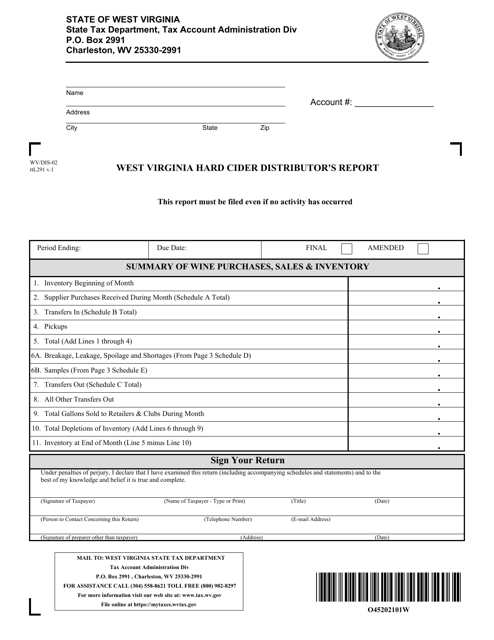

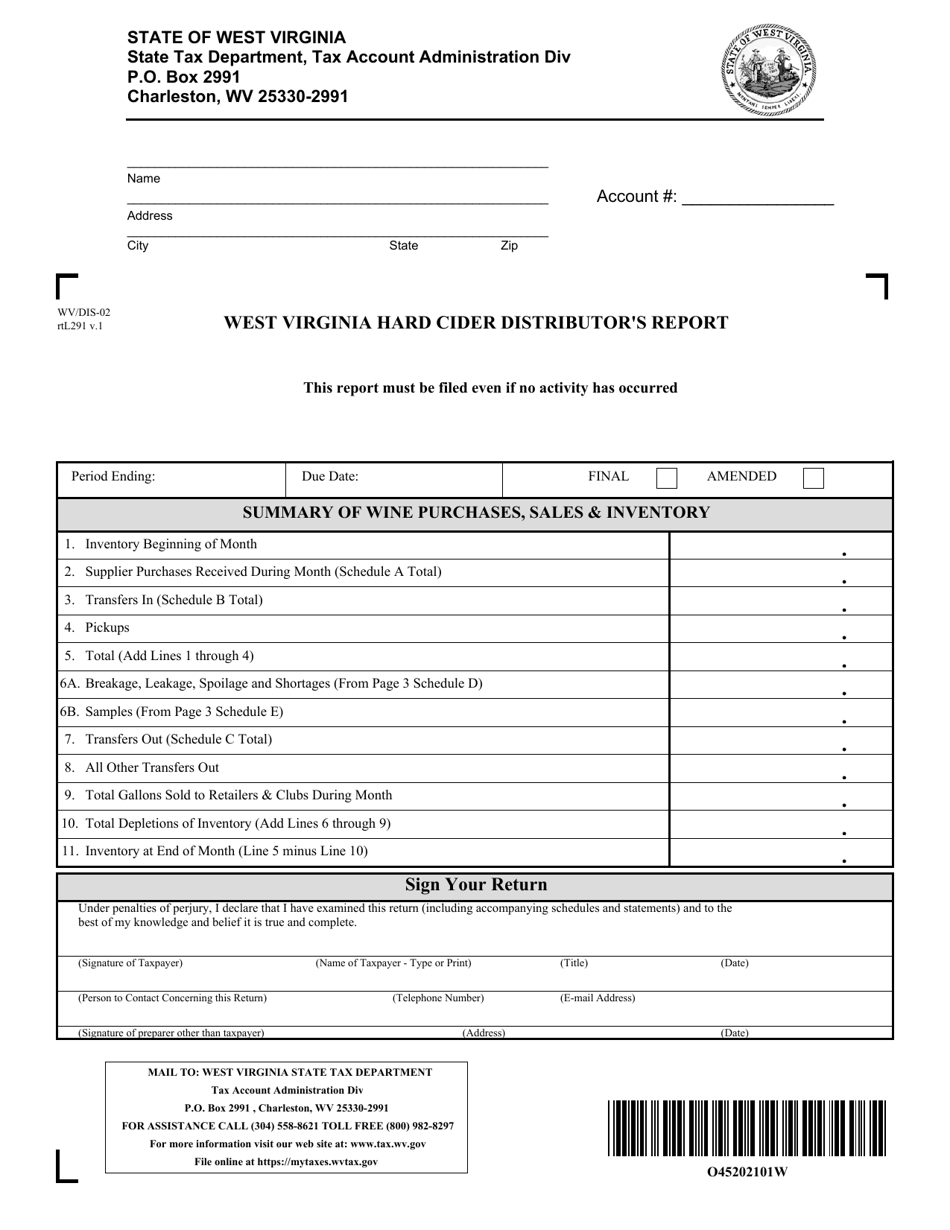

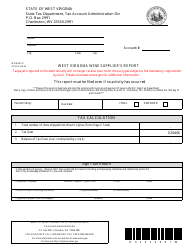

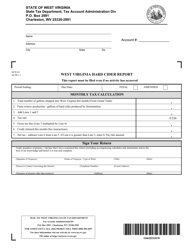

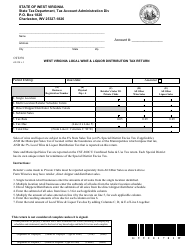

Form WV / DIS-02 West Virginia Hard Cider Distributor's Report - West Virginia

What Is Form WV/DIS-02?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form WV/DIS-02?

