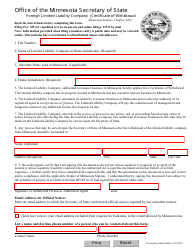

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

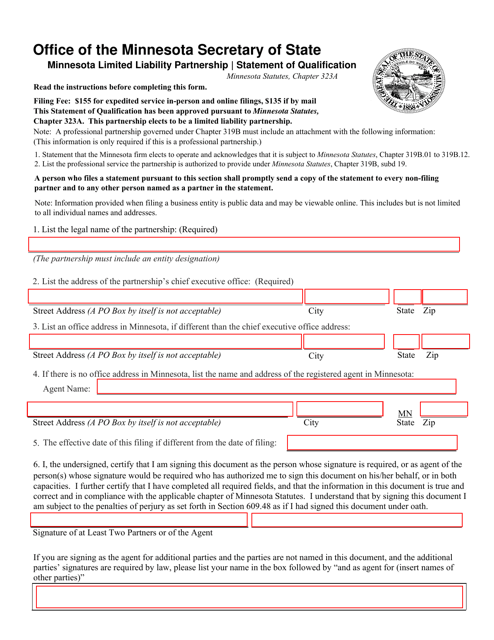

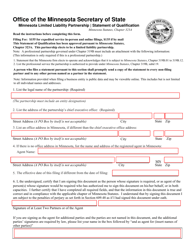

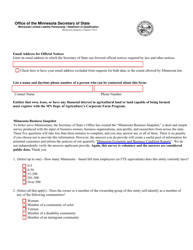

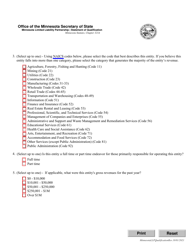

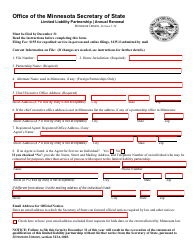

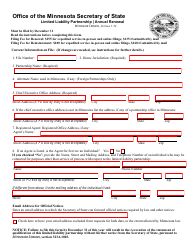

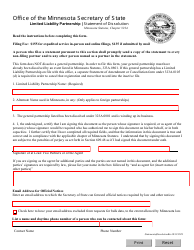

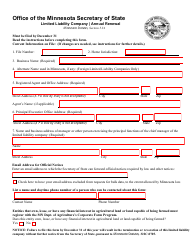

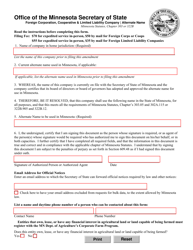

Minnesota Limited Liability Partnership Statement of Qualification - Minnesota

Minnesota Limited Liability Partnership Statement of Qualification is a legal document that was released by the Minnesota Secretary of State - a government authority operating within Minnesota.

FAQ

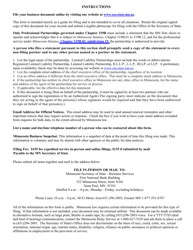

Q: What is a Minnesota Limited Liability Partnership Statement of Qualification?

A: A Minnesota Limited Liability Partnership Statement of Qualification is a legal document that allows a business to form a limited liability partnership (LLP) in Minnesota.

Q: How do I obtain a Minnesota Limited Liability Partnership Statement of Qualification?

A: To obtain a Minnesota Limited Liability Partnership Statement of Qualification, you need to file the appropriate form with the Minnesota Secretary of State.

