This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

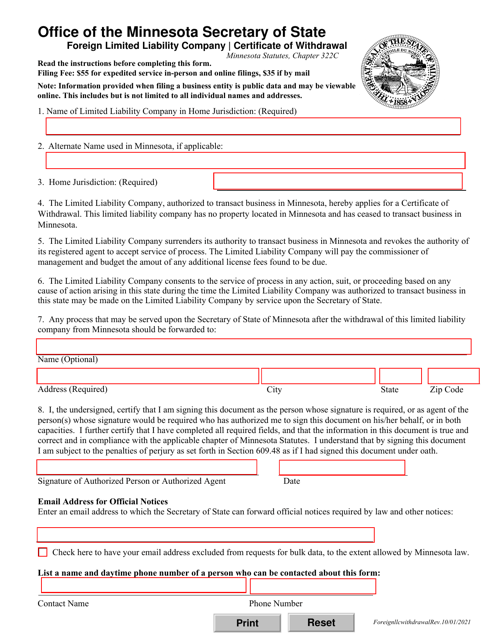

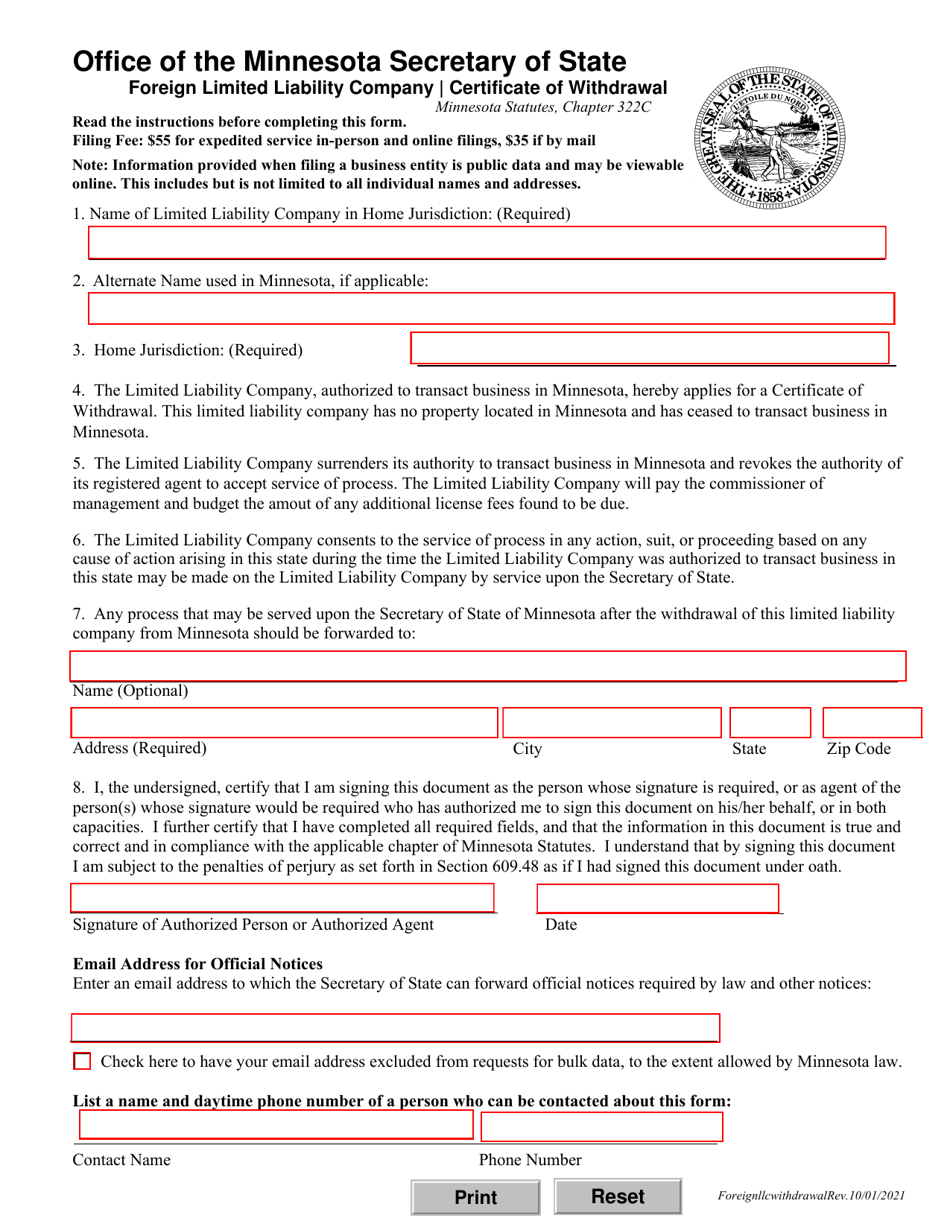

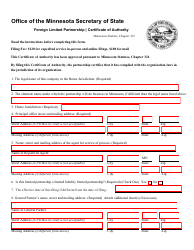

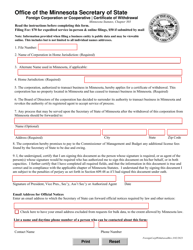

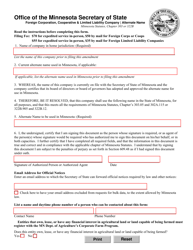

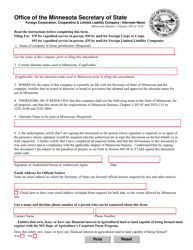

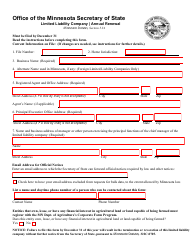

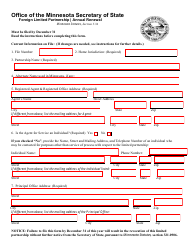

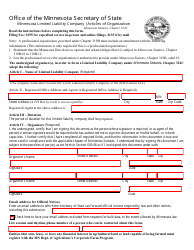

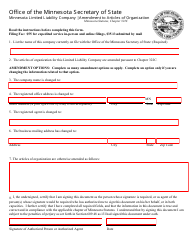

Foreign Limited Liability Company Certificate of Withdrawal - Minnesota

Foreign Limited Liability Company Certificate of Withdrawal is a legal document that was released by the Minnesota Secretary of State - a government authority operating within Minnesota.

FAQ

Q: What is a Foreign Limited Liability Company Certificate of Withdrawal?

A: A Foreign Limited Liability Company Certificate of Withdrawal is a document used to withdraw a foreign LLC (Limited Liability Company) from conducting business in the state of Minnesota.

Q: Why would a foreign LLC want to file a Certificate of Withdrawal in Minnesota?

A: A foreign LLC may want to file a Certificate of Withdrawal in Minnesota if they no longer wish to do business in the state or if they have ceased all business operations.

Q: How can a foreign LLC file a Certificate of Withdrawal in Minnesota?