A: The Form WV/DIS-02 is the West Virginia Hard Cider Distributor's Report for West Virginia.

Q: Who needs to file the Form WV/DIS-02?

A: Hard cider distributors in West Virginia need to file the Form WV/DIS-02.

Q: What is the purpose of the Form WV/DIS-02?

A: The purpose of the Form WV/DIS-02 is to report the distribution of hard cider in West Virginia.

Q: When is the deadline for filing the Form WV/DIS-02?

A: The deadline for filing the Form WV/DIS-02 is usually the 20th day of the month following the reporting period.

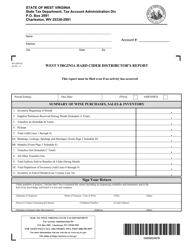

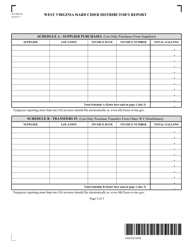

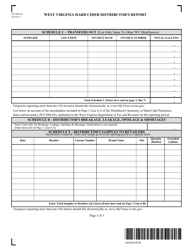

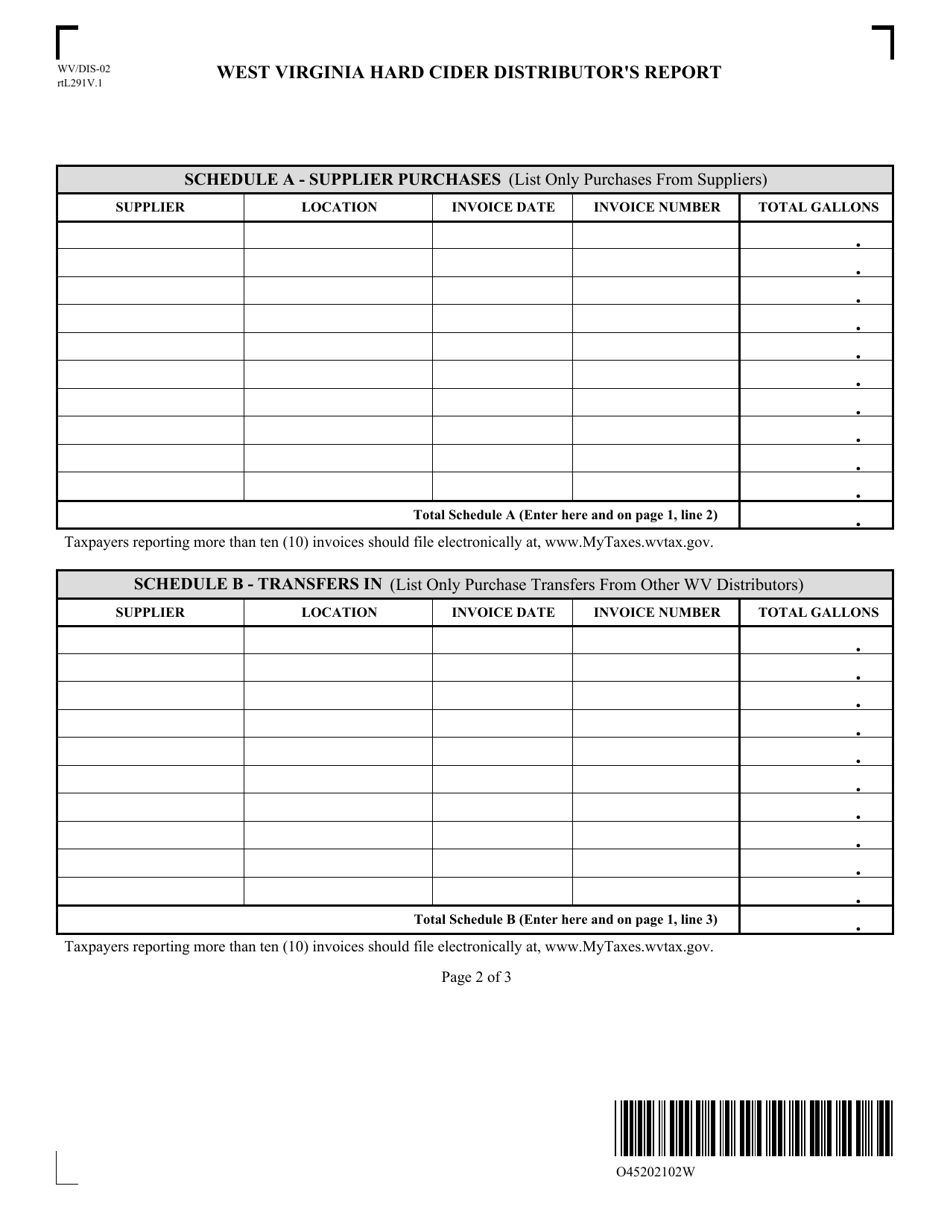

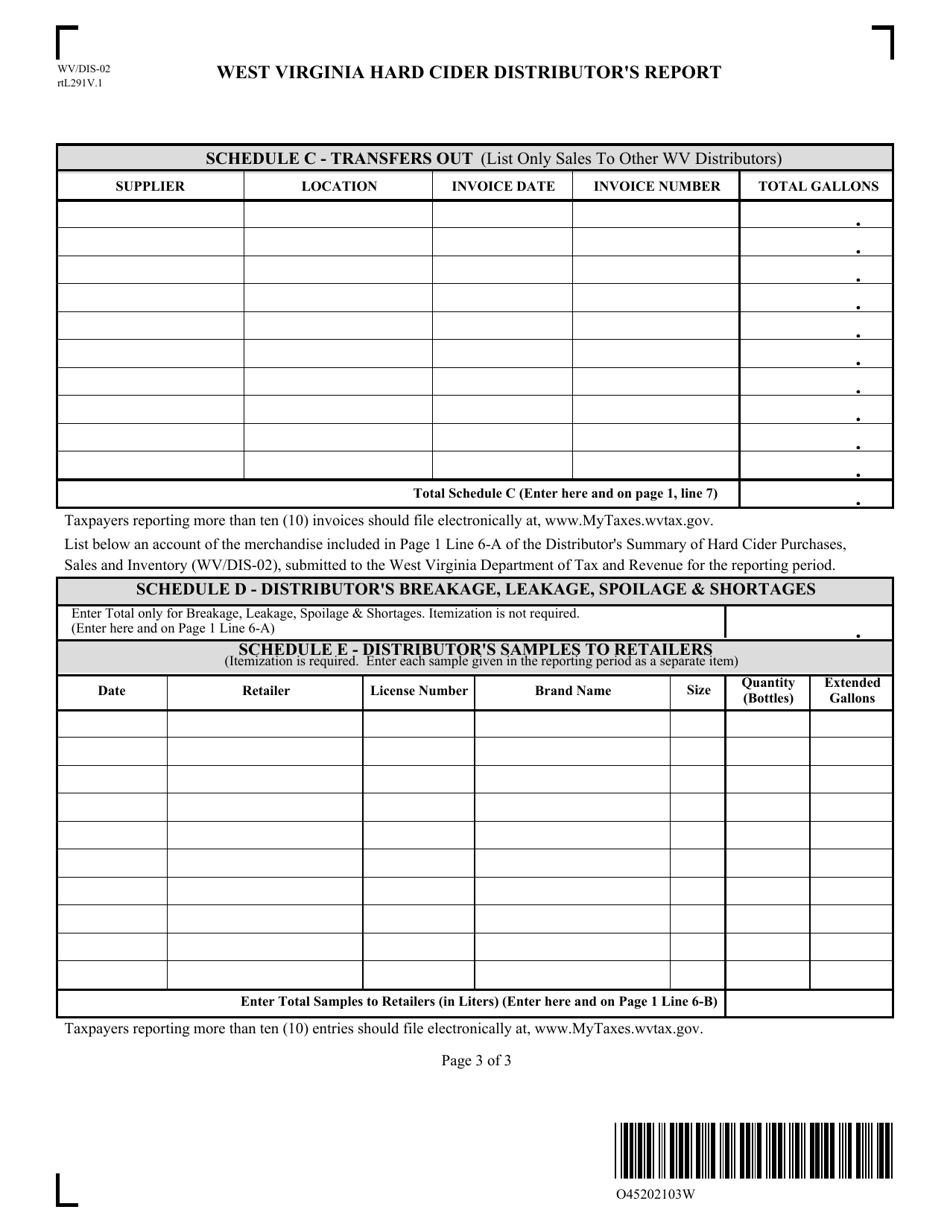

Q: What information do I need to provide on the Form WV/DIS-02?

A: You will need to provide information such as the distributor's name, address, sales information, and taxes due.

Q: Are there any penalties for not filing the Form WV/DIS-02?

A: Yes, there can be penalties for not filing the Form WV/DIS-02, including fines and possible license suspension.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/DIS-02 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.