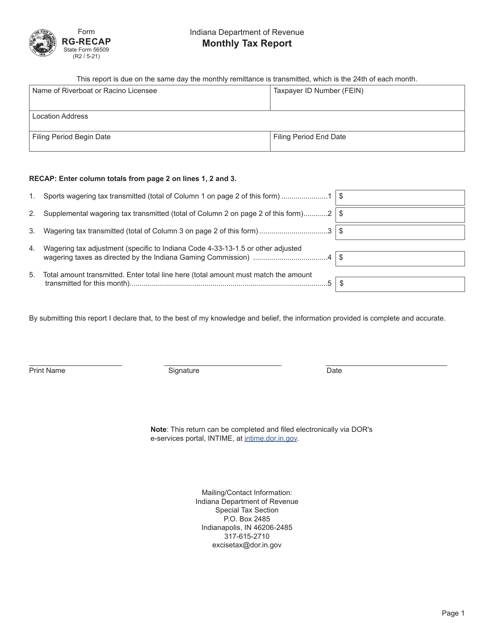

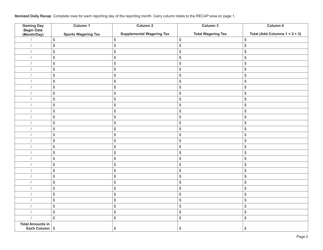

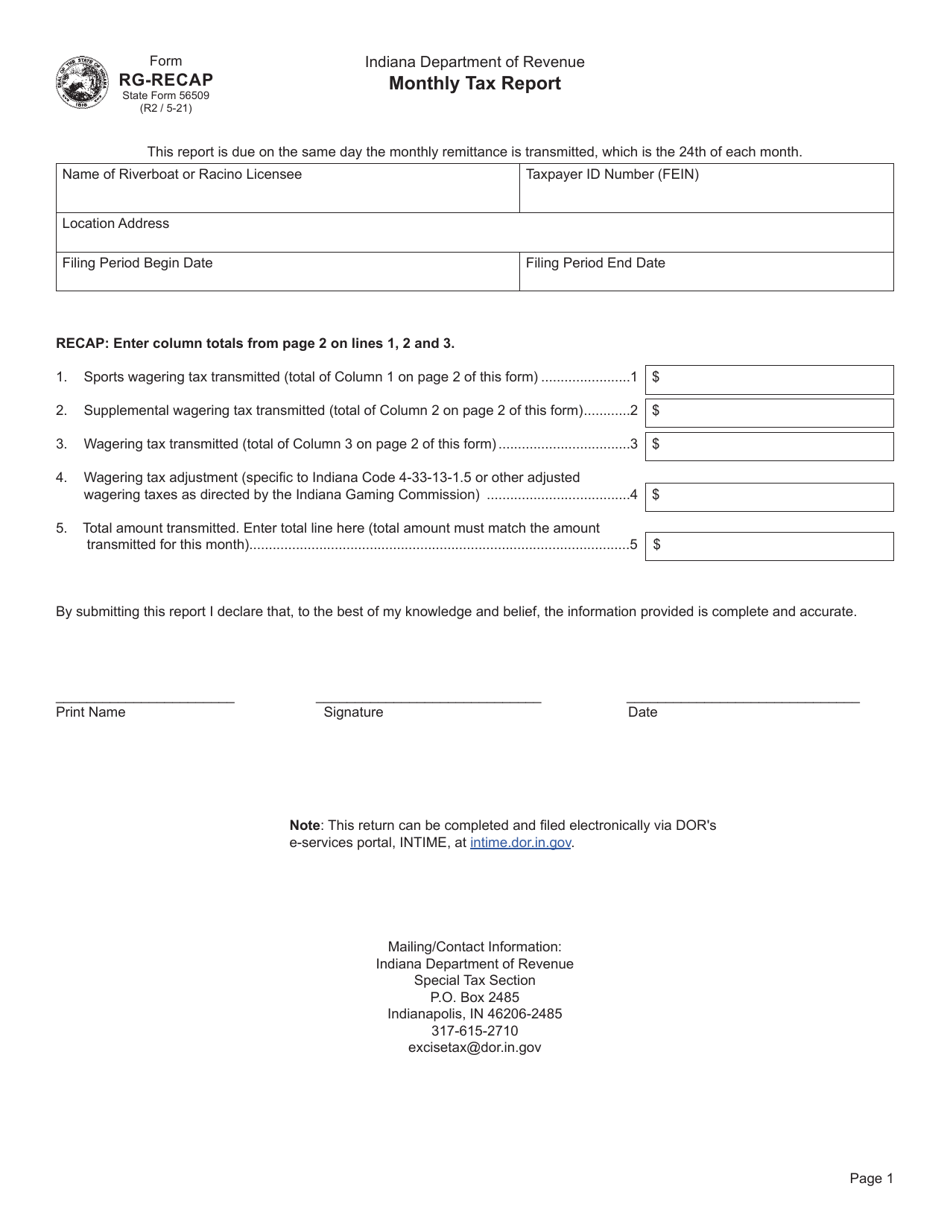

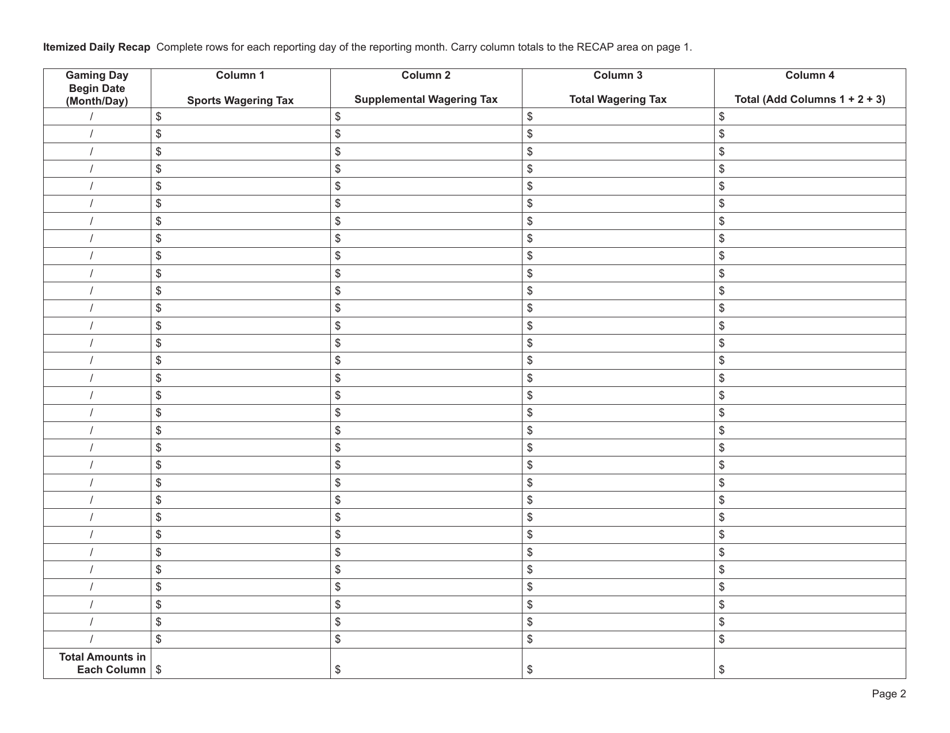

Form RG-RECAP (State Form 56509) Wagering Monthly Tax Report and Itemized Daily Recap - Indiana

What Is Form RG-RECAP (State Form 56509)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RG-RECAP?

A: Form RG-RECAP is the Wagering Monthly Tax Report and Itemized Daily Recap for the state of Indiana.

Q: What is the purpose of Form RG-RECAP?

A: The purpose of Form RG-RECAP is to report and summarize wagering tax information on a monthly basis in Indiana.

Q: Who needs to file Form RG-RECAP?

A: Businesses or individuals engaged in wagering activities in Indiana are required to file Form RG-RECAP.

Q: What information is required on Form RG-RECAP?

A: Form RG-RECAP requires information such as total wagers, gross receipts, prizes, and taxes withheld.

Q: When is Form RG-RECAP due?

A: Form RG-RECAP is due on or before the 20th day of the month following the reporting period.

Q: Are there any penalties for late or non-filing of Form RG-RECAP?

A: Yes, there are penalties for late or non-filing of Form RG-RECAP, including interest charges and potential enforcement actions.

Q: Is Form RG-RECAP only applicable to businesses?

A: No, Form RG-RECAP is applicable to both businesses and individuals engaged in wagering activities in Indiana.

Q: What should I do if I have questions or need assistance with Form RG-RECAP?

A: If you have questions or need assistance with Form RG-RECAP, you should contact the Indiana Department of Revenue or consult their resources for guidance.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RG-RECAP (State Form 56509) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.