This version of the form is not currently in use and is provided for reference only. Download this version of

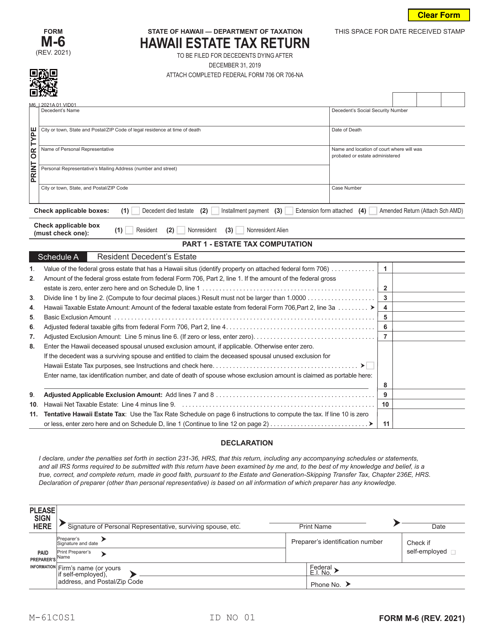

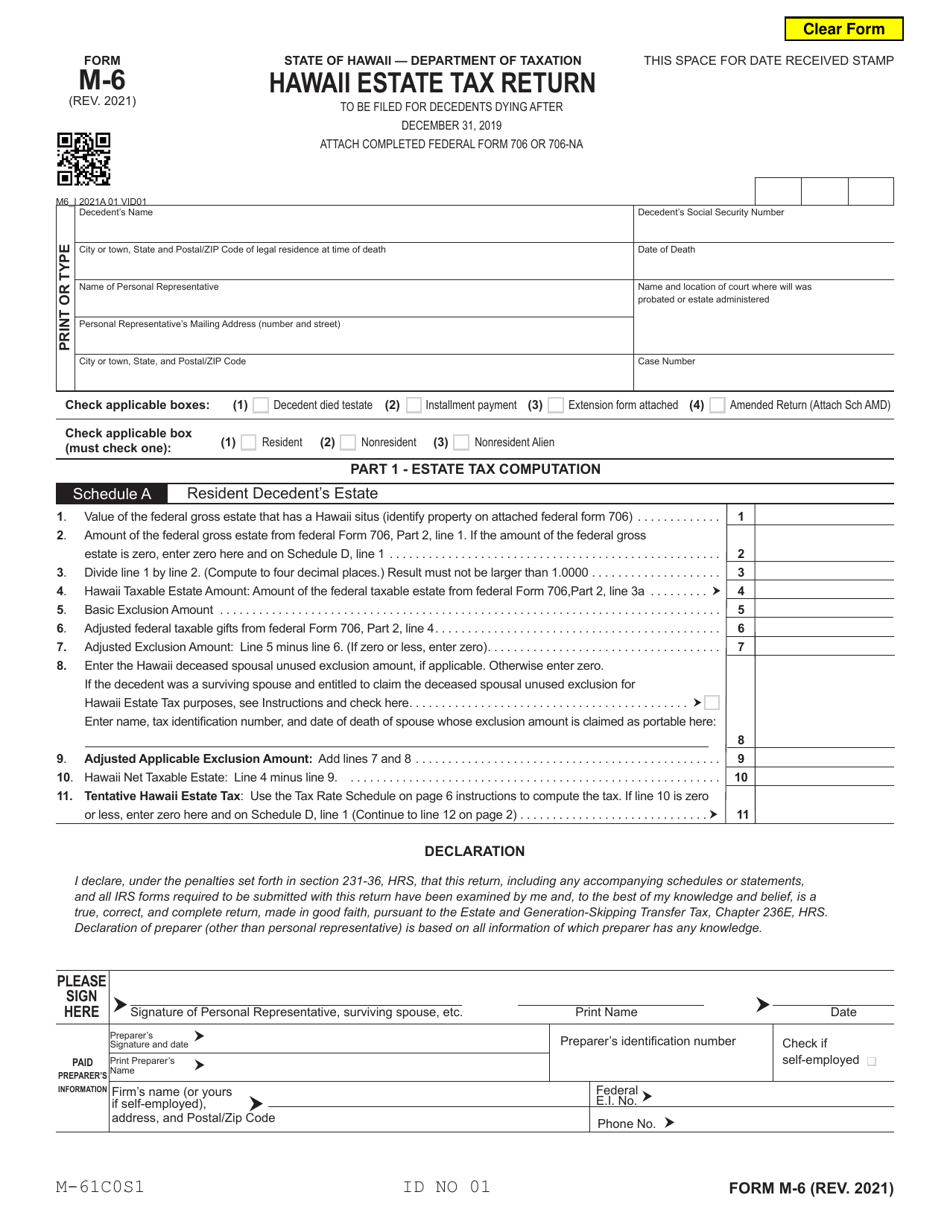

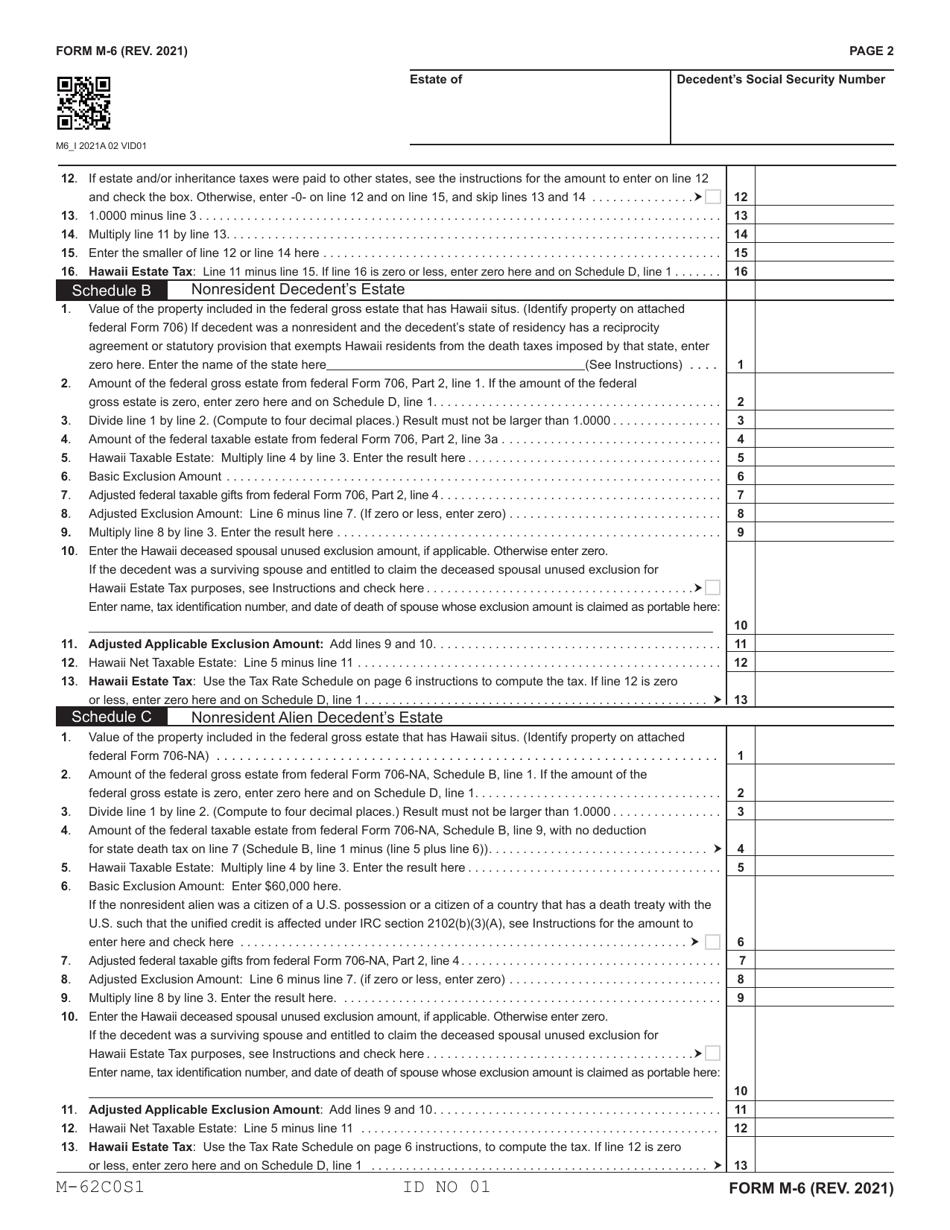

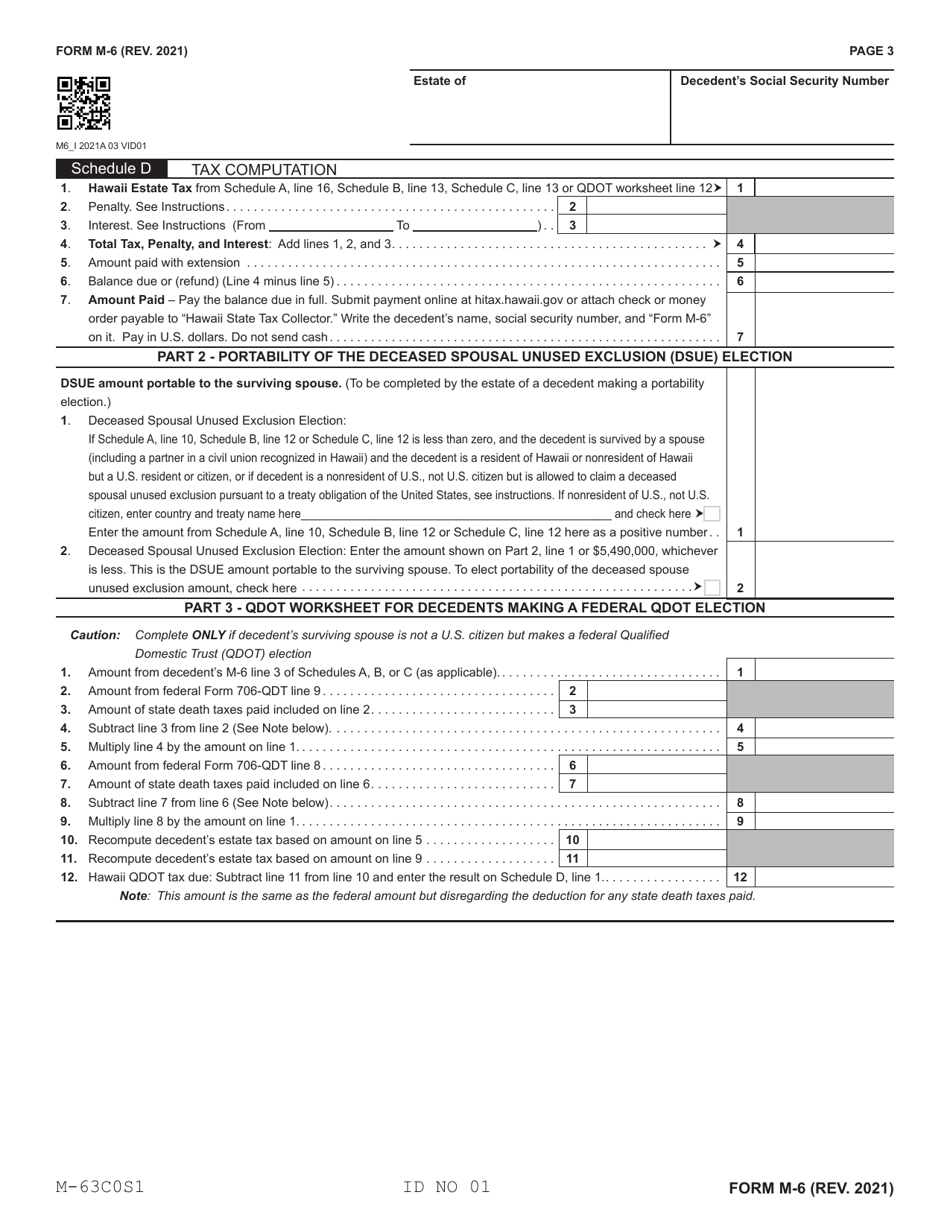

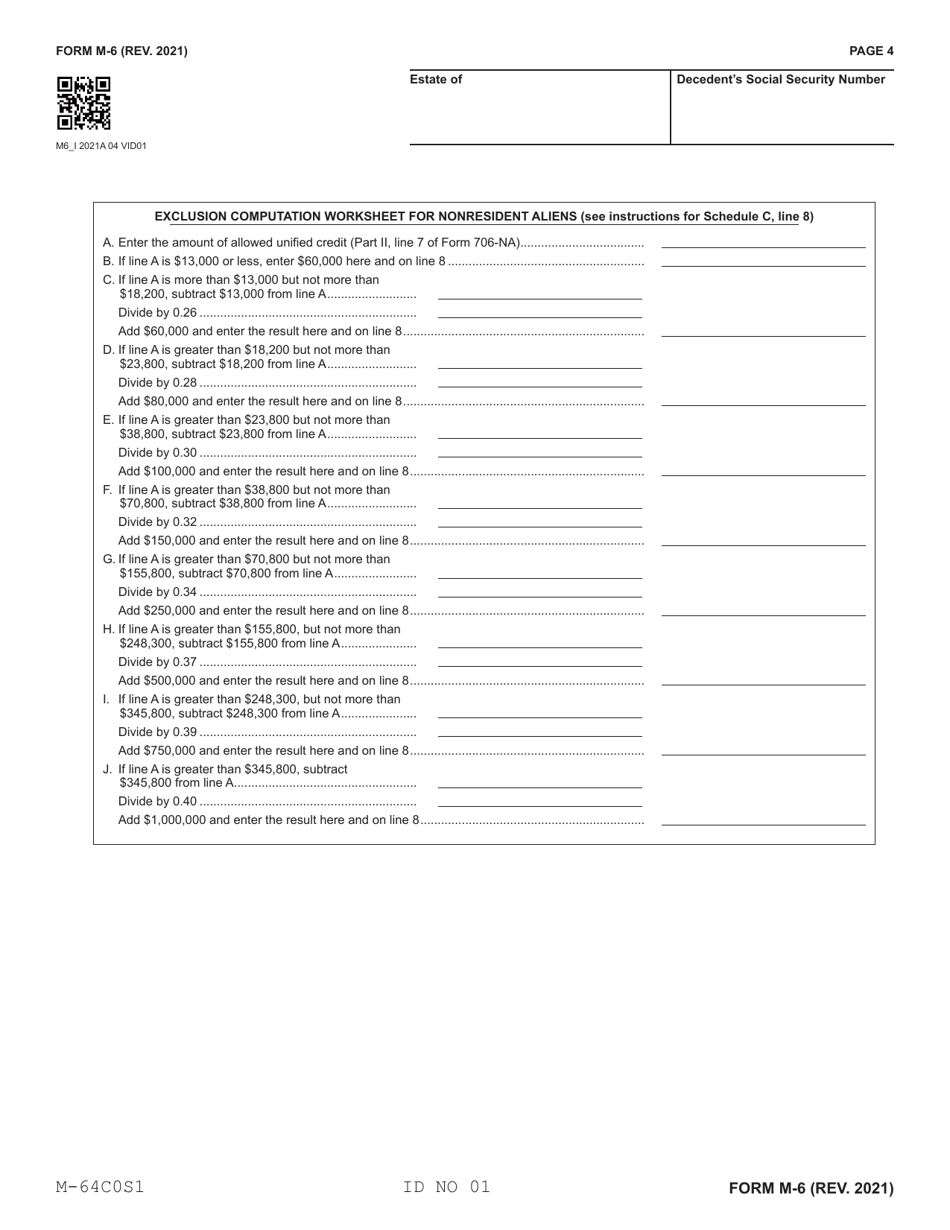

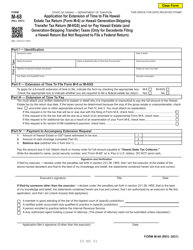

Form M-6

for the current year.

Form M-6 Hawaii Estate Tax Return - Hawaii

What Is Form M-6?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form M-6?

A: Form M-6 is the Hawaii Estate Tax Return.

Q: Who needs to file Form M-6?

A: Individuals who are required to pay estate taxes in Hawaii need to file Form M-6.

Q: What is the purpose of Form M-6?

A: The purpose of Form M-6 is to report and calculate the estate tax owed to the State of Hawaii.

Q: When is Form M-6 due?

A: Form M-6 is due 9 months after the date of death or the date the federal estate tax return is filed, whichever is earlier.

Q: Are there any penalties for late filing of Form M-6?

A: Yes, there are penalties for late filing of Form M-6. It is important to file the form by the due date to avoid penalties.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-6 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.