This version of the form is not currently in use and is provided for reference only. Download this version of

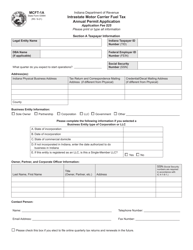

Form IFTA-1A (State Form 54049)

for the current year.

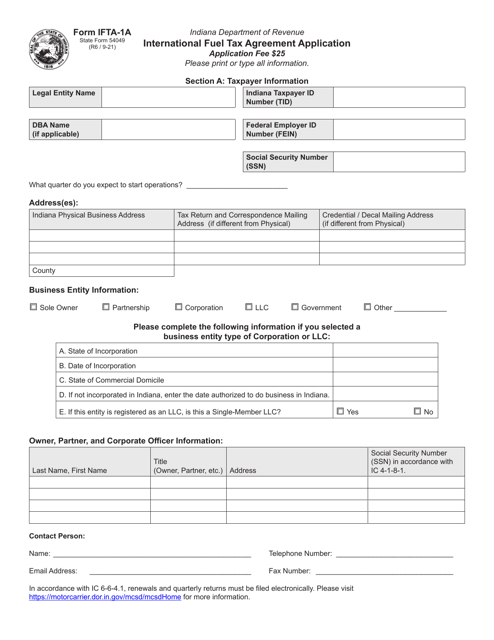

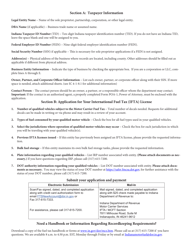