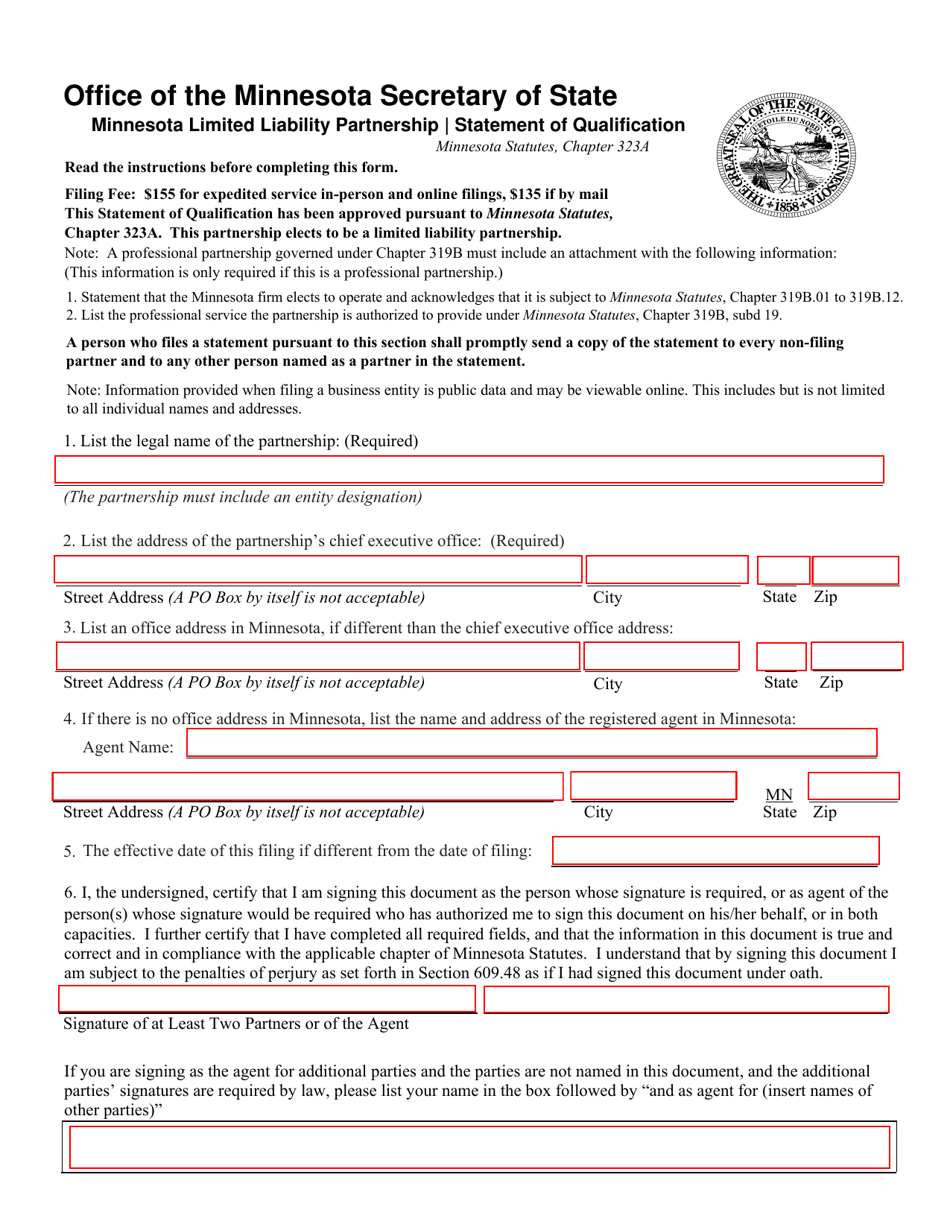

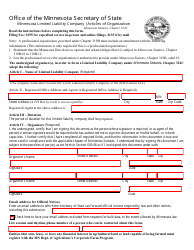

Q: What information is required on a Minnesota Limited Liability Partnership Statement of Qualification?

A: The Minnesota Limited Liability Partnership Statement of Qualification typically requires information such as the name of the LLP, its principal office address, the names and addresses of partners, and a designated agent for service of process.

Q: Is a Minnesota Limited Liability Partnership Statement of Qualification necessary for all businesses?

A: No, a Minnesota Limited Liability Partnership Statement of Qualification is only necessary if you want to form a limited liability partnership in Minnesota.

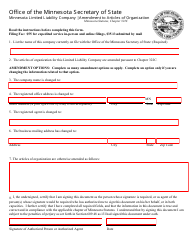

Q: Can I convert an existing business into a limited liability partnership using a Minnesota Limited Liability Partnership Statement of Qualification?

A: Yes, you can convert an existing business into a limited liability partnership by filing a Minnesota Limited Liability Partnership Statement of Qualification and meeting the necessary requirements.

