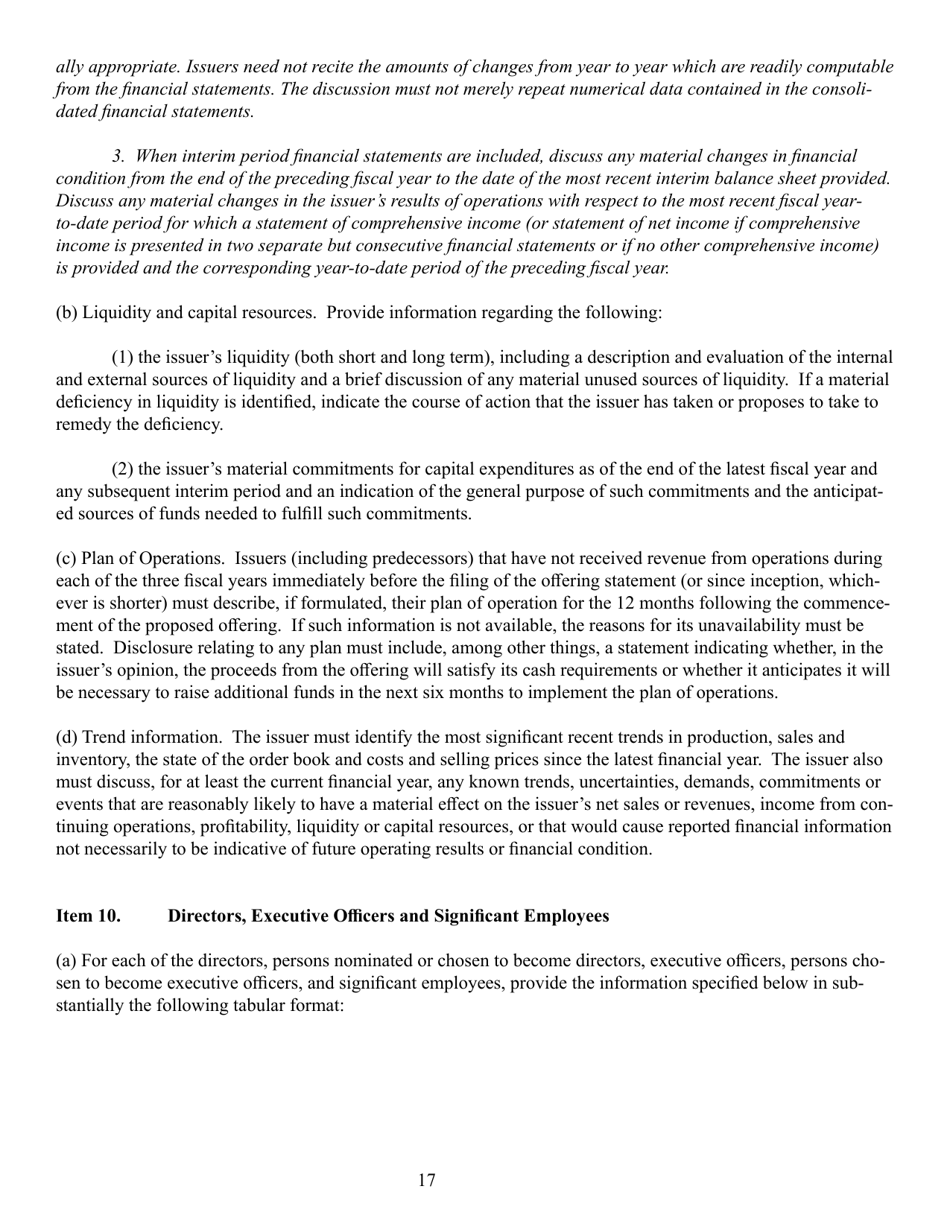

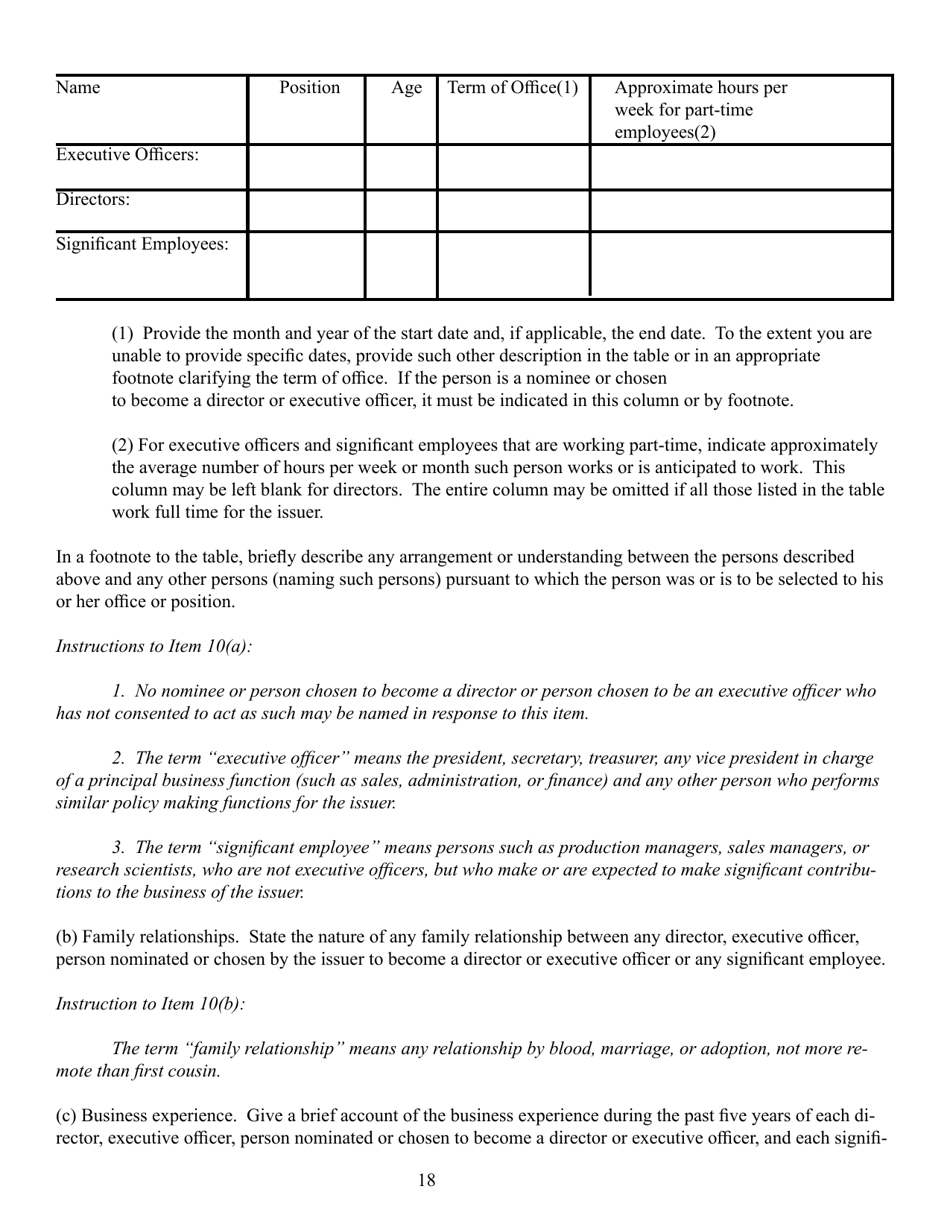

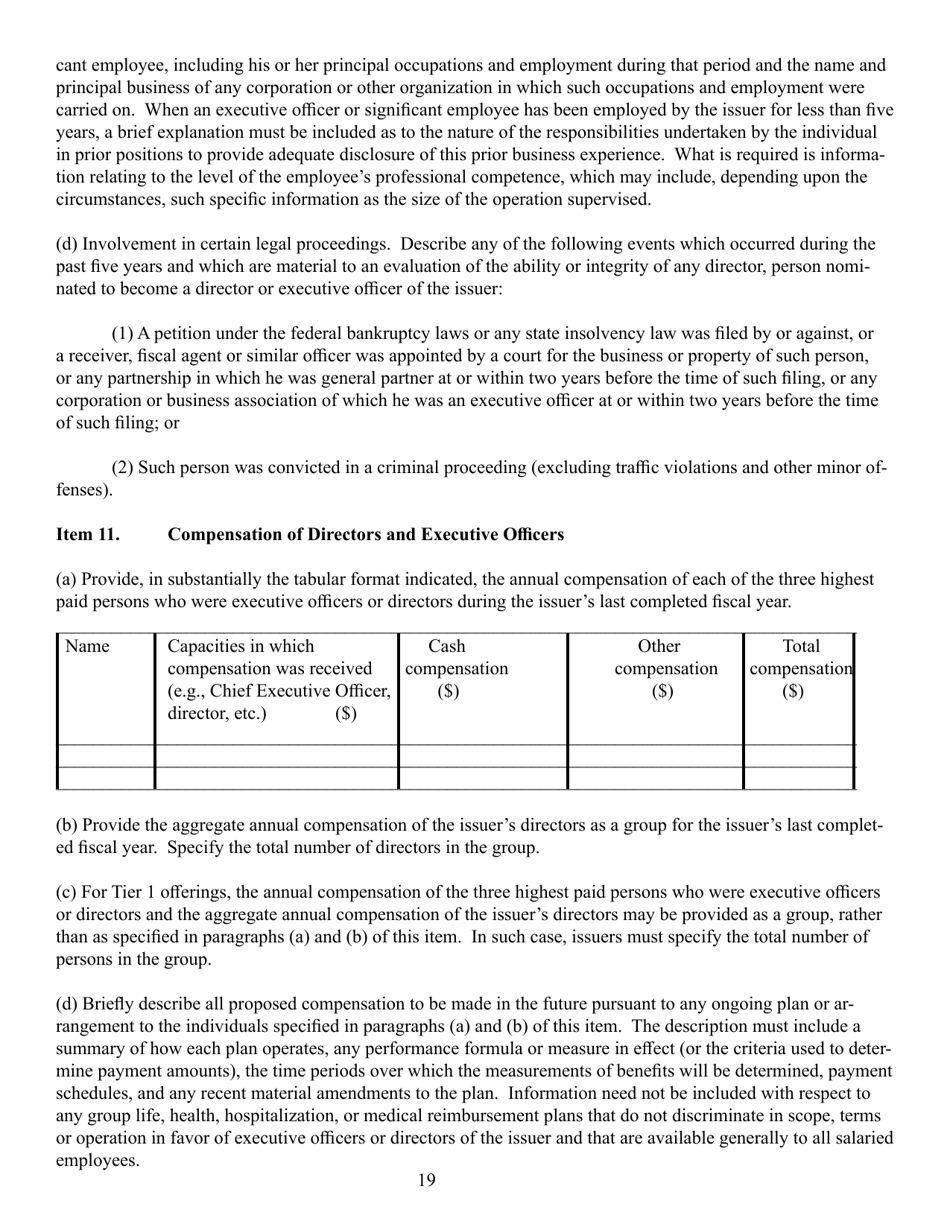

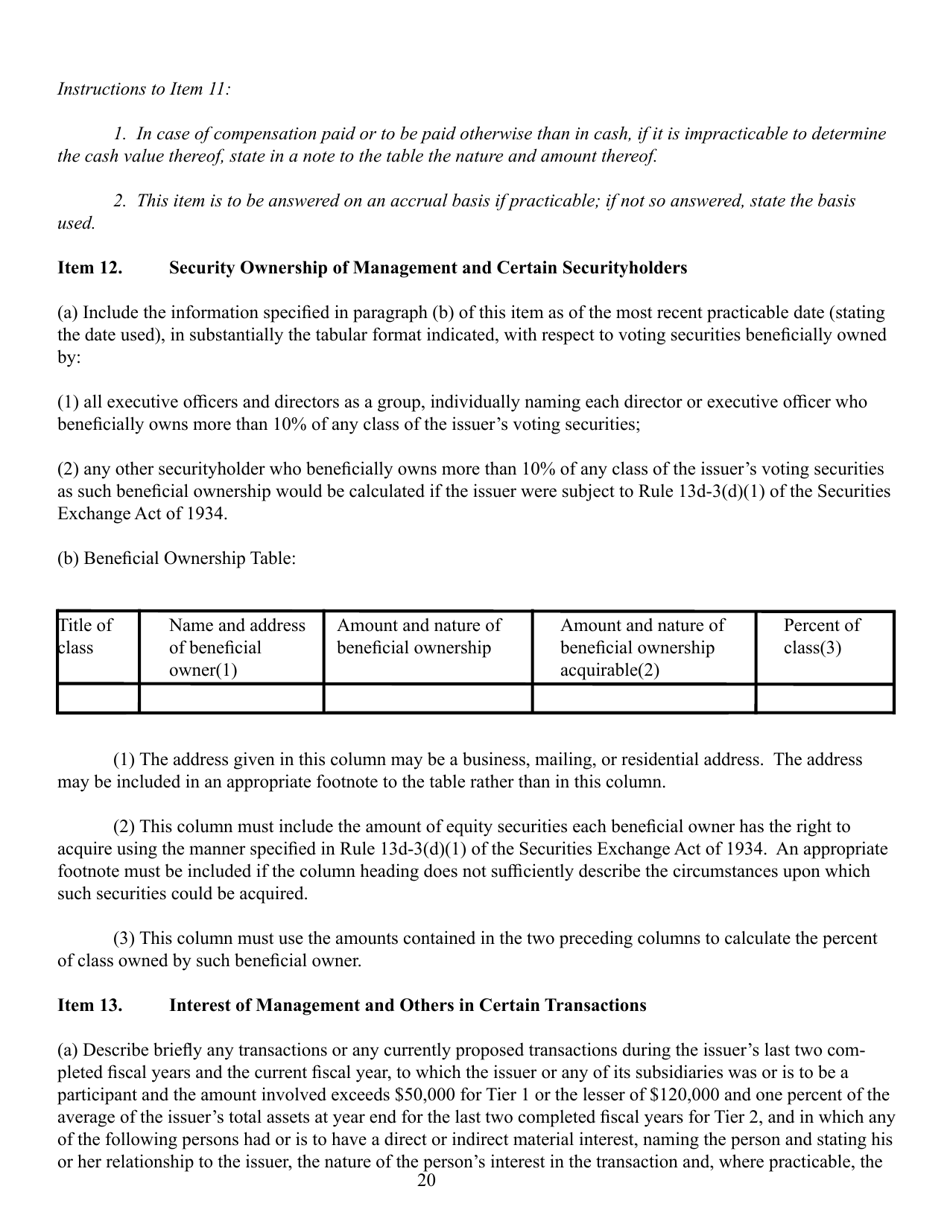

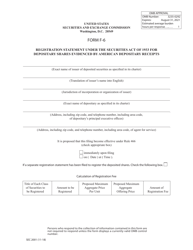

Q: What information is required in SEC Form 0486 (1-A)?

A: SEC Form 0486 (1-A) requires companies to provide information such as the purpose of the offering, risks associated