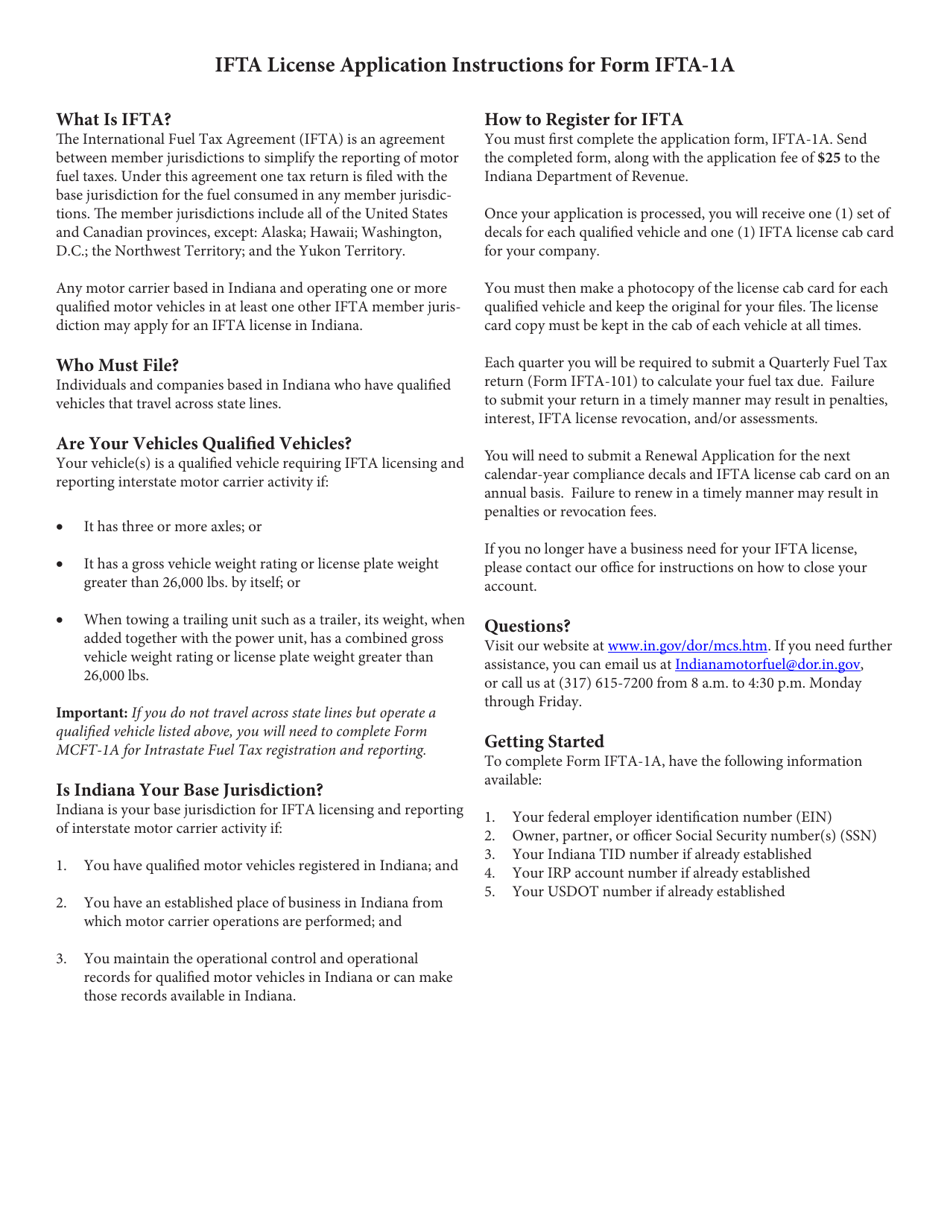

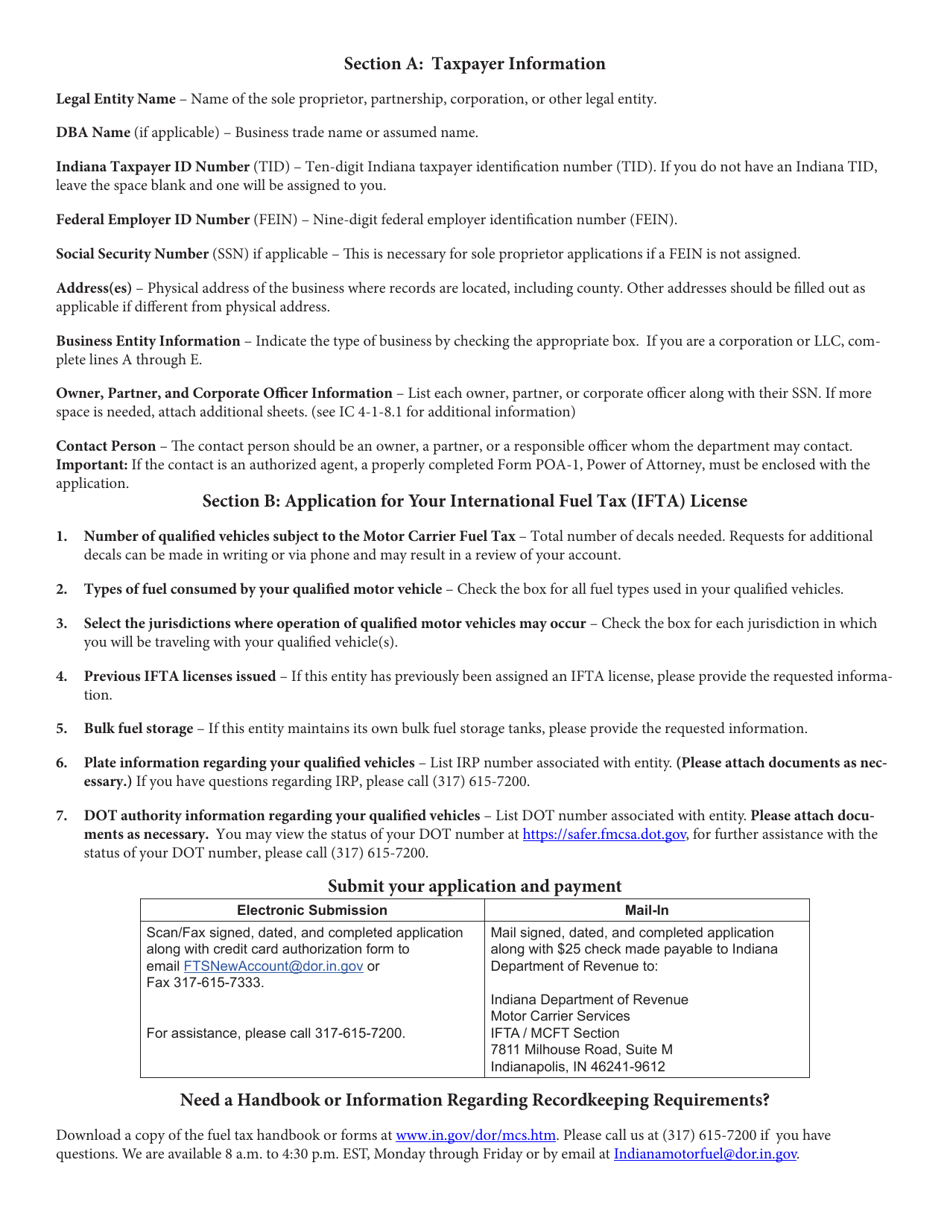

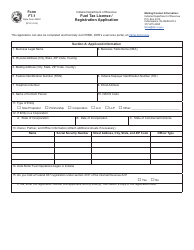

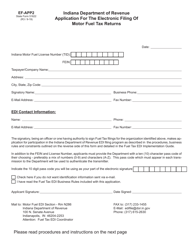

Form IFTA-1A (State Form 54049) International Fuel Tax Agreement Application - Indiana

What Is Form IFTA-1A (State Form 54049)?

