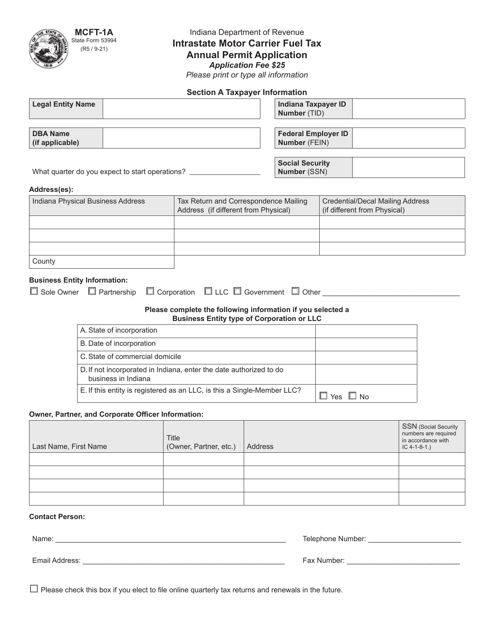

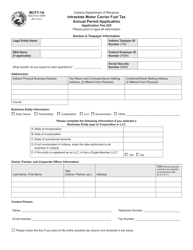

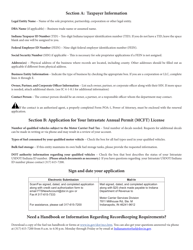

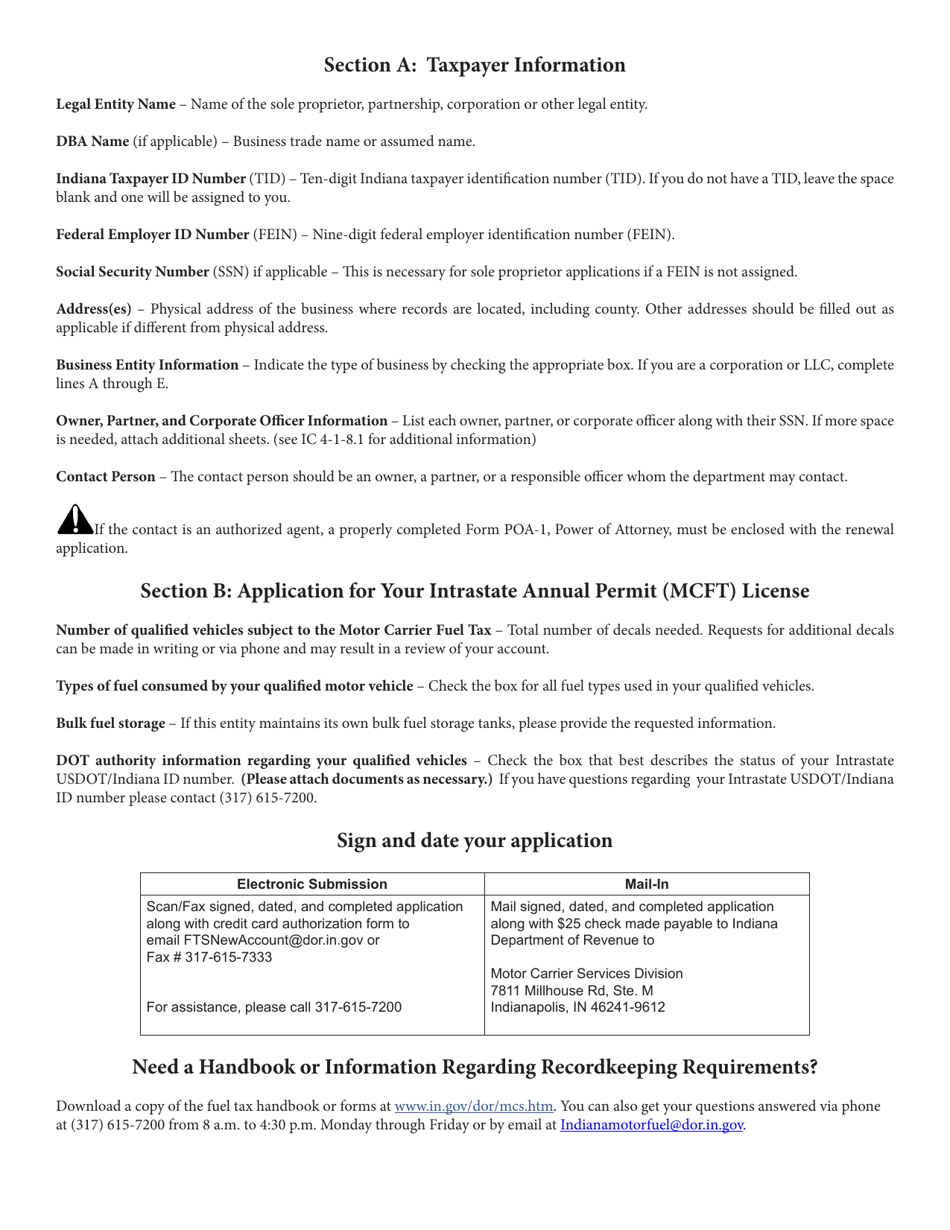

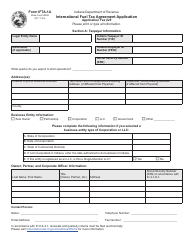

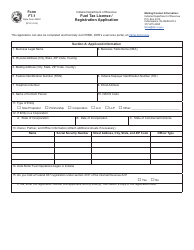

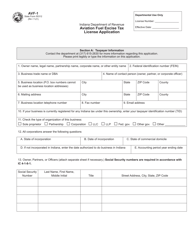