with the investment, financial statements, and other relevant details.

Q: What happens after filing SEC Form 0486 (1-A)?

A: Once SEC Form 0486 (1-A) is filed, the company's offering statement will undergo a review process by the SEC. If approved, the company can proceed with the exempt offering.

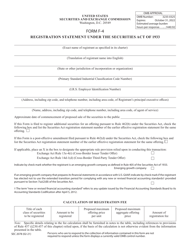

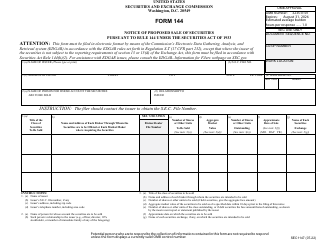

Q: Are there any filing fees for SEC Form 0486 (1-A)?

A: Yes, there are filing fees associated with SEC Form 0486 (1-A). The amount of the fees depends on the size of the offering.

Q: Is SEC Form 0486 (1-A) required for all securities offerings?

A: No, SEC Form 0486 (1-A) is specifically used for exempt offerings under Regulation A of the Securities Act of 1933. Other types of offerings may require different forms.

Form Details:

- Released on March 1, 2021;

- The latest available edition released by the U.S. Securities and Exchange Commission;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of SEC Form 0486 (1-A) by clicking the link below or browse more documents and templates provided by the U.S. Securities and Exchange Commission.