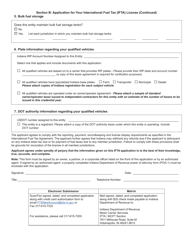

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IFTA-1A?

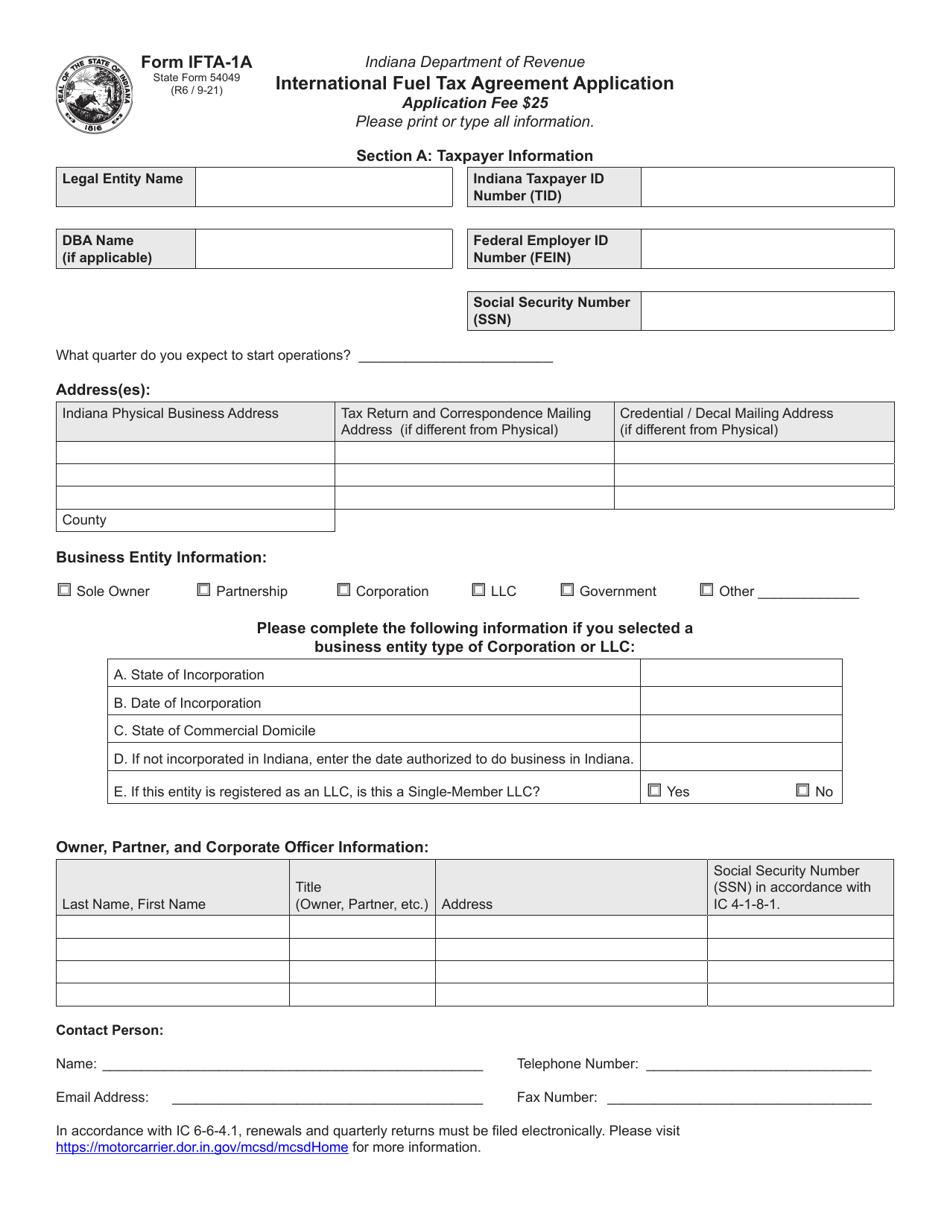

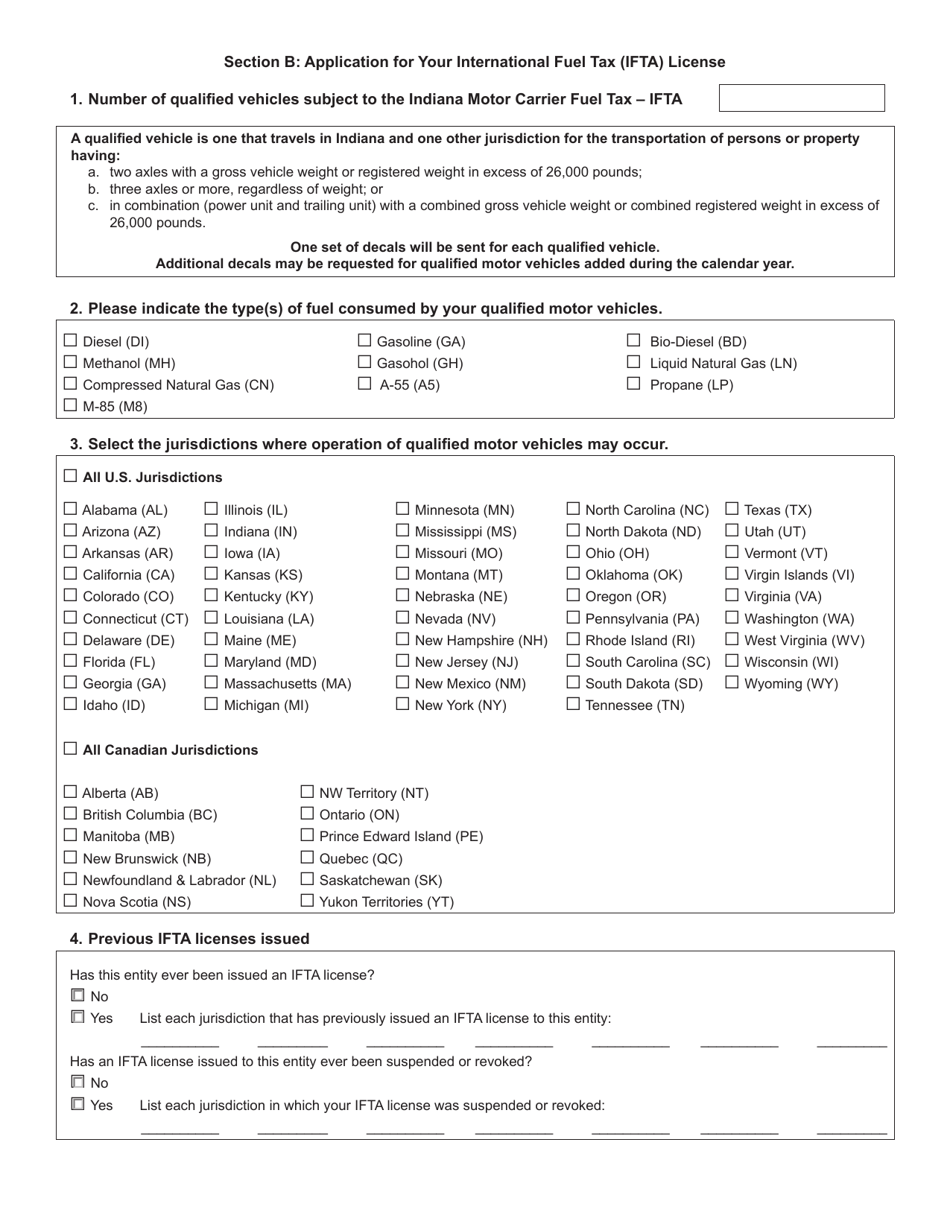

A: Form IFTA-1A is the International Fuel Tax Agreement Application.

Q: What is the purpose of Form IFTA-1A?

A: The purpose of Form IFTA-1A is to apply for the International Fuel Tax Agreement.

Q: Who needs to file Form IFTA-1A?

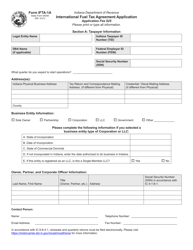

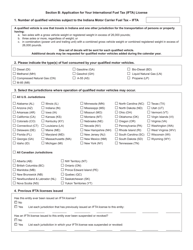

A: Truck owners or operators who operate in multiple jurisdictions and qualify for the International Fuel Tax Agreement need to file Form IFTA-1A.

Q: What information is required on Form IFTA-1A?

A: Form IFTA-1A requires information about the vehicle(s) being operated, distance traveled in each jurisdiction, and amount of fuel consumed.

Q: How often is Form IFTA-1A filed?

A: Form IFTA-1A is filed quarterly, meaning it is filed four times a year.

Q: Are there any fees associated with filing Form IFTA-1A?

A: Yes, there are fees associated with filing Form IFTA-1A. Contact the Indiana Department of Revenue for more information.

Q: What happens if Form IFTA-1A is not filed?

A: Failure to file Form IFTA-1A or not paying the required taxes can result in penalties and interest charges.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IFTA-1A (State Form 54049) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.