Form MCFT-1 (State Form 53994) Intrastate Motor Carrier Fuel Tax Annual Permit Application - Indiana

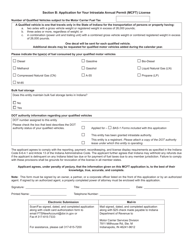

What Is Form MCFT-1 (State Form 53994)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

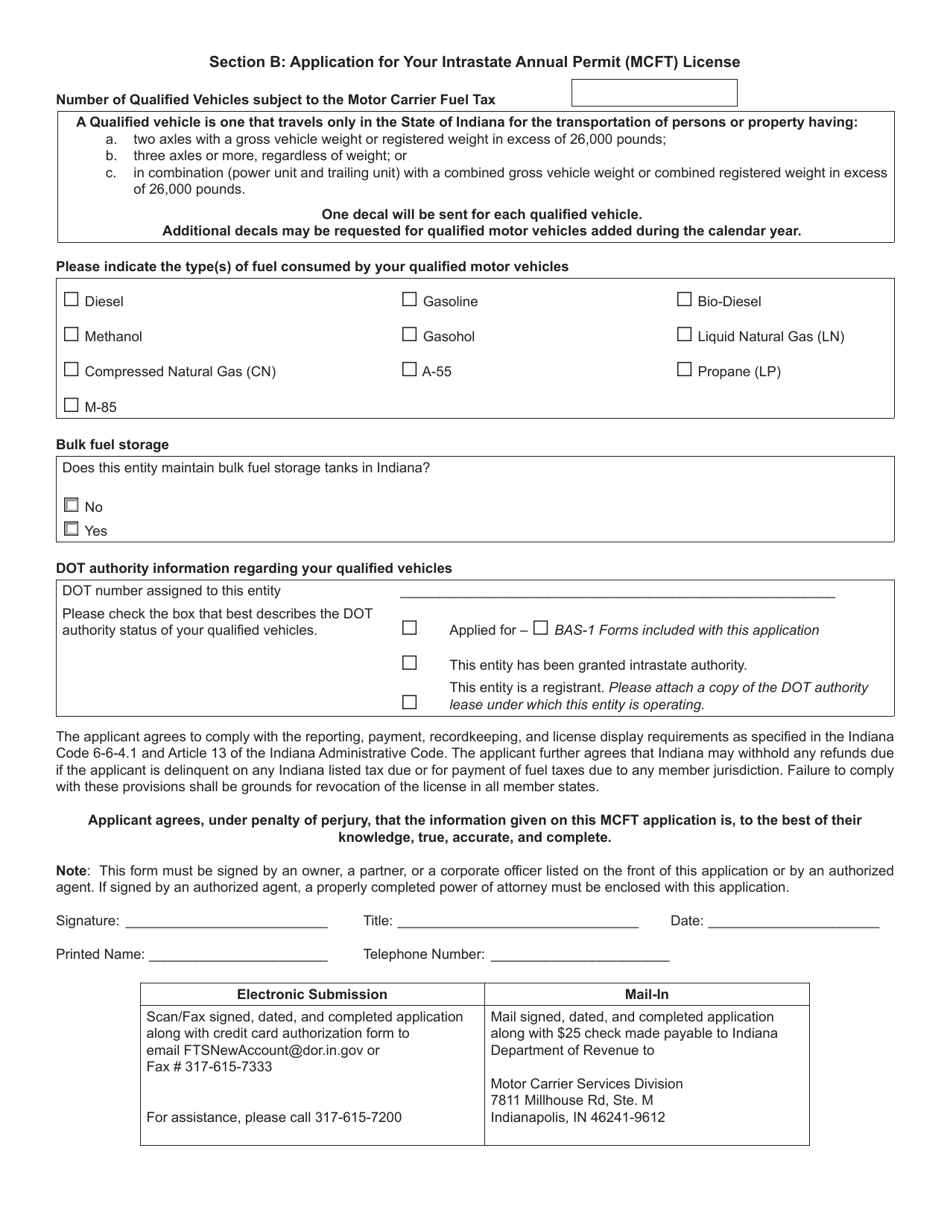

Q: What is Form MCFT-1?

A: Form MCFT-1 is the Intrastate Motor Carrier Fuel Tax Annual Permit Application.