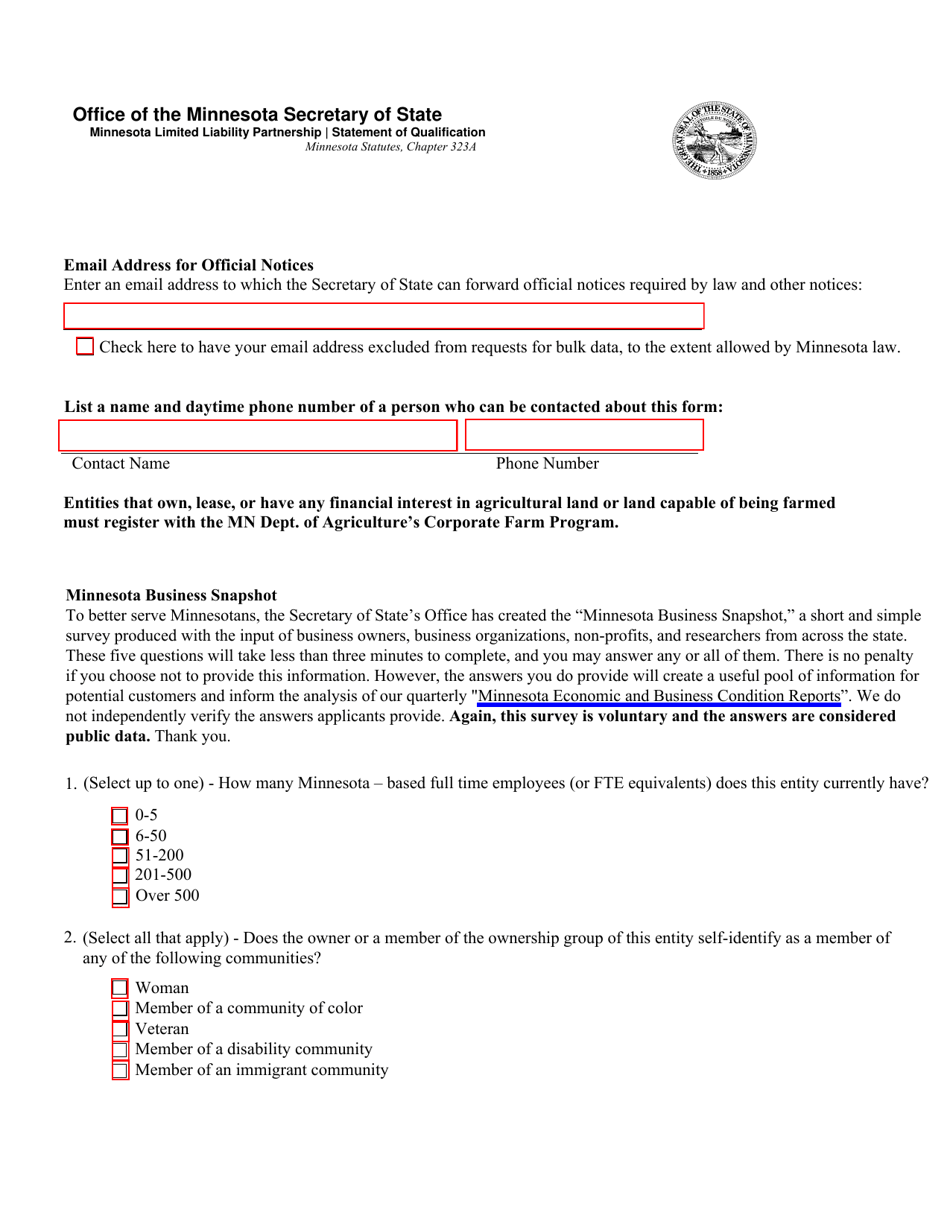

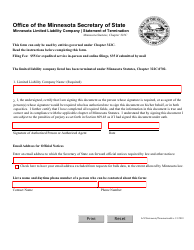

Q: Can I dissolve a Minnesota Limited Liability Partnership?

A: Yes, you can dissolve a Minnesota Limited Liability Partnership by filing a certificate of cancellation or a statement of dissolution with the Minnesota Secretary of State.

Q: What are the benefits of forming a limited liability partnership in Minnesota?

A: The benefits of forming a limited liability partnership in Minnesota include personal liability protection for partners, flexibility in management and decision-making, and pass-through taxation.

Q: Who can serve as the designated agent for service of process on a Minnesota Limited Liability Partnership Statement of Qualification?

A: The designated agent for service of process on a Minnesota Limited Liability Partnership Statement of Qualification can be an individual resident of Minnesota or a business entity authorized to do business in Minnesota.

Q: How long does it take to process a Minnesota Limited Liability Partnership Statement of Qualification?

A: The processing time for a Minnesota Limited Liability Partnership Statement of Qualification can vary, but it generally takes several business days to weeks.

Form Details:

- Released on October 1, 2021;

- The latest edition currently provided by the Minnesota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Secretary of State.