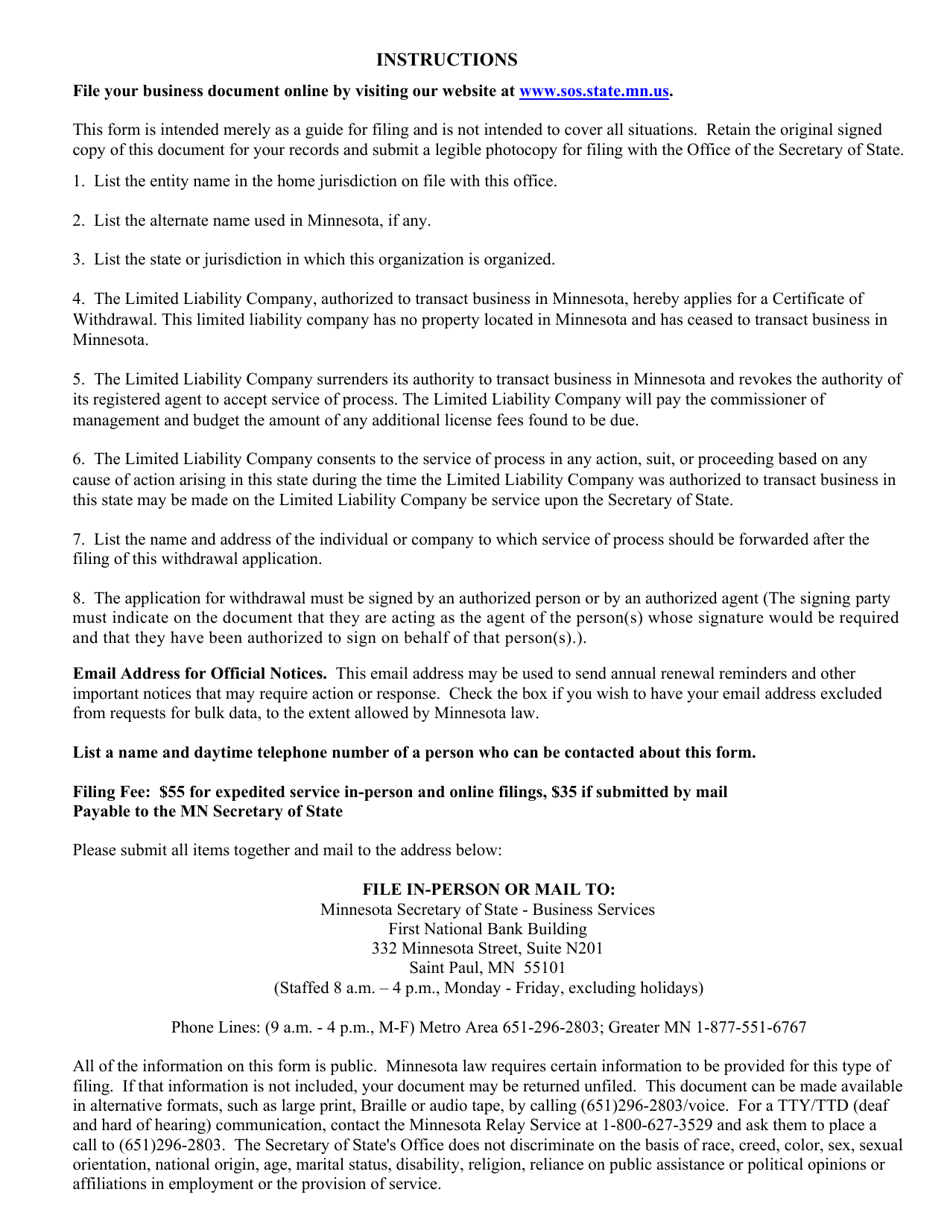

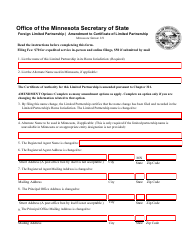

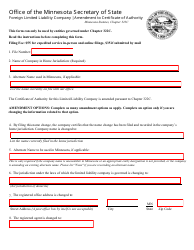

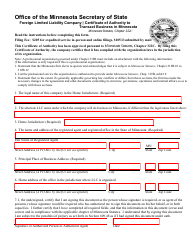

A: To file a Certificate of Withdrawal in Minnesota, a foreign LLC must complete the necessary form provided by the Minnesota Secretary of State, pay the required fee, and submit the form to the Secretary of State's office.

Q: What information is required in a Certificate of Withdrawal?

A: The information required in a Certificate of Withdrawal may vary, but typically includes the foreign LLC's name, state or country of formation, date of formation, and a statement of withdrawal.

Q: What happens after a foreign LLC files a Certificate of Withdrawal in Minnesota?

A: After a foreign LLC files a Certificate of Withdrawal in Minnesota, they will no longer be authorized to conduct business in the state. The LLC's registration will be terminated, and they will no longer be required to file annual reports or pay state fees.

Q: Is there a fee for filing a Certificate of Withdrawal in Minnesota?

A: Yes, there is a fee for filing a Certificate of Withdrawal in Minnesota. The fee amount can vary, so it's best to check with the Minnesota Secretary of State for the current fee schedule.

Q: Can a foreign LLC reinstate their registration in Minnesota after filing a Certificate of Withdrawal?

A: Yes, a foreign LLC can reinstate their registration in Minnesota after filing a Certificate of Withdrawal, but they will need to follow the reinstatement process outlined by the Minnesota Secretary of State. This may involve filing additional forms and paying any applicable fees.

Form Details:

- Released on October 1, 2021;

- The latest edition currently provided by the Minnesota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Secretary of State.