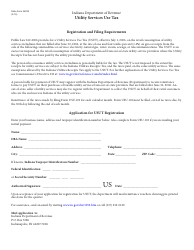

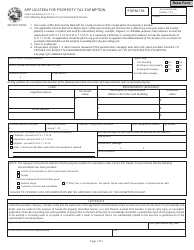

This version of the form is not currently in use and is provided for reference only. Download this version of

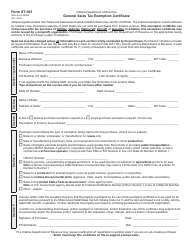

Form ST-200 (State Form 48843)

for the current year.

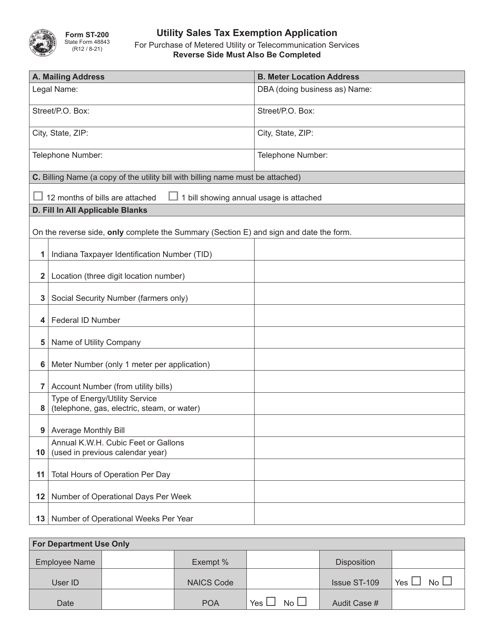