Q: What is the purpose of Form MCFT-1?

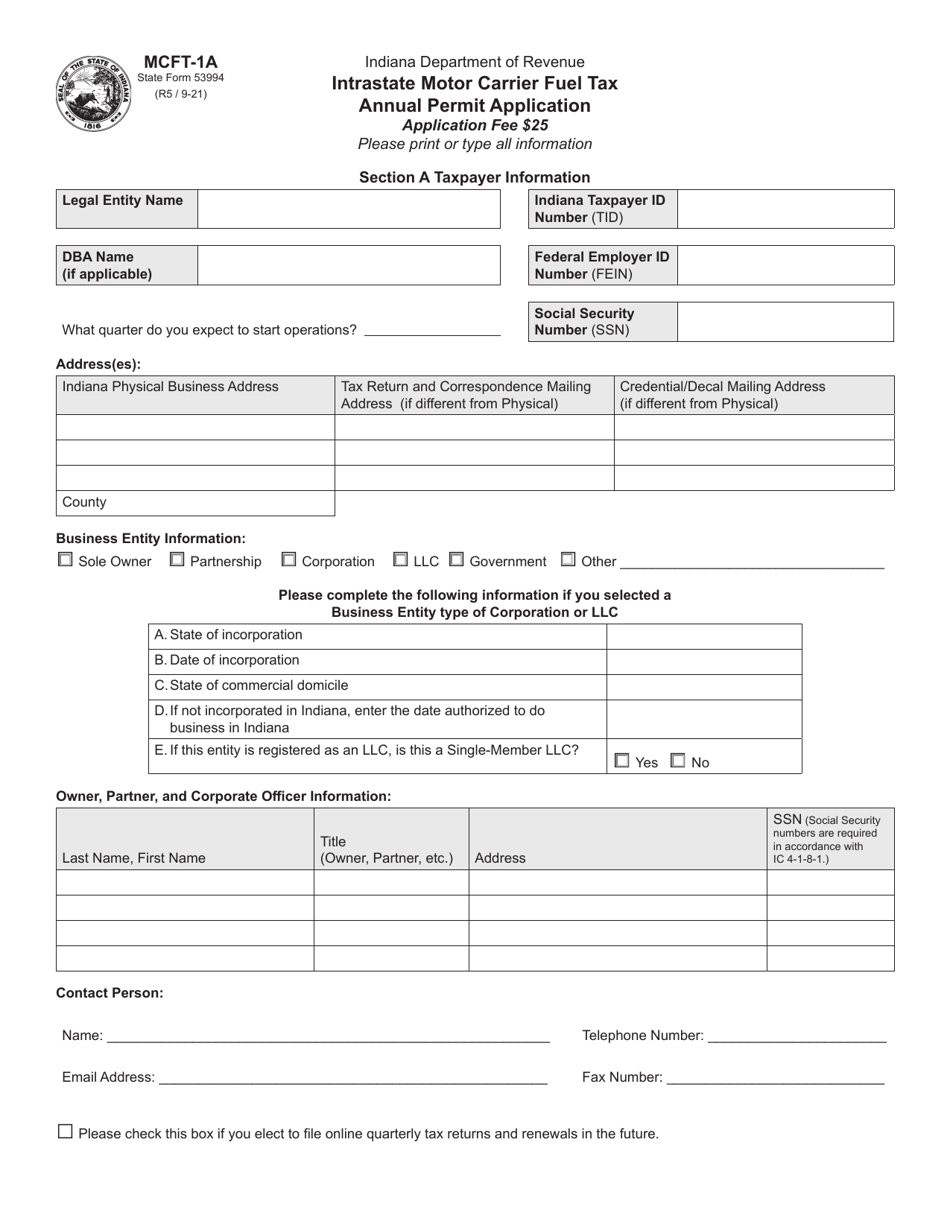

A: The purpose of Form MCFT-1 is to apply for an annual permit for intrastate motor carrier fuel tax in Indiana.

Q: Who needs to use Form MCFT-1?

A: Motor carriers operating intrastate in Indiana need to use Form MCFT-1.

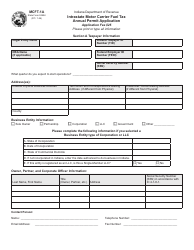

Q: What information is required on Form MCFT-1?

A: Form MCFT-1 requires information such as carrier details, fuel usage data, and vehicle information.

Q: Is there a fee for filing Form MCFT-1?

A: Yes, there is a fee associated with filing Form MCFT-1. The fee amount may vary.

Q: How often should Form MCFT-1 be filed?

A: Form MCFT-1 should be filed annually.

Q: Are there any penalties for not filing Form MCFT-1?

A: Yes, failure to file Form MCFT-1 or pay the required fuel tax may result in penalties and interest charges.

Q: Is Form MCFT-1 only applicable in Indiana?

A: Yes, Form MCFT-1 is specifically for motor carriers operating intrastate in Indiana.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MCFT-1 (State Form 53994) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.