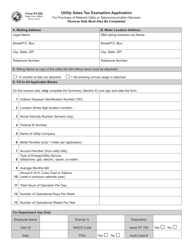

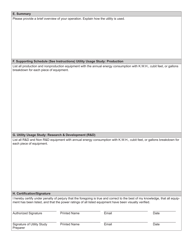

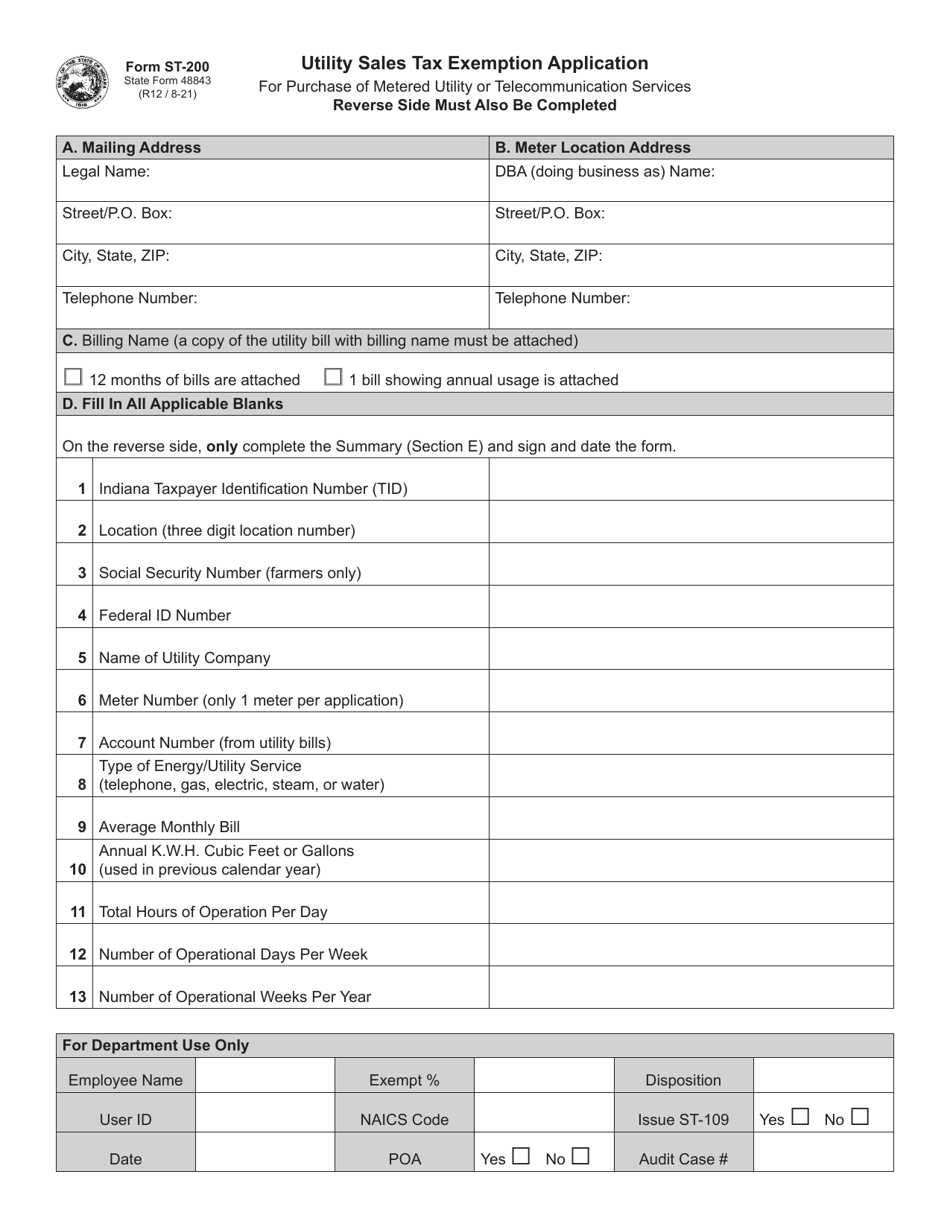

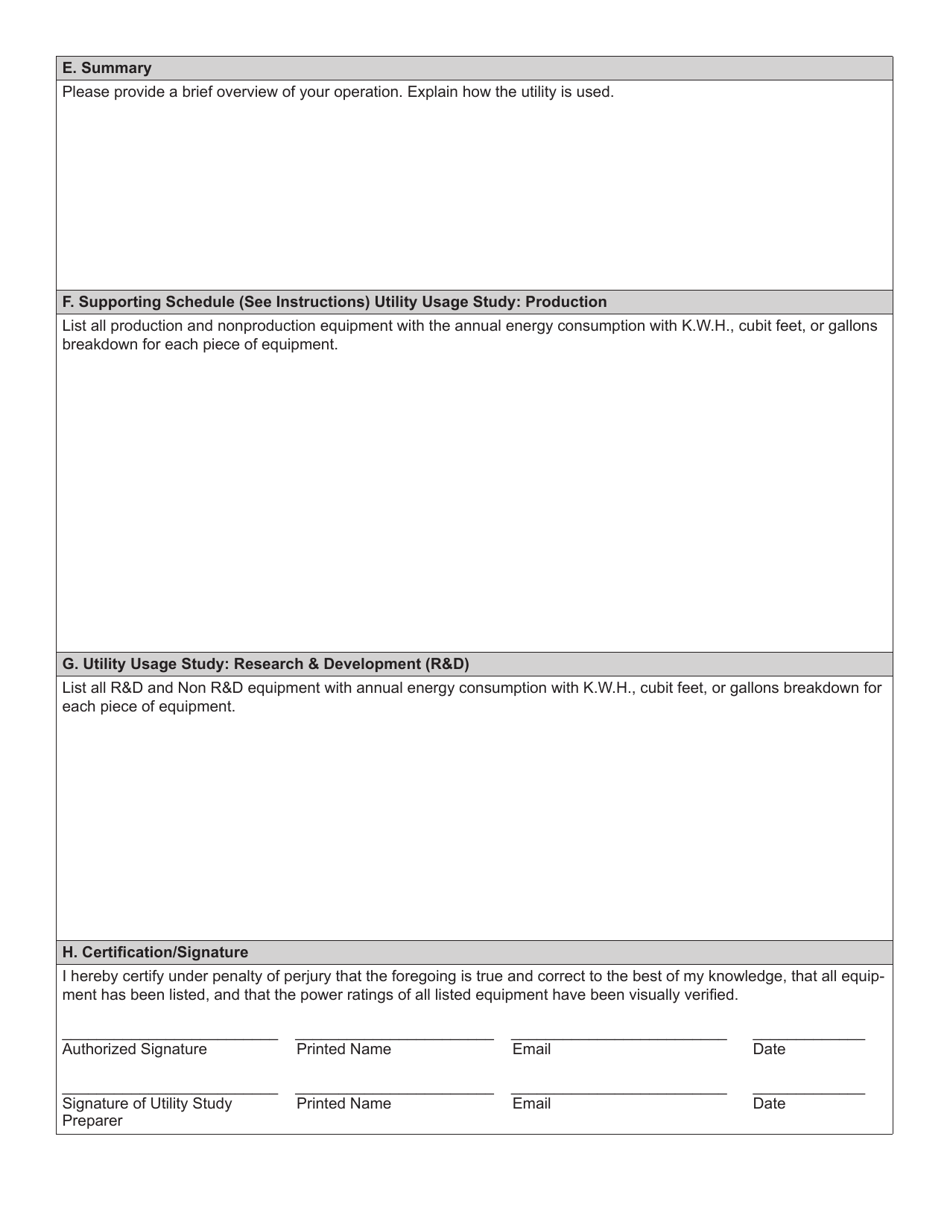

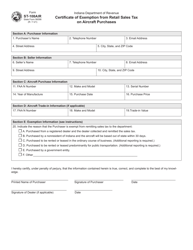

Form ST-200 (State Form 48843) Utility Sales Tax Exemption Application - Indiana

What Is Form ST-200 (State Form 48843)?

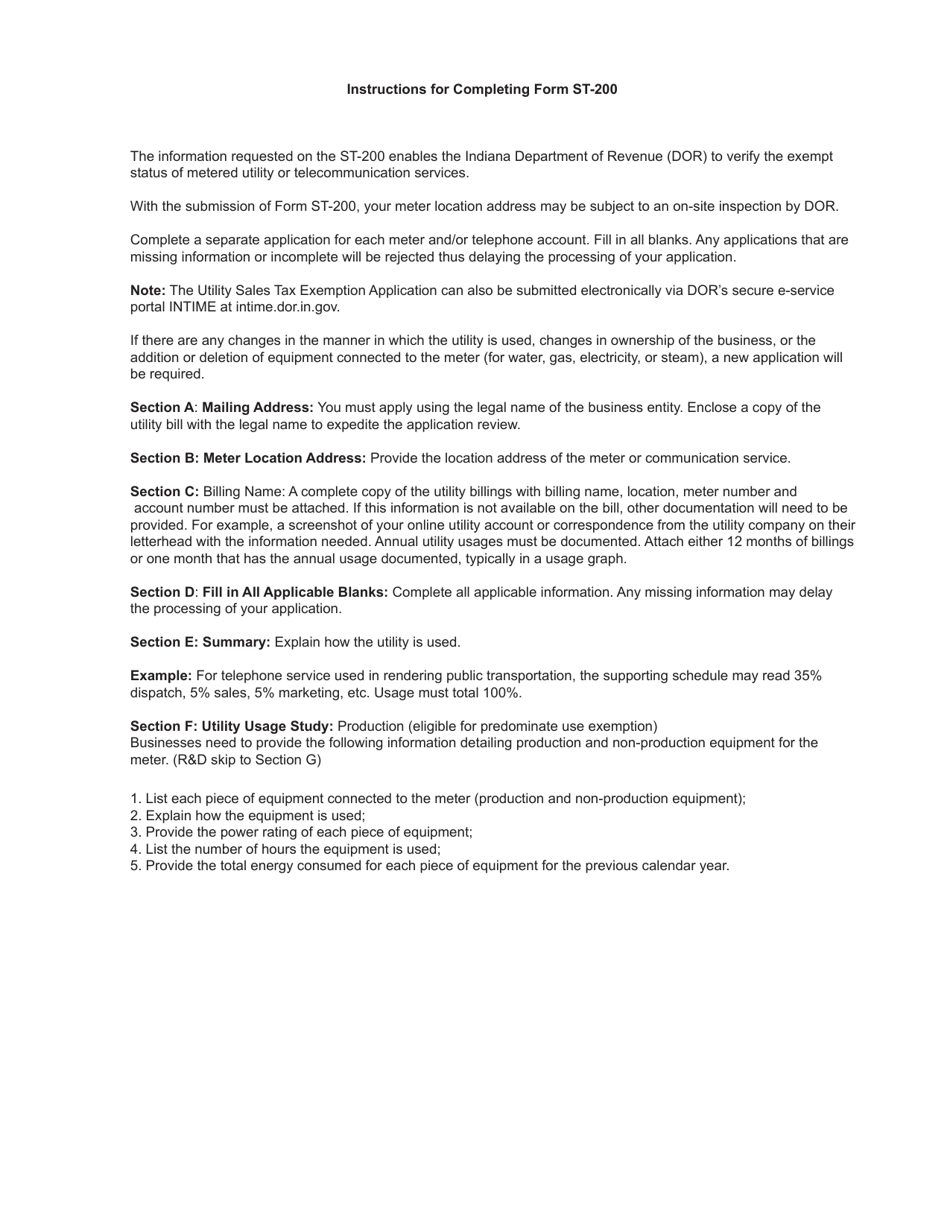

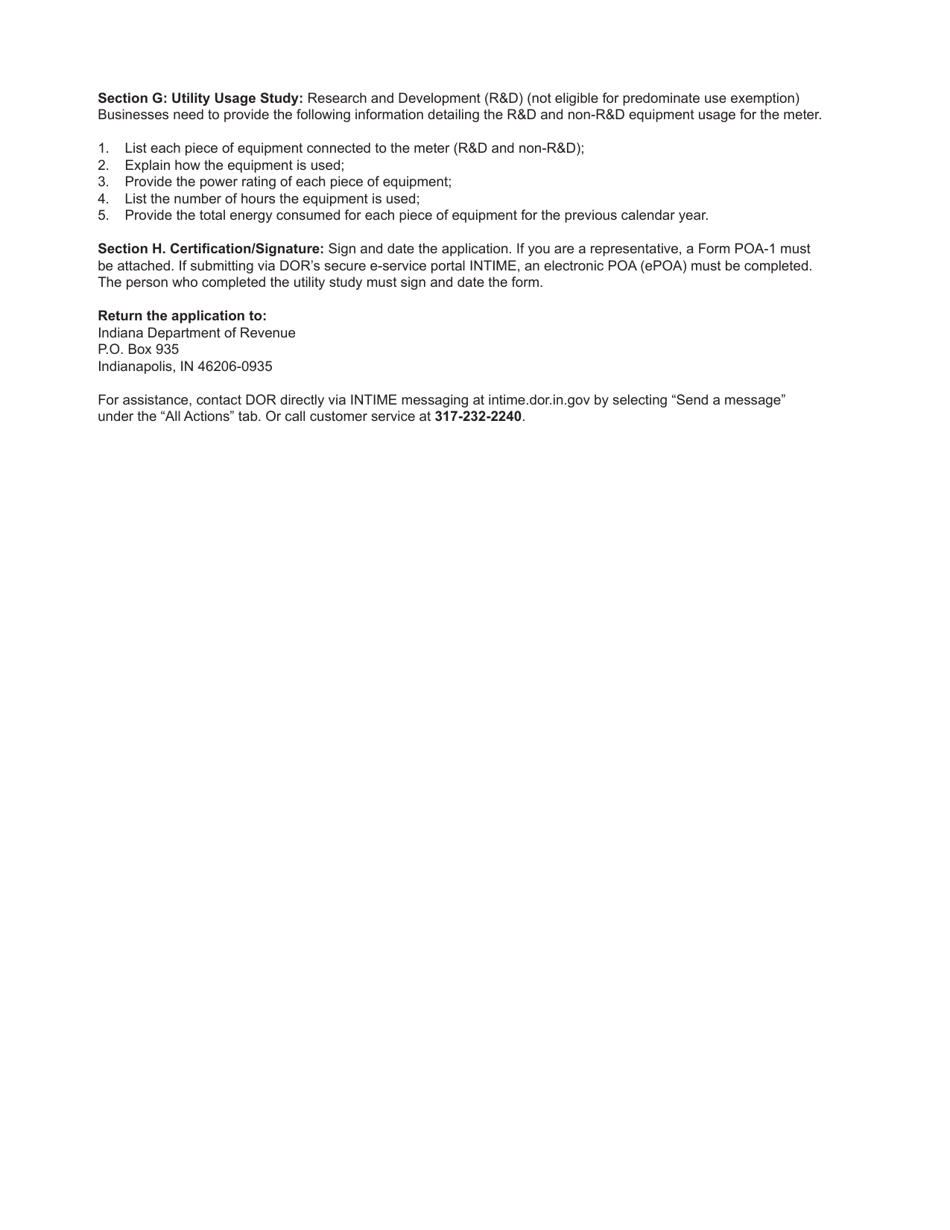

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

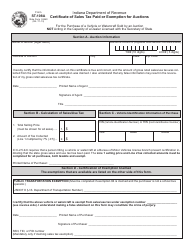

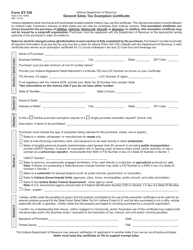

Q: What is Form ST-200?

A: Form ST-200 is the Utility Sales Tax Exemption Application.

Q: What is the purpose of Form ST-200?

A: The purpose of Form ST-200 is to claim exemption from sales tax on utilities in Indiana.

Q: What is the State Form number for Form ST-200?

A: The State Form number for Form ST-200 is 48843.

Q: Who should use Form ST-200?

A: Any entity or organization that is eligible for a sales tax exemption on utilities in Indiana should use Form ST-200.

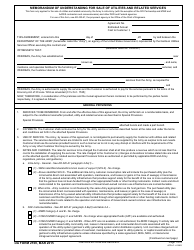

Q: Are there any fees associated with filing Form ST-200?

A: No, there are no fees associated with filing Form ST-200.

Q: Is it mandatory to file Form ST-200?

A: Yes, if you are eligible for a sales tax exemption on utilities in Indiana, it is mandatory to file Form ST-200.

Q: What documents do I need to attach with Form ST-200?

A: You need to attach the necessary supporting documents, such as invoices, contracts, or other records that prove your eligibility for the sales tax exemption.

Q: Is there a deadline for filing Form ST-200?

A: Yes, Form ST-200 must be filed on or before the 20th day of the month following the end of the billing period for which the exemption is claimed.

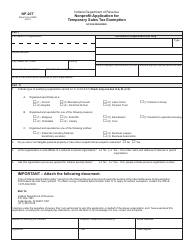

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-200 (State Form 48843) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.